Line 2: American Opportunity Tax Credit

The American Opportunity Tax Credit is for educational costs you paid on behalf of you, your spouse, or any of your dependents. You can calculate it by completing Form 8863. The amount of the credit you’re entitled to appears on line 8 of Form 8863, and you would enter this amount on line 29 of your 1040 tax return.

Withholding Taxes For Disability Benefits

If you believe you may need to pay taxes on your disability benefits, you can ask the SSA to withhold a percentage of your monthly payment. This instance works in the same way as an employer withholding taxes from your check. Doing so is not a requirement but may be a good idea if you worry about putting enough aside to pay your taxes at the end of the year.

For a free legal consultation, call

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2022. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

Read Also: Social Security Office In Dallas

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Withholding On Social Security Benefits

You can elect to have federal income tax withheld from your Social Security benefits if you think youll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2021. Youre limited to these exact percentagesyou cant opt for another percentage or a flat dollar amount.

If youd like the government to withhold taxes from your Social Security income, file Form W-4V, the Social Security Withholding Tax Form. This will let the Social Security Administration know exactly how much tax you would like to have withheld.

Recommended Reading: Dekalb County Social Security Office

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

Is Social Security Income Taxable

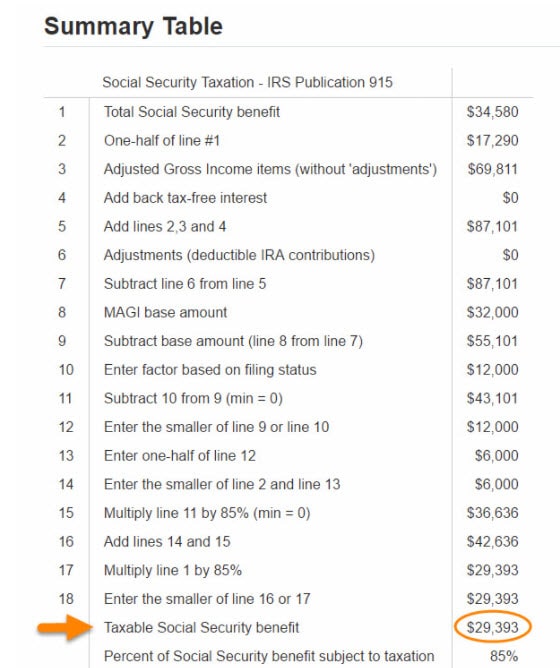

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

Also Check: Social Security Changes In The Future

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Free Legal Aid Social Security Disability

What If I Dont Have Any Employees

Youâll still have to remit Medicare and Social Security taxesâfor yourself. This is called self-employment tax, and itâs effectively Medicare plus Social Security for yourself .

If you had self-employment income earnings of $400 or more during the year, you are required to pay self-employment taxes and file Schedule SE with your federal income tax return , which is generally due by April 15.

Use our free estimated tax calculator to figure out how much estimated tax youâll owe.

Don’t Miss: Social Security Office In Milwaukee

Does Irs Tax Social Security

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Read Also: Social Security Office Beaumont Texas

Social Security: Use This Irs Form To Have Federal Income Tax Withheld

Related: 5 Things You Must Do When Your Savings Reach $50,000

Federal income taxes are typically paid on Social Security benefits if you have other substantial income in addition to your benefits, such as wages, self-employment, interest, dividends and other taxable income. You may have to pay federal income taxes on your Social Security benefits if you:

-

File a federal tax return as an individual. If your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If its more than $34,000, up to 85% of your benefits may be taxable.

-

File a joint return. If you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If its more than $44,000, up to 85% of your benefits may be taxable.

-

Are married and file a separate tax return, you may have to pay taxes on your benefits.

You can find and download Form W-4V on IRS.gov or call the IRS toll-free number at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request. If youre deaf or hard of hearing, you can call 1-800-829-4059.

If you dont have your federal income tax withheld from your benefits, youll be required to make quarterly estimated tax payments

Once the form is completed, return it to your local Social Security office by mail or in person. If you want to make any changes in the future, youll need to fill out a new Form W-4V.

More From GOBankingRates

You May Like: Social Security Office On Buffalo

What Is The Social Security Tax

The Social Security tax is one of two taxes all employers are required to withhold under the Federal Insurance Contributions Act . The other is the Medicare Tax. FICA also mandates an Additional Medicare tax, though only for employees earning more than a set dollar amount.

Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax .

The Social Security tax is a percentage of gross wages that most employees, employers and self-employed workers must pay to fund the federal program. Certain groups of taxpayers are exempt from paying social security tax. It is the employers obligation to withhold the correct amount of Social Security tax from every paycheck and forward it to the federal government on time. Failure to do so can result in significant penalties.

Only the social security tax has a wage base limit. The wage base limit is the maximum wage that’s subject to the tax for that year. Refer to “What’s New” in Publication 15 for the current wage limit for social security wages.

Go deeper

What Happens If Too Much Social Security Tax Is Withheld

Unfortunately, you cannot stop the withholding. However, you will get a credit on your next tax return for any excess withheld. Each employer is obligated to withhold social security taxes from your wages. The total they both can withhold may exceed the maximum amount of tax that can be imposed for the year.

Recommended Reading: Social Security Office In Colorado Springs

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06% to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets.

The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

Why Is My Social Security Tax Withheld So High

For tax year 2021, youll have excess Social Security withholdings if the sum of multiple employers withholdings exceeds $8,853.60 per taxpayer. You dont need to take any action. Well automatically add the excess to your federal refund or subtract it from federal taxes you owe, whichever applies.

Read Also: Aiken South Carolina Social Security Office

Special Help For Retirees

A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive. The tool then automatically calculates the taxable portion and incorporates it into an overall estimate of their projected tax liability and withholding for the year. If a withholding change is needed, the retiree can choose a tax due of close to zero or a refund amount. The tool will then link to Form W-4P, Withholding Certificate for Pension or Annuity Payments, and give the retiree a specific withholding recommendation based on the option chosen. It also gives instructions on how to fill in each line of the form.

What To Do When Excess Social Security Tax Is Withheld

Posted August 2019

If you are switching jobs or working two jobs as an employee and your total wages for the calendar year will exceed the social security wage base , you may be overpaying social security tax. Unfortunately, you cannot stop the withholding. However, you will get a credit on your next tax return for any excess withheld.

Each employer is obligated to withhold social security taxes from your wages. The total they both can withhold may exceed the maximum amount of tax that can be imposed for the year. This amount is $8,239.80 with a 6.20% rate in effect for 2019 and based on the $132,900 wage. If your total withholding is more than that amount, you can recover the excess by claiming a credit for a payment of taxes on your individual tax return for the year.

Example:

E is an employee of ABC, Inc. from January through April 2019, and earns $70,000 during that period. From May through the end of the year, E works for XYZ, Inc. and earns $65,000. ABC withholds $4,340 in social security taxes , and XYZ withholds $4,030 , for a total $8,370 withheld. This withholding is $130.20 more than the $8,239.80 maximum amount for 2019. On Es 2019 individual tax return, E will be entitled to claim a credit for a payment of taxes of $130.20.

Note that every employer must also withhold a Medicare tax of 1.45% on all wages. Since there is no ceiling on this tax, as there is for the social security tax, you are not entitled to any refund from the amounts your employers withhold.

Recommended Reading: Social Security Office In Lumberton North Carolina

Request To Withhold Taxes

Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time.

You will pay federal income taxes on your benefits if your combined income exceeds $25,000/year filing individually or $32,000/year filing jointly. You can pay the IRS directly or have taxes withheld from your payment.

You May Have To Pay Taxes On Your Social Security Benefits

PeopleImages / Getty Images

You’ve reached the age when you can begin collecting Social Security. When tax time rolls around, you may be wondering if you have to pay income tax on your Social Security benefits. Unfortunately, the answer isn’t a simple yes or no. Your tax liability depends on other details about your situation. Social Security benefits might be either non-taxable or partially taxable.

Learn the factors that determine whether or not you’ll owe taxes on your Social Security benefits.

Recommended Reading: What Happens If I Change My Social Security Number

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

What Is Social Security Tax

Social Security tax is a federal tax that pays for things like the Social Security benefits you get from the federal government when you retire, survivor benefits for your family if you die, disability benefits, etc.

If you, your children or your widow ever receive any kind of Social Security income, these taxes are probably what paid for it.

Both employees and employers have to pay into Social Security tax. Payroll taxes like Medicare and Social Security are usually grouped together as FICA . Itâs also referred to as âold age, survivors, and disability insurance taxâ , Social Security taxes pay into the United States Social Security Administrationâs Social Security programsâretirement benefits, disability benefits, dependent and survivor benefits, etc.

If youâre self-employed, youâll hear tax professionals refer to your Social Security and Medicare tax as âself-employment tax.â

Also Check: Social Security Office Bend Oregon

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |