Social Security: New Bill Could Give Seniors An Extra $2400 A Year

Related: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

The Social Security Expansion Act was introduced on June 9 by U.S. Rep. Peter DeFazio and U.S. Sen. Bernie Sanders , CBS News reported. Under terms of the bill, anyone who is a current Social Security recipient or who will turn 62 in 2023 would receive an extra $200 in each monthly check.

The bill is timely for a couple of reasons. First, it follows a Social Security Administration announcement earlier this month that Americans will stop receiving their full Social Security benefits in about 13 years without actions to bolster the program.

Take Our Poll: Whats the Table Time Limit on a $400 Restaurant Meal?

It also comes during a period of historically high inflation that has a particularly big impact on seniors living on fixed incomes, many of whom rely solely on Social Security payments. This years Social Security Cost-of-Living Adjustment of 5.9% is based on inflation figures from 2021. But since then, inflation has pushed well above 8%, meaning Social Security recipients today are actually losing money.

The new bill aims to ease the financial strain by boosting each recipients monthly check. The average monthly Social Security check is about $1,658, meaning a $200 increase would represent a 12% boost.

Another change would be adding more funding by applying the Social Security payroll tax on all income above $250,000. Currently, earnings above $147,000 arent subject to the Social Security tax.

Social Security Benefits Increase

Did you know that Social Security recipients will soon be receiving an increase to their monthly payments? In 2023, Social Security benefits will increase by nearly 9%.

- More than $140 per month on average

- Medicare Part B premiums decreasing

- Benefits could help offset high costs

- Largest increase in four decades

Updates to your benefits will typically be sent via mail. However, if you would like to figure out how much youll get even sooner, you can follow these steps:

- Opt to receive text or email alerts for messages from Social Security

- Check for Medicare changes at medicare.gov

Enrolling later in the year? If youre over the age of 62 and youre not receiving these benefits, you will receive the cost-of-living adjustment when you begin to receive the benefits.

- Delaying benefits can increase monthly check sizes

- Financial planners recommend waiting if possible

- Not everyone is able to wait, so factor in personal health and budget

How Bill Would Expand Retirement Benefits

The latest Social Security 2100 bill put forward by Larson seeks to enhance Social Security benefits in multiple ways.

It calls for increasing all checks by about 2% of the average benefit. At the same time, it would also set the minimum benefit above the poverty line and tie it to current wage levels.

The measure for the annual cost-of-living adjustment would be changed with the goal of better keeping up with the costs retirees face.

Widows and widowers would also receive more generous benefits. It would repeal rules that reduce benefits for public workers, including the Windfall Elimination Provision and Government Pension Offset.

The bill also calls for providing caregiver credits to people who take time out of the workforce to care for children or other family members.

Benefits for students would be extended to age 26. Children who live with grandparents or other relatives would also have increased access to benefits.

The bill also calls for ending the five-month waiting period for disability benefits.

In order to pay for the benefit increases, the bill calls for reapplying the Social Security payroll tax on wages above $400,000, which would affect an estimated 0.4% of wage earners.

Currently, wages of up to $147,000 are taxed for Social Security in 2022. Employers and employees each pay a 6.2% tax on wages, for a total of 12.4%.

Also Check: Social Security Appointment Name Change

A Group Of Politicians Is Proposing To Shake Up Social Security In A Big Way

Social Security has now been in place for more than 80 years, and has likely helped billions of people supplant their income, especially later on in life when they retire.

But despite its success, it is no secret that the Social Security program is in a dangerous place when you consider that it may not be able to cover every eligible person who qualifies by 2035. Additionally, many say the benefits are no longer enough to keep up with the cost of living.

Something is likely going to need to happen at some point to continue the program in its full capacity. Now, a Congressional bill is not only aiming to fund the program well past 2035, but also increase Social Security benefits.

A Benefits Boost: $200 Plus Cola Changes

Anyone who is a current Social Security recipient or who will turn 62 in 2023 the earliest age at which an individual can claim Social Security would receive an extra $200 per monthly check.

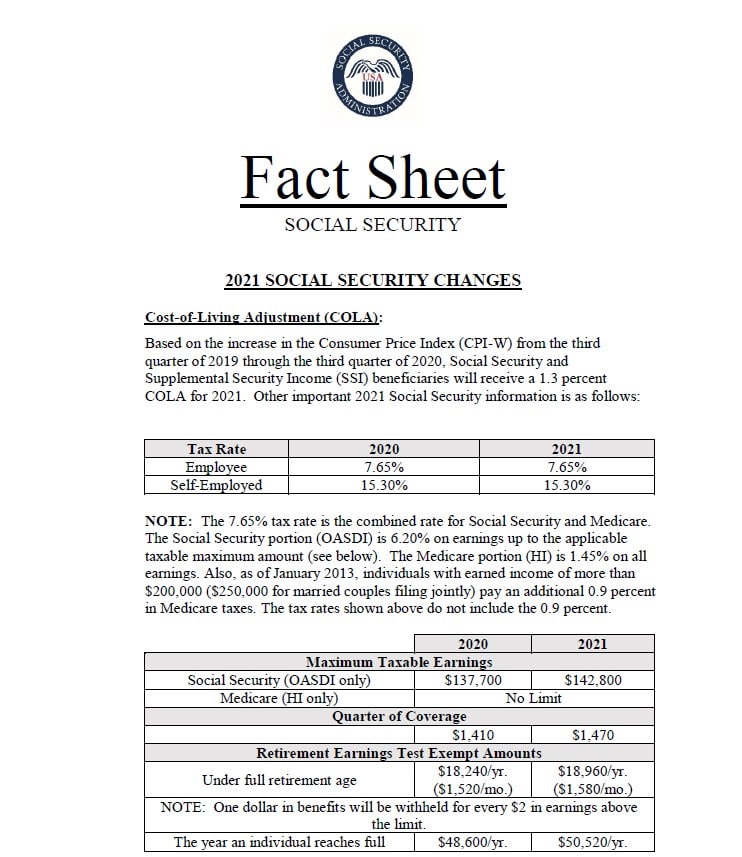

There are some additional tweaks that would boost benefits over the long-term. One of the primary changes would be to base the annual COLA on the Consumer Price Index for the Elderly , rather than the current index that the Social Security Administration uses for its calculation the Consumer Price Index for Urban Wage Earners and Clerical Workers .

The CPI-E more accurately reflects seniors’ spending patterns, according to experts on Social Security. For instance, it puts more weight on health care expenses, which can be considerable for senior citizens.

If the CPI-E had been used to index the annual COLA for Social Security, a senior who filed for Social Security benefits over 30 years ago would have received about $14,000 more in retirement than compared with the CPI-W, according to the Senior Citizens League.

The bill would also boost benefits for the lowest income earners in the U.S., who receive benefits under a program called the Special Minimum Benefit. Under the legislation, it would be indexed so that it is equal to about 125% of the federal poverty line, or about $1,400 a month. In 2020, the Special Minimum Benefit paid about $900 per month, according to the Social Security Administration.

Recommended Reading: Social Security Cola Increase 2023

What Can You Do About It

If you’re receiving Social Security benefits today, you want to create other sources of income in retirement – outside of social security – in case your benefits do get cut. You never want to be too reliant on any single source of income.

If you haven’t filed for your Social Security benefits yet, this threat could completely change your claiming strategy as to when you file for your benefits. You can no longer rely on some traditional rule of thumb or one-size-fits-all strategy. There’s too much money at stake.

Why The Adjustment Isnt A Perfect Solution To Seniors Rising Costs

Its not clear right now whether higher Social Security payments will contribute to spiraling inflation. But Arnone said that older people are much more likely to spend money than save it, giving his organization a clear sense that it will help mitigate a recession.

Every month this year, the cost of inflation has far exceeded the 5.9 percent cost-of-living increase that was set at the end of 2021, Johnson said. That means last years COLA is not meeting the current economic strains.

Recommended Reading: Social Security Office Sikeston Mo

Previous Openings And Closings

· Jimmyâs Barbershop in Allentown has moved to 822 N. 19th Street

· Air Products and Chemicals Inc.s chosen warehouse developer, Prologis Inc., will have to wait until July 13 for a final decision by Upper Macungie Townships zoning hearing board on 2.61 million square feet of warehouses.

· Chubbys of Southside Easton has added Krispy Krunchy Chicken to its offerings and name.

· Curaleaf Holdings Inc., which operates in the U.S. and Europe, will open a medical-marijuana dispensary at 1801 Airport Road, Hanover Township.

· Habitat for Humanity, which has ReStores that sell new and lightly used furniture, has leased 30,000 square feet at the South Mall.

· Nat Hymans bid to convert an old warehouse at 938 Washington St. in Allentown into 48 apartments did not win zoning hearing board approval this week after neighbors said more housing would make an on-street parking shortage worse.

· Members 1st Federal Credit Union opened a new branch this week at 5605 Hamilton Blvd, Trexlertown. Its one of five planned for the Lehigh Valley.

· A Turkish restaurant has relocated from one downtown to another, taking its fresh ingredients and cozy atmosphere from Nazareth to 200 Main St., Tatamy.

· The Tennessee Titans have chosen Allentown-based Shift4 Payments to handle payments at Nissan Stadium.

· Wells Fargo Bank held ribbon-cutting at its downtown Allentown branch at 740 Hamilton St.

· Hunter Pocono Peterbilt plans to move Pocono Township operations to Stroudsburg.

Maximum Social Security Benefit Also Set To Increase

As expected, the maximum Social Security benefit for a worker retiring at full retirement age will also increase in 2023, from $3,345 to $3,627. Its important to note that this maximum applies to those retiring at the full retirement age, which is 67 for anyone born after 1960.

The maximum will be different for those who retire before the full retirement age, because benefits are reduced in that situation. The same applies for those who retire after the full retirement age, a strategy that can max out your benefit check.

You May Like: What Will Happen When Social Security Runs Out

Social Security Adjusts Earnings Test Exempt Amounts

If you claim your retirement benefits before you hit full retirement age, Social Security will withhold some benefits from your check above certain levels of income. Its what the program calls the retirement earnings test exempt amounts, and it can claim a serious chunk of your benefits if youre still working. Heres how it will work in 2023.

If you start collecting Social Security before full retirement age, you can earn up to $1,770 per month in 2023 before the SSA will start withholding benefits, at the rate of $1 in benefits for every $2 above the limit. In 2022, the maximum exempt earnings were $1,630 per month .

In the year you reach full retirement age, this rule still applies, but only up until the month you hit full retirement age and with much more forgiving terms. In 2023, you can earn up to $4,710 per month before benefits are withheld, at the rate of $1 in benefits for every $3 earned above the limit . In 2022, the threshold was $4,330 per month .

Congressman Kildee Introduces Bill To Strengthen Social Security Increase Benefits For Seniors

WASHINGTONCongressman Dan Kildee , Chief Deputy Whip of the House Democratic Caucus, today introduced the Social Security 2100: A Sacred Trust Act, which would increase Social Security benefits for Michiganders while making the system financially strong through the end of the century.

Kildee, a member of the Ways and Means Committee which oversees Social Security, joined Congressman John B. Larson , Chairman of the Social Security Subcommittee and 194 other Members of Congress in introducing this landmark legislation.

People who work their entire lives and contribute every paycheck should be able to rely on Social Security when they retire, Congressman Kildee said. Over two million Michiganders rely on Social Security to pay their bills and live with dignity. I am proud to introduce this legislation to strengthen Social Security and increase Social Security benefits for current and future retirees.

The Social Security 2100: A Sacred Trust Act would provide:

- An across-the-board benefit increase for current and new beneficiaries

- An improved cost-of-living adjustment that considers the true costs incurred by seniors

- A stronger minimum benefit, so someone who works their whole life does not retire into poverty

- A tax cut for over 12 million middle income Social Security recipients by eliminating the tax on their benefits

- An end to the 5-month waiting period to receive disability benefits

- An enhanced benefit for widows and widowers in two income households.

Recommended Reading: When Does Social Security Become Taxable

Can The Bill Get Passed Into Law

The bill was only introduced in June, and it doesn’t look like much legislative action has happened since, although 52 groups have endorsed the bill. Congress also hasn’t passed major Social Security legislation since the early 1980s, so the passage of this bill in its current form is probably more unlikely right now.

Democrats and Republicans have long been at odds over Social Security because extending the solvency of the trust funds would likely require tax increases one way or the other, which has long been a hot-button issue.

That said, as 2035 gets closer, there will be more pressure on Congress to do something, so expect more bills and proposals to get introduced and the issue to become a bigger debate in the coming years.

The Motley Fool has a disclosure policy.

Social Security Increase: New Bill Could Give Seniors More Money

A new proposal would change the way Social Security benefits are calculated, potentially putting more money into the pockets of beneficiaries.

A new proposal would change the way Social Security benefits are calculated, potentially putting more money into the pockets of beneficiaries.

U.S. Rep. John Larson, D-Conn., will introduce Social Security 2011: A Sacred Trust, that would, among other things, discontinue the use of the Consumer Price Index for Urban Wage Earners and Clerical Workers in determining yearly adjustments. Critics say the CPI undercounts some common senior expenses such as healthcare and housing.

Instead, the bill would change to calculations based on the Consumer Price Index for the Elderly, which places greater emphasis on costs for food, housing, apparel, medical care and goods and services.

The bill would also provide a benefit bump for current and new Social Security beneficiaries, including those who are receiving retirement, disability, or dependent benefits, equal to the average of 2% of benefits to make up for what Larson described as a inadequate COLAs since 1983.

It would also set a new minimum benefit of 25% above the poverty line which would be tied to wage levels as benchmark, eliminate the 5-month waiting period to receive payments and provide caregiver credits for those who take time off the workforce to care for children or other dependents.

Larson is set to introduce the bills in the coming days.

Also Check: Report My Social Security Card Stolen

Social Security Bill Would Give Seniors An Extra $2400 A Year Here’s How It Would Work

Seniors and other Social Security recipients in the U.S. are being hit hard by inflation, which has outpaced increases in their benefits this year. Now, some lawmakers have a plan to boost Social Security payments by $2,400 per recipient annually, while also shoring up the program financially.

The Social Security Expansion Act was introduced June 9 by Rep. Peter DeFazio, a Democrat from Oregon, and Senator Bernie Sanders, an Independent from Vermont. The plan comes after the Social Security Administration earlier this month said Americans will stop receiving their full Social Security benefits in roughly 13 years without actions to shore up the program.

Social Security recipients receive one cost-of-living adjustment, or COLA, each year, which is based on inflation and is supposed to keep their benefits in line with rising prices. But this year, beneficiaries are seeing their purchasing power wane as inflation overtakes their latest COLA increase of 5.9%. Inflation in May rose 8.6% from a year ago, a four-decade high that pushed up the cost of food, shelter, energy and other staples.

The new bill would seek to lessen the strain on people collecting Social Security by boosting each recipient’s monthly check by $200 an annual increase of $2,400.

Here’s what to know about the Social Security Expansion Act.

Inflation Is Cutting Into The Purchasing Power Of Seniors Receiving Social Security How Could The 2023 Cola Affect Benefits

Inflation is beginning to impact the wallets of many across the country, but seniors, many of whom are on a fixed income, are really struggling to keep up. Twenty-three percent of people over sixty-five reported difficulty covering basic household expenses in May. This is up from sixteen percent during the same period last year.

The Senior Citizens League has released the preliminary results of a study showing that many Social Security recipients have lost around forty percent of their purchasing power since 2000. In part, much of this loss stems from inflation currently affecting the market.

Also Check: Free Legal Aid Social Security Disability

Defazio Sanders Introduce Legislation To Expand And Strengthen Social Security

WASHINGTON Congressman Peter DeFazio and Senator Bernie Sanders today introduced joint legislation, the Social Security Expansion Act , to strengthen and expand Social Security for current and future generations.

As a trained gerontologist, I have devoted my career to protecting and expanding programs that are vital to seniors. One of my highest priorities is protecting Social Security, which millions of Americans rely on, including hundreds of thousands of Oregonians. With the cost of living at an all-time high, Social Security has never been more important, yet Congressional Republicans continue to play games with its funding, saidRep. DeFazio . This legislation would ensure that the Social Security Trust Fund remains solvent for another 75 years, increase monthly benefits for most recipients by $200, and alter the cost-of-living-adjustment formula to meet the everyday needs of our nations seniors.

The Senior Citizens League is proud to support Congressman DeFazios Social Security Expansion Act. An extra $200 a month would go a long way in helping retirees make ends meet and extending the solvency of the Social Security program for 75 years means this benefit will pay itself forward for years to come, said Richard Delaney, Chair, The Senior Citizens League.

The Social Security Expansion Act would:

Understand What Happened To Bidens Domestic Agenda

Build Back Better.Before being elected president in 2020, Joseph R. Biden Jr. articulated his ambitious vision for his administration under the slogan Build Back Better, promising to invest in clean energy and to ensure that procurement spending went toward American-made products.

A two-part agenda.March and April 2021: President Biden unveiled two plans that together formed the core of his domestic agenda: the American Jobs Plan, focused on infrastructure, and the American Families Plan, which included a variety of social policy initiatives.

A $6 trillion budget.June 2021: President Biden proposed a $6 trillion budget for 2022. The proposal detailed the highest sustained levels of federal spending since World War II, with the goal of funding the investments in education, transportation and climate initiatives articulated in the two plans.

The Infrastructure Investment and Jobs Act.Nov. 15, 2021: President Biden signed a $1 trillion infrastructure bill into law, the result of months of negotiations. The president hailed the package, a pared-back version of what had been outlined in the American Jobs Plan, as evidence that U.S. lawmakers could still work across party lines.

It doesnt just fix Social Security for 75 years, Mr. Biggs said. It would keep the system permanently solvent. Thats a real plus.

Don’t Miss: When Does Social Security Disability Convert To Regular Social Security