What Does It All Mean To Me

I am happy to report that if The Wine Squirrels never earn another penny, and wait as long as possible to start collecting, Social Security will pay out about $50k/year . Remember this is indexed to inflation. The actual number will grow over time in order to provide the same buying power. I really cant complain about that!

My pension will provide some income as well, but Ill save that for another blog post. I need to run some future value calculations that take into account the impact of inflation over time.

While not the most frugal family ever, we are very conscious of our spending and generally our needs are low. We live a very fulfilling life and definitely want for free time much more than material things at this point. This is evident by the fact that our savings rate is high as we dont have a bunch of stuff we need/want to buy. Assuming that trend continues, and in fact reduces over time as mortgages are paid and kids become less dependent, this $50k+ is definitely going to fund a large percentage of our old age retirement.

Knowing that a good chunk of our needs in our 70s and beyond are already taken care of opens up options for the years between now and then!

How To Calculate The Impact Of A Benefit Cut

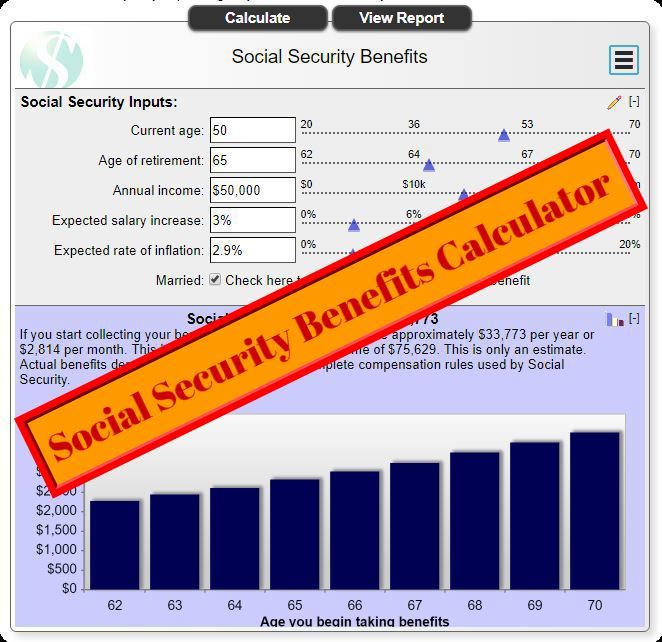

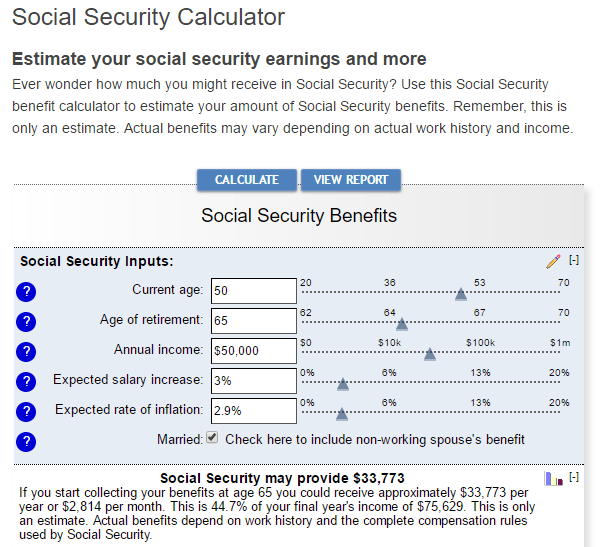

Covisum, a provider of Social Security claiming software, recently updated its calculator to reflect the Social Security trustees’ latest projections. That includes a free version for consumers and a more complex paid version for financial advisors.

Another product, Maximize My Social Security, lets consumers evaluate which claiming strategy might best suit them for a $40 annual fee. It also has a separate version for financial advisors.

The free Covisum calculator can help individuals do a quick calculation based on their benefits alone and some key facts year of birth, full retirement age benefit amount, percentage of the benefit cut and the year that benefit cut occurs.

So someone turning their full retirement age this year, for example, can calculate the effect of a 23% reduction in benefits starting in 2034, as well as the effect of no benefit cut.For each scenario, the calculator will show the value of claiming either at age 65 or age 70, and when beneficiaries stand to get the maximum amount possible from the program.As beneficiaries live longer, the value of waiting to claim until 70 goes up, as demonstrated in the difference in total benefits per the tool’s calculations.

To be sure, the free calculator is just a starting point when it comes to getting a sense of the trade-offs when claiming Social Security, according to Joe Elsasser, founder and president of Covisum.

Do You Plan To Continue Working In Your 60s

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

You can maximize your benefits even if you work fewer hours or stop working.

You can maximize your benefits even if you work fewer hours or stop working.

Consider working in your 60s for an extra boost to your income and savings.

Consider working extra years in your 60s for an extra boost to your income and savings

Also Check: Who Is Eligible For Survivor Benefits From Social Security

How Much Social Security Will You Get When You Retire

The amount of your Social Security benefit is a function of your full retirement age. If you were born in 1960 or after, your normal retirement age when you are eligible to receive full or unreduced Social Security benefits is 67. When you choose to retire is central to your retirement planning strategy because it activates your various streams of retirement income: drawing upon Social Security and your pension, if you have one, as well as beginning withdrawals from your other retirement accounts, such as your 401 or IRA, and other possible income sources like annuities. With the right planning, you may be able to retire early and depend on alternative sources of retirement income until you reach your normal retirement age, at which point you can start collecting your full Social Security benefits. You also can increase your Social Security benefit amount by waiting beyond your full retirement age to retire. However, the benefit increase stops when you reach age 70. Access my Social Security Retirement Calculator to learn more.

Our Retirement Savings Calculator gives you the option of including your Social Security benefits in its calculations to determine if you have enough funds to retire. Discover how early retirement can affect your Social Security benefits and the truth behind some common Social Security myths.

Measure Performance To Stay On Track

Planning is at the heart of any successful saving and investment effort. Without a clearly defined mission, the probability of leaving the workforce prior to the standard age is left to chance. It may unfold as hoped, willed to materialize, but that is an unrealistic approach for those truly committed to the prospect. In order to stay on track, it is essential to maintain comprehensive awareness of where money is held and how investments perform.

Over the course of years employed, workers may change jobs several times, creating a number of different work-sponsored retirement plans. Issued by multiple employers, 401 accounts may even become hard to keep track of, as jobs change and life intervenes. There is legal protection in place to prohibit past employers from ditching reserves, but it is up to each investor to monitor various holdings.

The easiest way to stay on top of investments prior to leaving the workforce is to minimize the number of accounts held. In many cases, funds can be rolled into new accounts as jobs change, consolidating IRAs and other plans. To simplify the picture, at a glance, documents from each resource should be held together, separate from one another. Various apps and web-based resources are also available to help stay current on investment and savings performance.

Recommended Reading: What Age Do You Receive Social Security

Apply The Social Security Benefits Formula

Once you know your AIME, you can plug it into the Social Security retirement benefits formula as outlined above. But remember to choose the correct formula for your age. You should use the one that was in effect in the year you turned 62 regardless of whether you signed up for benefits at that age.

The results you get from this step will give you your PIA. If you choose to sign up at your FRA, that’s also how much you’ll get for a benefit. But if you sign up before or after your FRA, there are a few extra steps to calculating your monthly benefit.

Do You Expect To Have Additional Sources Of Retirement Income Beyond Social Security

Continue saving in the coming years.

Social Security won’t replace all of your pre-retirement income. On average, Social Security replaces 40 percent of a worker’s income. That means your retirement savings, pension, 401, or Individual Retirement Account will need to fill the gap. Claiming at your full Social Security benefit age or later can minimize this gap and maximize your monthly benefit. If you claim before your full retirement age, your monthly benefit could be reduced by as much as 30 percent.Learn more about saving for retirement.

You have an opportunity to continue growing your money.

If you can, get the highest monthly Social Security benefit possible by claiming at your full Social Security benefit age or later. If you claim before your full retirement age, your monthly benefit could be permanently reduced by as much as 30 percent. Also, take advantage of catch-up contributions to your 401 or Individual Retirement Account . Lastly, avoid losing your retirement savings to unnecessary tax penalties. If you withdraw your 401 or IRA savings before age 59½, you will likely face an early withdrawal penalty.Learn more about how retirement savings grow.

It’s a perfect time to start saving.

It’s never too late to start saving!

There are many ways to plan for a secure retirement outside of Social Security.

It’s never too late to start saving!

A type of retirement savings account offered by employers to help their employees save for retirement.

Read Also: Social Security Medicare Sign Up

How Do I Increase My Social Security Benefits After Retirement

To increase your monthly benefit, don’t start taking Social Security payments right when you reach full retirement age. The longer you wait, the more you’ll get each month. If you want to get the highest possible amount of Social Security benefits each month, you need to wait until age 70 to retire.

How To Calculate Social Security Benefits

Lets say your FRA is 66. If you start claiming benefits at age 66 and your full monthly benefit is $2,000, then youll get $2,000 per month. If you start claiming benefits at age 62, which is 48 months early, then your benefit will be reduced to 75% of your full monthly benefitalso called your primary insurance amount. In other words, youll get 25% less per month, and your check will be $1,500.

That reduced benefit wont increase once you reach age 66. Rather, youll continue to receive it for the rest of your life. It may go up over time due to cost-of-living adjustments , but only slightly. You can do the math for your own situation using the Social Security Administration Early or Late Retirement Calculator, one of a number of benefits calculators provided by the SSA that can also help you determine your FRA, the SSAs estimate of your life expectancy for benefit calculations, rough estimates of your retirement benefits, individualized projections of your benefits based on your personal work record, and more.

Although the cost-of-living adjustments announced each year are usually only slight increases, Social Security benefits will increase by 8.7% in 2023considerably more than the 5.9% in 2022, which was already a significant raise. This is the largest increase since 1981.

Read Also: Social Security Administration Knoxville Tennessee

% Of Full Retirement Age Calculator

When planning when to file for Social Security, its helpful to know how much your benefit will be increased, or decreased, based on the month you file.

This calculator will tell you two things:

- your full retirement age

- the percent of your benefit you can expect to receive based on your chosen filing age.

The math behind this calculator is based on the calculations used by the Social Security Administration.

If you file at your full retirement age, youll receive the full benefit.

If you file before your full retirement age your benefit will be reduced. You can file as early as age 62, but doing so could result in a benefit reduction of up to 30%. The monthly reduction percentage is 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

If you file after your full retirement age, you can receive delayed retirement credits up until age 69 & 11 months. These delayed retirement credits will increase your full retirement age benefit by 2/3 of 1% per month that you delay.

Thankfully, you dont need to remember all this math. Just use the calculator below.

Weigh Taking Early Retirement Benefits Against Full Retirement Benefits

A Tea Reader: Living Life One Cup at a Time

People nearing retirement can implement a number of strategies to cover living expenses during their post-working years. Although retirement plans, such as 401s and IRAs, are part of a retirement strategy for many, Social Security benefits are the most common source of income among retirees. The benefit is a guaranteed amount that you can start receiving as early as age 62, or you can wait until 70 to receive the highest monthly payment.

Various factors impact how much Social Security income you get when you start claiming benefits. To determine the optimal age to start taking benefits, you need to calculate your Social Security breakeven age to ensure that you balance payments versus longevity.

Recommended Reading: Social Security Office Billings Mt

Can I Use The Calculator To Figure Out Social Security Disability Insurance And Supplemental Security Income

No. SSDI is aimed at people who cant work because they have a medical condition expected to last a year or more or result in death. Your SSDI benefits last only as long as you suffer from a significant medical impairment while not earning significant other income.

SSI is a separate program for people with little or no income or assets who are 65 or older, as well as for those of any age, including children, who are blind or who have disabilities. The maximum monthly SSI payment for 2022 is $841 for a single person and $1,261 for a couple. But some states add to that payment, and you may receive less than the maximum if you or your family has other income. Get more information about SSDI and SSI from the Social Security Administration.

Also of Interest

No More ‘file And Suspend’

Note that the claiming strategy called file and suspend, which allowed married couples who had reached their FRA to receive spousal benefits and delayed retirement credits at the same time, ended as of May 1, 2016. However, spouses born before Jan. 2, 1954, who have attained their FRA may still be able to file a restricted application. It allows them to claim spousal benefits while delaying their own benefits up to age 70.

Social Security benefits can be taxable if your combined income is high enough.

Don’t Miss: Social Security Office Denton Tx

What Is Full Retirement Age

The size of your monthly Social Security benefit depends on several factors, including how much you earned over the years, the year you were born, and the age when you start claimingdown to the month.

Youll receive your full monthly benefit if you start claiming when you reach what Social Security considers your full retirement age , sometimes also referred to as normal retirement age. FRA was 65 when Social Security began, but it has been raised to 67 for anyone born in 1960 or later. To find your FRA, see the chart below.

| Finding Your Full Retirement Age |

|---|

| 67 |

Benefit Reduction For Early Retirement

|

We sometimes call a retired worker the primary beneficiary, because it is upon his/her primary insurance amount that all dependent and survivor benefits are based. If the primary begins to receive benefits at his/her normal retirement age, the primary will receive 100 percent of the primary insurance amount. If the spouse of a primary begins to receive benefits at his/her normal retirement age, the spouse will receive 50 percent of the primary’s primary insurance amount. The table below illustrates the effect of early retirement, for both a retired worker and his/her spouse. For our illustration, we have used a $1,000 primary insurance amount. With this primary insurance amount and both primary and spouse retiring at their respective normal retirement ages, the primary would receive $1,000 per month and his/her spouse would receive $500 per month. The table shows that retirement at age 62 results in substantial reductions in monthly benefits. Please note that relatively few people can begin receiving a benefit at exact age 62 because a person must be 62 throughout the first month of retirement. Thus most early retirees begin at age 62 and 1 month. Primary and spousal benefits at age 62 |

|

| Year of | |

|---|---|

| 35.00% |

Recommended Reading: Dekalb County Social Security Office

Spouses Who Dont Qualify For Their Own Social Security

Spouses who didnt work at a paid job or didnt earn enough credits to qualify for Social Security on their own are eligible to receive benefits starting at age 62 based on their spouses record. As with claiming benefits on your own record, your spousal benefit will be reduced if you take it before reaching your FRA. The highest spousal benefit that you can receive is half of the benefit that your spouse is entitled to at their FRA.

While spouses get a lower benefit if they claim before reaching their own FRA, they will not get a larger spousal benefit by waiting to claim after their FRAsay, at age 70. However, a nonworking or lower-earning spouse may get a larger spousal benefit if the working spouse has some late-career, high-earning years that boost their benefits.