Merrill: And What Are The Rules For Divorced Couples

Storey: If you donât remarry and you are 62 years of age or older, you can file for spousal benefits whether or not your ex has filed as long as you were married 10 years and have been divorced for at least two years. To qualify, your ex must be entitled to benefits, and the benefit you would receive on your own work record must be less than what youâd receive based on your exâs record. Thereâs a Social Security Administration web page that explains these requirements in more detail.

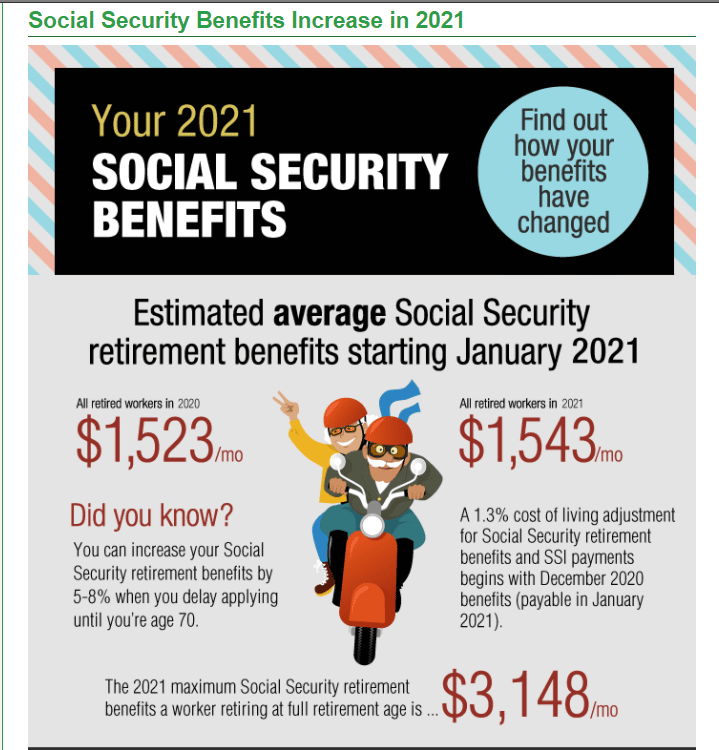

How Much Social Security Will You Receive

It depends on how much you paid in FICA taxes, your birth year and when you decide to begin receiving benefits.

The maximum payout in 2021 for someone who files at age 70 is $3,895 per month, or $46,740 a year. The size of your check will depend on how much FICA tax youve paid, your birth year and when you decide to retire.

To qualify for any pay, you must have at least 40 credits. Americans receive one credit for each $1,470 they earn in 2021, and they get up to four credits per year.

That doesnt mean that if you earn four credits for 10 years you can saddle up and head into the retirement sunset. The earliest you can do that is age 62. Though the longer you wait, the more money youll receive.

In the U.S., full retirement age is 66 years and two months for those born in 1955, and it gradually increases to 67 for those born in 1960 and after. Full retirement age varies among countries, typically ranging between 65 and 67 years old.

If you want to retire at 62, you will receive just 70% of your full retirement benefits. The penalty decreases every year until you reach full retirement age .

If you wait until after you reach full retirement age to start receiving benefits, the funds will increase. If you wait to retire until age 67, you will get 108% of the monthly benefits because you delayed getting benefits for 12 months. If you can work longer and retire at age 70, youll get 132% of the monthly benefits for 48 months.

Were There To Provide Comfort During Difficult Times

The loss of a loved one can be both emotionally and financially difficult. Some widows, widowers, and children may receive survivors benefits to help them cope with the financial loss.

The number of credits needed to provide benefits for survivors depends on the workers age when he or she dies.

Unmarried children who are under age 18 can be eligible to receive Social Security benefits when a parent dies.

Recommended Reading: Social Security Attorneys In My Area

To Wait Or Not To Wait

Consider taking benefits earlier if . . .

- You are no longer working and can’t make ends meet without your benefits.

- You are in poor health and don’t expect the surviving member of the household to make it to average life expectancy.

- You are the lower-earning spouse, and your higher-earning spouse can wait to file for a higher benefit.

Consider waiting to take benefits if . . .

- You are still working and make enough to impact the taxability of your benefits.

- Either you or your spouse are in good health and expect to exceed average life expectancy.

- You are the higher-earning spouse and want to be sure your surviving spouse receives the highest possible benefit.

What Is The Future Of Social Security

As of June 2022, the Social Security Trust Fund is projected to have enough resources to cover all promised benefits until 2035 when, absent a change from Congress, benefits would need to be cut for all current and future beneficiaries to about 80% of scheduled benefits.2 Over the longer term, changes to the full retirement age or means testingâwhich could reduce or eliminate benefits based on your other income sourcesâmay also be considered.

If you’re skeptical about the future of Social Security or wary of potential changes, you may be tempted to start benefits early, assuming that it’s better to have something than nothing. Regardless of your situation, if you are concerned about the future prospects for Social Security, then that’s a good reason to save moreâand earlierâfor your retirement.

Recommended Reading: How Do I Apply For Social Security Online

What If I Delay Taking My Benefits

If you retire sometime between your full retirement age and age 70, you typically earn a “delayed retirement” credit for your own benefits . For example, say you were born in 1960, and your full retirement age is 67. If you start your benefits at age 69, you would receive a credit of 8% per year multiplied by two . This means your benefit would be 16% higher than the amount you would have received at age 67.

Fact #: Social Security Provides A Guaranteed Progressive Benefit That Keeps Up With Increases In The Cost Of Living

Social Security benefits are based on the earnings on which people pay Social Security payroll taxes. The higher their earnings , the higher their benefit.

Social Security benefits are progressive: they represent a higher proportion of a workers previous earnings for workers at lower earnings levels. For example, benefits for a low earner retiring at age 65 in 2021 replace about half of their prior earnings. But benefits for a high earner replace about 30 percent of prior earnings, though they are larger in dollar terms than those for the low-wage worker.

Many employers have shifted from offering traditional defined-benefit pension plans, which guarantee a certain benefit level upon retirement, toward defined-contribution plans s), which pay a benefit based on a workers contributions and the rate of return they earn. Social Security, therefore, will be most workers only source of guaranteed retirement income that is not subject to investment risk or financial market fluctuations.

Once someone starts receiving Social Security, their benefits increase to keep pace with inflation, helping to ensure that people do not fall into poverty as they age. In contrast, most private pensions and annuities are not adjusted for inflation.

Read Also: How To Pass Social Security Disability Mental Exam

About Social Security Disability Benefits

Supplemental Security Income and Social Security Disability Income are federal disability benefits that provide income to people who cannot keep a job because of a disability. Benefits can be a critical step toward ending homelessness and promoting recovery.

Supplemental Security Income provides a monthly cash benefit to children and adults who are disabled with limited income and resources.

Social Security Dependents Benefits

If you’re the spouse of a retired or disabled worker who qualifies for Social Security retirement or disability benefits, you may be entitled to benefits based on the worker’s earnings record. This is true whether or not you actually depend on your spouse for your support.

Spousal benefits are available for those who reach age 62 or are taking care of the worker’s child age 16 or under. Read about spousal dependents benefits here.

Minor children, and older children who became disabled before age 22, can also collect dependent benefits based on the worker’s earnings record. Read about child dependents benefits here.

Don’t Miss: Will Social Security Be Around When I Retire

Federal Income Taxation Of Benefits

Originally the benefits received by retirees were not taxed as income. Beginning in tax year 1984, with the Reagan-era reforms to repair the system’s projected insolvency, retirees with incomes over $25,000 , or with combined incomes over $32,000 or, in certain cases, any income amount generally saw part of the retiree benefits subject to federal income tax. In 1984, the portion of the benefits potentially subject to tax was 50%. The Deficit Reduction Act of 1993 set the portion to 85%. Moreover, since the taxable income threshold is not indexed to inflation, the portion of beneficiaries’ social security payments subject to income tax has risen significantly in real terms since the threshold was set in 1984.

Estimated Net Benefits Under Differing Circumstances

In 2004, Urban Institute economists C. Eugene Steuerle and Adam Carasso created a Web-based Social Security benefits calculator. Using this calculator it is possible to estimate net Social Security benefits for different types of recipients. In the book Democrats and Republicans Rhetoric and Reality Joseph Fried used the calculator to create graphical depictions of the estimated net benefits of men and women who were at different wage levels, single and married , and retiring in different years. These graphs vividly show that generalizations about Social Security benefits may be of little predictive value for any given worker, due to the wide disparity of net benefits for people at different income levels and in different demographic groups. For example, the graph below shows the impact of wage level and retirement date on a male worker. As income goes up, net benefits get smaller even negative.

However, the impact is much greater for the future retiree than for the current retiree . The male earning $95,000 per year and retiring in 2045 is estimated to lose over $200,000 by participating in the Social Security system.

The next image shows estimated net benefits for married men and women at different wage levels. In this particular scenario it is assumed that the spouse has little or no earnings and, thus, will be entitled to collect a spousal retirement benefit. According to Fried:

Don’t Miss: Social Security Administration Twin Cities Card Center

How To Stop Social Security Check Payments

The SSA can not pay benefits for the month of a recipients death. That means if the person died in July, the check received in August must be returned. Find out how to return a check to the SSA.

If the payment is by direct deposit, notify the financial institution as soon as possible so it can return any payments received after death. For more about the requirement to return benefits for the month of a beneficiarys death, see the top of page 11 of this SSA publication.

Family members may be eligible for Social Security survivors benefits when a person getting benefits dies. Visit the SSA’s Survivors Benefits page to learn more.

Claim Of Discrimination Against The Poor And The Middle Class

Workers must pay 12.4 percent, including a 6.2 percent employer contribution, on their wages below the Social Security Wage Base , but no tax on income in excess of this amount. Therefore, high earners pay a lower percentage of their total income because of the income caps because of this, and the fact there is no tax on unearned income, social security taxes are often viewed as being regressive. However, benefits are adjusted to be significantly more progressive, even when accounting for differences in life expectancy. According to the non-partisan Congressional Budget Office, for people in the bottom fifth of the earnings distribution, the ratio of benefits to taxes is almost three times as high as it is for those in the top fifth.

Also Check: Protect Your Social Security Number

Social Security Disability Benefits

If you haven’t reached full retirement age but you’ve worked enough to meet the requirements , you could be eligible for benefits from the Social Security Disability Insurance program. To receive benefits, you must have a physical or mental impairment that prevents you from working full-time for at least a year. If Social Security considers you disabled under its medical guidelines, you can receive benefits roughly equal to what your full retirement benefits would be.

Where Does Money Collected For Social Security Go

The quick answer is into the governments massive retirement fund for American workers. How massive is it?

Since its inception, FICA has collected more than $20 trillion for Social Security and Medicare.

Congress enacted FICA in 1935. There were various state and local retirement funds at the time, but lawmakers decided workers needed a national safety net to keep them from spending their retirement and stuck eating cold beans every night for dinner.

That fund would also cover people who were disabled before reaching retirement.

The Social Security Board of Trustees 2020 annual report said that $1.062 billion was collected. The Social Security Administration paid $1.059 billion in benefits. The costs are projected to exceed the income by 2021 and in the years to come, sounding the alarms for future generations.

That $3 billion surplus was put into trust funds to cover future payments. The Trustees reported the total asset reserves in the trust funds were $2.85 trillion, which seems like a lot of money, and it is, but with people living longer, more benefits are going out and there are questions about whether there will be enough for your descendants.

You May Like: Social Security Office Russellville Ar

What Is The Social Security Tax

Social Security tax is the tax levied on both employers and employees to fund the Social Security program in the U.S. Social Security tax is collected in the form of a payroll tax mandated by the Federal Insurance Contributions Act or a self-employment tax mandated by the Self-Employed Contributions Act .

The Social Security tax pays for the retirement, disability, and survivorship benefits that millions of Americans receive each year under the Old-Age, Survivors, and Disability Insurance Programthe official name for Social Security.

Merrill: Can You Apply For A Spousal Benefit If Your Spouse Hasnt

Storey: A married person can only apply for a spousal benefit if his or her spouse is receiving retirement or disability benefits. People can no longer file and then suspend their benefits, allowing them to grow while their spouses collect on their record as they could before May 2016. And if you were born after January 1, 1954, you no longer can âclaim twiceâ â or file for spousal benefits at full retirement age while allowing your own future retirement benefit to grow.

You May Like: North Carolina Social Security Office

Read A Brief Summary Of This Topic

social security, any of the measures established by legislation to maintain individual or family income or to provide income when some or all sources of income are disrupted or terminated or when exceptionally heavy expenditures have to be incurred . Thus social security may provide cash benefits to persons faced with sickness and disability, unemployment, crop failure, loss of the marital partner, maternity, responsibility for the care of young children, or retirement from work. Social security benefits may be provided in cash or kind for medical need, rehabilitation, domestic help during illness at home, legal aid, or funeral expenses. Social security may be provided by court order , by employers , by central or local government departments, or by semipublic or autonomous agencies.

The International Labour Organisation uses three criteria to define a social security system. First, the objective of the system must be to grant curative or preventive medical care, to maintain income in case of involuntary loss of earnings or of an important part of earnings, or to grant a supplementary income to persons having family responsibilities. Second, the system must have been set up by legislation that attributes specified individual rights to, or that imposes specified obligations on, a public, semipublic, or autonomous body. And third, the system should be administered by a public, semipublic, or autonomous body.

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:

- Direct Express debit card – a pre-paid debit card. Get help by calling the Go Direct Helpline at .

Make Changes to an Existing Direct Deposit Account:

On Go Direct’s FAQ page, learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.

Recommended Reading: Va Survivors Pension And Social Security

Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Other Pensions Might Reduce Your Social Security Benefits

Your benefits will be affected if you have a pension from a job that didnt have Social Security taxes taken out of your paycheck. Common examples include people who worked for a public education system, railroad workers and Federal government employees hired before 1984 who are covered by the Civil Service Retirement System .

Two complicated provisions will affect your claiming strategy: the Windfall Elimination Provision and the Government Pension Offset . The WEP reduces your own benefits by a discounted factor based on how many years you worked in jobs that did not withhold Social Security taxes. The GPO reduces your spousal and survivor benefits by two-thirds of the amount of your noncovered pension.

Also Check: Social Security Office Columbus Georgia

Will Social Security Be Available When I Retire

Yes, if you are 50 or older right now. Younger than that age? Maybe, maybe not.

And even if it is still functioning, it likely wont pay out enough income for you to comfortably retire. That means you need to plan accordingly and start saving as much as possible by contributing to retirement accounts such as an IRA or a 401.

As massive as the Social Security fund is, its not massive enough to allow you to retire comfortably. Demographic trends show that more people will be retiring and taking money in the coming years, while fewer will be working and contributing to the fund.

The trust funds are predicted to grow through 2021. After that, the total cost of the program is expected to exceed its income.

Lawmakers have long known that reforms are necessary, but politicians have been petrified at the voter backlash that might ensue if they tinker with the program. But the clock is ticking, and the SSA predicts it will strike midnight in 2034.

Sadly, that means workers who have paid into the fund for decades likely wont be able to reap the benefits of the system and collect funds for retirement.

If that happens, the SSA says it will be able to pay benefits until 2090. So, in essence they are simply kicking the problem down the street and making it your kids and grandkids problem.