Minimize Taxes Now Or Maximize Benefits Later

Should you skip some or all of the business tax deductions youre entitled to increase your future Social Security benefit? Maybe. The answer is complicated because lower-earning business people stand to gain more in the future than their higher-earning counterparts due to how Social Security retirement benefits are calculated.

Another critical factor is where your Schedule C earnings fall compared to your previous years earnings. If you have a full 35-year career behind you and youre not earning nearly as much in your current self-employed pursuits, it makes sense to take all the deductions you can, as your Social Security benefits will be calculated based on your 35 highest-earning years. In this case, you want to minimize your Social Security taxes.

But if youre currently in the high-earning part of your career, a higher Schedule C income can help you get higher Social Security benefits later. Unless you enjoy complex math problems or have a top-notch accountant, its probably not worth the headache to figure out whether youll earn more in future Social Security benefits than youd save by claiming all the deductions you can today.

Of course, suppose youre on the cusp of not having enough Schedule C income to give you the work you need to qualify for Social Security. In that case, it may be worth foregoing some deductions to make sure youre entitled to any benefits at all.

What You Need Know If Youre Self Employed:

- Instead of withholding Social Security taxes from each paycheckyou pay all the Social Security taxes on your earnings when you file your annual federal income tax return.

- Self-employed individuals earn Social Security work credits the same way employees do and qualify for benefits based on their work credits and earnings.

- How much you pay in Social Security taxes is based on net income.

- Deductions that you claim can make your taxable income substantially lower, but it can also potentially decrease your Social Security benefits later.

- Your Social Security benefit payment is calculated based on your 35 highest-earning years.

- If you earned $400 or less, Social Security taxes will be waived.

Free Self Employed Tax Filing

How do you calculate self employed tax? Calculating self-employment tax: find out your net income. The bottom line for your business is your profit minus all operating expenses. Calculate the net income from your own business. To do this, multiply the net income by the percentage. Calculate your self-employment tax.

Also Check: Sending A Check In The Mail

Read Also: Social Security Office In Forest Mississippi

What Are Ssdi Work Credits

Disabled workers can apply for SSDI if they have worked long enough and earned sufficient wages over the past 10 years. To be fully insured for purposes of eligibility, a workers Social Security account must be credited with at least 20 quarters of earnings in the past 10 years. Thats a total of 40 quarters.

If your employer did not report your wages to SSA or file FICA taxes, you may not receive credit for the necessary quarters. If you worked for cash and did not report those wages or pay taxes, you may have a problem establishing enough quarters of coverage.

Snts And Able Accounts

SNTs and ABLE accounts can work together well to further the economic independence of self-employed individuals with disabilities, while protecting their means-tested benefits. Each has its own array of regulations which must be followed in order to avoid negative consequences.

For instance, ABLE accounts can be managed by the beneficiary, but have contribution limitsâ$15,000 annually as of 2019. SNTs have no such limits but distributions are made at the sole discretion of a trustee. If SNT distributions are used for food or shelter, SSI payments will decrease, which is not the case with ABLE expenditures.

As an example, in New Hampshire, someone might transfer funds from their MEAD earned income account into an SNT. Then, as needed, a trustee could transfer funds from their first party SNT to an ABLE account up to its $15,000 annual limit. In this way, they could optimize their control of earnings while maintaining important government benefits.

In summary, thereâs a lot to consider before going the entrepreneurial route. Be sure to consult both a special needs attorney and CPA before making big decisions. But if itâs a fit for you or a loved one, it can deliver profit, a sense of fulfillment and a flexible lifestyle.

Read Also: Social Security Number For International Students

Don’t Miss: Social Security Office Muskogee Oklahoma

How Social Security Benefits Are Calculated For Self

You may be wondering if Social Security benefits are calculated differently for employees versus self-employed people. The good news is they arent. Theyre calculated precisely the same way.

First, you must qualify for Social Security benefits. To do that, most people have to earn 40 credits to qualify. You can earn up to four credits each year. In 2021, you earn one credit for each $1,470 in qualifying earnings. If you max out the credits you earn each year, you need ten years worth of credits to be eligible for benefits.

After you qualify for benefits, you can start receiving benefit payments. Your benefit payments are calculated using a complex formula. It is based on the amount you paid in Social Security taxes, though.

Currently, the full retirement age for most people is 67. You can take benefits as early as age 62, but the benefit will be reduced by roughly half of a percent for each month you take your benefits early. You can delay your benefits until age 70 and receive a higher payout.

You can also claim Social Security benefits in other ways. For instance, you may get benefits if you are disabled or if your working spouse passes away.

Are Se Earnings Also Subject To Income Tax

Yes, though the amount of taxable income is figured slightly differently than for employees, because of the much greater range of allowed deductions. One of the deductions is for half of your self-employment tax. So even though you have to pay the entire self-employment tax, you get half of it back when you prepare your return.

You May Like: Social Security Office Vincennes Indiana

Special Deductions For Certain Work Expenses

Impairment Related Work Expenses are out-of-pocket expenses related to your disability if necessary to help you work or to continue to be able to work even if you would have those same expenses if you were not working. 20 C.F.R. §§ 404.1576, 416.976. The IRWE will be applied if you work and receive a disability benefit . Examples of IRWEs include attendant care assistance while at work to get you ready for work, to help you return to work, transportation costs if you are unable to use or rely on public transportation because of your disability. See The Red Book for more examples.

IRWEs for people who receive SSI: IRWEs that you pay for yourself can be deducted from your earned income. Your countable income the amount by which your SSI grant would be reduced is determined after deducting IRWEs along with other earned income deductions. This deduction is available to persons who receive SSI on the basis of disability, other than for blindness . It is also available to persons who receive SSI on the basis of age but who have a disability and received SSI on the basis of disability in the month before their 65th birthday. 20 C.F.R. 416.1112.

Your IRWEs are deducted from your net earnings from self-employment to determine if your earned income after IRWEs is more than $1,000 or more than $1640 for 2011 . 20 C.F.R. §§ 404.1574 , 404.1576. IRWEs are not deducted from earnings to see if a month counts as a trial work period month.5

How To Calculate Self

To calculate your self-employment tax, start by finding your net earnings from self-employment. You can calculate your net earnings for tax purposes by subtracting your business expenses from business income. This is generally done by filling out a Schedule C as part of IRS Form 1040, your federal income tax return. Schedule C must be completed by sole proprietors, independent contractors, and other small business owners as part of their tax filing.

If the result is less than the Social Security wage base, the calculation is simple. If your net earnings are more than the Social Security wage base, your calculation will have a few additional steps. You can use our free self-employment tax calculator otherwise weâll show you how to calculate your tax either way.

You May Like: Social Security Office Augusta Ga

What Are Social Security Points

Social Security started in the 1930s as a way to provide financial assistance to retirees. Today, Social Security benefits are available to anyone who meets the eligibility requirements. This money is allocated based on the number of points a person accrues through employment during their lifetime.

Social Security points are assigned based on your earnings. For every $1510 you earn, you receive one Social Security point, explains the team at AARP. You may earn up to four Social Security points per year. These points stay with you for life and affect the amount of Social Security benefits you receive in retirement. Social Security benefits typically comprise about 40 percent of a person’s retirement income, so it is important to understand how the system works.

According to the Social Security Administration, you must have a minimum of 40 points or credits to receive any benefits. This number of points equates to at least 10 years of income earning. You must also meet the full retirement age of 66 for those born between 1943 and 1954. If you were born between 1955 and 1960, your full Social Security retirement age is 67.

Filing Totalization Benefit Claims

People generally do not need to take action concerning Totalization benefits under an agreement until theyare ready to file a claim for retirement, survivors or disability benefits. A person who wishes to file aclaim for benefits under a Totalization agreement may do so at any Social Security office in the UnitedStates or the foreign country.

Also Check: Social Security Office San Angelo

Advisers Often Ask Whether There’s A Way To Minimize Payroll Taxes For Small

I often get questions from financial advisers who work with self-employed individuals asking if theres a way to minimize payroll taxes, which small-business owners pay at double the rate of employees, while maximizing future Social Security retirement benefits.

Kim Seymour, a financial planner with Family Wealth Planning Group in Naples, Florida, said she has a client whos 63 years old and working in the family business. The client receives a salary of about $40,000 a year.

The clients current estimated Social Security benefit is about $1,800 per month at her full retirement age of 66 and 8 months and about $2,400 at the maximum age of 70. Her benefit is larger than any amount she would receive as a spouse while her husband is alive but less than the monthly survivor benefit she would receive if he died first.

Would it be beneficial to increase her salary between now and her full retirement age or beyond to increase her future Social Security benefits? Kim asked me in an email. Is there a way I can calculate the increased benefit per $1,000 of additional salary taking into account the additional payroll taxes paid by her and the business?

Oh, if it were only that simple.

Above the $147,000 threshold, the Social Security tax component goes away but the 2.9% Medicare tax continues before rising to 3.8% at higher income levels .

Are Social Security Benefits Based On My Last Three Years Of Earnings

No, the only things that matter are 1) having enough credits and 2) your highest 35 years of earnings. Unlike some pension plans, Social Security doesnt go by your last X years of earnings.

The only thing that maxing out your income right before you retire does is increase your average lifetime income.

If your income is lower in your later years, it can never lower your benefits.* If you had more than 35 years of work history, Social Security goes by your highest 35 years not your last 35 years.

*Special rules apply if youre receiving benefits below full retirement age while still working but youll normally see a temporary drop in benefits followed by an increase later on.

Read Also: Maximum Social Security Disability Benefit

Social Security Contributions As A Freelancer

Each month, the Spanish Social Security will charge you a fixed fee, and this is true even if you fail to make any money .

This fee is what will grant you access to the Spanish Health Care system, and also allow you to receive unemployment or sick leave benefits if required.

It is the same contribution companies do withdraw from your gross salary if you work for a company.

In Spain, this monthly Social Security fee is, at minimum, 293.

We say minimum because you can choose to pay more than that in order to guarantee a higher pension once you retire.

Nevertheless, there are a few exceptions to this fixed fee:

- During your first 12 months as a freelancer, you will just pay 60 per month

- During your second year , you will pay 150

- If you are a mother who returns from maternity, you can claim a 100% discount for 12 months

- And if you work full-time for a company but part-time as a freelance, you will automatically get a 50% reduction for the first 18 months, and then you will get a 25% reduction

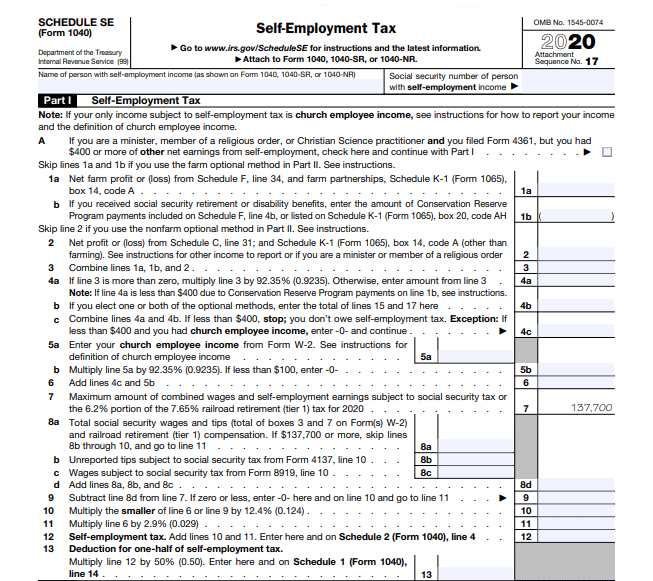

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule CPDF to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C InstructionsPDF may be helpful in filling out this form.

In order to report your Social Security and Medicare taxes, you must file Schedule SE , Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions for Schedule SEPDF may be helpful in filing out the form.

Read Also: Social Security Office In Clarksville Tennessee

How To Claim Your Benefits

If you’re self-employed, you claim your Social Security benefits via the same route as traditional employees. Workers can apply for benefitsonline or by calling the SSA.

Those who are at full retirement age or older may keep their benefits even if they continue to work and earn money. However, those younger than full retirement age will run into an income cap if they continue to work, because the SSA will deduct $1 from a workers benefits for every $2 earned above $19,560 in 2022, and $21,240 in 2023.

When you’re self-employed, you only count a payment as income when it is received. For example, if you did some freelance work in December of 2022 but didn’t receive payment for it until January 2023, you would report that income on your 2023 taxes.

Form To Be Used By Social Security Disability Recipients :

Fill in the address of your Social Security office and information about you after the “re.” Fill in the first month in a calendar year that you were self-employed. Make many copies of the form. We recommend you three-hole punch the copies and keep them in your notebook.

You must report the first month you have any earnings from self employment. Thereafter, you report if you have any increase in the amount of your earnings from self-employment. You also report any month in which your work activity took more than 80 hours. We also recommend that you report your earnings from self employment for months in which your income goes down. If you have not had nine months that count as trial work period months, it is important that you report any month following a trial work period month where your income drops to $720 a month in 2011 or less or your hours of work activity drop to 80 hours a month or less.

For each month that you report about, mail in the filled in and signed letter form together with a copy of the itemization form. Enter the date you are signing and mailing the form on the top of the letter form. In the second paragraph of the letter, enter the month you are reporting to Social Security about. Check whether your work takes 80 hours or less or more than 80 hours a month. Photocopy the checks or check stubs paying you for your work and send in the photocopies with your letter.

Haga clic en enlaces a continuación para una versión completa descargable.

Read Also: Social Security Benefits Retirement Calculator

How Do Independent Contractors Avoid Paying Taxes

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

Being Taxed As An Llc

If you set up an LLC, you have some options when it comes to LLC self-employment taxes:

- Disregarded LLC. If you create an LLC with one member and do not elect to be taxed as a corporation , then you will still continue to pay self-employment tax as an LLC. Your tax liability for self-employment tax does not change.

- LLC taxed as an S corporation. As an LLC you can elect to be taxed as an S corporation. If you choose this option, you will not pay self-employment tax.

Recommended Reading: Can I Go To Any Social Security Office

What Are The Typical Withholdings And Basic Tax Rates

Typically, an employer contributes 6.2 percent of your income into Social Security and 1.45 percent into Medicare. Through your withholdings, you pay an additional 6.2 percent of Social Security tax plus another 1.45 percent of your income for Medicare. Generally, your employer will deduct these amounts from your paycheck and forward them to the government along with its own contribution.

When youre self-employed, however, the task of payingas well as paying the full amount of the taxesshifts entirely onto your shoulders. Currently, that means you have to pay 12.4 percent for Social Security and 2.9 percent for Medicaid. If you earn more than $200,000, for taxpayers filing as single, or $250,000, for married taxpayers filing jointly, youll have to pay an extra 0.9 percent for Medicare. In general, none of these taxes are considered deductible from your overall business overhead. This is the self-employment tax, and it does not take into account federal or state income taxes.