Can You Receive Retroactive Payments

Once the SSA approves your SSDI application and calculates your monthly benefit, you may be entitled to a back pay award. How many months of payments you will receive will depend on the date you applied for benefits and your disability onset date.

If you are applying for SSDI benefits, you need the assistance of a skilled Social Security disability lawyer to get your application approved and receive the benefits you deserve. To schedule a free consultation with a member of our legal team, fill out the online form on this page or call our Roswell office today.

|

Related Links: |

Estimating Your Social Security Disability Amount

In 2022, the average SSDI payment for an individual is $1,358, but almost two-thirds of SSDI recipients receive less than that. And only 10% of SSDI recipients receive $2,000 per month or more.

The 2022 average monthly benefit for an SSDI recipient who has a spouse and children is $2,383.

Because benefit amounts depend on lifetime earnings, there’s a large range in how much Social Security pays. For instance, let’s look at age 55, the most common age disabilities start. For 55-year-olds who have worked their entire lives, Social Security typically pays $1,000 to $2,700. The benefits pay chart here shows you the ranges based on income.

Within those ranges, the amount you’ll receive will depend on the following:

- your average income over 35 years

- whether you paid self-employment taxes if you owned your own business or freelanced

- whether you worked in any jobs that didn’t pay into the Social Security system , and

- whether you took any years off work for child-rearing or long-term illness.

Maximum Social Security Benefits

If you are wondering about the maximum social security benefits under this program, then this part explains to you the actual benefits that you will receive after a successful enrollment with this program every month.

The maximum supplemental security income for individuals in the year 2022 is $841 per month.

The maximum amount for social security disability insurance benefits is $3,148 per month.

Disabled workers average monthly benefits under this program are $1,358

Recommended Reading: Social Security Office In Newark

Ssi Limits On Working

For people who are receiving SSI, the new federal income limit for SSI is $841 per month, but complicated rules govern what income is countable and what income is not. Over half of the income made by an SSI recipient isnt counted toward the limit, so you can actually receive SSI until you make up to $1,766 per month in 2022 .

But any income you receive between $0 and $1,766 will reduce your monthly benefit. In some states that make extra payments to SSI recipients, the income limit for SSI recipients may be higher.

The income exclusion amount for students receiving SSI is now $2,040 per month .

Read Also: Estée Lauder Employee Benefits Website

Tips On Estate Planning

- A financial advisor who specializes in Social Security Disability Insurance can help when applying for benefits. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre planning for the future then its a good time to think through how you can maximize your social security benefits.

- Dealing with social security benefits can be complicated. Check out these ten other secrets you should know about social security.

You May Like: What To Do When You Lose Your Social Security Card

How Cost Of Living Impacts Social Security Disability Payments

Anyone receiving Social Security disability or retirement benefits is subject to the Social Security Administrations COLA, or Cost of Living Adjustment. As the cost of common household goods increase, SSA adjusts benefits upward at a comparable rate.

To arrive at their decision, SSA uses varous tools to analyze cost increases nationally. The most well-known index is the Consumer Price Index. Since 1975, Social Securitys general benefit increases have been based on increases in the Consumer Price Index.

Because the cost of goods increase at different rates in different areas, the SSA uses a tool called an index. An index gathers data from many sources. Since 1975, Social Securitys general benefit increases have been based on increases in the cost of living as measured by the Consumer Price Index.

Another commonly used index is the Meric cost of living index. It derives the cost of living index for each state by averaging the indices of participating cities and metropolitan areas in that state. And, since 1968, the Council for Community and Economic Research , has also published a popular cost index.

Benefits For Disabled Children

A disabled child can qualify for their own SSDI benefits even though they have no earnings record. The same goes for an adult child who becomes disabled before the age of 22. The process can be difficult, however, to qualify. Once approved, the disabled child can receive up to 50% of their parents benefit.

You May Like: Social Security Office Topeka Ks

What Is The Cost

Every fiscal year, the Social Security Administration sets forth an updated cost-of-living adjustment , based on the percentage increase in the Consumer Price Index for Urban Wage Earnings and Clerical Workers . The CPI-W measures the change in prices of goods and services over time.

After the U.S. Bureau of Labor Statistics calculates the monthly CPI-W, the SSA pulls data from the third quarter of the previous fiscal year to the third quarter of the current year to determine the COLA for the upcoming year.

In the fall, the Senate passes new legislation to allow a cost-of-living increase for veterans benefits. Then, on December 1, the Department of Veterans Affairs will adjust veterans monthly compensation amounts to reflect the updated cost of living. Veterans can expect to collect their newly adjusted benefits starting December 31.

Which Disability Benefits Can Affect Your Ssdi

If you were injured on the job and you’re receiving workers’ compensation benefits, the SSA might reduce the amount of your SSDI benefit. That’s because the SSA has set a limit on how much public disability income you can have. And worker’s comp isn’t the only public benefit that can affect the amount of your SSDI.

Other disability benefits that aren’t job-related and are paid for by the federal, state, or local government might also reduce your SSDI benefit amount. Examples of these include:

- temporary disability benefits paid by the state

- military disability benefits, and

- state or local government retirement benefits that are based on disability.

But some public benefits aren’t counted toward the disability benefits limit, including SSI and VA benefits.

Read Also: Wichita Falls Social Security Office

How Can I See My Cost

If you set up your My Social Security account online by Nov. 15, you can now see how much your benefits will be increased for 2023. Just log in to your My Social Security account and check the message center to view the document that has all the details about your new 2023 benefit amount.

The document should tell you how much your monthly benefit is before and after deductions, and when you’ll get your first payment with the COLA increase.

If you didn’t sign up for a My Social Security account, keep an eye on your mailbox because you’ll receive a COLA notice in the mail sometime this month.

Note that your higher Social Security payment will take effect in January 2023. If you’re a Supplemental Security Income beneficiary, your first increased payment will be on Dec. 30.

Calculating Benefit Payment Amounts

Your Weekly Benefit Amount depends on your annual income. It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim start date and up to the maximum WBA.

Note: Your claim start date is the date your disability begins.

We will calculate your WBA using a base period. To receive these benefits, you must have paid into State Disability Insurance during your base period and meet eligibility requirements. You will see this listed as CASDI on your paystub.

Read Also: Can You Get Credit Card Without Social Security Number

The Average Monthly Benefit In 2022 Is $1358 And It Will Increase In 2023

In 2022, the estimated average Social Security disability benefit for a disabled worker receiving Social Security Disability Insurance is $1,358 per month, according to the Social Security Administration . That figure is expected to go up to $1,483 in 2023. These benefits are based on average lifetime earnings, not on household income or the severity of an individuals disability.

If youve kept your annual Social Security statement, you can find what you are likely to receive in the Estimated Benefits section. The total amount that a disabled worker and their family can receive is about 150% to 180% of the disabled workers benefit. Eligible family members can include a spouse, divorced spouse, child, disabled child, and/or an adult child disabled before age 22.

The estimated average monthly Social Security benefits payable to a disabled worker, their spouse, and one or more children in 2023 is $2,616, which is an increase from the approximate benefit of $2,383 in 2022. These, along with other amounts, are subject to change annually based on inflation.

For a more precise indication, Social Security has an online calculator that you can use to obtain an estimate of both retirement and disability benefits for you and your family members.

Calculating Your 2022 Va Disability Rates

The U.S. Department of Veterans Affairs has long recognized the value and importance of ensuring that Americas veterans are compensated for their military service. This is especially true when military service has led to service-connected medical issues or disabilities.

To ensure disability compensation is awarded fairly, the VA examines disability rates each year to adjust for inflation and higher costs of living. This ensures disability benefits maintain value over time.

If you currently receive VA disability benefits, its worth taking the time to review the charts presented here that outline new VA compensation rates for 2022. This way, you will know how much disability compensation you will receive each month and be able to plan your 2022 finances accordingly.

Read Also: Social Security Office Coconut Creek

What If You Make More Than The 2022 Maximum Income Limit

Earning more than the monthly income limit for eligibility has the effect of disqualifying the SSD recipient from the formal definition of disabled. The fact that an SSD recipient earned more than the monthly income limit is evidence that the benefits recipient is not disabled under the governments regulations. The result is a suspension of benefits. However, SSD recipients whose income rises above the monthly eligibility income limit immediately become eligible for SSD benefits again when their income returns to a level beneath the maximum income set by the Social Security Administration.

Also Check: Houston Methodist Employee Benefits 2022

Why Are My Social Security Benefits Set To Increase

When the cost of living rises, as measured by the Department of Labors Consumer Price Index , federal benefit rates rise as well. When inflation rises, the CPI-W rises, resulting in a greater cost of living. Because prices for products and services are, on average, increased as a result of this change, the cost-of-living adjustment helps balance these costs.

Also Check: Social Security Disability Overpayment Statute Of Limitations

How Are Social Security Increases Calculated

To ensure the value of money at retirement keeps up with the rate of inflation, the SSA ties its adjustment for Social Security benefits to the wage earners Consumer Price Index . It calculates each years Cost-of-Living Adjustment by calculating the change in the CPI-W for urban wage earners and clerical workers from the third-quarter average of the previous year to the third-quarter average for the current year.

| CPI-W Measurement | |

|---|---|

| Average | 253.412 |

| Inflation According to the CPI-W | 1.3% |

Fact #: Social Security Provides A Foundation Of Retirement Protection For Nearly All People In The Us

97% of older adults either receive Social Security or will receive it.

Almost all workers participate in Social Security by making payroll tax contributions, and almost all older adults receive Social Security benefits. In fact, 97 percent of older adults either receive Social Security or will receive it, according to Social Security Administration estimates.

The near universality of Social Security brings many important advantages. It provides a foundation of retirement protection for people at all earnings levels. It encourages private pensions and personal saving because it isnt means-tested it doesnt reduce or deny benefits to people whose income or assets exceed a certain level. Social Security provides a higher annual payout than private retirement annuities per dollar contributed because its risk pool is not limited to those who expect to live a long time, no funds leak out in lump-sum payments or bequests, and its administrative costs are much lower.

Universal participation and the absence of means-testing make Social Security very efficient to administer. Administrative costs amount to only 0.6 percent of annual benefits, far below the percentages for private retirement annuities. Means-testing Social Security would impose significant reporting and processing burdens on both recipients and administrators, undercutting many of those advantages while yielding little savings.

Recommended Reading: Free Social Security Disability Lawyers

What We Mean By Disability

The definition of disability under Social Security is different than other programs. Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability.

We consider you to have a qualifying disability under Social Security rules if all the following are true:

- You cannot do work and engage in substantial gainful activity because of your medical condition.

- You cannot do work you did previously or adjust to other work because of your medical condition.

- Your condition has lasted or is expected to last for at least one year or to result in death.

This is a strict definition of disability. Social Security program rules assume that working families have access to other resources to provide support during periods of short-term disabilities, including workers compensation, insurance, savings, and investments.

Recommended Reading: Social Security Office Denton Tx

Social Security Disability Benefits Pay Chart 2021

Instead, SSI benefits are set by federal regulations. The monthly benefits as shown on the SSI benefits chart issued for 2021 are the following:

- Eligible individual: $9,530.12 annual maximum, which is rounded to a monthly payment of $794.

- Eligible couple: $14,293.61 annual maximum, which is rounded to a payment of $1,191 monthly.

- Essential person: $4,775.99 annual maximum paid to an essential person that is rounded to a monthly payment of $397.

An essential person is a person who lives with and provides essential care to someone who is blind or disabled and receiving SSI benefits. An SSI lawyer at NY Disability can review the requirements that must be met for someone to qualify as an essential person.

You May Like: Does Social Security Count As Income For Extra Help

Family Benefit Maximums And Ruleseach Member Of The Family Of Someone Getting Ssdi Benefits Can Qualify For A Separate Monthly Payment Equal To As Much As 50% Of The Disabled Persons Benefit Amount So Assuming A Disabled Person Is Receiving The 2021 Average Amount Of $128237 That Persons Child Under 18 Could Receive $64118 Each Month

That can change, however, if a disabled person has more than one family member who qualifies to receive SSDI. Thats because the Social Security Administration has a cap on the total SSDI benefits a family can receive. This cap is generally 150% of the disabled persons monthly SSDI benefit. However, it can go as high as 180% in some circumstances.

If a familys total SSDI benefits exceed the maximum percentage, then Social Security will reduce each persons payment to keep the total below the cap. The reductions are applied proportionately to each individuals benefit to get below the cap, except that the disabled parents benefit is not reduced. This will reduce each family members benefit below 50% of the disabled parents benefit.

What Are The Maximum Social Security Disability Benefits

The monthly benefits issued for 2022 include:

- The current maximum Supplemental Security Income for an individual is $841 per month.

- The current maximum amount for Social Security Disability Insurance benefits is $3,148 per month.

- The average disability payment for a disabled worker receiving SSDI is $1,358 per month.

Recommended Reading: Social Security Office In Springfield Missouri

How Much Disability Will I Receive This Year

There is one main factor that is used to help determine the amount of your SSDI payment each month. This is because social Security Disability offers a monthly benefit for those that qualify. It’s not a flat amount set for everybody that qualified, however. Instead, the amount can vary depending on one main factor.

Understanding some of the maximum Social Security Disability benefits can help, however. For 2022, the monthly benefit maximums included:

· The maximum Supplemental Security Income for an individual was $841 per month

· The maximum Social Security Disability Insurance benefits was $3,148 per month

Along with these two maximum payment amounts, the average disability payment for a disabled worker that qualified for an SSDI payment was $1,358 per month. While your amount will vary, knowing the maximum and the average can help you get a better idea of what to expect.

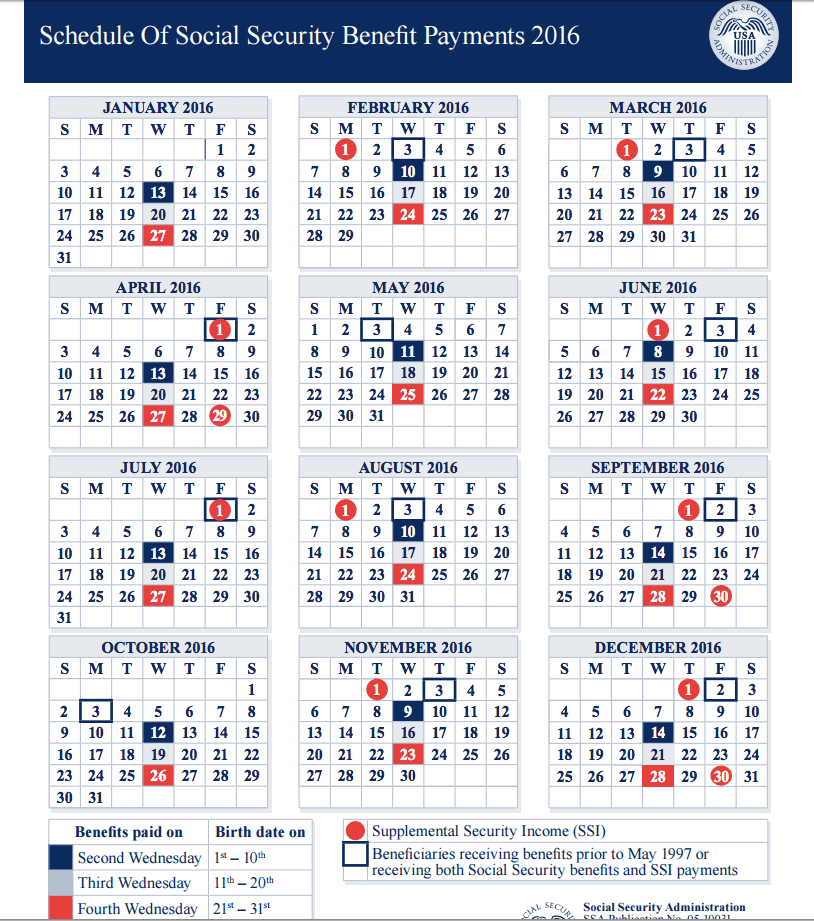

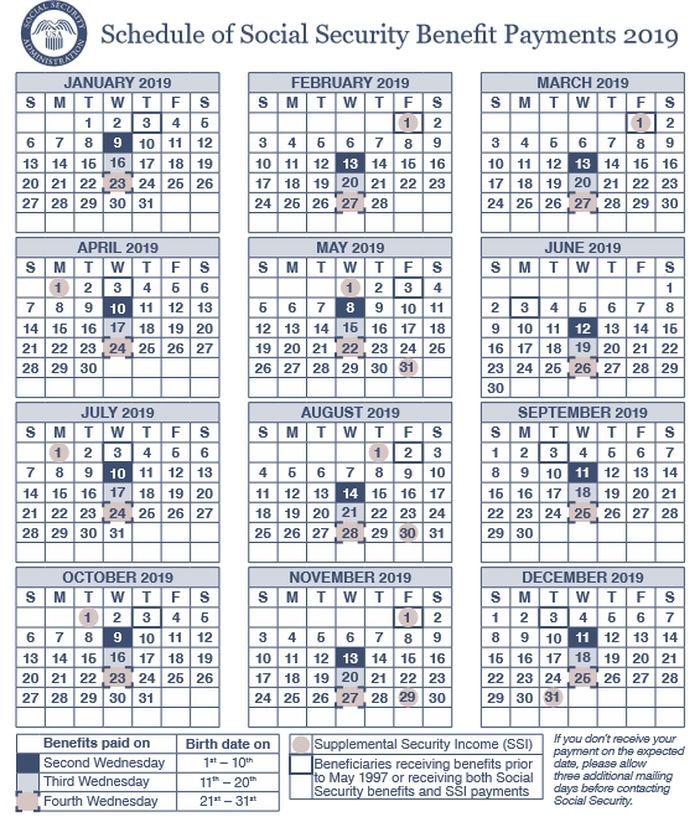

When Will My Ssdi Payments Begin

Social Security Disability payments will begin after your application is processed and approved by the Social Security Administration . There is a five-month waiting period before your SSDI payments can begin, which usually starts running when your application is approved or your disability begins, depending on the situation. This opens the door to SSDI backpay, which is essentially payment of back benefits while you were waiting for your application to be approved.

Also Check: Social Security Office Natchez Ms