Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January detailing your benefits during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security website.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

Apply The Social Security Benefits Formula

Once you know your AIME, you can plug it into the Social Security retirement benefits formula as outlined above. But remember to choose the correct formula for your age. You should use the one that was in effect in the year you turned 62 regardless of whether you signed up for benefits at that age.

The results you get from this step will give you your PIA. If you choose to sign up at your FRA, that’s also how much you’ll get for a benefit. But if you sign up before or after your FRA, there are a few extra steps to calculating your monthly benefit.

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Read Also: Social Security Advocates For The Disabled

Withdraw From Retirement Accounts Before Signing Up For Social Security

One way to lower your combined income is to start taking withdrawals from IRAs and 401s before you start collecting Social Security. You can begin taking penalty-free distributions as early as age 59 1/2 and even 55 in some cases. Theoretically, you could withdraw all of your retirement account money before you start collecting Social Security, but thats probably not the best long-term strategy if you want to live comfortably.

Who Can Use The Retirement Estimator

You can use the Retirement Estimator if you have enough Social Security credits to qualify for benefits and you are not:

- Currently receiving benefits on your own Social Security record.

- Waiting for a decision about your application for benefits or Medicare.

- Age 62 or older and receiving benefits on another Social Security record.

- Eligible for a Pension Based on Work Not Covered By Social Security.

If you are currently receiving only Medicare benefits, you can still get an estimate. For more information, read our publication Retirement Information for Medicare Beneficiaries.

If you cannot use the Retirement Estimator or you want a survivors or disability benefit estimate, please use one of our other benefit calculators.

Read Also: Retirement Benefits For Federal Employees

Read Also: Social Security Emergency Advance Payment

People Are Also Reading

But making $160,200 over the next year won’t be enough by itself. The Social Security Administration uses your highest 35 years of earnings to calculate your retirement benefit.

No, you don’t have to make at least $160,200 for 35 years during your career. The Social Security payroll tax cap has changed significantly over time. Because of this, though, there isn’t just one salary level you need to make to receive the max $4,555 monthly benefit. Instead, there are 35 different salary levels you must have achieved in the past.

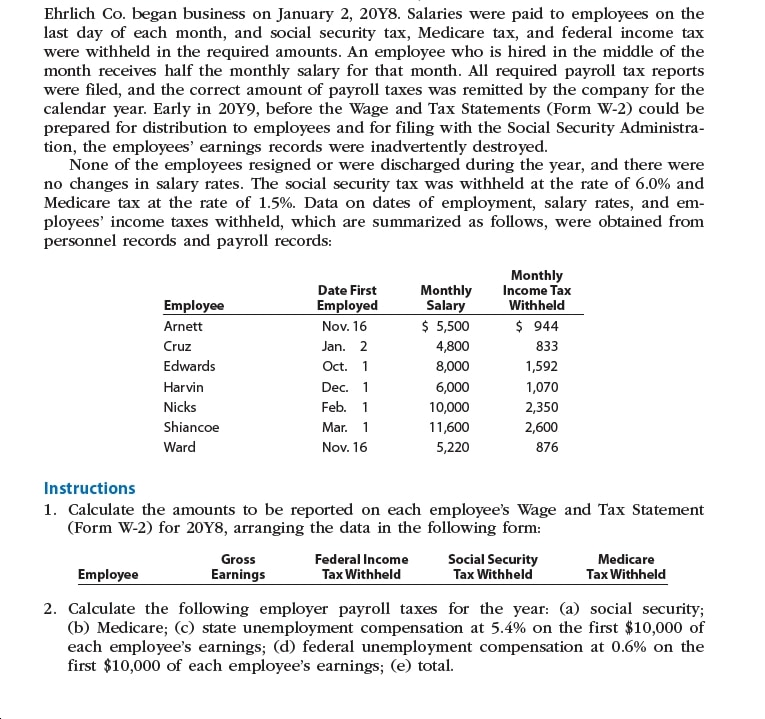

The following table shows the maximum amount taxed for Social Security for each year going back to 1973. You can see for yourself if you earned enough during 35 years to receive the maximum Social Security retirement benefit.

| Year |

|---|

Data source: Social Security Administration.

If You Will Be Eligible For Spouse’s Benefits And Have Access To Your Spouse’s Estimate:

Don’t Miss: Social Security Office In Chatsworth

To Find Out If Their Benefits Are Taxable Taxpayers Should:

- Take one half of the Social Security money they collected during the year and add it to their other income.

Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

Up To 85% Of A Taxpayers Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

You May Like: Do Non Profits Pay Property Taxes

Don’t Miss: W2 With Full Social Security Number

Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

What If You Paid Too Much In 2016

Since many people will be doing their 2016 tax returns in the coming weeks, its worth mentioning the 2016 Social Security taxable wage limit and what happens if you paid too much.

The maximum amount of income that can be taxable for Social Security was $118,500 in 2016, which translates to a maximum Social Security tax of $7,347 per employee. If your employer withheld too much Social Security tax from your paycheck which isnt uncommon for high earners with multiple jobs a refund of the excess can be claimed.

If the excess Social Security tax was the result of multiple employers withholding money from your paychecks, it can be claimed as a credit on your federal tax return . If a single employer withheld too much, you have a couple of options. You can either ask that employer for a refund of the excess and a corrected W-2 or you can claim a refund of the excess with IRS Form 843.

The Motley Fool has a disclosure policy.

Also Check: How Can I Figure Out My Property Taxes

Also Check: Dekalb County Social Security Office

How To Calculate My Social Security Benefits

You can use the Money Help Center calculator to determine how much Social Security you will get and how income tax may impact your benefits and income. You need to plan for retirement by considering how you will be taxed once your working life ends. You dont want to get an unpleasant surprise when you start earning your retirement income or getting your benefits and realize it is less than you expected because of tax withdrawals.

At the same time, Social Security can be a smart part of your retirement plan. Even if you are taxed at the highest level, you may still benefit. After all, from virtually any other source of income, 100% of your wages and income will be taxed after retirement. Dollar for dollar, Social Security retirement benefits can still be a better deal as far as taxation, than other sources of retirement.

As you plan for your golden years, it is important to keep in mind all the sources of income you may have once you finish working. Plan ahead and consider the tax impact on your income as well as any tax advantages you can secure today while saving for retirement. Use the Money Help Center calculators to help you plan. Our calculators are free, have no bias and never ask you for your personal information, such as contact information or e-mail address. You can use them at any time and instantly get information to help you plan for your financial future.

Sign up for our newsletter and get the latest news and updates

Money Help Center

Learn About The Calculations That Determine Your Social Security Benefits

You probably expect to get some money from the government in retirement, but how much you get depends on the Social Security benefits formula. Many don’t understand how this formula works or when it applies, but it’s not too difficult to figure out as long as you’re comfortable with some basic arithmetic. Below, we’ll break it down step by step so you can better estimate how much money you’ll get from the program.

Also Check: Married Couple Social Security Calculator

How To Calculate The Credit

To calculate your credit for employer Medicare and social security taxes, you first calculate the amount of creditable tips. The creditable tips calculations goal is to remove the tips making up the difference between an employees hourly wage and the federal minimum wage from credit eligibility.

To determine creditable tips:

- Multiply the employee hours worked by the federal minimum wage

- rate in the year of payment to determine the employees federal minimum wage amount

- Subtract the actual wages paid to the employee to determine the amount of tips not eligible for credit

- Subtract the amount of ineligible tips from the total tips reported by the employee to determine the amount of creditable tips

- Multiply the creditable tip amount by the combined Medicare and FICA tax rate to determine the amount of your credit

For 2022, the FICA and Medicare taxes total 15.3% of employee earnings. Employees and employers are each responsible for half the bill, or 7.65%. This includes a 6.2% Social Security tax and a 1.45% Medicare tax.

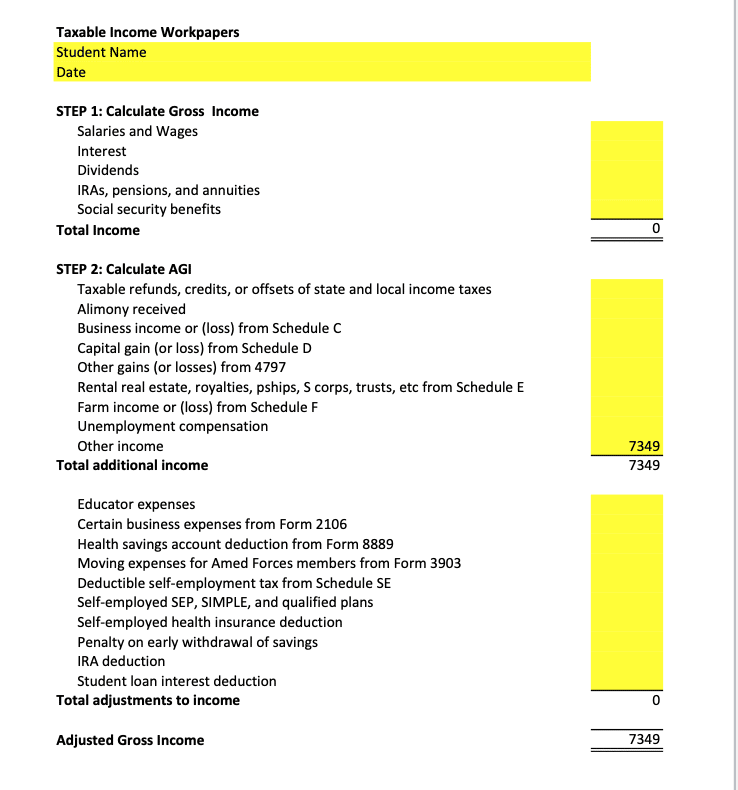

An Example Of How Combined Income Calculations Work

That can seem really confusing when were just talking about things in theory. Lets look at a more tangible example so you can better understand how taxes on Social Security benefits are calculated.

Imagine that Tim and Donna have recently retired. They have some rental property that generally averages $12,000 in net annual income.

Their combined Social Security benefit will be $3,000 per month, which equals $36,000 per year. In addition to this income, they will take an annual distribution from their IRA in the amount of $32,000.

Using the income from those sources, heres how the combined income would be calculated and remember that only half of the Social Security income is counted in the calculation:

From this, we can see that Tim and Donna have $62,000 worth of combined income. From here, we can see how much of their Social Security benefit is taxable.

Don’t Miss: Social Security Office Fairfield Ca

Calculate My Social Security Income

These days thereâs a lot of doom and gloom about Social Securityâs solvency or lack thereof. And regardless of whether you think Social Securityâs future is secure, the fact remains that you shouldnât plan on living exclusively off your Social Security benefits. After all, Social Security wasnât designed to make up a retireeâs entire income.

Still, many people do find themselves in the position of having to live off their Social Security checks. And even if you have other income sources in retirement, Social Security can make up a significant part of your retirement income plan. Thats why itâs important to know all the rules surrounding eligibility, benefit amounts, taxation and more.

Do you need help managing your retirement savings? To find a financial advisor who serves your area, try our free online matching tool.

Who Is Eligible For Social Security Benefits

Anyone who pays into Social Security for at least 40 calendar quarters is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born. But if you claim later than that you can put it off as late as age 70 youâll get a credit for doing so, with larger monthly benefits. Conversely, you can claim as early as age 62, but taking benefits before your full retirement age will result in the Social Security Administration docking your monthly benefits.

The bottom line: Youâre eligible for Social Security Benefits if youâve paid into the system for at least a decade, but your actual benefits will depend on what age â between 62 and 70 â you begin to claim them.

You May Like: When Will Social Security Offices Open For In-person Appointments

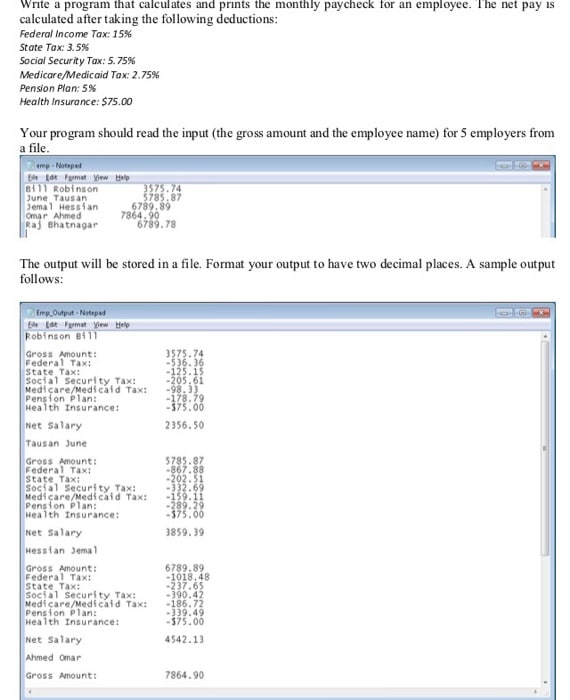

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method:The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

What Is Social Security

Social Security is a federal program that pays monthly benefits to retirees, surviving spouses and children, and disabled people. About 65 million Americans collect Social Security monthly.

The money for Social Security, as well as Medicare, comes from a tax that every working American pays. It’s a 7.65% tax on every paycheck that is matched by employers. Self-employed people cover both the employee and employer portions. That tax is levied on the first $147,000 of a worker’s income in the 2022 tax year.

So, while workers pay a tax to fund the Social Security program, other people are benefiting by collecting a monthly check. Those benefit checks are then often taxed as income, returning a portion of the money to the federal government.

Recommended Reading: What Will Happen When Social Security Runs Out

What Is Social Security Tax

It is a tax charged on the employer and the employee to fund the social security program. It is collected in the form of self-employment tax or payroll tax. Employers usually withhold the tax from the employees paycheck and remit it to the relevant government authority. This amount is used to pay retirees and people who have various disabilities. Social security tax is also used to support people who are entitled to survivorship benefits.

Give your loved ones the best care

What To Expect From Taxes On Social Security Income

Ultimately, in my dads situation, we were able to mitigate some of his tax burden. But for a good part of it, he was stuck.

As you can imagine, he didnt like this one bit. And you might not either if you find yourself in the same position.

Every year individuals retire and are faced with sticker shock when they find out how much theyll have to pay in taxes on Social Security income.

To some, it doesnt seem fair. Youve worked for years and paid your Social Security tax as the admission ticket to a Social Security benefit.

Now that youre collecting that benefit, you have to pay taxes? Again?

Recommended Reading: Can I Contact Social Security By Phone