How Thieves Steal Ssns

There are several ways thieves can get a hold of your SSN. The most obvious is by stealing the physical Social Security card. Be sure to keep it in a secure place. This is a no-brainer.

Things get more tricky when we go online. The three most used methods for stealing Social Security Numbers are phishing, malware and data breaches.

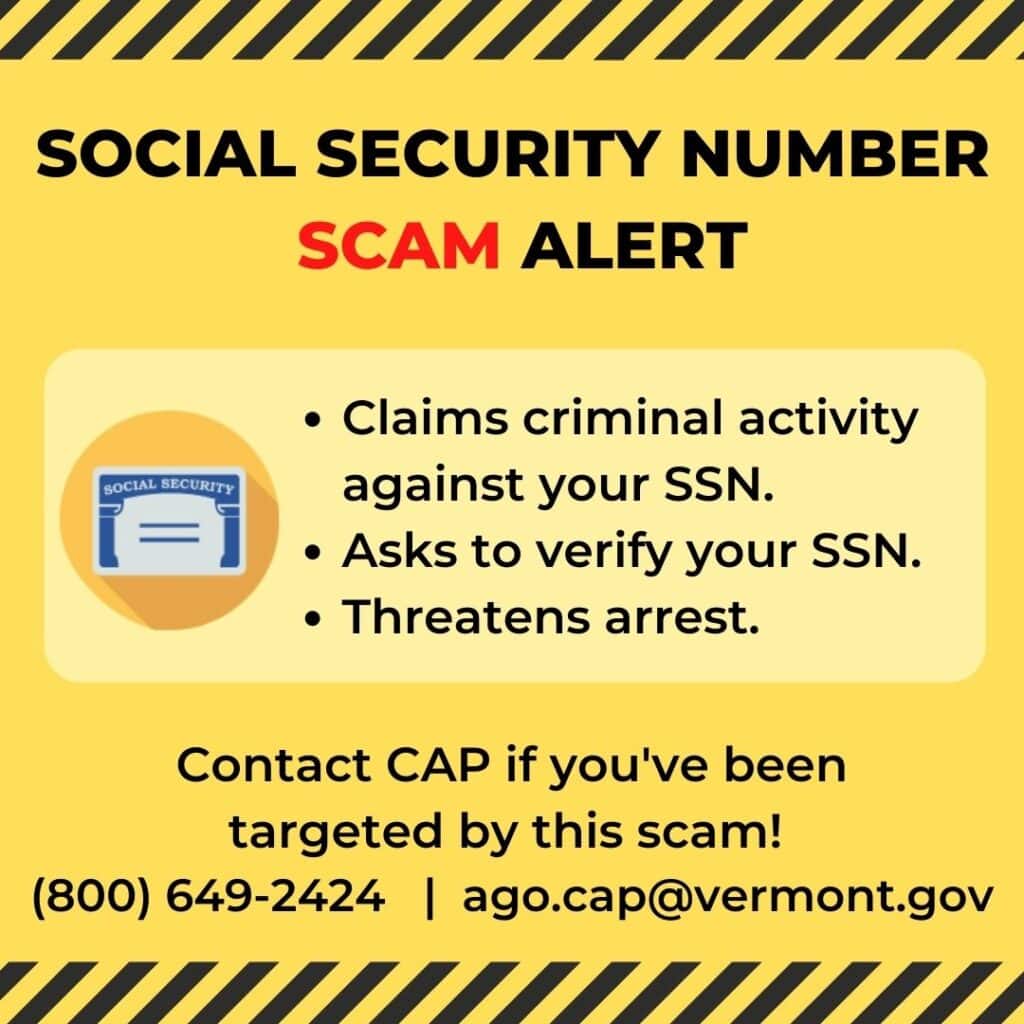

Phishing attempts are nothing new. In their efforts to steal your identity, jack your crypto or drain your rewards account, thieves use ever-more convincing methods to trick you into sharing your personal information. They often create fake websites that resemble websites of real companies that you may use regularly. The goal is to trick you into entering your private information. Often scammers will send spoofing emails with links asking you to re-enter your login information or even your SSN.

Malware falls more under the traditional hacker category. Thieves who use this method to steal personal information, including Social Security numbers, infect your computer or mobile devices with software. That software can record your keystrokes, and if you type in your social security number at some point, that will be recorded. Other types of malware steal information from files on your device.

Data breaches are a major threat to consumers because its difficult to manage your data, including Social Security Number, once submitted to a website or service and stored on their servers.

Get A Fraudulent Drivers License

When scammers steal your SSN, they can use it to obtain a fraudulent driverâs license and pose as you. This scam can be hard to trace. But some warning signs include warrants for arrests and traffic tickets issued in states you didnât visit.

Contact your state Department of Motor Vehicles if you suspect an identity thief obtained a fraudulent driverâs license in your name.

Phishing Attacks Over Email Text Message Or Phone Calls

Phishing is a type of social engineering attack in which scammers pose as employees from organizations or businesses and use fraudulent emails, texts, or phone calls to trick you into sharing personal details. The messages appear legitimate, but they include malicious links to spoofed websites where scammers can steal your SSN.

In other types of phishing attacks, scammers may call and pretend to be from Medicare or another government organization and ask you to âverifyâ your SSN.

ð Related: Phishing Email Examples: 20 Emails That Donât Look Like It â

You May Like: Portsmouth Ohio Social Security Office

Is Ssn Considered Public Information

No, your Social Security Number is not considered a public record. The only way to discover someones Social Security number is through one of the following methods:

If you are not a family member or close friend, you must be an authorized third party with some form of legal consent from that person and provide them with a signed release for their records.

The owner of the SSN may choose to give it to you directly if he feels it is in his best interests. This is something that many people do when applying for credit cards, loans, or employment opportunities.

It is only legal if the following conditions are met: 1099 Collection, Taxation, Child Support, Judgment Collection, and Tax Account Generation are some examples. Never search for a Social Security number before consulting with a legal professional.

How To Check If Your Identity Was Stolen/leaked

The worst situation about identity theft is it may have occurred months ago, and by the time the victim finds out, the damage has already been there.

Here are signs of identity theft you should know:

When you think someone is using your identity, freeze your credit report, report it to related authorities and the local police departments to stop the loss.

You May Like: Social Security Disability Process Flow Chart

The Purpose Of Having A Social Security Number

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

A Social Security number is a nine-digit number that the U.S. government issues to all U.S. citizens and eligible U.S. residents who apply for one. The government uses this number to keep track of your lifetime earnings and the number of years worked.

When the time comes to retire, or if you ever need to receive Social Security disability income, the government uses the information about your contributions to Social Security to determine your eligibility and calculate your benefit payments. Most people will use the same Social Security number their entire lives, though some people might need to apply for a replacement number at some point because of identity theft.

Keep reading below to find out more about when and why you need a Social Security number as well as when you should avoid using it.

Does A Temporary Fraud Alert Prevent Accounts From Being Opened In My Name

It doesn’t prevent it the way a does, but it does make it more difficult. Any business that has been approached to open an account in your name is supposed to take extra steps to verify the identity of the person opening the account. That means you can still open accounts, you’ll just have to go through a couple of extra steps to prove that you are who you say you are.

It would be possible for a thief to open a fraudulent account too, but they’d have to put in more effort to impersonate you.

Read Also: Social Security Office Fort Wayne In

Steal Your Benefits And Social Security Checks

Federal benefits such as Medicaid and Supplemental Security Income are tied to your SSN. A scammer with your SSN can divert your existing benefits checks and apply for other benefits â leaving you without support while you spend months trying to prove your identity.

ð Related: How Scammers Claim Benefits in Your Name â

Contact Companies Where Your Social Security Number Has Been Used Fraudulently

In the case that your information was used to create fraudulent accounts, you’ll want to contact each company involved. For example, if your SSN was used to create bank accounts or credit accounts in your name, reach out to each company and explain that you’re a victim of identity theft. They can then close your accounts so the identity thief can’t use the accounts any longer.

If someone used your information to create fraudulent identification records, you’ll need to contact all agencies involved, possibly including the IRS, Social Security Administration and your secretary of state’s office, which handles cases of fraudulent identification.

Recommended Reading: Social Security Disability Appeal Time Frame

Request A Credit Freeze

A prevents anyone from accessing your credit file. This makes it much harder for scammers to apply for loans, take out credit cards, or open new accounts in your name. You can place a credit freeze on your file at any time â even if no fraud has occurred.

To place a credit freeze, contact each of the three major credit reporting agencies â Experian, Equifax, and TransUnion â and request a PIN for your account.

Alternatively, you can request a fraud alert on your account. Rather than restrict access to your credit file, a fraud alert tells lenders that they should take extra steps to verify your identity before extending your credit .

To place a fraud alert, you only have to notify one of the credit bureaus. By law, theyâre required to notify the others of the alert.

ð Related: Fraud Alert vs. Credit Freeze â Which Protects You More? â

What Can You Do If Someone Steals Your Ssn

If your Social Security number gets stolen and you wish to protect yourself from possible harm, there are a few things you can do:

*Freezing your credit will not impact your credit score. However, it will prevent you or anyone else thats using your information to apply for loans, opening bank accounts, or renting any apartments as long as the freeze is active.

You May Like: Social Security Office Fort Worth Tx

Reach Out To Companies Where The Fraudster Used Your Ssn

If youre a victim of fraudulent accounts, reach out to the company in question as soon as possible.

Contact credit card companies, bank accounts, and utility companies, as they have the authority to close or freeze those accounts. After doing so, get the IRS and the Social Security Administration involved and report everything in detail.

They Can Use Your Ssn To Drain Your Existing Bank Accounts

Identity hackers also can use your stolen SSN to dip into any of your existing bank accounts. Armed with that knowledge, they simply can transfer money.

If they hacked your SSN, they might have obtained your passwords and the answers to secret security questions, too, such as your mothers maiden name. The drain on your accounts might be gradual or you might wake up to find your entire savings gone. Hackers also have begun to use apps such as Zelle to transfer money illegally.

Pro tip: Its important to protect yourself from hackers and scammers. Monitor your bank account on a daily basis to identify the slightest unfamiliar withdrawal or other changes to the account. The earlier you catch the fraud, the easier it will be to deal with it.

Read Also: Social Security Office Hartford Connecticut

You Can Request Your Card Online Today

Sign in or create an account to submit your request

You can replace your card online and receive it in 14 days. You can also use your account to check the status of your request and manage other benefits you receive from us.

Trouble signing in?

Start the application online and visit your local SSA office for additional guidance for completing your application.

Prefer to talk to someone?

Contact your local SSA office.

You can start your Social Security number card application online. Once you’ve submitted your request, visit your local SSA office for additional guidance for completing your application. You will need to give us some of the information you provided again.

You Gave Your Social Security Number Away

If you suspect somebody has your Social Security Number — whether they stole it from a company or you gave it to them voluntarily — it’s important to set up credit monitoring. Typically your bank or the company that was breached will provide this to you for free.

You generally shouldn’t pay for credit monitoring, as high quality free products have proliferated in the marketplace particularly after the incident at Equifax. Paid credit monitoring services can be tricky to cancel, and you can typically achieve the same level of service with a free product.

Set up alerts so you know the instant anything changes with your credit score — you can usually do this through the credit monitoring program offered by your bank or credit card company, which is almost always a free service. Some of these services are free even if you’re not a customer of the bank, such as Capital One’s Credit Wise. In fact, you may want to do this anyway — monitoring your credit in this manner is good for everyone, not just victims of cybercrime.

If you provided a scammer with your Social Security Number directly, or you already think your number was used fraudulently, you will need to act more urgently. You can place a credit freeze on your account with the three credit reporting agencies: Equifax, Transunion and Experian.

Recommended Reading: Number For Social Security Administration

Examining Your Credit Report

One definite way to check if someone has used your SSN is to find discrepancies in your credit report.

Go to AnnualCreditReport.com or call the hotline 1-877-322-8228 to check your credit report. Examine your report thoroughly to confirm your accounts and other information. If not, then you may have a stolen SSN.

Contact Companies Where The Fraudster Used Your Ssn

Contact each company where fraudsters used your SSN to create an account.

For example, if a scammer used your SSN to open phone and bank accounts, contact both companies to close the accounts, and explain that you were the victim of identity theft. Additionally, if a fraudster used your Social Security number to create identification records with government agencies, inform the SSA, IRS, and your Secretary of State office that handles fraud identification.

Take action:

You May Like: Is Medicare Part Of Social Security

File A Fraudulent Tax Return

Tax identity theft happens when fraudsters use your stolen personal information, such as your SSN, to file a tax return and claim a fraudulent refund in your name.

Unfortunately, you probably wonât realize youâve become a victim until youâre unable to file your tax return. In the meantime, you canât access your stolen tax refund â as it can take months to resolve the problem with the Internal Revenue Service and prove you were a victim of identity theft.

In Conclusion: So Should You Keep Your Ssn In A Safe

No, you shouldnt. Instead, you should keep all your personally identifiable information as safe as possible.

In todays world, our personal information is mostly digital. Online security, cyber hygiene, and browsing habits are more important than ever. Take some time to educate yourself on how to be safe online, and you wont have to worry about losing your personal data or resources!

Recommended Reading: What Is The Phone Number To Social Security Administration

They Can Use Your Ssn To Receive Medical Treatment Under Your Insurance

Medical records typically lay out a patients complete identity, according to CNBC which means that if theres a breach affecting healthcare systems, hackers can do a lot with what theyve stolen. That includes accessing your medical insurance.

Weisman said scammers can incur large medical bills in your name that might not be covered by your medical insurance. In that case, youll be hounded by collection companies for payment. This will definitely hurt your credit score.

Pro tip: Weisman said you need to stay on top of your medical records. Just as you should regularly check your credit report, you also should regularly check your medical records to make sure that there are not mistakes, he said.

Today, most medical providers have online records but not all do. Ask your provider how best to review your records.

Can Someone Access My Bank Account With My Social Security Number

Someone could try to access your bank account using your Social Security number, but it alone wouldnt be enough. Theyd need a lot more personal information than that to get to your finances.

Dont believe me? Try calling your bank and saying youve forgotten your password. Youll be surprised at the range of questions theyll ask you, from What is the second letter of your mothers maiden name? to When and how big was your last deposited check? and Is the number youre calling from your personal one?

Many times, youll be required to physically show up if you want to reset your bank account password. Why?

Anyone can call a bank having stolen someone elses Social Security number, but its not enough to prove your identity. Usually, a bank would not even ask for your SSN if you called them because it is not a good way to verify who you are.

Without additional information, no one could access your bank account with your Social Security number alone. In terms of bank security, you should worry about other things like a poor password, lack of two-factor authentication, and general carelessness when online banking.

Read Also: How To Pay Into Social Security

You Put An Account Number Into A Dummy Website

Some phishing emails or fraudulent URLs are created to look so convincingly like your bank’s, it is easy to mistakenly enter your username and password or, if they ask for it, your checking or savings account number. Other websites are made to emulate popular e-commerce or retail websites, tricking you into entering your credit card details.

If you’ve given away any of these numbers, call your bank immediately and describe the error in detail. Your bank should be able to read back any charges have been made fraudulently and connect you to the right department to help freeze or suspend the accounts that may have been comrpomised. You can typically find the fraud department directly by using the fraud services number on the back of your credit card, or on the bank’s website.

If fraudulent charges have been made, you may have to fill out a paper report, and any reimbursement may take time, typically a bit longer for debit cards than for credit cards. Here’s a version of one of these forms, used by Inova Federal Credit Union. A banker may call you to ask follow-up questions.

Request For Identity Verification From The Irs

When the IRS stops a suspicious tax return filing, they may send a letter called “Letter 5071C” asking that you verify your identity. It will include a couple ways to verify it: via a phone number or through the IRS’s Identity Verification Service, .

This online service is the quickest method and will ask you multiple-choice questions to verify whether or not the tax return flagged for further identity verification was filed by you or someone else. The IRS only sends such notices by mail. The IRS will not request that you verify your identity by contacting you by phone or through email. If you receive such calls or emails, they are likely a scam.

If you can’t confirm your identity using the IRS’ online Identity Verification Service, you can call the IRS at the phone number included in the letter.

When confirming your identity, you will need:

Also Check: Aiken Sc Social Security Office