How Much Is Social Security Taxed At Full Retirement Age

Even if you work past full retirement age, you still have to make applicable Social Security contributions on your income however, if you work past full retirement age, you can also increase the amount of Social Security benefits you receive.

Once you start receiving Social Security benefits, your income will determine if you pay income tax on part of your Social Security income.

The Tax Is Also Subject To An Income Cap

The Old-Age, Survivors, and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

The Social Security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

Fica Tax Rates And The Benefits They Fund

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Jacobs Stock Photography Ltd / Getty Images

Most W-2 employees’ pay stubs detail the taxes and deductions that are taken from their gross pay. You’ll almost certainly see two items among these deductions, in addition to federal and state or local income taxes: Social Security and Medicare taxes. These taxes are part of the Federal Insurance Contributions Act tax, a group of payroll taxes that are collected from both the employer and the employee.

An Additional Medicare Tax can be deducted from some employees pay as well. After federal and state income taxes, Social Security and Medicare, or FICA taxes, make up the bulk of taxes that are routinely withheld from your paychecks.

Also Check: Social Security Office In Monroe Louisiana

What Is Social Security Or Medicare Tax

The Federal Insurance Contributions Act mandates that U.S. resident taxpayers must fund the following programs:

- Social Security- old-age, survivors, and disability insurance taxes

- Medicare- hospital insurance taxes

Together these taxes total nearly 8% of yearly earned income and are usually deducted or withheld automatically by the employer based on the employee’s tax residency status and other information.

Nonresident federal tax filers are exempt from these taxes. If you are a nonresident tax filer and these taxes were withheld from your paycheck in error, you will need to request a refund. See the section below for more information.

If you are not sure about your tax residency status, please see our section on determining this status.

Who Pays Social Security And Medicare Taxes

Employees, employers, and self-employed persons pay social security and Medicare taxes.

When referring to employees, these taxes are commonly called FICA taxes . When referring to self-employed persons, these same taxes are referred to as self-employment taxes, which are figured on Schedule SE by self-employed individuals.

If a person has a job and is also self-employed, the gross compensation from the job plus net income from self-employment are added together and counted toward the maximum social security wage base for the tax year

Social Security Wage Base:

- 2012: $110,100.

Medicare Taxes: Every dollar of wages, salary, bonuses, and other compensation is subject to Medicare taxes. Unlike the income limitation for Social Security taxes , there is no income limitation for Medicare taxes.

Don’t Miss: Social Security Office Muskogee Ok

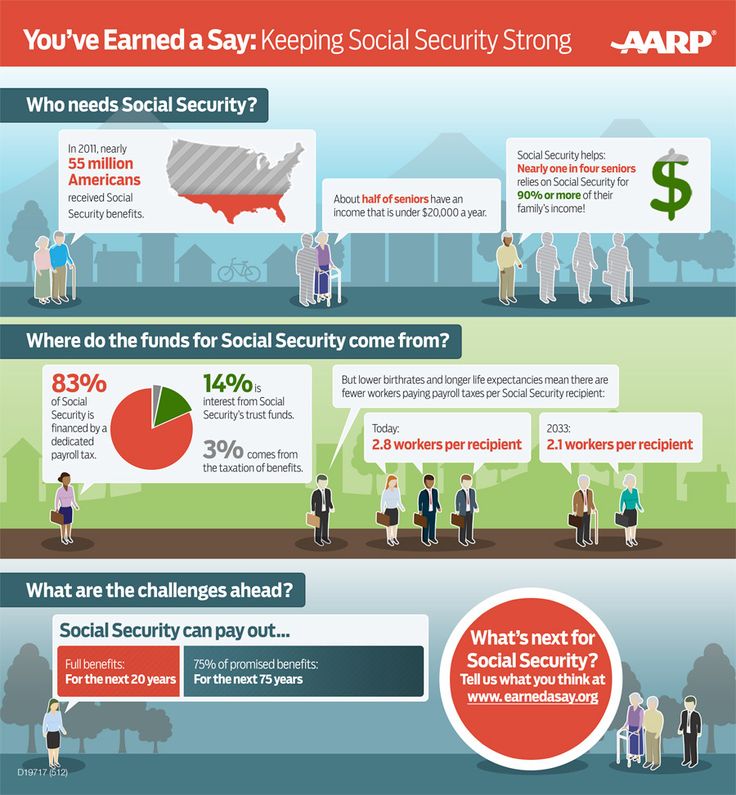

Increasing Payroll Taxes Would Strengthen Social Security

Social Security faces a significant though manageable long-term funding shortfall, which policymakers should address primarily by increasing Social Securitys tax revenues. If policymakers elect to reduce Social Security benefits, those cuts will need to be limited and carefully targeted to avoid causing significant hardship. Moreover, the cuts will almost certainly be phased in slowly, which means they could not produce significant savings for many years. Increasing Social Securitys revenues will be necessary.

Social Securitys tax base has eroded since the last time policymakers addressed solvency.Boosting Social Securitys payroll tax revenue also is justified by recent trends: Social Securitys tax base has eroded since the last time policymakers addressed solvency in 1983, largely due to increased inequality and the rising cost of non-taxed fringe benefits, such as health insurance. And it enjoys broad support: the majority of Americans oppose cuts to Social Security and support strengthening the program by contributing more in taxes.

This paper presents three approaches to increasing payroll taxes that would improve the programs solvency:

Don’t Screw Up Trust Fund Taxes

A trust fund tax is money withheld from an employee’s wages by an employer and held in trust until paid to the Treasury. Trust fund taxes include income taxes, social security taxes, and Medicare taxes.

Congress has established large penalties for delays in turning over employment taxes to the Treasury. In addition, if you intentionally don’t turn these taxes over to the U.S. Treasury, you can face criminal prosecution.

Using a payroll service is a low cost and effective way of handling the complexities involved in payroll processing and avoiding stiff noncompliance penalties. A payroll preparation service will do the tax computations, file the quarterly and annual payroll tax returns , remit payroll taxes to the IRS on your behalf, cut the paychecks, and provide you with periodic payroll reports for your records.

Do Your Payroll Online!

|

|---|

Don’t Miss: Customer Service Number For Social Security

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employee’s death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a “Statement Concerning Your Employment in a Job Not Covered by Social Security”. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

Who Can File For A Refund

In addition to nonresident federal tax filers, you are also not subject to Social Security or Medicare tax withholding on your wages if:

- you have on-campus employment, or

- you are authorized for Curricular Practical Training or Optional Practical Training , or

- you are authorized for employment due to Economic Hardship

If these taxes were withheld from your paycheck in error, you will need to request a refund. See the section below for more information.

Read Also: Social Security Part B Cost

Social Security Tax Limit For 2017 Is $788640

One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

Related blog post: How are Payroll Taxes Calculated? Federal Income Tax Withholding

Employers Must Share Fica Payments With Employees

RyanJLane / Getty Images

Every person working in the United States as an employee must have FICA taxes withheld from every paycheck by law. FICA taxes include taxes for both Social Security and Medicare, and it is shared by employees and employers, so half of the tax is deducted from your paychecks when you work as an employee. The other half, an amount equal to the total deducted from employee paychecks, must be paid by your employer.

The following provides a step-by-step guide on how to calculate FICA taxes.

Don’t Miss: Social Security Office In Puyallup

Social Security And Medicare Tax Withholding Rates And Limits

| Tax | ||

|---|---|---|

| Over $147,000 in 2022, over $160,200 in 2023 | ||

| Medicare tax | No earnings exempt in 2022 and 2023 | |

| Additional Medicare Tax | 0.9% | Earnings under $200,000 in 2022 and 2023 |

Employees are no longer required to pay the Social Security tax in a given year once their earnings hit the contribution and benefits base, often referred to as the taxable maximum. For example, if you earned $150,000 in 2022, youand your employerwould pay the Social Security tax on only the first $147,000. The remaining $3,000 is free of Social Security taxes. For 2023, the taxable maximum is $160,200.

What Are The Medicare Tax Rates

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the Medicare tax rate for 2020?

The Federal Insurance Contributions Act tax rate, which is the combined Social Security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2020 up to the Social Security wage base.

How much is Social Security and Medicare tax?

If you work for an employer, you and your employer each pay a 6.2 percent Social Security tax on up to $142,800 of your earnings and a 1.45 percent Medicare tax on all earnings.

Read Also: Social Security Office Augusta Ga

Social Security Wage Base Increases To $160200

The Social Security Administration has announced that the maximum earnings subject to Social Security tax will increase from $147,000 to $160,200 in 2023 . The maximum Social Security employer contribution will increase $818.40 in 2023.

For 2023, the FICA tax rate for both employers and employees is 7.65% .

For 2023, an employer must withhold:

Social Security and Supplemental Security Income benefits will increase by 8.7% in 2023. The average monthly Social Security benefit will increase from $1,681 to $1,827, and the maximum federal SSI monthly payment to an individual will increase from $841 to $914. The maximum federal SSI monthly payment to a couple will increase from $1,261 to $1,371 in 2023. The amount of earnings that is required in order to be credited with a quarter of Social Security coverage will increase from $1,510 to $1,640.

The SSA has a 2023 Fact Sheet on the changes.

For more information on the Social Security wage base, see Checkpoints Federal Tax Coordinator ¶A-6035.

Get all the latest tax, accounting, audit, and corporate finance news with Checkpoint Edge. Sign up for a free 7-day trial today.

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Read Also: How Much Is My Social Security Taxed

Federal Income Tax Withholding

Withhold federal income tax from each wage payment or supplemental unemployment compensation plan benefit payment according to the employee’s Form W-4 and the correct withholding table in Pub. 15-T. If you’re paying supplemental wages to an employee, see section 7. If you have nonresident alien employees, see Withholding income taxes on the wages of nonresident alien employees in section 9.

See section 8 of Pub. 15-A, Employers Supplemental Tax Guide, for information about withholding on pensions , annuities, and individual retirement arrangements .

Employer Responsibilities

| The following list provides a brief summary of your basic responsibilities. Because the individual circumstances for each employer can vary greatly, responsibilities for withholding, depositing, and reporting employment taxes can differ. Each item in this list has a page reference to a more detailed discussion in this publication. |

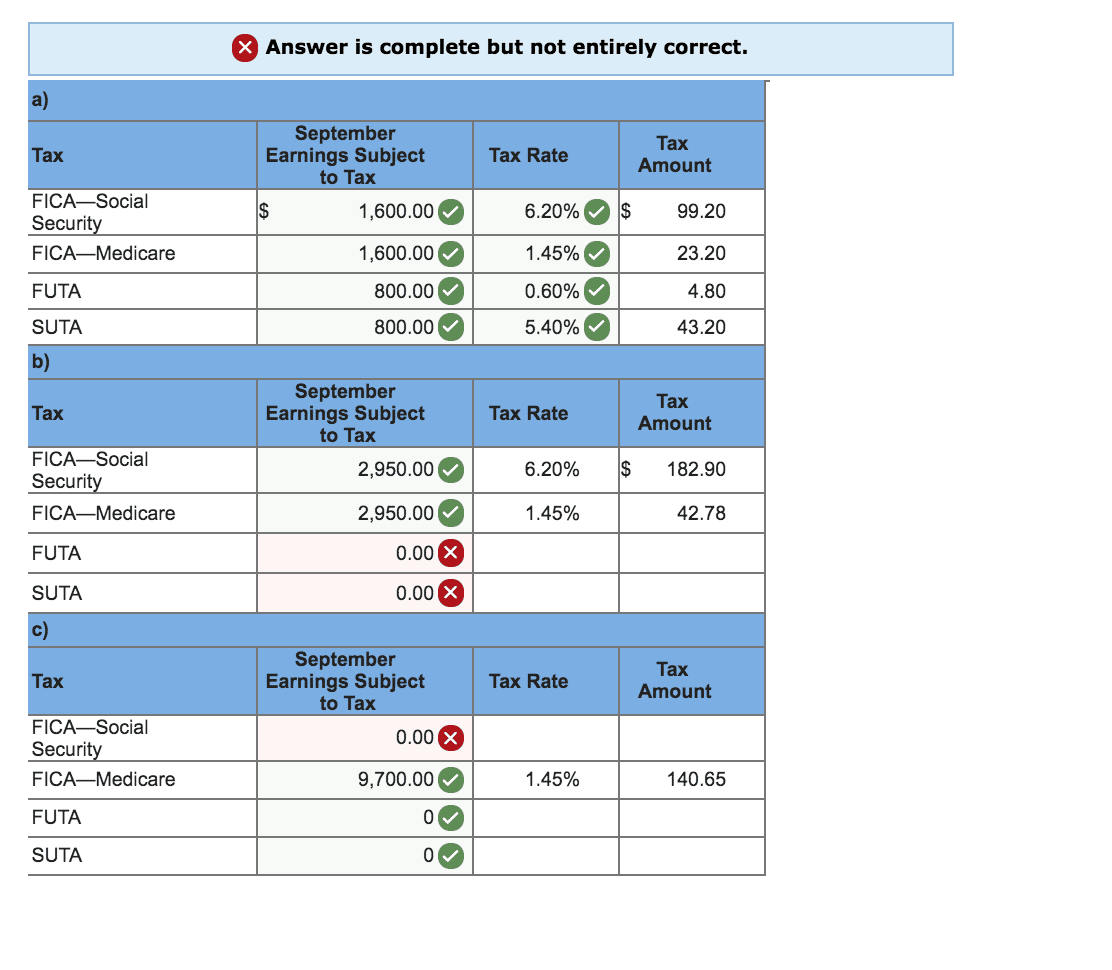

Question: Calculating Social Security And Medicare Taxesassume A Social Security Tax Rate Of 62% Is Applied To Maximum Earnings Of $128400 And A Medicare Tax Rate Of 145% Is Applied To All Earnings Calculate The Social Security And Medicare Taxes For The Following Situations: If Required Round Your Answers To The Nearest Centcumul Paybefore

Calculating Social Security and Medicare Taxes

Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations:

If required, round your answers to the nearest cent.

| Cumul. Pay |

|---|

You May Like: How To Apply Social Security Disability

Other Payroll Tax Items You May Hear About

-

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

-

SUTA tax: The same general idea as FUTA, but the money funds a state program. Employers pay the tax.

-

Self-employment tax: If you work for yourself, you may also have to pay self-employment taxes, which are essentially the full load of Social Security and Medicare taxes. Thats because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing. Because you may not be receiving a traditional paycheck, you may need to file estimated quarterly taxes in lieu of withholdings.

Tips For Tax Planning

- If you are looking to make charitable contributions, transfer some of your wealth or leave your estate to your heirs in the most tax-advantageous way, a financial advisor can help. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Its important to plan ahead for your income taxes so youll know what to expect. Learn more by using SmartAssets income tax calculator.

Read Also: What Age Do You Receive Social Security

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

What Is The Social Security Tax

The Social Security tax is one of two taxes all employers are required to withhold under the Federal Insurance Contributions Act . The other is the Medicare Tax. FICA also mandates an Additional Medicare tax, though only for employees earning more than a set dollar amount.

Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax .

The Social Security tax is a percentage of gross wages that most employees, employers and self-employed workers must pay to fund the federal program. Certain groups of taxpayers are exempt from paying social security tax. It is the employers obligation to withhold the correct amount of Social Security tax from every paycheck and forward it to the federal government on time. Failure to do so can result in significant penalties.

Only the social security tax has a wage base limit. The wage base limit is the maximum wage that’s subject to the tax for that year. Refer to “What’s New” in Publication 15 for the current wage limit for social security wages.

Go deeper

Read Also: File And Suspend Social Security