How Should I Decide When To Take Benefits

Consider the following factors as you decide when to take Social Security.

Your cash needs: If you’re contemplating early retirement and you have sufficient resources , you can be flexible about when to take Social Security benefits.

If you’ll need your Social Security benefits to make ends meet, you may have fewer options. If possible, you may want to consider postponing retirement or work part-time until you reach your full retirement ageor even longer so that you can maximize your benefits.

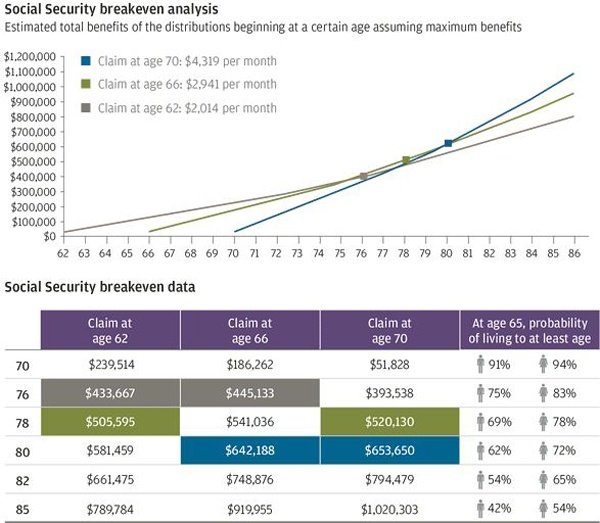

Your life expectancy and break-even age: Taking Social Security early reduces your benefits, but you’ll also receive monthly checks for a longer period of time. On the other hand, taking Social Security later results in fewer checks during your lifetime, but the credit for waiting means each check will be larger.

At what age will you break even and begin to come out ahead if you delay Social Security? The break-even age depends on the amount of your benefits and the assumptions you use to account for taxes and the opportunity cost of waiting . The SSA has several handy calculators you can use to estimate your own benefits.

If you think you’ll beat the average life expectancy, then waiting for a larger monthly check might be a good deal. On the other hand, if you’re in poor health or have reason to believe you won’t beat the average life expectancy, you might decide to take what you can while you can.

A quick note about life expectancy

To wait or not to wait?

Questions To Ask Yourself

From a purely mathematical point of view, most people are better off waiting to start collecting their social security benefits, but there are questions you need to ask yourself.

Do you need the cash? If you need help paying for basic living expenses, you probably should elect to begin receiving benefits as soon as possible.

How is your health? According to the most recent Social Security Administration life expectancy tables, a healthy 65-year-old females average life expectancy is 86.6. Further, one out of every four will live past age 90.

In any case, it is important to consider your familys pattern of longevity. The longer you live, the more you benefit from delaying. If your health and family history predict a long life, you may be better off delaying your benefits until FRA or later.

If you dont expect to attain a normal life expectancy and you are single, consider taking benefits early. But if you are married, be aware that doing so will reduce your spouses survivor benefit.

Will you continue to work? If your working wages are greater than $18,240 in 2020 and you selected early benefits, your social security benefits will be reduced by $1 for every $2 you earn. If you earn more than $48,600 in the year you reach your FRA, your benefits will be reduced by $1 for every $3 you earn. After that point, working has no effect on the amount of your benefit, although it may impact whether your benefits are taxed.

Factor In Mortality And Marriage

Of course, the trick to coming out ahead by starting to collect social security later is to live long enough to reach the breakeven age.

Whether or not you will be able to do that, though, is impossible to know. The Social Security Administration does provide a life expectancy calculator that can provide some general guidance. For example, according to this calculator, a 62-year-old male can expect to live to age 83.6. In the example given earlier, the breakeven age for coming out ahead by delaying collecting social security was 80, so on average it would make sense for a person in that situation to delay collecting social security to earn the maximum benefit.

However, the life expectancy calculator is based on average life spans. Your health and family history are also important considerations in estimating how your life span is likely to relate to the average.

It also makes a difference if you are married. Survivor benefits for spouses are increased if you delay when you start to collect social security. So, if you are married, there is a better chance that at least one of you will live long enough to reach the breakeven age. According to the Social Security Administration, a married couple at age 65 today has a 50-50 chance of at least one spouse living till age 90.

Also Check: Self Employed And Social Security

Social Security For Retirement

The biggest determinant of retirement benefit amount is lifetime earnings since the benefit is based largely on the average of a persons 35 highest-earning years. Because the SS tax is regressive, in retirement, lower-income earners will have a higher portion of their SS retirement benefits paid out in relation to their lifetime earnings than higher-income earners. Another important determinant of benefit amount is the age at which a person applies for retirement benefits.

SS is designed to replace about 40% of the average American workers pre-retirement income. This value is dependent on each individuals work history higher-income earners will receive larger SS checks than lower-income earners, but the check will be a smaller percentage of their pre-retirement income. SS is not intended to be a sole source of retirement income, and as such, it is advisable to have other forms of income in retirement. This can take the form of anything from rental property income to annuities, mutual funds, or even tax-shielded retirement plans such as a 401 and/or IRAs.

Full Retirement Age

When to Apply for Social Security Retirement Benefits

- The immediate need for cash

- Life expectancy

- Relative age, income, and health of spouse

Social Security Credits

Receiving Retirement Benefits Outside of the U.S.

Should You Use A Break Even Calculator For Social Security

Can a Social Security break even calculator help you decide the best age to file? Yes! Just knowthe results of this calculation alone cannot be the deciding factor when choosing the best filing age. Deciding when to file…

Can a Social Security break even calculator help you decide the best age to file? Yes!

Just knowthe results of this calculation alone cannot be the deciding factor when choosing the best filing age.

Before using this calculator, Id highly encourage you to read my article on the right way to use a Social Security break-even calculator.

Access the break-even calculator here

Although this show does not provide specific tax, legal, or financial advice, you can engage Devin or John through their individual firms.

Contact Devins team at https://www.carrolladvisory.com/ Contact Johns team at https://www.rossandshoalmire.com/

Read Also: List Of Leaked Social Security Numbers

The Right Way To Use A Break Even Calculator For Social Security

Trying to decide the best age to file for Social Security Benefits? Using a break even calculator for Social Security can give you some important data to help you make the right decision for you.

A break even calculator for Social Security can help you understand which filing age will net you the highest total payments from Social Security over your lifetime.

At face value, using these calculations seems like a logical approach to making the filing decision. But its just one step in the process, as this is a complex situation with more data points to consider. Break even age is an important consideration, but that information alone cannot be the deciding factor when choosing the best filing age.

It is, however, a great starting point, so in this article well aim to make sure you walk away with an understanding of the following:

- Who should use a break even calculator for Social Security

- The problem with the calculators available today that you need to bear in mind

- How to access our one-of-a-kind Social Security break even calculator

What If I Continue Working In My 60s

Many people whose health allows them to continue working in their 60s and beyond find that staying in the workforce keeps them young and gives them a sense of purpose. If this sounds like something youâd like to do, know that working after claiming early benefits may affect the amount you receive from Social Security. Why? Because the Social Security Administration wants to spread out your earnings so you donât outlive them. If you claim Social Security benefits early and then continue working, youâll be subject to whatâs called the Retirement Earnings Test.

If youâre between age 62 and your full retirement age, and youâre claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly. For 2022, the Retirement Earnings Test Exempt Amount is $19,560/year . If youâre in this age group and claiming benefits, then every $2 you make above the Exempt Amount will reduce by $1 the Social Security benefits youll receive.

Contrary to popular belief, this money doesnât disappear. It gets credited back to you with interest in the form of higher future benefits. You may hear people grumbling about the Social Security âEarnings Taxâ, but itâs not really a tax. Itâs a deferment of your benefits designed to keep you from spending too much too soon. And after you hit your full retirement age, you can work to your heartâs content without any reduction in your benefits.

You May Like: Disadvantages Of Social Security Disability

You May Like: Retirement Calculator With Pension And Social Security

What About Taxes On Social Security

Keep in mind that Social Security benefits may be taxable, depending on your combined income. Your combined income is equal to your adjusted gross income , plus non-taxable interest payments , plus half of your Social Security benefit.

As your combined income increases above a certain threshold , more of your benefit is subject to income tax, up to a maximum of 85%. For help, talk with a CPA or tax professional.

In any case, if you’re still working, you may want to postpone Social Security either until you reach your full retirement age or until your earned income is less than the annual limit. In no situation should you postpone benefits past age 70.

When Should You Start Collecting Social Security Benefits

To determine when you should start taking your benefits, its important to understand how much your check is affected by when you claim your benefit. As mentioned before, you can claim your benefit as early as age 62 but reaching full retirement age can secure your full benefit.

So when exactly is the full retirement age for Social Security? That depends on when you were born.

| Year of birth | |

|---|---|

| 65 + 2 months for each year past 1937 | |

| 1943-1954 | |

| 66 + 2 months for each year past 1954 | |

| 1960 and later | 67 |

While the full retirement age used to be 65, changes to the program have increased that age. For example, those born in 1955 now have to wait an extra two months beyond age 66 to claim their full benefit. Someone born in 1959, for example, would have to wait until age 66 and 10 months to get the full benefit. Anyone born in 1960 or later, receives their full benefit at 67.

But some retirees choose to wait even longer. You may wait until as late as age 70 to claim your benefit, but then you must take it. Youll receive a bigger check for doing so.

So, what is the upside to delaying your Social Security benefit after age 62? Your check wont get hit by a serious benefit reduction. Heres how much a $1,000 monthly check will become if you claim your benefit as soon as youre eligible at age 62.

| Year of birth | If you file at 62, benefit reduced by: | A $1,000 check becomes |

|---|---|---|

| $700 |

You May Like: Negatives Of Getting Social Security Disability

Social Security Benefits Starting Age 62 Vs Fra

You can use this calculator to calculate the break-even point and the cumulative benefits for an individual taking his own Social Security retirement benefits beginning at age 62 versus beginning at his or her full retirement age . It is an estimate only, and should not be the only consideration when deciding when to begin social security benefits.

To open this calculator, click Calculators in the toolbar, and then click Retirement > Social Security Benefits – Starting Age 62 vs. FRA in the left panel.

You can export the data as a PDF file or clear all data that you entered. For more information, see Financial calculators.

Many factors can affect the decision to receive Social Security benefits, including health, personal financial considerations, and employment status. One method of assessing the financial advantage is to calculate the break-even age.

Taxpayers planning for retirement should be aware that retirement benefits depend on age at retirement. If a taxpayer begins receiving benefits before full retirement age, the taxpayer will receive a reduced benefit. A taxpayer can choose to retire as early as age 62. Starting to receive benefits after full retirement age may result in larger benefits.

Social Security For The Disabled

People who are disabled, are dependents of retired or disabled workers, or are surviving spouses/children may also receive benefits. Note that this is supplementary information and that the Social Security Calculator only provides calculations for retirement benefits.

The SSAs definition of disability refers to total disability, so partial or short-term disabilities are not qualified for benefits. Under the SSAs rules, a person is disabled only if they meet all of the following conditions:

- They cannot do work they did before

- The SSA decides that they cannot adjust to other work because of their medical condition

- The disability has lasted or is expected to last at least one year or to result in death

Benefits usually continue until beneficiaries are able to work again. Disability beneficiaries that reach full retirement age will have their benefits converted into retirement benefits, with the amount remaining the same. It is against the law to receive both disability and retirement benefits at the same time.

Social Security Disability Insurance

Supplemental Security Income

In some situations, it is possible to receive both SSDI and SSI. This usually happens when a qualified application for SSDI is granted low enough an SSDI benefit to make the applicant also eligible for SSI.

You May Like: Social Security Disability Earnings Limit 2022

You May Like: Social Security Flex Card For Seniors

The 2 Big Problems With Break Even Calculators

Most financial planning calculations have variables that can come up and render the entire plan useless. But even knowing that, having some kind of plan increases your odds of a better outcome as compared to not having a plan.

A break even analysis is the same way: there are inherent limitations, but that doesnt mean the exercise is useless. It just means you need to understand the potential problems and not be overly reliant on the calculator you use.

When it comes to using a break even calculator for Social Security, there are two main problems that you need to understand and acknowledge first:

Problem #1: The Impossible Question

The first big problem with using the break even method in deciding when to file is that you have to answer an impossible question: How long will you live? Obviously, no one knows that for sure. The best you can do is make a guess but most people are extremely bad at estimating their own lifespan.

There are countless reasons for this, but one big explanation for why we cant reliably guess at our own life expectancy is because selective retrieval of information from memory gets in the way.

Some studies, for example, show that if a close friend recently died of a heart attack, youre probably more likely to think youll also die early.

This means that 50% of 60 years old males will die before age 83.1, but 50% will die after that age.

Problem #2) They Dont See the Big Picture

Supplementing Your Social Security Income

For many retirees, the income they receive from Social Security is not enough to live off of: According to AARP, the estimated average Social Security monthly benefit in 2022 is $1,657. If you havent started saving for retirement its essential to start early so you can take advantage of the power of compound interest .

If your company offers an employer-sponsored 401 with matching contributions, you should prioritize receiving the match because its essentially free money.

You might also consider opening an individual retirement account, either a traditional IRA or a Roth IRA, both of which have unique tax benefits.

With a traditional IRA, individuals invest pretax income and dont pay taxes until they withdraw their earnings. With a Roth IRA individuals invest after-tax money so their withdrawals are tax-free. A Roth IRA is considered a good option for those who anticipate being in a higher income tax bracket in retirement: Rather than paying higher taxes later on, youll pay taxes on your contributions upfront.

A Roth IRA, however, is not available to everyone. For 2022, the income limit for single-filers is $144,000 and for married couples filing jointly its $204,000. Companies like Vanguard, Wealthfront, Betterment, and Fidelity Investments all provide traditional and Roth IRA options.

You May Like: How To Pay Into Social Security

How Does A Break Even Calculator For Social Security Work

The basic premise of a break even calculator is based on the way Social Security benefits are calculated, where the earlier you file the lower your benefit will be. Waiting longer can get you a higher benefit amount but by filing at a younger age, youll receive more benefit checks in total.

This is why you need to understand the break even point. If you file later, your benefit will be higher. When compared to the same life expectancy as filing early, youll receive larger checks but for fewer months.

The age at which filing early versus filing later results in the same amount of cumulative payments is your break even age.

For example, lets use a very basic benefit amount that doesnt include any cost of living adjustments. Lets assume that your full retirement age benefit is $2,000:

- If you file at 62 you would receive $1,400

- If you wait until age 70, you would receive $2,480

Using simple math you can see that the total benefits you would receive in each scenario would be equal, or break even, at 80 years and 4 months. For every year you live beyond this age, the choice to file later is the winner as youll have more money by waiting to claim benefits than you would have if you filed early.

But what if you dont expect to live until 80 years and 4 months? Youd actually be better off by filing for benefits sooner.