Your May Have To Pay Taxes On Social Security Benefits

Most people know that Social Security is funded by a tax on earnings, currently 6.2% for the employee . But some retirees dont realize that you may well have to pay income tax on Social Security benefits when it comes time to claim them. Benefits lost their tax-free status in 1984, and the income thresholds for triggering tax on benefits havent been increased since then.

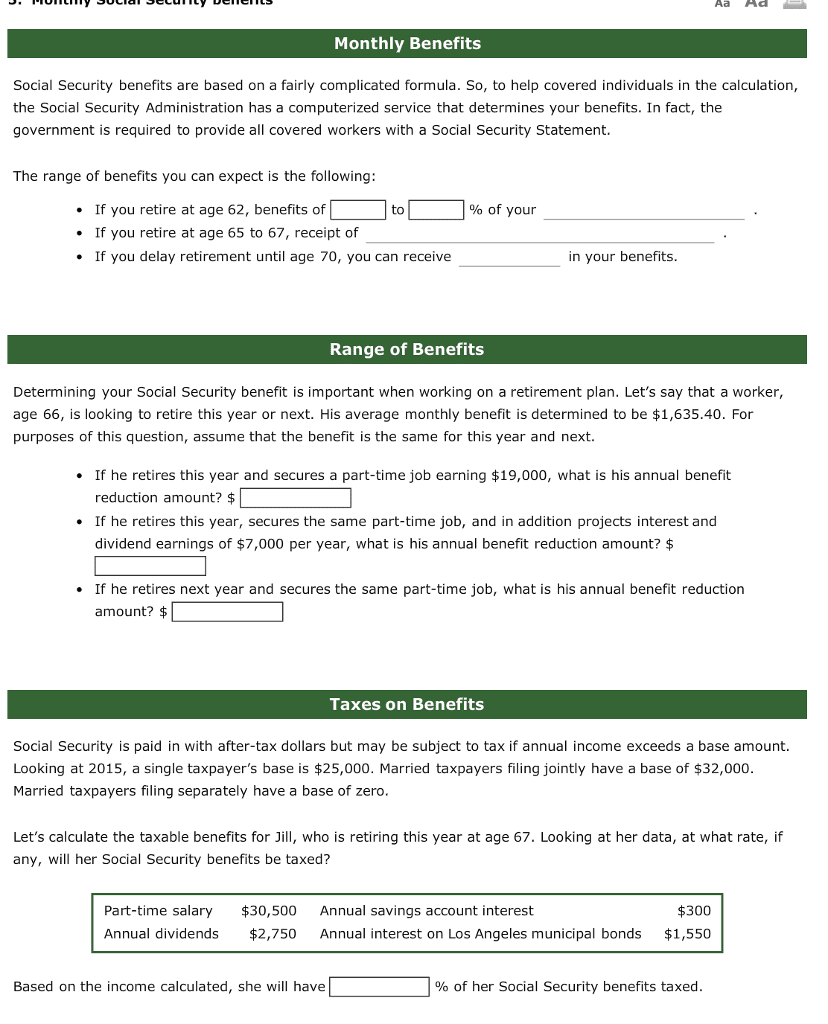

It doesnt take a lot of income for your Social Security benefits to be taxed. Your benefits wont be taxed if your provisional income is less than $25,000 if youre single or $32,000 if youre married. If youre single and your provisional income is between $25,000 and $34,000, or married filing jointly with provisional income between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. If your provisional income is more than $34,000 on a single return or $44,000 on a joint return, up to 85% of your benefits may be taxable.

The Social Security Administration says about 40% of beneficiaries pay taxes on their benefits. Since the thresholds arent adjusted for inflation, the number of beneficiaries who pay taxes on Social Security benefits increases every year. The Social Security Trustees annual report estimates that taxes on Social Security will total $45.1 billion in 2022, up from $34.5 billion in 2021.

You may also have to paystateincome taxes on your Social Security benefits. See our list of the 12 States That Tax Social Security Benefits.

What Are Social Security Benefits Definition Types And History

Consumer Reports

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Can I Collect My Retirementbenefits Early

You can start collecting Social Security as early as age 62 but theres a catch. If you collect before you reach your full retirement age , youll receive a lower monthly payment permanently. For example, if your FRA is 67, but you begin to claim benefits at 62, youre signing up to get 30% less. However, this reduction will decrease for each month you wait after age 62, up until your FRA. Think of your FRA as your break-even point.

Age to receive full Social Security benefits2

|

Year born |

- equal opportunities, or

- social inclusion and participation in society.

Incapacity, by contrast, refers to the situation where people aretoo sick to work, or unable to do work that they did previously.Disability might be one reason for incapacity, but so might besickness, or a range of fluctuating conditions which affect people fromday to day or month to month. The aims of provision for incapacityinclude

- social protection and insurance

Read Also: How Do I Apply For Social Security Retirement Benefits

Recommended Reading: Social Security Administration Louisville Kentucky

What Is Full Retirement Age

For Social Security purposes, your full or normal retirement age is between age 65 and 67, depending on the year you were born. If, for example, your full retirement age is 67, you can start taking benefits as early as age 62, but your benefit will permanently be 30% less than if you wait until age 67.

If you can manage without receiving your Social Security benefits at full retirement age, you can wait until age 70. That will give you the maximum benefit each month.

There’s no advantage to waiting past age 70 to start collecting benefits.

Social Security Spousal Benefits Explained

- Social Security spousal benefits can pay an eligible spouse 50% of the partners benefit if it is higher than his or her own benefit. Claims can begin at age 62 but may be worth more at full retirement age. Read our Social Security review to learn more.

Social security is complicated for individual filers, and being married can make it even more complicated. Thats because Social Security includes benefits for the spouse as well as the individual.

When an individual files for retirement benefits, that persons spouse may be eligible for a benefit based on the workerâs earnings according to the Social Security Administration.

In this Social Security review, we outline the rules for spousal benefits.

You May Like: Social Security Office In Chicago Heights

How Means Testing Works

One such option to achieve that goal is means testing. Means testing is the concept of distributing benefits to retirees based on need.

Now there are different ways means testing could play out. Lawmakers could decide that seniors above a certain income level might see their Social Security benefits reduced. Or, they might decide that higher-earning seniors can’t receive Social Security at all.

In a recent survey by the University of Maryland’s Program for Public Consultation, 81% of respondents favored reducing Social Security benefits for higher earners. And it’s worth noting that the idea received strong support from both respondents who identify as Republican and those who identify as Democrats. Furthermore, reducing benefits for the top 20% of earners could eliminate 11% of Social Security’s anticipated shortfall.

But while means testing could serve the important purpose of addressing Social Security’s financial woes, it begs the question: Is it fair?

Brace yourself: How Fed’s bigger rate hike will affect credit cards, mortgages, savings

And the answer? Not really.

Workers today are on the hook for Social Security taxes with the promise that they’ll be entitled to benefits down the line. Now, imagine someone who’s a higher earner pays those taxes for 45 years, only to then be told, come retirement, that they’re not getting benefits, or their benefits are getting reduced, because they also happened to save really well and have a large amount of nest egg-produced income.

What Are Social Security Benefits

Social Security benefits are payments made to qualified retired adults and people with disabilities, and to their spouses, children, and survivors. Social Securityofficially the Old-Age, Survivors, and Disability Insurance program in the U.S.is a comprehensive federal benefits program designed to provide partial replacement income for retired adults and their spouses, those whose spouse or qualifying ex-spouse has died, and people with disabilities. Under specified conditions, it also supports the children of beneficiaries.

Recommended Reading: Social Security Office Austin Tx

Other Pensions Might Reduce Your Social Security Benefits

Your benefits will be affected if you have a pension from a job that didnt have Social Security taxes taken out of your paycheck. Common examples include people who worked for a public education system, railroad workers and Federal government employees hired before 1984 who are covered by the Civil Service Retirement System .

Two complicated provisions will affect your claiming strategy: the Windfall Elimination Provision and the Government Pension Offset . The WEP reduces your own benefits by a discounted factor based on how many years you worked in jobs that did not withhold Social Security taxes. The GPO reduces your spousal and survivor benefits by two-thirds of the amount of your noncovered pension.

How To Get A Social Security Card

Don’t Miss: Social Security Administration Customer Service Number

How Inflation Impacts Your Pia

Your PIA is calculated at age 62. If you wait beyond age 62, cost-of-living adjustments will be applied to your PIA for each year afterward.

If you have already had most of your 35 years of earnings, and you are near age 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost-of-living adjustments. Many people do not account for this when doing their own calculations, which can lead them to think that taking Social Security early is a better deal, when waiting is often the better deal.

In the table below, our hypothetical worker, born in 1954, is eligible for full retirement at age 66. The column on the right shows the effect of inflation for waiting beyond age 62 to take their benefits.

| Effect of Age on Claiming Benefits |

|---|

| Year |

Will You Pay Taxes On Your Social Security Benefits

If, in addition to Social Security benefits, your retirement income includes taxable income in the form of wages, interest, dividends, and other sources, you could end up paying taxes on part of your benefits.

It all depends on your provisional income. Provisional income includes your adjusted gross income, plus tax-exempt interest, plus half of your Social Security benefits. Single taxpayers reporting $25,000 or less in provisional income pay no taxes on their Social Security benefits. For married taxpayers filing jointly, the threshold is $32,000. If your provisional income exceeds those limits, a part of your Social Security benefits will be taxable.

Don’t Miss: How Does Social Security Tax Work

Social Security Disability Benefits

Supplemental Security Income and Social Security Disability Insurance are disability income benefits administered by the Social Security Administration that also provide Medicaid and/or Medicare health insurance to individuals who are eligible. The application process for SSI/SSDI is complicated and difficult to navigate. Nationally, about 37 percent of individuals who apply for these benefits are approved on initial application and appeals take an average of two years to complete.

For people who are homeless or who are returning to the community from institutions , access to these programs can be extremely challenging. Approval on initial application for people who are homeless and who have no one to assist them is about 10-15 percent. For those who have a mental illness, substance use issues, or co-occurring disorders that impair cognition, the application process is even more difficult yet accessing these benefits is often a critical first step in recovery.

Critical components of SOAR include:

- Serving as the applicants representative

- Collecting medical records

- Writing a medical Summary Report

- Conducting quality review

- Please contact a regional coordinator below to find your nearest SOAR Specialist:

| Ashley Blum |

What Happens If You Work Less Than 35 Years For Social Security

If you claim benefits with fewer than 35 years of earnings, Social Security credits you with no income for each year up to 35. For example, if you worked for 30 years, there will be five zeroes in your benefit calculation. … If you file before reaching full retirement age, your benefit is reduced whether you work or not.

Don’t Miss: Social Security Office Alexander City Al

Child Beneficiaries December 2020

About 2.9 million children under age 18 and students aged 1819 received OASDI benefits. Children of deceased workers had the highest average payments, in part because they are eligible to receive monthly benefits based on 75% of the workers PIA, compared with 50% for children of retired or disabled workers. Overall, the average monthly benefit amount for children was $653.

How To Calculate Your Social Security Benefits

If you simply want to know how large your Social Security checks will be if you sign up at a certain age, you can figure this out by creating a my Social Security account. But if you want to understand how the government arrived at this number, you can duplicate its work by taking the following steps:

You May Like: What Do Social Security Cards Look Like

How Is My Social Security Benefit Amount Calculated

Another common Social Security benefits question is how payments are calculated based on your lifetime earnings. To account for changes in average wages each year, the Social Security Administration indexes your income using the national average wage index.

The SSA calculates your average indexed monthly earnings based on the 35 years in which you earned the most. A formula generates your basic benefits, otherwise known as your primary insurance amount. This primary insurance amount is what you would receive at your full retirement age. If you were born between 1955 and 1959, full retirement age is between age 66 and 67. For those born in 1960 or later, full retirement age is 67.5

Can You Receive Retroactive Payments

Once the SSA approves your SSDI application and calculates your monthly benefit, you may be entitled to a back pay award. How many months of payments you will receive will depend on the date you applied for benefits and your disability onset date.

If you are applying for SSDI benefits, you need the assistance of a skilled Social Security disability lawyer to get your application approved and receive the benefits you deserve. To schedule a free consultation with a member of our legal team, fill out the online form on this page or call our Roswell office today.

|

Related Links: |

Recommended Reading: Social Security Office Corpus Christi

Will A Government Pension Impact My Retirement Benefits

If you worked for an employer that didnt withhold FICA taxes from your salary, such as a government agency, the pension you receive based on that work may reduce your Social Security retirement benefits. This reduction, as part of the windfall elimination provision , affects individuals who earned a pension in any job where FICA taxes werent paid and who worked in other jobs long enough to qualify for Social Security retirement benefits.

In addition to a reduction in individual benefits, spousal and/or survivor benefits may also be reduced accordingly. In this case, Social Security benefits will be reduced by two-thirds of the government pension.

How Is Social Security Calculated

There is a three-step process used to calculate the amount of Social Security benefits you will receive.

Step 1: Use your earnings history to calculate your Average Indexed Monthly Earnings .Step 2: Use your AIME to calculate your primary insurance amount .Step 3: Use your PIA, and adjust it for the age when you will begin receiving benefits.

You can use a copy of your Social Security statement that provides your earnings history to plug your own numbers into the formulas below.

Also Check: Social Security Panama City Fl

Myth #: You Can Claim Early Then Get A Bump Up Once You Reach Full Retirement Age

Many believe there is a “bump up” or “added income” once they reach their FRA. They’ve heard they can claim early at 62, then when they reach 66 or older, their checks will increase to the amount that corresponds to their FRA benefit. That’s a big misperception.

There’s no bumping up of income once you’ve claimed your Social Security retirement benefit. However, anyone receiving a benefit can voluntarily “suspend” that benefit after they reach FRA and resume it as late as age 70. If they do, the annual benefit will increase by 8% per year of delay up until age 70. After that, you get an annual cost of living adjustment, but no increase in your base benefit, which will start automatically the month you reach age 70 unless you specify otherwise.

Read Viewpoints on Fidelity.com: Social Security do-over: Claim, suspend, and restart

In general, you can cancel your Social Security claim if you do so within the first 12 months of receiving benefits.2 You must repay the full amount you’ve received, and the full amount a current spouse or family member received based on your benefit. Then, you’re eligible to claim again at a later date and will receive a larger monthly payment. Each individual can only cancel a claim once in their lifetime.

Working Can Mean Lower Benefits Until You Reach Full Retirement Age

You can collect Social Security benefits if you are still working and earning income. But if you earn more than a certain amount from your workand havenât reached your full retirement ageyour benefit will temporarily be smaller. Hereâs a rundown of how earned income can reduce your Social Security benefits.

- Ex-spouses, if the marriage lasted for at least 10 years and they have not remarried

- Children under 18, or up to 19 if still enrolled in high school

- Children of any age who were disabled before 22 â that is, not earning more than $1,260 per month in 2020, having a medical condition that results in severe functional limitations and that is expected to last 12 months or longer or result in death

Spouses and ex-spouses must be at least 62 in order to claim benefits, and spouses and children must wait for the worker to begin claiming benefits themselves before they can claim family benefits on their record.

Read Also: Social Security Office Lees Summit

How Do Benefits Work And How Can I Qualify

While you work, you pay Social Security taxes. This tax money goes into a trust fund that pays benefits to:

-

Those who are currently retired

-

People with disabilities

-

The surviving spouses and children of workers who have died

Each year you work, youll get credits to help you become eligible for benefits when its time for you to retire. Find all the benefits the Social Security Administration offers.

There are four main types of benefits that the SSA offers:

-

Learn about earning limits if you plan to work while receiving Social Security benefits