Information For Military & Veterans

Social Security pays disability benefits through two programs: the Social Security Disability Insurance program and the Supplemental Security Income program. SSDI is for workers and certain family members if they worked long enough and recently enough to qualify for benefits. SSI is for people who are 65 or older, as well as people of any age, including children, who are blind or have disabilities. To be considered eligible for SSI, you must also have income and resources below specific financial limits.

Before you apply for Social Security disability benefits, please review the to make sure you understand what to expect during the application process. Also, gather the information and documents youll need to complete an application.

Programs Affecting One Another

SSDI payments and VA disability benefits will not affect each other, meaning you can receive full monthly payments from both programs. SSDI benefits are also available to eligible spouses or children. The Social Security Administration does offer another type of benefits known as Supplemental Security Income, or SSI, which would be affected by VA disability. People who receive SSI have a low income and limited resources, and are usually awarded to veterans who receive VA Pension, not VA disability benefits.

Does Tdiu Help With Ssdi

Total disability based on individual unemployability is for veterans who cant keep or obtain gainful employment because of service-connected impairments. Those TDIU disabilities must be related to your time in the service and be considered service-connected to receive benefits.

Veterans can receive individual unemployability and Social Security disability simultaneously. But being eligible for one disability benefit does not mean you are automatically entitled to the other because of the organizations different guidelines. Even if you have one benefit, you still have to submit each application and go through the unique processes.

Also, the amount veterans receive in SSDI benefits isnt reduced because of their VA benefits, so it can be beneficial to apply for both. The two benefit programs have different eligibility requirements, meaning some veterans will qualify for one or the other, and some will qualify for both.

Both TDIU and 100% disability service connection compensation are tax-free benefits, Underwood said. They can also be received while you are receiving Social Security disability.

Total Disability Individual Unemployability Benefits Explained

Read Also: Social Security Disability Spousal Benefits

Only In Certain States Or If Your Income Exceeds The Federal Limits

A Tea Reader: Living Life One Cup at a Time

Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of people who receive Social Security benefits do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for the program have little or no additional income.

What Other Tax Benefits Are Available To Disabled Veterans

The IRS does not tax VA education benefits, and you do not have to file any special paperwork to receive the tax break on your tuition, books, and other expenses. You can learn more about VA education benefits by reading IRS Publication 970 titled Tax Benefits for Education since certain limits and exclusion apply.

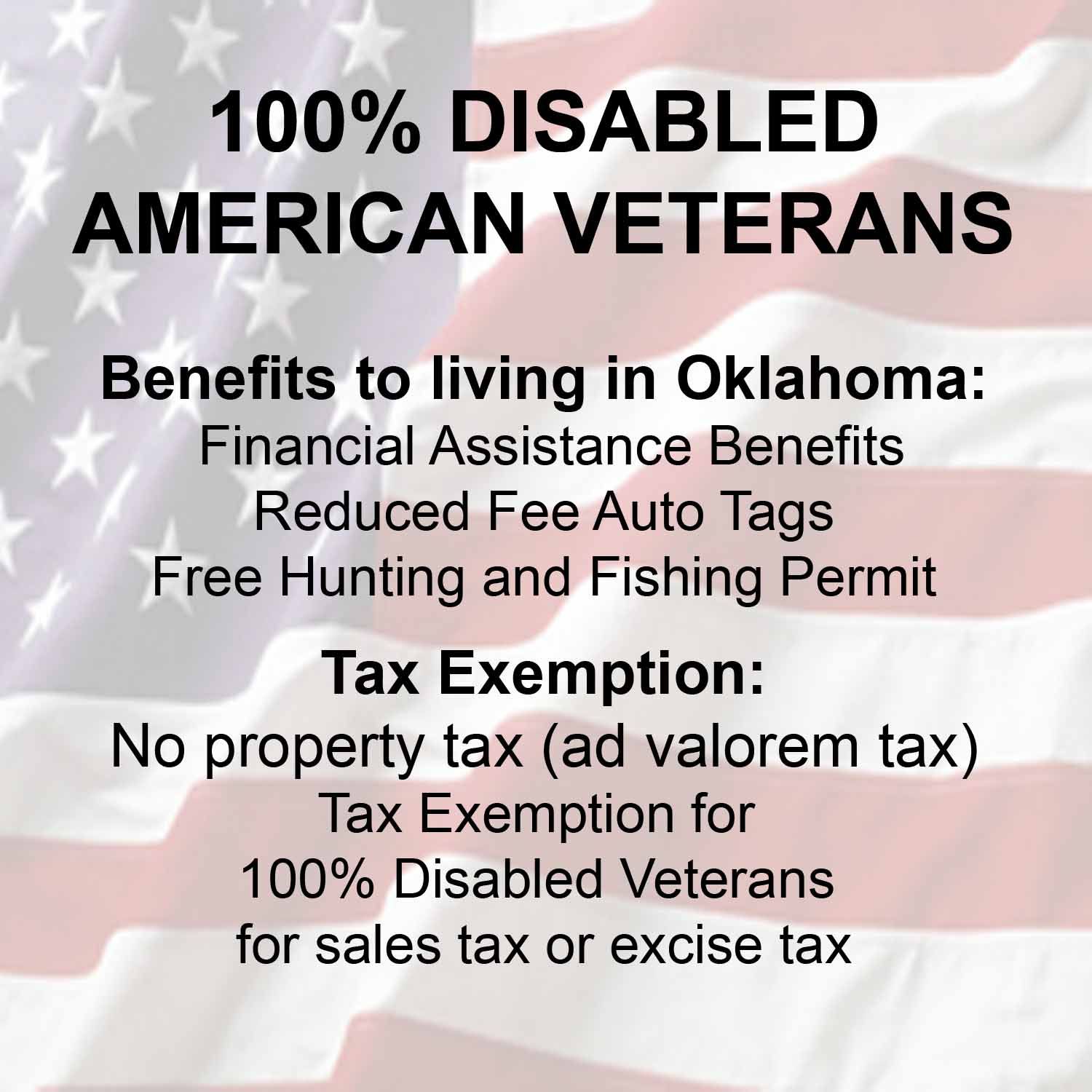

Federal and state government offer additional tax breaks to disabled veterans, such as property tax benefits. The specific benefit you receive depends on where you live. In Florida, for example, a veteran with a minimum 10 percent disability rating can receive a property tax deduction of up to $5,000. That state provides a full property tax exemption for veterans with a 100 percent disability rating. You can find the disabled veterans property tax exemption for your state at the website MilitaryBenefits.info. Other non-taxable VA benefits include:

- Bonus payments received from a political or state subdivision related to the veterans service in a combat zone.

- Death gratuity benefits paid to an Armed Forces survivor who died any time after September 10, 2001.

- Insurance dividends and proceeds paid to veterans or beneficiaries of the policy. This includes any proceeds paid by a veterans endowment policy that the veteran received prior to death.

- Interest paid on insurance benefits the veteran left on deposit with the VA.

- Payments received from the veterans compensated work therapy program.

Read Also: Social Security Office Troy Mi

What Are Ssdi And Sdi

SSDI, also known as Social Security Disability Insurance, is offered to those who have qualifying disabilities or conditions regardless of whether they have served in the United States military. SSDI is a federal-level benefit you earn after working long enough to earn 40 credits.

According to the Social Security Administration, those credits are earned by your work and payments into the Social Security fund for a maximum of four credits per year. The credits are based on your total earnings during the year, and the requirement to earn those credits is subject to review and change.

» MORE:Veterans Can Buy a Home with $0 Down

Some may earn more credits than they can use in a lifetime, but this does not increase the level of benefit or payment amounts.

Social Security benefits have medical requirements and nonmedical criteria. Those meeting the nonmedical requirements are paid benefits when it is determined their medical issues are expected to last a minimum of one year or result in the death of the patient.

Social Security Insurance, also known as SSI, is similar to SSDI in some ways, but is a need-based benefit and subject to income caps. Such caps mean if you draw VA disability pay but not military retirement pay, you may qualify for SSI.

The Social Security Administration official website advises veterans those approved for a VA pension will not qualify to receive SSI because the pension amount is higher than the SSI payment amount, exceeding the income cap.

Differences Between Social Security And Veterans Disability

One major difference between Social Security disability and veterans disability is that you don’t need to be totally disabled in order to be eligible for VA compensation. In fact, most veterans who receive VA compensation do not receive a total disability rating. Veterans can receive a compensable rating as low as 10%, and can even have a rating as low as 0%.

Social Security disability, conversely, does not compensate disability claimants based on a partial loss of employability. You are either totally disabled or not disabled under Social Security’s definition of disability.

In the past, another difference between the two programs was due to Social Security’s “treating physician rule.” Until March 27, 2017, a “treating physician’s” medical opinion was generally given a great deal of weight. In VA law, the treating doctor’s opinion is not given deferential weight, because of the important VA principle that decisions be based on the entire file, so as not to give any particular evidence extra weight. After March 27, 2017, neither program gives deference to the opinions of a treating physician.

Recommended Reading: Social Security Office On Crenshaw

Withholding Taxes For Disability Benefits

If you believe you may need to pay taxes on your disability benefits, you can ask the SSA to withhold a percentage of your monthly payment. This instance works in the same way as an employer withholding taxes from your check. Doing so is not a requirement but may be a good idea if you worry about putting enough aside to pay your taxes at the end of the year.

For a free legal consultation, call

Quick Breakdown Of Ssa Benefits

- Earned by working/paying into the SSA system

- Four credits per year must be earned

- SSI is a benefit that is reduced by other forms of income/compensation that exceeds program guidelines

- SSDI is a program that is not reduced by VA benefit payments

Lets compare that to VA medical benefits paid to those with VA-rated disabilities.

Read Also: What Can Someone Do With My Social Security Number

Do Va Disability Benefits Count Toward The Earned Income Tax Credit

The Earned Income Tax Credit is a refundable tax credit for low-income Americans that, in some cases, enables them to receive a tax refund exceeding what they paid in taxes throughout the year.

However, even though a veteran earned their VA disability benefits through military service and the disability they suffered on behalf of the country, these benefits are not considered earned income and therefore do not count towards the EITC. Military pension also does not count towards the EITC.

It is important to note that VA disability does not reduce or eliminate tax credit for veterans who have other income that qualifies them for the EITC.

Federal Taxes On Veterans’ Disability Or Military Retirement Pensions

Benefit Fact Sheet

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes. However, military disability retirement pay and Veterans’ benefits, including service-connected disability pension payments, may be partially or fully excluded from taxable income.

Service members with service-connected disabilities may be eligible for Federal income tax exclusions of Veterans’ benefits and disability pension payments.

Military Retirement Pay

Military retirement pay based on age or length of service is taxable and must be included as income for Federal income taxes. The amount a Retiree pays to participate in the Survivors Benefit Plan is excluded from taxable income. For Social Security tax purposes, military retirement pay is not considered earned income and no Social Security payroll taxes taxes) are withheld from military retirement pay.

Military Disability Retirement Pay

Military Disability Retirement Pay received as a pension, annuity or similar allowance for personal injury or sickness resulting from active service in the armed forces should not be included in taxable income if any of the following conditions apply:

You would be entitled to receive disability compensation from the Department of Veterans Affairs if you filed an application for it .

Veterans Benefits

Veterans’ benefits are also excluded from Federal taxable income. The following amounts paid to Veterans or their Families are not taxable:

Read Also: Social Security Lump Sum Payment

Taxes On Disability Income

In the U.S., if you work long enough, pay your taxes, and meet certain income thresholds during your career, you can participate in Social Security programs. Over time, you pay into this system and can expect to receive several benefits for you and your family.

If you work but later become disabled and have limited resources and means to earn income, the Social Security Disability Insurance program can assist. The program pays benefits to you and your children. But because your taxes fund this program, you may wonder is Social Security disability income taxable? Let’s find out.

Are Va Benefits Taxable

In addition to VA disability compensation, if you receive one of these VA disability benefits listed below, you dont have to pay any taxes on them.

More Disabled Veteran Tax-Free Benefits:

- Payments under the VAs work therapy program

- VA healthcare benefits

- Veterans insurance proceeds and dividends

Read Also: Social Security Office In Shreveport Louisiana

What If I Have More Questions About My Va Claim

I understand you want your VA claim to be done as quickly as possible. But remember the ultimate goal to win your VA disability compensation claim.

You may eventually get there on your own, but it may be after a series of decisions by the Regional Office and Board of Veterans Appeals. Sometimes claims are appealed and remanded several times, which can cause a claim to drag on for years. If you are interested in avoiding unnecessary delay in your claim and want to do everything you can to maximize your chances of success, it is probably a good idea for you to consult with an accredited veterans disability attorney.

We would be happy to talk to you. If you would like a free consultation with our Perkins Studdard veterans disability attorneys just click here or give us a call to begin the process.

Travis Studdard is an attorney who focuses on representing veterans in VA disability compensation claims. He regularly writes about issues that are important to veterans and their families.

Proceeding With A Va Disability Claim

If you suffered a military-related injury, you might be entitled to receive VA disability benefits. VA benefits are non-taxable, and they are awarded based on the disability rating you receive. If the VA approves your claim, they will assign a rating that ranges anywhere from 0% to 100%. Evan a rating of 0% is acknowledgement that you have suffered an illness or injury while on active duty that is connected to your military service, but it doesnt warrant benefits at this time. It is good to get a 0% rating rather than get a no-service related ratings because if your condition worsens later on, you can ask to have that rating upgraded. To proceed with a disability claim, you need to enlist the help of a disability lawyer.

If you are among veterans with PTSD, the disability rating is listed under the General Rating Formula for Mental Disorders, which indicates the criteria for disability ratings with such impairments are 0%, 10%, 30%, 50%, 70%, or 100%. Veteran PTSD benefits are part of the VA disability benefits available to soldiers who suffered injuries while on active duty. Impairment ratings are how the symptoms of your service-related condition are equated into a percentage and monetary value. Many veterans with PTSD believe that they did not receive an accurate rating for their condition. A Social Security disability lawyer can help you with these claims and help you argue your case as well as your disability rating.

Read Also: What Can Someone Do With Your Social Security

Some Background On Va Benefits Compared To Social Security Disability

VA compensation for medical conditions, injuries, and other issues is conditional. The VA must determine that your medical issues are service-connected or service-aggravated and award a disability rating on that basis.

VA disability pay requires the veteran to submit medical documentation, evidence , civilian care records, etc. A VA medical claim is reviewed by the VA. Compensation is awarded on a scale of percentages with a maximum award of 100% disability.

Who Is Eligible For Social Security Disability Insurance

To receive SSD benefits, you must be unable to work because of a medical condition that has lasted or is expected to last a year or to result in death. The amount of your SSD benefits depends on your average lifetime earnings before you became disabled.

Generally speaking, the more you earned and the longer you worked, the more youll receive in benefits, up to a maximum amount. The SSA calculates your disability benefits based on your past earnings that were subject to the Social Security tax.

In most cases, if you receive VA benefits or Supplemental Security Income, these benefits will not reduce the amount of your Social Security Disability Insurance payment. However, receiving SSD payments may reduce your SSI payments if you receive SSI benefits.

Read Also: Social Security Office Corsicana Tx

Are Va Disability Benefits Taxable At The State Level

No. You dont have to pay state taxes on your VA disability paid to you or your family. Many states within the U.S. also offer tax incentives for veterans as a thank-you for their service. This includes property tax and income tax exemptions, which can be especially beneficial if you receive military retirement pay.

For example, Texas veterans with a 100% VA disability rating are exempt from paying property and state income taxes .

You can learn more about veteran tax benefits by state here.

VA disability benefits are a vital source of income for many veterans. These tax-free benefits can provide much-needed financial assistance for veterans unable to work due to a service-related injury or illness. The more your VA disability rating increases, the more tax-free money you will receive.

Contact our team of expert Veteran Coaches today if you need help winning your VA claim or increasing your VA rating.

Additional Programs And Information:

Disability Decisions

A team comprising a staff physician or clinical psychologist and a professionally trained analyst makes the disability decision. Applications for Social Security disability benefits may be completed online at Apply for Benefits. The public may also call SSAs toll-free number, 772-1213, to schedule an appointment in person or by phone. Find the most conveniently located Social Security office at the Social Security Office Locator. To apply for Medicaid, visit Virginias Medical Assistance Programs.

Fraud Prevention

The Virginia DDS works in conjunction with SSAs Office of the Inspector General through a Cooperative Disability Investigations unit to prevent fraud in the disability program. The CDI program was established in 1998 to effectively pool resources and expertise to prevent fraud in SSAs disability programs. The CDI programs primary mission is to obtain evidence that can resolve questions of fraud before benefits are ever paid. Reports from CDI Units can also be used to cease benefits of in-payment beneficiaries during the continuing disability review process. For more information about CDI, OIG, or to report fraud, waste, or abuse, visit or contact Brett Fielding at the number listed below.

SOAR in Virginia

School Evidence

For more information about the disability process, visit Childhood Disability for School Professionals. More information is also available from the Social Security Administrations Benefits Planner.

Read Also: Social Security Office Coconut Creek

Are Veterans Disability Benefits Taxable

If you are new to receiving Veterans Administration disability benefits, or if you are in the process of applying of them you might be curious about the tax liability that comes along with the monthly check. Military disability pay is awarded to disabled veterans for personal injury or sickness suffered during military duty that led to a disability. If you receive VA disability benefits, they are not taxable and are not included in the gross income you list on your income taxes.

However, if you receive military retirement disability pay, it could be taxable. Military retirement disability pay is not the same as VA disability income, where you apply for monthly disability benefits. If any of these apply, your military retirement disability income can be excluded from your taxable income:

You were eligible to receive disability pay before September 25, 1975.

You were serving as a member of a listed government service or with its reserve unit or you were under a binding written contract to join as of September 24, 1975.

Your disability payments are from a combat-related injury. This is a personal illness or injury that is:

Resulting from armed military conflict

Happened while you were engaged in an extra-hazardous service

Occurred under conditions simulating war, including training exercises or maneuvers or

Is caused directly by an act of war.