Overview Of South Carolina Retirement Tax Friendliness

South Carolina does not tax Social Security retirement benefits. It also provides a $15,000 taxable income deduction for seniors receiving any other type of retirement income. The state has some of the lowest property taxes in the country.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Are Other Forms Of Retirement Income Taxable In South Carolina

Yes, but they are also largely deductible. For taxpayers under the age of 65 the deduction is $3,000. For seniors 65 and older, the deduction is $15,000. This can be applied across all types of retirement income, including income from a 401, an IRA, a government pension or a public pension. Those with a military retirement plan can exclude up to $30,000 of income.

If you are a senior and your total income from all those sources is less than $15,000, you will not pay any South Carolina income taxes. Above that limit, you may need to pay taxes at the rates shown in the table below.

A Special Note Before Getting Into The Comparison:

Its often advisable to rent for a while before making a full-time move to a new place where youve never spent a considerable amount of time and dont have a social network. Saving money on property taxes and warmer winters are nice, but the lifestyle change is sometimes underestimated.

In cases where people jump into purchasing a new home, sometimes paying contractors to build a new house from scratch without even being in the state to supervise, needless to say, regret is often the result. Advice on making a big move like this is well within the scope of work of a fiduciary financial advisor who specializes in retirement planning.

Also Check: Maximum For Social Security Tax

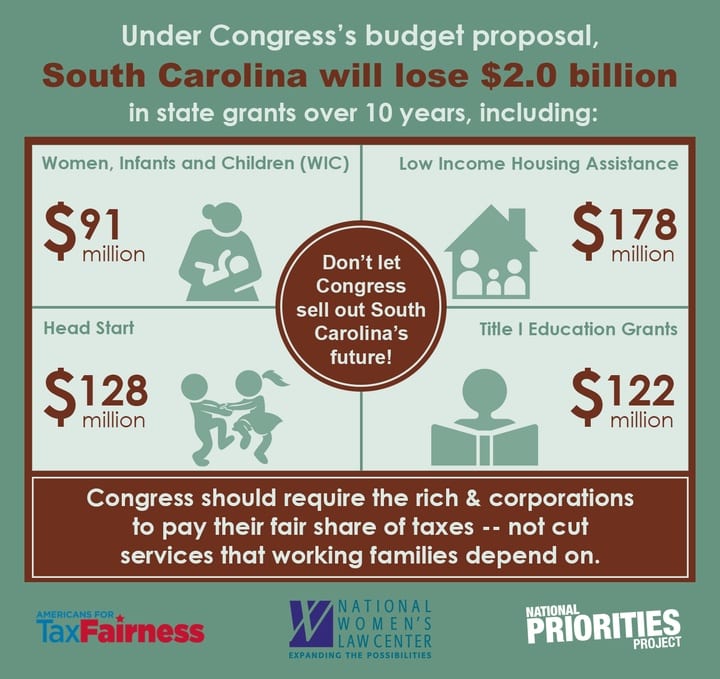

Only 11 States Actually Levy A Tax On Social Security Benefits

Social Security benefits are a vital source of income for many retired Americans. However, as with any income, the federal government is able to tax Social Security benefitshow much depends on the retirees income. Generally speaking, this is all that Social Security recipients in most parts of the United States will have to pay.

However, this isnt always the case. While most states dont tax Social Security, 11 states do.

Heres what to know.

Is It Cheaper To Live In Sc Or Nc

While North Carolinas overall cost of living is still lower compared to the national average of 100%, its still slightly above South Carolinas cost of living. Furthermore, people living in NC pay below the countrys average for housing, groceries, utilities, and transportation.

Don’t Miss: How To Change Social Security Number

South Carolina Property Tax

The property tax rate for residential property in South Carolina is 4% of the assessed value. This rate covers the house and up to five acres of land surrounding it. The first $100,000 in home value in South Carolina is exempt from school district property taxes. Homeowners over 65 are eligible for a homestead property tax exemption of $20,000.

All vehicles including cars, motorcycles, and recreational vehicles are taxed as property in South Carolina. The rate is around is 3% of the vehicle’s Blue Book value.

South Carolina would be an excellent low cost retirement option for a person or couple with a good source of income. It offers a low cost of living, low taxes, and many recreational opportunities.

| Capital: |

South Carolina Property Taxes

According to SmartAsset, The average effective property tax rate in South Carolina is just 0.55 percent, with a median annual property tax payment of $980. Thats a much better rate than the national average. Currently, households in the U.S. spend an average of $2,471 on property taxes each year, according to WalletHub.

You May Like: Social Security Administration Kansas City Mo

States That Dont Tax Social Security

Thirty-seven states plus the District of Columbia do not tax Social Security benefits. These states include the nine that dont have any income tax at all, which are:

-

Washington, D.C.

If you live in any of these states or the District of Columbia you wont have to worry about paying state taxes on your Social Security income.

Popular Destinations In The Carolinas Retirees Are Targeting

The short list is a long one. The Carolinas are actively recruiting retirees, and local governments are friendly to the developers of the numerous active adult over-55 communities that surround beach and mountain communities.

U.S. Census Bureau population estimates from April 2010 to July 2019 note this is well before the pandemic show:

- The region straddling the North Carolina-South Carolina border that includes Myrtle Beach, Conway, and North Myrtle Beach grew a whopping 32.6% last decade with the arrival of 122,581 new residents.

- Raleigh, N.C.s population grew by 16% with the arrival of 180,756 new residents.

- South Carolinas Hilton Head Island-Bluffton-Beaufort regions population grew 15.6%, with 29,093 new residents.

- Charleston-North Charleston, S.C., gained 101,288 new citizens in that time frame, a 15.2% growth rate.

Popular retirement communities in North Carolina include Pinehurst Trace in Pinehurst and The Gables at Kepley Farm in Salisbury. Popular retirement towns in North Carolina include Brevard and Asheville in the mountains, New Bern and Oak Island, as well as Southport, Carolina Beach and Chapel Hill.

Retirement communities also dot some of the top retirement destinations in South Carolina as well, including popular destination towns Georgetown, Spartanburg, West Columbia, Greenville and Hilton Head Island.

Recommended Reading: Social Security Help For Seniors

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

Many working-class residents will likely find themselves in the state’s highest income bracket , but retirees fair much better thanks to a collection of income tax breaks aimed at seniors. Residents who file a 2021 South Carolina income tax return by February 15, 2023, may also get a tax rebate .

Unfortunately, sales taxes are on the high end in South Carolina, with an average combined state and local rate of 7.44%.

Is South Carolina Tax

South Carolina does not tax Social Security retirement benefits whatsoever. It provides a substantial deduction on all other types of retirement income, including income from retirement accounts. Retirees who own a home in South Carolina will fare especially well, as the state has some of the lowest property taxes in the country.

Also Check: Medicare And Social Security Taxes

Retirees In The South Get A Free Pass With Social Security Except In One State

All but one of the 16 states of the South are tax-friendly when it comes to Social Security. Florida, Tennessee, and Texas don’t charge state income taxes generally, which makes Social Security taxation largely a moot point. But most of the other states in the region Alabama, Arkansas, Delaware, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, and Virginia also have a blanket exemption on taxing Social Security. West Virginia is the only exception it uses the federal rules to determine what gets included in state income taxes.

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

Don’t Miss: Social Security And Medicare Tax Rates

The Pros And Cons Of Living In South Carolina

South Carolinas natural beauty, southern hospitality, festivals, activities, a thriving economy, and nearly perfect year-round weather make it one of the top five states for new residents.

With a population of just over five million people, SC is the 40th largest state and covers an area 260 miles long and 200 miles wide. North Carolina borders to the north, and Georgia is on the west. Along the east coast is the Atlantic Ocean and the SC Lowcountry.

The top reasons most Americans choose to relocate between states are new job opportunities, living closer to family, and retirement.

But why do 59% of Americans looking for a change choose South Carolina?

Clearly, the beauty of SC is not lost on others. They are drawn to the warmth of its climate, its abundance of natural green spaces, and the welcoming warmth of southern hospitality.

Making the right choice of moving to a new location such as South Carolina should consider the good and not so good aspects of a place, and we want to share those with you.

As with all choices we make, there are pros and cons.

Lets first take a look at what is motivating your interest in living somewhere new.

If youre happy and fulfilled right where you are and envision the future as a healthy, productive one with you settled contentedly within it as it unfolds, consider yourself fortunate.

But some of us are itching for a change.

What Is The State Income Tax Rate For Sc

South Carolina accepts the adjustments, exemptions and deductions allowed on your federal tax return with few modifications. Your federal taxable income is the starting point in determining your state income tax liability. Individual income tax rates range from 0% to a top rate of 7% on taxable income.

Don’t Miss: Phone Number For Social Security Disability

How High Are Property Taxes In North Carolina

North Carolina has relatively low property taxes. The states average effective property tax rate is 0.77%. This means that, on average, homeowners can expect to pay about $770 annually for every $100,000 in home value.

Low property taxes are one reason housing costs in North Carolina are below national averages. That also contributes to North Carolinas generally low cost of living.

Also Check: Can You Claim College Tuition On Taxes

How Does South Carolina Rank For Retirement

Asked by:Cleora Mohr

Florida is better for retirement if you like warm weather, beaches, and water sports. It offers educational opportunities and good healthcare services. However, South Carolina is equally great since it offers numerous recreational activities, low retirement tax rates, and warm weather.

Also Check: Do I File Taxes On Social Security

Additional Social Security Deductions If You Work And Collect Benefits Before Full Retirement Age

State and federal taxes are not all you need to worry about with Social Security. There can also be a temporary reduction in benefits if you have not achieved full retirement age and you are receiving work income above a certain level.

So while you are allowed to start benefits as soon as you turn 62 , the sooner you start collecting your benefits, the less your monthly benefit will be. Conversely, the longer you wait , the more your monthly income will be.

And the other downside to starting benefits early is that if you elect to collect benefits before your full retirement age and you are receiving work income, you will get less money than if you wait to collect, and the money you get will be subject to tax.

The full retirement age from 2022 onward is 67 for anyone born after 1960.

Is South Carolina A Tax Friendly State For Retirees

South Carolina Is Tax-Friendlier to Retirees Than North Carolina. Kiplinger ranks South Carolina as one of the most-friendly states for taxes on retirees. As in North Carolina, South Carolina does not tax Social Security benefits. The state also offers other generous exemptions on other types of retirement income.

Also Check: Social Security Office Marietta Ga

Cost Of Living In South Carolina

South Carolina is across the board a very cheap state to live in. This can be a big plus for retirees hoping to extend their savings or live a higher quality of life than they could afford in more populated states.

According to data from the Missouri Economic Research and Information Center, South Carolina has the 18th lowest cost of living in the United States. The spending power of $100 in the state would be equal to more than $110.

Simply put, your money will go far in South Carolina. Not only could this upgrade your quality of life compared to what you could afford in other states, but it could also extend your retirement savings years out.

The low housing costs are particularly attractive to retirees since property can be a major expense in other states. If youre a property owner in a more expensive region of the country, this also gives you the chance to sell your current home and pocket much of the money towards your retirement since you wont need all of it to buy a new home.

On Medicare? Annual Enrollment Ends On December 7th!ends tomorrow

The Best Places To Retire In South Carolina

If you are looking for a unique combination of serenity and fun, look no further than Kiawah Island and Seabrook Island. Charlestons most beloved sea islands are a wonderful playground for retirees. Enjoy access to championship golf, world-class tennis, miles of pristine beaches, and more.

In addition, Charleston offers beautiful year-round weather. You can enjoy your favorite sports and outdoor activities throughout the four seasons!

Also Check: When Does Social Security Become Taxable

Senior Citizen State Of South Carolina And Federal Tax Deductions

For senior citizens, there are a variety of tax deductions that you may be able to claim on both your South Carolina and Federal Tax Filings. For those who are filing their taxes, looking at the overall tax snapshot of your state and federal taxes is important for perspective. To ensure that youre getting the most out of your money, begin by looking at your income taxes and state sales tax rate, then progressing to social security, retirement accounts, property, and additional exemptions, deductions, refunds, and credits that you may be eligible for to give you the biggest possible refund.

Do I Owe Taxes On My Social Security Income

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401 or a part-time job, then you should expect to pay income taxes on your Social Security benefits. If you rely exclusively on your Social Security checks, though, you probably won’t pay taxes on your benefits. State laws vary on taxing Social Security. Regardless, it’s a good idea to work with a financial advisor to help you understand how different sources of retirement income are taxed.

Also Check: Grand Rapids Social Security Office

See South Carolina For Yourself Book A Discovery Visit

Whether you base your decision to relocate on a pros and cons list, or simply decide to go with your heart, you should visit a few places before taking the plunge. South Carolina offers beautiful planned communities that focus on health and wellness and are close to charming seaside towns like Beaufort.

Many happy people are living in South Carolina, and you could be one of them.

Ready to have a look for yourself? Contact us at 843.379.9095 and find out about booking a Discovery Visit.

Three days to explore Beaufort and Celadon, with two nights in your choice of one of three of Beauforts finest inns or hotels.

We cant wait to show you around!

Do I Have To Pay Income Tax In South Carolina

In South Carolina, the filing requirements depend on your age, filing status, and residency status.

- Resident taxpayers under 65: You must file if you submitted a federal tax return or had South Carolina income tax withheld from any wages.

- Resident taxpayers 65 or older: In this case, it depends on your filing status.

- You must file if your gross income is greater than or equal to the federal filing requirement amount plus $30,000 or you had South Carolina income tax withheld from any wages.

- All other filing status: You must file: if your gross income was greater than the federal filing requirement amount for your status plus $15,000 or, if you had any South Carolina income tax withheld from your wages.

Read Also: Social Security Office Jonesboro Ar