How Filing Early Or Late Impacts Benefits Under Dual Entitlement

Im going to make the assumption that you are the one who will be receiving the spousal benefits. If you look at the chart below, that means that the center shows your filing age. The left-hand column shows reductions or increases to your own benefit. The column on the right shows the reductions or increases to your spouses payment.

Lets make the assumption that your full retirement age is 67 . At full retirement age you would receive 100% of your own benefit. You would also receive 100% of your spousal amount.

If you file a year early, at 66, you would receive 93.33% of your benefit and 91.67% of your spousal amount. At 65 it would be 86.66% of your benefit and 83.33% of your spousal amount.

You can see that the difference in reductions between your benefit and the spousal benefit continue to widen all the way back to the earliest age of filing, which is age 62.

The other notable part of the difference is that your own benefit will increase if you delay filing, but your spousal payment will not increase.

So just to make sure we are real clear on how a spousal benefit will actually be reduced, let me walk you through an example where we use dollars.

Lets continue with our assumption from earlier, that the higher-earning spouse has a full retirement age benefit of $2,000 and the lower-earning spouse has a benefit of $800.

But now theres a small wrench Id like to throw into the machine here to make this interesting.

The Two Exceptions To Know Around The 1 Year Marriage Requirement

Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

Exception 1

If you marry someone who is the natural mother or father of your child, the one year requirement is waived.

Be the natural mother or father of the workers biological son or daughter i.e., this requirement is met if a live child was born to the number-holder and claimant although the child need not be alive.

Exception 2

The 1-year requirement is also waived if you were entitled to Social Security benefits on someone elses work record in the month before you were married.

An example of these benefits would be spousal benefits, survivor benefits or parents benefits.

For example, lets assume you will be eligible for a spousal benefit from your ex-husband Joe. If you remarry, you wouldnt have to wait the full 12 months to get a spousal benefit from your new spouse. Instead, youd be immediately eligible.

This topic is closely related to the Social Security Survivor Benefit. Ive written an in-depth but easy-to-understand article titled Social Security Survivor Benefits: The Complete Guide to Who Gets What and How to Calculate It if you want to learn more.

Strategies For Maximizing Spousal Benefits

Every married couple has to figure out the best way to maximize their benefits depending on their own circumstances.

The three strategies below will help you make the most of your Social Security spousal benefits, depending on your circumstances. However, keep in mind that, regardless of your circumstances, the most a spouse can get is 50% of the amount that the higher-earning partner is entitled to at full retirement age.

Read Also: Social Security Office South Jordan

How Does The Social Security Administration Calculate Benefits

Benefits also depend on how much money youâve earned in life. The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat âzeroâ for each year you donât have earnings, so people who worked for fewer than 35 years may see lower benefits.

The Social Security Administration also makes annual Cost of Living Adjustments, even as you collect benefits. That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. Itâs a big perk that doesnât get a lot of attention.

Social Security Spousal Benefits Explained

- Social Security spousal benefits can pay an eligible spouse 50% of the partners benefit if it is higher than his or her own benefit. Claims can begin at age 62 but may be worth more at full retirement age. Read our Social Security review to learn more.

Social security is complicated for individual filers, and being married can make it even more complicated. Thats because Social Security includes benefits for the spouse as well as the individual.

When an individual files for retirement benefits, that persons spouse may be eligible for a benefit based on the workers earnings according to the Social Security Administration.

In this Social Security review, we outline the rules for spousal benefits.

Recommended Reading: Social Security Benefits For Disabled Veterans

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Now Enhanced To Include Divorced Widowed And Gpo/wep Benefits

Deciding when and how to take Social Security is an important part of retirement income planning. The Social Security Retirement Income Estimator is designed to help individuals and married couples decide when to file a claim and how to coordinate their Social Security benefits to enhance their retirement income. Youll gain insight into questions, such as:

- How should Social Security benefits be integrated into an overall retirement income plan?

- When is the best time to claim benefits?

- What are the advantages of waiting to receive payments?

- What percentage of retirement expenses will Social Security cover?

Also Check: Social Security Office In Madison Tennessee

Three Key Ways To Maximize Your Spousal Benefits

If you’re eligible for Social Security spousal benefits, how much you’ll receive depends on a number of factors, including your age, the amount of your spouse’s benefit, and whether you have other retirement benefits available to you. Who’s eligible? Anyone whose spouse, ex-spouse, or deceased spouse was or is eligible for benefits, once you have reached the age of eligibility, is eligible.

The maximum amount you can receive is 50% of your spouse’s full benefit. That’s straightforward enough, but the precise amount you’ll get and when you’ll get it depends on several circumstances, including your spouse’s age and work history, your own age and work history, and more. That leaves some room for you to maximize the amount you receive. And, remember, if that amount is less than the amount you’d get based on your own work history, you’ll automatically get the higher amount.

Below, you’ll find out if you qualify for Social Security spousal benefits and how to find out the amount you’ll get. And, you’ll learn the fate of a couple of once-popular spousal benefits loopholes in the Social Security rules. Nevertheless, if you know the rules highlighted in this article, you’ll be able to maximize your Social Security spousal benefits.

Social Security And Your Sers Pension

If you are a SERS retiree who also is eligible for a Social Security benefit, you may be affected by federal law regulating Social Security benefits. As a result, your Social Security benefit may be reduced by either the Government Pension Offset or the Windfall Elimination Provision .

Neither the GPO nor the WEP will reduce your SERS pension. They can affect only your Social Security benefit.

For more detailed information on the GPO and WEP and how they may affect your specific Social Security benefit, you should contact the Social Security Administration through your local office, by visiting the SSA website at www.ssa.gov, or by telephone at 800-772-1213. The following is provided only as general information.

You May Like: Social Security Office Corsicana Tx

Do You Expect To Have Additional Sources Of Retirement Income Beyond Social Security

Continue saving in the coming years.

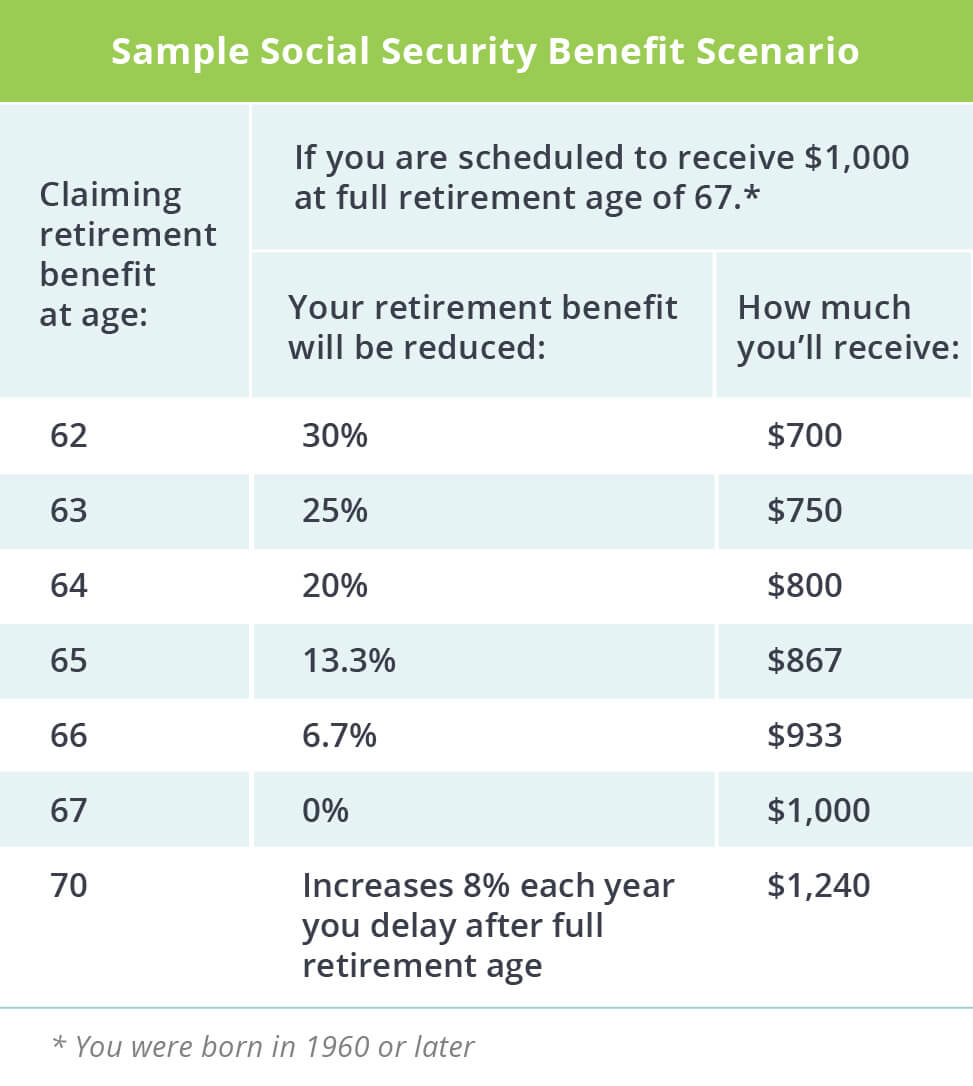

Social Security wont replace all of your pre-retirement income. On average, Social Security replaces 40 percent of a workers income. That means your retirement savings, pension, 401, or Individual Retirement Account will need to fill the gap. Claiming at your full Social Security benefit age or later can minimize this gap and maximize your monthly benefit. If you claim before your full retirement age, your monthly benefit could be reduced by as much as 30 percent.Learn more about saving for retirement.

You have an opportunity to continue growing your money.

If you can, get the highest monthly Social Security benefit possible by claiming at your full Social Security benefit age or later. If you claim before your full retirement age, your monthly benefit could be permanently reduced by as much as 30 percent. Also, take advantage of catch-up contributions to your 401 or Individual Retirement Account . Lastly, avoid losing your retirement savings to unnecessary tax penalties. If you withdraw your 401 or IRA savings before age 59½, you will likely face an early withdrawal penalty.Learn more about how retirement savings grow.

Its a perfect time to start saving.

Its never too late to start saving!

There are many ways to plan for a secure retirement outside of Social Security.

Its never too late to start saving!

A type of retirement savings account offered by employers to help their employees save for retirement.

Special Situation: Both People File Early

If your deceased spouse had filed for his/her own retirement benefit prior to his/her FRA and you file for your benefit as a survivor prior to your survivor FRA, then the math is a bit more complicated.

Specifically, your benefit as a survivor would be your deceased spouses PIA, but you must reduce that benefit as described above due to the fact that you filed early . Then, the resulting benefit is limited to the greater of:

- 82.5% of your deceased spouses PIA, or

- The amount your deceased spouse was receiving on the date of his/her death.

You May Like: Social Security Office Merrillville Indiana

Apply For Survivors Benefits

You should notify us immediately when a person dies. However, you cannot report a death or apply for survivors benefits online.

In most cases, the funeral home will report the persons death to us. You should give the funeral home the deceased persons Social Security number if you want them to make the report.

If you need to report a death or apply for benefits, call 1-800-772-1213 . You can speak to a Social Security representative between 8:00 a.m. 7:00 p.m. Monday through Friday. You can find the phone number for your local office by using our Social Security Office Locator and looking under Social Security Office Information. The toll-free Office number is your local office.

If you are not getting benefits

If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

If you are getting benefits

If you are getting benefits on your spouse’s or parent’s record:

- You generally will not need to file an application for survivors benefits.

- We’ll automatically change any monthly benefits you receive to survivors benefits after we receive the report of death.

- We may be able to pay the automatically.

If you are getting retirement or disability benefits on your own record:

- You will need to apply for the survivors benefits.

- We will check to see whether you can get a higher benefit as a widow or widower.

Who Qualifies For Social Security Spousal Benefits

If your spouse has filed for Social Security benefits, you can also collect benefits based on the spouse’s work record, if:

- You are at least 62 years old.

- Regardless of your age, if you care for a child who is entitled to receive benefits on your spouseâs record, and who is under age 16 or disabled.

When you apply for spousal benefits, you will also be applying for benefits based on your own work history. If you’re eligible for benefits based on your own earnings, and that benefit amount is higher than your spousal benefit, that’s what you’ll get. If it is lower, you’ll get the spousal benefit.

Don’t Miss: Social Security Office In Valdosta Ga

How Do Social Security Spousal Benefits Work

You’re eligible for spousal benefits if you’re married, divorced, or widowed, and your spouse is or was eligible for Social Security. Spouses and ex-spouses generally are eligible for up to half of the spouse’s entitlement. Widows and widowers can receive up to 100%.

You can claim benefits based on your own work history or on that of your spouse. You’ll automatically get the larger amount.

If you are no more than three months away from age 62, you can apply online or by phone. If you plan to put off applying to get the largest payment possible, wait until you’re no more than three months from full retirement age. That’s 66 or 67, depending on your year of birth.

Strategy For Late Claimers

If one partner has little or no earnings history, the best strategy is for the wage earner to postpone applying for Social Security retirement benefits until age 70 to get the highest amount possible. Full retirement age is 66 for most baby boomers and 67 for everyone born in 1960 or later, but by delaying claiming benefits until age 70, the wage-earner will accrue delayed retirement credits that will increase the monthly payments by 8% for each year of delay.

Keep in mind that this won’t affect the spousal benefit amount. Spousal benefits differ from personal benefits when it comes to delaying payments. If you delay claiming for personal retirement benefits past full retirement age, the benefit increases over time, as explained above. However, that will have no impact on your spouse’s benefits, since they max out at full retirement age . In other words, there is no benefit for your spouse in delaying the spousal benefit claim past your full retirement age.

On the other hand, if both partners work, and their earnings are more or less equal, their individual Social Security benefits will each be greater than the spousal benefit, so the best strategy for both is to postpone applying for benefits until age 70.

Recommended Reading: Social Security Office In Lumberton North Carolina

Your May Have To Pay Taxes On Social Security Benefits

Most people know that Social Security is funded by a tax on earnings, currently 6.2% for the employee . But some retirees dont realize that you may well have to pay income tax on Social Security benefits when it comes time to claim them. Benefits lost their tax-free status in 1984, and the income thresholds for triggering tax on benefits havent been increased since then.

It doesnt take a lot of income for your Social Security benefits to be taxed. Your benefits wont be taxed if your provisional income is less than $25,000 if youre single or $32,000 if youre married. If youre single and your provisional income is between $25,000 and $34,000, or married filing jointly with provisional income between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. If your provisional income is more than $34,000 on a single return or $44,000 on a joint return, up to 85% of your benefits may be taxable.

The Social Security Administration says about 40% of beneficiaries pay taxes on their benefits. Since the thresholds arent adjusted for inflation, the number of beneficiaries who pay taxes on Social Security benefits increases every year. The Social Security Trustees annual report estimates that taxes on Social Security will total $45.1 billion in 2022, up from $34.5 billion in 2021.

You may also have to paystateincome taxes on your Social Security benefits. See our list of the 12 States That Tax Social Security Benefits.

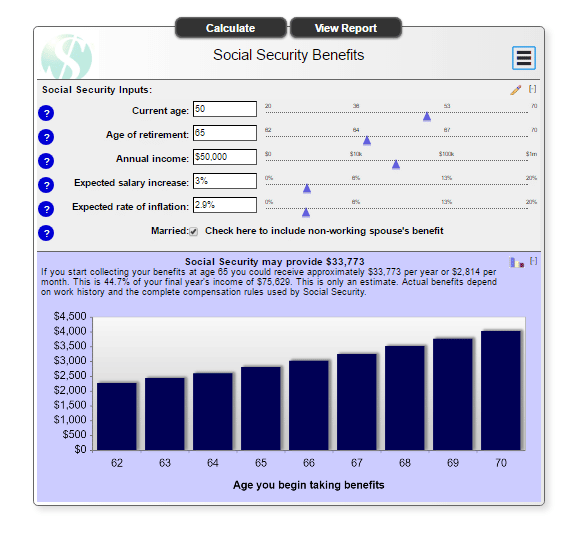

Social Security Benefit Calculator

Social Security benefits can be an important factor to consider in your future retirement income. Use this calculator to estimate what your retirement benefit amount could be.

An Ameriprise advisor can look at your overall financial picture and provide personalized advice to help you meet your retirement income goals.

Don’t Miss: Social Security Administration Wichita Kansas

A Few Other Situations:

- If you already receive benefits as a spouse, your benefit will automatically convert to survivors benefits after we receive the report of death.

- If you are also eligible for retirement benefits, but haven’t applied yet, you have an additional option. You can apply for retirement or survivors benefits now and switch to the other benefit later.

- For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

If you became entitled to retirement benefits less than 12 months ago, you may be able towithdraw your retirement application and apply for survivors benefits only. If you do that, you can reapply for the retirement benefits later when they will be higher.