Federal Income Tax Withholding Vs Social Security Wages

The list of payments to employees that aren’t included in FICA tax can be different from the types of payments that aren’t included in income tax calculations. Some payments may be exempt from federal income tax withholding but taxable as Social Security wages.

| Income Tax Withholding | FICA Tax Withholding |

| Wages paid by a parent to a child are taxed. | Wages paid by a parent to a child are not taxed if the child is younger than age 18, or age 21 for domestic workers. |

| Payments to statutory non-employees are taxable for income tax purposes. | Payments to statutory non-employees are not subject to the FICA tax. |

| It applies to all earnings. | Social Security is taxed only on the first $137,700 in earnings annually as of 2020 and $142,800 in 2021. |

The instructions for completing Form W-2 have a list of payments that must be included for federal income tax purposes. IRS Publication 15 also includes a detailed list of payments to employees and whether they’re subject to income tax or includable in Social Security wages.

What If My W2 Is Wrong

If you see that theres a mistake on your W2 form, you must report that immediately to your employer.

Sometimes, employers make mistakes when issuing your tax form W2.

To avoid getting into trouble for your taxes with the IRS, make sure your employer corrects the mistake and sends the IRS a revised version of your W2 tax form.

How Do You Calculate Social Security Tips

The calculation of social security tips is straightforward. First, make a note of the lowest of your total wages or for instance, $115,000. To compute your Social Security tax, multiply this number by 0.062 .

The Social Security tax rate for both employees and employers is 6.2% of employee compensation .

The Social Security tax rate for those who are self-employed is the full 12.4%.

Don’t Miss: Calculate Social Security Retirement Benefits

Box : Medicare Tax Withheld

Box 6 displays how much you withheld from an employees wages for Medicare tax. The employee share of Medicare tax is 1.45% of their wages.

The amount in Box 5 multiplied by the Medicare tax rate should equal Box 6. But if the employee earned above $200,000 , their tax liability should be greater.

If you paid an employee above $200,000 , you should have also withheld the additional Medicare tax rate of 0.9% from their wages above $200,000.

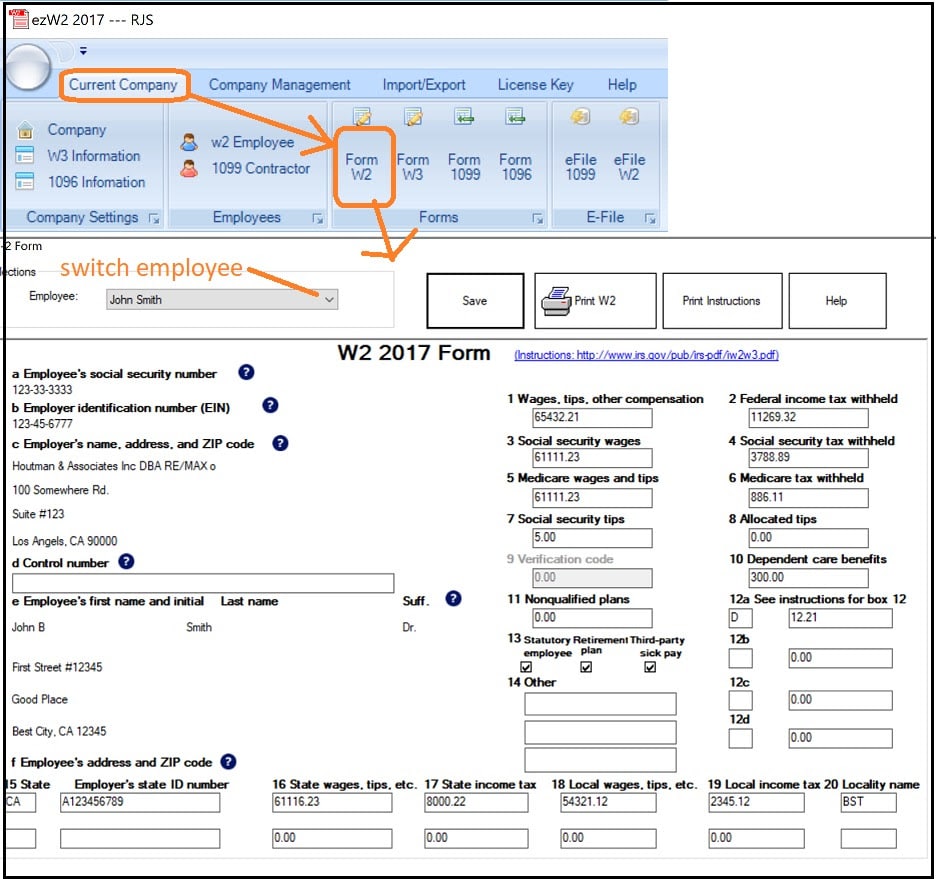

How To Fill Out Form W

You might have your Form W-2 responsibilities down to a science. Input employee information send copies to employees file the form with the SSA and state, city, or local tax department and repeat the following year.

Or, you just might spend hours gathering employee information and trying to decode the Wage and Tax Statement.

Whether you complete Forms W-2 on your own, use payroll software, or have a tax preparer, you should be semi-fluent in knowing how to fill out Form W-2.

As a generalization, Form W-2 boxes show identification, taxable wage, taxes withheld, and benefits information.

Boxes A-F are straightforward. They list identifying information about your business and employee. The numbered boxes, Boxes 1-20, can get a little more tricky.

If you want Form W-2 explained, dive into each boxs purpose below.

You May Like: Beaumont Tx Social Security Office

What Are The Employer’s Responsibilities Regarding Tips

The employers responsibilities regarding tips are to:

What Is The Difference Between W2 And W4 Forms

A W2 form is a tax document that your employer is obligated to issue reporting your total earnings and the total amount of taxes you paid during a given tax year.

On the other hand, a W4 form is a document that employees fill out initially when they are hired giving their employers essential information about themselves allowing employers to know how much taxes to withhold on the employees paycheck.

On the W4 form, youll confirm information like:

- Number of dependents

You May Like: Does Social Security Count As Income For Extra Help

Do Other Taxes Have A Wage Base

Social Security tax is the only federal tax employees pay with a wage base. Although Medicare also makes up FICA tax, it does not have a wage base. Instead, it has an additional tax once an employee earns a certain amount.

Keep in mind that some state taxes, like SUTA tax, and federal unemployment tax also have a wage base.

What Happens If An Employee Fails To Report Their Tips

According to the IRS, If an employee fails to report tips to his or her employer, the employer is not liable for the employer share of Social Security and Medicare taxes on the unreported tips until notice and demand for the taxes is made to the employer by the IRS.

Also, he employer is not liable to withhold and pay the employee share of Social Security and Medicare taxes on the unreported tips.

Don’t Miss: Does Pennsylvania Tax Social Security

Reporting Tips Allocated By Your Employer

If the total tips reported by all employees at a large food or beverage establishment are less than 8 percent of the gross receipts , then the employer must allocate the difference among the employees who receive tips. If your employer allocated tips to you, then the allocated tips are shown separately in Box 8 of your Form W-2. They are not included in Box 1 , Box 5 , or Box 7 of your Form W-2, Wage and Tax Statement.

Generally, you must report the tips allocated to you by your employer on your income tax return. Attach Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Return for Seniors, to report tips allocated by your employer . Other tips not reported to the employer must also be reported on Form 4137. However, you do not need to report tips allocated to you by your employer on your federal income tax return if you have adequate records to show that you received less tips in the year than the allocated amount.

Do Not Include Service Charges In Your Daily Tip Record

Charges added to a customer’s check, such as for large parties, by your employer and distributed to you should not be added to your daily tip record. These additional charges your employer adds to a customer’s bill do not constitute tips as they are service charges. These service charges are non-tip wages and are subject to social security tax, Medicare tax, and federal income tax withholding.

An employer’s or employee’s characterization of a payment as a “tip” is not determinative. Distributed service charges should be characterized as non-tip wages. Revenue Ruling 2012-18 reaffirms the factors which are used to determine whether payments constitute tips or service charges. Q& A 1 of Revenue Ruling 2012-18 provides that the absence of any of the following factors creates a doubt as to whether a payment is a tip and indicates that the payment may be a service charge:

- The payment must be made free from compulsion

- The customer must have the unrestricted right to determine the amount

- The payment should not be the subject of negotiation or dictated by employer policy and,

- Generally, the customer has the right to determine who receives the payment.

See example below.

Read Also: List Of Leaked Social Security Numbers

Employer Share Of Social Security And Medicare Taxes On Unreported Tips

If an employee fails to report tips to his or her employer, then the employer is not liable for the employer share of Social Security and Medicare taxes on the unreported tips until notice and demand for the taxes is made to the employer by the IRS. The employer is not liable to withhold and pay the employee share of Social Security and Medicare taxes on the unreported tips.

For more information on the Section 3121 Notice and Demand, see Revenue Ruling 2012-18, which sets forth additional guidance on Social Security and Medicare taxes on tips.

What Are Considered As Social Security Tips

Social security tips that need to be taxed include cash tips, tip charges on credit or debit cards, and non-monetary tips. Only cash, debit, or credit tips totalling more than $20 in a month must be recorded and taxes withheld.

In other words, tips worth more than $20 in a given month are taxed in the same manner as taxable wages, compensation, and other kinds of income are. As a result, tips are subject to the same payroll tax requirements as other employees, including Social Security, Medicare, and federal unemployment taxes.

You May Like: Social Security Office Ann Arbor

Box : Medicare Wages And Tips

The wages subject to Medicare tax are the same as those subject to social security tax in Box 3, except there is no wage base limit for Medicare tax.

Medicare wages are reduced for health insurance premiums, Commuter Benefits, DeCAP, and HCFSA contributions.

Medicare wages are not affected by deferred compensation or pension contributions.

What Is Social Security Tax

Social Security tax is a federal tax that pays for things like the Social Security benefits you get from the federal government when you retire, survivor benefits for your family if you die, disability benefits, etc.

If you, your children or your widow ever receive any kind of Social Security income, these taxes are probably what paid for it.

Both employees and employers have to pay into Social Security tax. Payroll taxes like Medicare and Social Security are usually grouped together as FICA . Itâs also referred to as âold age, survivors, and disability insurance taxâ , Social Security taxes pay into the United States Social Security Administrationâs Social Security programsâretirement benefits, disability benefits, dependent and survivor benefits, etc.

If youâre self-employed, youâll hear tax professionals refer to your Social Security and Medicare tax as âself-employment tax.â

You May Like: Lump Sum Social Security Payment

Determine Your Taxable Income

You can find the year to date totals on your most recent paycheck. For better accuracy, get this information from the last paycheck of the year. Also, make sure that youre not using the number for the most recent pay period. Youll want the total of all the wages that youve earned that year. This amount may need to be adjusted if you have any deductions that are excluded from taxable income.These types of deductions will include:

- Premiums for group life insurance

- Vision and dental insurance premiums

- Dependent care reimbursement accounts

You will subtract any of these items from your gross taxable wages. The number you come to should match the number you see in Box 1 on your W2 when you receive it. Youll take these same steps when figuring out your state taxable income. Should this information be incorrect, you may need to reach out to your companys payroll department for an explanation.

Calculate Medicare and Social Security Taxable Wages

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. However, there is a maximum amount of wages that is taxable for social security tax. For any wages earned during the year of 2017, this is capped at $127,200. Youll start by looking at your most recent pay stub. Look at the gross taxable income for the year to date.

- Insurance premiums

Tip Allocation In Large Food And Beverage Establishments

If, according to the IRS, you are a large food or beverage establishment, this means that as an employer you have the same general reporting obligations with regard to tips that other employers have and then some. Your employees must report tips received to you. You, in turn, report this information to the IRS.

What’s unique to large establishments is that if your employees don’t report total tips equal to at least 8 percent of your gross receipts for a payroll period, you must also allocate some extra tips to employees, so that this 8 percent floor is achieved. You do not pay any payroll taxes on these allocated tips they are reported to the IRS for information purposes only.

Gross receipts are all receipts from the provision of food or beverages, including cash sales, charged sales, and the retail value of any complimentary food or beverages served, but excluding tips and state or local taxes.

Example

Michael’s Pizza & Pasta has gross receipts of $20,000 for a payroll period. Employees report tips for that period totaling $1,000. The amount allocated to employees is therefore $600 .

What can you do if you feel that the percentage of gross receipts you must use to determine the tip allocations doesn’t accurately reflect the tips your employees are actually getting?

If convinced, the IRS can lower the percentage to as low as 2 percent. You can’t use a reduced percentage before receiving notice in writing from the IRS that the petition is approved.

You May Like: How Much Is Full Social Security

How To File W2 Form

Filing a W-2 Form is relatively simple.

Every year, by no later than , your employer must send you a copy of your W2 tax form.

At the same time, your employer sends the IRS a copy as well.

This means that your W2 form is filed directly by your employer.

When you receive your tax form W2, youll be able to complete your Form 1040 and file your personal income taxes.

You will need the information confirmed on your W2 to enter into your Form 1040 individual tax return.

In the past, most would complete their income tax returns manually.

Today, most people use tax preparation software allowing them to easily enter their information on their 1040 Form.

What Is Excluded From Medicare Wages On W2

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.Oct 31, 2018

You May Like: Social Security Administration Wichita Kansas

Also Check: What Is The Social Security Earnings Limit For 2022

Are Tips The Same As Service Charges

No, tips and service charges are not the same. We mentioned above that tips are additional payments that customers give freely and voluntarily. They are not required and the customer decides the amount of the tip and who they would like to give it to.

In contrast, service charges are charges that are added by the business to the customers bill. For example, a business may charge customers service charges for large parties or events, room service charges, delivery charges, and bottle service charges. Customers are required to pay service charges by the business. Service charges are considered non-tip wages.

What Are Social Security Wages

Social Security wages are an employees earnings that are subject to federal Social Security tax withholding . Employers must deduct this tax even if the employee doesnt expect to qualify for Social Security benefits.

Social Security wages include:

-

Hourly wages and salaried wages

-

Payments in-kind , unless the employee is a household or agricultural worker

-

Elective retirement contributions

Social Security wages have a maximum taxable income limit of $142,800 for the year 2021, which includes qualified employee wages and/or self-employment income. Be sure to check the maximum limit annually since it changes every year to adjust for inflation, improve the systems finances, and provide reasonable benefits for higher wage earners.

When an employee reaches the earnings limit, no more Social Security tax is withheld for the year. At 2021 rates, $142,800 would require $8,853.60 to be withheld for Social Security taxes.

Also Check: Social Security Administration Louisville Kentucky

Do These Wages Affect The Self

Self-employed individuals must pay both halves of Social Security and Medicare taxes. They can’t share them with their employers because they’re effectively their own employers.

These taxes are called self-employment taxes when applied to independent contractors, sole proprietors, and other self-employed individuals. They’re based on the net income of a business. The types of income that are included in Social Security wages are not relevant to self-employment taxes.

Which Tax Forms Do I Need To File

Employers must submit IRS Form 941, the Employerâs Quarterly Federal Tax Return, to report both the employee and employersâ portion of Social Security and Medicare. You should submit Form 941 quarterly to report these taxes.

Youâll also have to fill out a W-2, which is a combined wage and tax statement that you have to provide to each of your employees once a year to show how much FICA taxes were withheld that year.

Also Check: Social Security Office Des Moines Ia

Box : Dependent Care Benefits

These are the contributions to Dependent Care Assistance Program made through payroll deductions.

Contributions to DeCAP are not subject to federal, social security, and Medicare taxes. The amounts in Box 1 for taxable wages and Boxes 3 and 5 for social security and Medicare wages are reduced by the amount of the contribution.

Box : Wages Tips Other Compensation

These are your taxable wages during the year. You need it for filing federal and New York State tax returns.

The taxable wages consist of the gross wages and other compensation paid to you during the year, including the following taxable fringe benefits:

- Union Legal Service Benefit

- Commuter Benefits Administrative Fringe Fee

- Domestic Partner Health Insurance Premiums

- Health and Fitness Reimbursement

- Wellness Program

Your taxable wages are reduced by contributions to deferred compensation and/or tax deferred annuity accounts, pension plan, Commuter Benefits, and other programs that are not subject to federal taxes. These amounts are shown in Boxes 12 and 14.

The above listed taxable fringe benefits are shown in Box 14.

Recommended Reading: Social Security Office Port Arthur Texas