Are You Supposed To Include Medicare And Social Security Tax Withholdings On Line 13 Of 1040

We are married filing jointly. For 2018 I am a W2 employee and my wife is now a 1099 contract employee. I am trying to figure our estimated tax payments for 2018. On line 13 of 1040-ES it asks for “Income tax withheld and estimated to be withheld during 2018”. Since I am a W2 employee my employer withholds federal income tax, medicare tax, and social security tax. I am unsure whether to include all three of these withholdings or just the federal income tax portion.

Capital Gains Tax Rates

Long-term capital gains result from the sale of property you’ve held for more than one year, such as a stock portfolio, while short-term capital gains result from assets you’ve owned for one year or less and are taxed as ordinary income.

Long-term capital gains have their own tax brackets to determine how they are taxed. These income spans apply to your overall income, including both capital gains and ordinary income.

The long-term capital gains tax rates for single filers for the 2022 tax year are:

| Income Range |

| $517,201 or more | 20% |

Capital gains resulting from certain investments are also subject to the net investment income tax at a rate of 3.8%. This tax may apply if filers have net investment income and a modified adjusted gross income over the following threshold amounts, according to their filing status.

- : $250,000 or more

- Single or head of household: $200,000 or more

- : $125,000 or more

Do You Have To Pay Taxes On Unemployment Benefits

Federal income tax: yes. For purposes of calculating your federal income tax liability, unemployment benefits are treated as taxable income.

What kind of taxes do you pay on your paycheck?

Payroll taxes are amounts of pay withheld from an employees paycheck during the payroll process, and employers must usually match these amounts. Payroll taxes contributed a major part of the U.S. federal budget, particularly for social insurance programs. Some payroll taxes are also known as FICA taxes .

Don’t Miss: What Is The Difference Between Social Security And Ssi

What Is Ordinary Income

Ordinary income represents most of your household’s taxable income from sources such as wages, self-employment income, pensions, Social Security benefits, rents, royalties, and interest. Other forms of household income, such as capital gains, qualified dividends, and capital gains from collectibles, are not considered to be ordinary income instead, they are taxed at different rates.

Social Security Tax Rates

Another tax that probably applies to your income is the Social Security tax. TheSocial Security tax rate is 12.4% on wages up to the Social Security wage base, which is $147,000 in 2022. Anything above the wage base amount is not subject to Social Security tax.

The maximum Social Security tax paid by employees is $9,114 for the tax year 2022, or 6.2% of $147,000. Self-employed filers pay the full 12.4%, for a maximum of $18,228 for tax year 2022.

This wage base isadjusted annually to keep up with inflation. For the 2023 tax year, the wage base for the Social Security tax is $160,200.

You May Like: Social Security Office Elkhart Indiana

Is Fica Included In Federal Income Tax

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

To calculate the federal income tax, the employer will use the information provided in Form W-4 along with the taxable income and how frequently youre paid. If youre paid for overtime or receive a bonus, your federal income tax withholding will increase.

To calculate the FICA tax withholding, the employer must set apart a set amount from the gross wages, which includes 6.2% for Social Security and 1.45% for Medicare. If you earn more than $200,000, an additional Medicare tax of .09% is applied to the excess.

Based on the size of your total employee payroll, you must make payments to the IRS semi-weekly or monthly. Also, at the end of each quarter, you must report the payroll taxes using Form 941. Failure to pay payroll taxes leads to penalties and fines.

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Read Also: Social Security Springfield Mo Office

How Do You Calculate Income Tax On Social Security

Step 1: Calculate Your Monthly EarningsList Each Years Earnings. Your earnings history is shown on your Social Security statement,which you can now obtain online. Adjust for Inflation. Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation.Average the Highest 35 Years.

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Don’t Miss: Social Security Office Alexander City Al

Contribution And Benefit Base

The Social Security Contribution and Benefit Base will be $132,900 in 2019, so the maximum amount of Social Security taxes due was slightly lower. However, the rules are still the same: once you reach the maximum amount of Social Security taxes withheld for the year, your employer will stop withholding it. But, if you have multiple employers, they dont know what other income you have, so you can claim the excess withholding as a tax refund.

References

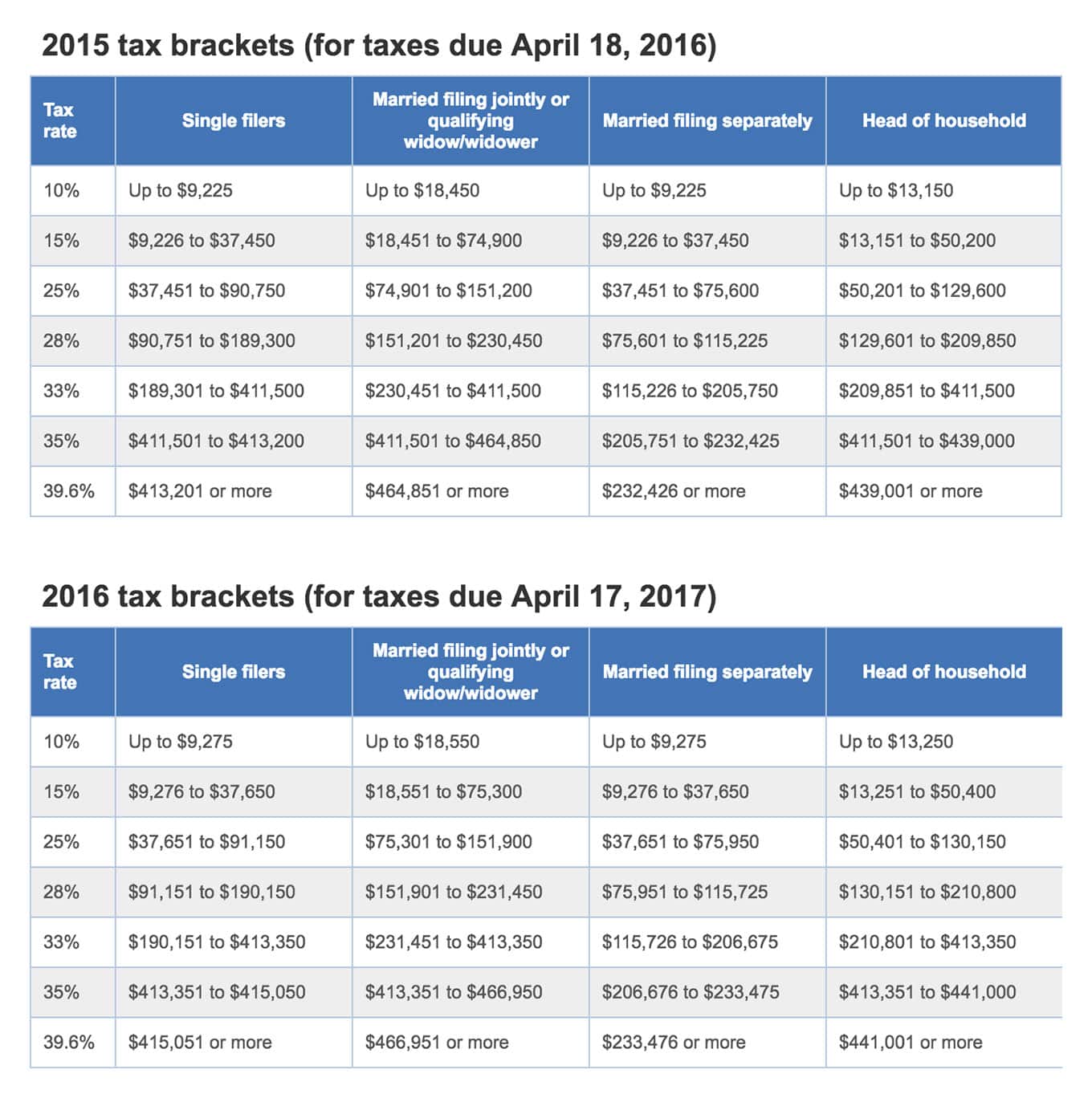

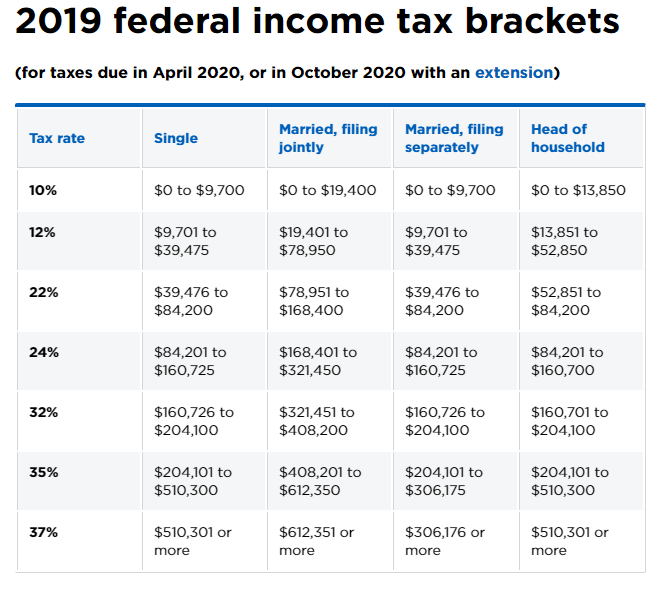

Understanding Income Tax Brackets

Tax brackets show you the tax rate you will pay on each portion of your income. For example, if you are single, the lowest tax rate of 10% is applied to the first $10,275 of your income in 2022. The next chunk of your income is then taxed at 12%, and so on, up to the top of your taxable income.

The progressive tax system ensures that all taxpayers pay the same rates on the same levels of taxable income. The overall effect is that people with higher incomes pay higher taxes.

Also Check: Social Security Office In Flint Michigan

Medicare Tax And Why You Pay It

Summary:

Once you become eligible for Medicare, the tax is automatically deducted from your paycheck on a monthly basis. Over each calendar year, you will see this as a tax on your earnings, including wages, tips, certain Railroad Retirement Tax Act benefits, and self-employment earnings that fall above a certain level. There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Fica Tax: Wage Base Limits

A wage base limit applies to employees who pay Social Security taxes. This means that gross income above a certain threshold is exempt from this tax. The wage limit changes almost every year based on inflation. In 2021, it was $142,800. For 2022, the limit rose to $147,000. This income ceiling is also the maximum amount of money thats considered when calculating the size of Social Security benefits.

Medicare taxes, on the other hand, dont have a wage limit. But theres an Additional Medicare Tax that high-income individuals must pay. That has been the case since January 1, 2013.

The Additional Medicare Tax rate is 0.90% and it applies to employees wages, salaries and tips. So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% . That income ceiling for 2021 and 2022 is $200,000 for single filers, qualifying widows and anyone with the head of household filing status, $250,000 for married couples filing joint tax returns and $125,000 for couples filing separate tax returns. You can calculate how much you owe using Form 8959.

Don’t Miss: Social Security Office In Springfield Missouri

Can You Opt Out Of Medicare Tax

While regular taxpayers may not opt out, there are certain religious groups which may qualify and be exempt from paying Social Security taxes. The qualifications for this are:

- Waive rights to all Social Security benefits including hospital care

- Be a member of a recognized religious sect that opposes accepting benefits under a private plan that makes payments in the event of death or disability and makes payments for medical costs

- Member of a religious sect that makes a reasonable provision of food, shelter, medical care for its dependents since December 31, 1950

- Never received or entitled to payable Social Security benefits

Those members who would like to apply for Social Security exemptions can do so with a FORM 4029 and file the request with the Social Security Administration. From there, the IRS will notify you if you have qualified.

How Do Employers Calculate Payroll Tax

Payroll taxes are calculated by multiplying an employees gross taxable wages against the applicable payroll tax rate. For example, if the gross taxable income for a particular pay period was $1,250, then the Medicare deduction would be 1,250 x 1.45% = $18.13 and the Social Security deduction would be 1,250 x 6.2% = $77.50. Payroll tax calculations like these are usually simpler than those for income tax because the rates are flat and withholding certificates arent necessary.

You May Like: Is Social Security Taxable In Nc

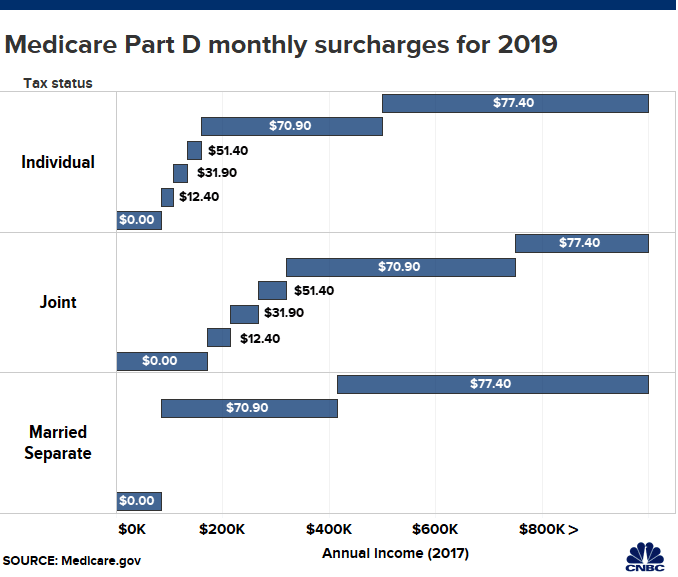

How Do I Pay The Medicare Irmaa Surcharge

You wont pay the IRMAA directly to your insurance company if you have Medicare Advantage or Medicare Part D.

You do not need to take action if you owe IRMAA if you receive Social Security benefits and have your Medicare Part B and Part D premiums deducted from your Social Security payment. A deduction will be made from your Social Security benefit for the IRMAA.

If you dont have any Medicare premiums deducted from your Social Security payment, youll receive a separate bill for your Part B and Part D IRMAAs.

Medicare Part D Irmaa

For the Part D prescription drug benefit, there is no specified premium amount. Each insurance company determines its own premium. The additional charge from the IRMAA is added to the insurance companys premium .

Medicare recipients with 2021 incomes exceeding $97,000 or $194,000 will pay an additional Part D premium between $12.20 and $76.40.

Income thresholds generally change annually in response to the CPI-U

Recommended Reading: Social Security Office Traverse City Mi

Busting A Tax Bracket Myth

Some people think that if their income increases and they are bumped into a higher tax bracket, they will pay taxes at a higher rate on all of their income. With this reasoning, tax filers believe they may have less money left over than they would if they had earned less.

Using the examples above, you can see thats not true.

Each dollar you earn only affects the federal income tax rate and taxes owed on additional income. It does not change the rate applied to dollars in lower tax brackets.

Unless you are in the lowest bracket, you are actually in two or more brackets. If you are in the 24 percent tax bracket, for example, you pay taxes at four different rates 10 percent, 12 percent, 22 percent, and 24 percent.

Based on the tax brackets, you always have more money after taxes when you earn more income. But, of course, rates are not the only factor in your final tax bill. You can lose tax benefits that phase out at higher income levels, such as tax credits for higher education. In some tax scenarios, it might make sense to avoid higher tax brackets if possible.

It pays to use tax software like TaxAct® as a planning tool to see how different levels of income affect your tax benefits and final tax bill.

What Are The Limits Of Social Security Tax

Key TakeawaysSocial Security tax is paid as a percentage of net earnings and has an annual limit.In 2022,the Social Security tax limit increased significantly,to $147,000. The amount of the benefits received by individuals and couples rose to 5.9%.The largest social security tax increase was in 2021 but 2022 is high as well.More items

Recommended Reading: Social Security Akron Ohio Office

Do Tax Brackets Include Social Security

Yes, a portion of your Social Security benefits may be subject to federal taxation using tax brackets. Your tax bracket is determined by your net taxable income, as shown on Form 1040. This value is your gross income minus all allowable deductions. For social security income that is combined with your other income, you may be subject to income tax on up to 85% of your SS benefits.

Fica Taxes: The Basics

Every payday, a portion of your check is withheld by your employer. That money goes to the government in the form of payroll taxes. There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes.

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare. If you own a business, youre responsible for paying Social Security and Medicare taxes, too. Self-employed workers are referred to as SECA taxes based on regulations included in the Self-Employed Contributions Act.

Recommended Reading: Social Security Office St Charles

How Much Is Fica Tax

The Federal Insurance Contributions Act imposes a Social Security withholding tax equal to 6.20% of the gross wage amount, up to but not exceeding the Social Security Wage Base . The same 6.20% tax is imposed on employers. For each calendar year for which the worker is assessed the FICA contribution, the SSA credits those wages as that years covered wages. The income cutoff is adjusted yearly for inflation and other factors.

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

Don’t Miss: How Much Is Social Security For Disabled Veterans

What Is Social Security

Social Security is a federal program that pays monthly benefits to retirees, surviving spouses and children, and disabled people. About 65 million Americans collect Social Security monthly.

The money for Social Security, as well as Medicare, comes from a tax that every working American pays. It’s a 7.65% tax on every paycheck that is matched by employers. Self-employed people cover both the employee and employer portions. That tax is levied on the first $147,000 of a worker’s income in the 2022 tax year.

So, while workers pay a tax to fund the Social Security program, other people are benefiting by collecting a monthly check. Those benefit checks are then often taxed as income, returning a portion of the money to the federal government.

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

Read Also: Social Security Calculator For Early Retirement