Benefits For Your Spouse Or Common

Allowance

If you are eligible to receive the Guaranteed Income Supplement, your spouse or common-law partner may be able to receive the Allowance if your spouse or common-law partner:

- is 60 to 64 years of age

- is a Canadian citizen or a legal resident

- resides in Canada and has resided in Canada for at least 10 years since the age of 18

Recommended Reading: What Is The Free Medicare Benefits Review

The Importance Of Paying Your Taxes

When you pay taxes on your earnings, you can supplement Social Security and Medicare benefits for people who are currently receiving them. In order to receive benefits, you do not have to keep your taxes in a personal account. Today, the majority of workers help with the cost of current retirees and other beneficiaries benefits. The Social Security trust funds are used to help you and your family stay safe today and tomorrow.

Are There Ways To Avoid Social Security Tax

Not everyone has to pay the Social Security tax. If you are a nonresident alien, either as a student or an employee of a foreign government, then you wont have to worry about paying. Furthermore, if you are part of a religious group that opposes the receipt of Social Security benefits, then you wont have to pay either.

However, these are all rare circumstances. Plus, these people wont receive Social Security benefits in retirement. If you want to avoid paying the Social Security tax but still receive benefits when you retire, you should know that the amount youve paid into the system determines your benefits to some degree.

Don’t Miss: Social Security Office Toms River Nj

You Social Security Tax Is Calculated As A Flat Rate Up To A Certain Amount Of Income

Social Security taxes are calculated in a different manner than federal and state income taxes. In some ways, the process is much less complicated — for example, there are no Social Security tax “brackets” — just one rate. However, Social Security tax does not apply to all types of income, and is calculated differently for self-employed individuals. With that in mind, here’s how you can calculate your Social Security taxes and what to do if you paid too much.

How Much Is Social Security Taxed At Full Retirement Age

Even if you work past full retirement age, you still have to make applicable Social Security contributions on your income however, if you work past full retirement age, you can also increase the amount of Social Security benefits you receive.

Once you start receiving Social Security benefits, your income will determine if you pay income tax on part of your Social Security income.

Don’t Miss: Social Security Attorneys In My Area

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 at any time. Just , fill it out and give it to your human resources or payroll team.

Calculating Taxes On Social Security Benefits

Many people are surprised to learn that Social Security benefits can be taxed. After all, why is the government sending you a payment one day and asking for some of it back the next? But if you take a closer look at how the federal tax on Social Security is calculated, you’ll see that many people actually don’t pay any tax on their Social Security benefits.

There’s no federal income tax on Social Security benefits for most people who only have income from Social Security. Thanks to the highest cost-of-living adjustment in 40 years, the average monthly Social Security check for a retired worker in 2022 is $1,658, which comes to $19,896 per year. That’s well below the minimum amount for taxability at the federal level.

On the other hand, if you do have other taxable income such as from a job, a pension or a traditional IRA then there’s a much better chance that Uncle Sam will take a 50% or 85% bite out of your Social Security check. Plus, depending on where you live, your state might tax a portion of your Social Security benefits, too.

payments sent by the Social Security Administration are not taxable.)

Also Check: Social Security Office Corsicana Tx

What Is Withholding Tax How Does A Withholding Tax Work

A withholding tax is an income tax that a payer remits on a payee’s behalf . The payer deducts, or withholds, the tax from the payee’s income.

Here’s a breakdown of the taxes that might come out of your paycheck.

-

Social Security tax: 6.2%. Frequently labeled as OASDI , this tax typically is withheld on the first $147,000 in 2022. Paying this tax is how you earn credits for Social Security benefits later.

» MORE:See what the maximum monthly Social Security benefit is this year

-

Medicare tax: 1.45%. Sometimes referred to as the hospital insurance tax, this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

-

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4.

-

State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf. The amount depends on where you work, where you live and other factors, such as your W-4 .

-

Local income or wage tax: Your city or county may also have an income tax. This money might go toward such expenses as the bus system or emergency services.

|

Employer pays |

How To Calculate It

To calculate how much Social Security tax you need to withhold from an individual employeesâ paycheck, multiply your employeeâs gross income for the current pay period by 6.2%, which is the current Social Security tax rate.

For example, letâs say an employeeâs gross pay for the current month is $2,000. To calculate Social Security tax withholding for that month, youâd make the following calculation:

$2,000 x 0.062 = $124

In this case, you would withhold $124 from the employeeâs paycheck, and contribute another $124 to their Social Security yourself.

Now letâs say your employee makes more than the $160,200 wage base for the year. They make $180,000 a year. How much Social Security tax will you need to withhold from their paycheck each month?

Youâre only required to withhold 6.2% of their pay on the first $160,200 they make, or the first $13,350 they make every month. Donât withhold for any salary above that maximum amount.

That means their monthly Social Security withholding would be:

$13,350 x 0.062 = $827.70

Recommended Reading: Social Security Office In Tuscaloosa Alabama

Reporting Fica Tax Withholding

Employers handle FICA tax reporting. Employers must report FICA tax withholding:

- To the employee on each paycheck, including both the withholding amount for the current pay and total amount of FICA tax withheld for the year to date

- To the IRS on Form 941- the Employer’s Quarterly Wage and Tax Report

- On the employee’s W-2 form at the end of the year

Some employees may want to claim an exemption from federal income tax withholding. This exemption has nothing to do with FICA taxes you must still withhold FICA tax from each paycheck for all employees.

How Much Of Your Income Is Subject To Social Security Taxes

Here’s where it gets a little trickier — not all income is subject to Social Security tax.

For 2017, Social Security tax is only applied to the first $127,200 of income per person, and this limit applies to both employees and self-employed individuals. Note that this is a per-person limit, not per job. If you earn $120,000 from your primary job and an additional $20,000 from a side job, only $7,200 of the side job income will be subject to Social Security taxes.

Furthermore, only “earned” income is considered. Dividend income, for example, is not subject to Social Security tax, and the same goes for other passive sources of income. The only types of income subject to Social Security tax are wages, salaries, tips, bonuses, and self-employment income that results from a business you actively participate in.

Read Also: How To Pay Into Social Security

How Beneficiaries Taxes May Increase In 2023

Increases in Social Security income next year may not give beneficiaries the ability to ramp up their retirement withdrawals without facing tax consequences, according to Joe Elsasser, a CFP and founder and president of Covisum, a provider of Social Security claiming software.

For example, with a roughly 7% increase in tax brackets, beneficiaries may think they can take 7% more from their individual retirement account next year and have the same tax results.

Thats not the case, because of a larger amount of Social Security becoming taxable, Elsasser said.

However, there may be room for some beneficiaries to increase their retirement withdrawals while still not incurring a tax liability on their benefits, according to Elsasser.

For example, a married couple who are both over 65 with $35,000 in Social Security benefits this year may take $23,967 in withdrawals in 2022 and pay no federal income tax, according to Elsassers calculations.

Dont wait to see your CPA by April 15 its too late.Brian Vosbergpresident of Vosberg Wealth

In 2023, that couples Social Security benefit would increase to $38,045 with the COLA, and the amount they would withdraw may go up to $24,793, Elsasser said.

If the couples Social Security benefits instead were $60,000, then they could withdraw $18,703 with no tax, which in 2023 would go up to $65,220 in benefits and slightly less $18,585 in possible withdrawals.

You May Like: What Are Medicare Part C Benefits

Average Social Security Check By Type

While most people think of Social Security as a program just for retirees, it serves many other groups, including the disabled, spouses and minor children of retirees as well as the spouses and minor children of deceased workers. The amount that each group receives differs substantially.

In fact, the average retired worker receives $1,676.53 each month about 8 percent more than Social Security recipients as a whole. Heres how the figures break down by recipient, as of October 2022.

| Type of beneficiary |

|---|

Don’t Miss: Social Security Office On Terry Parkway

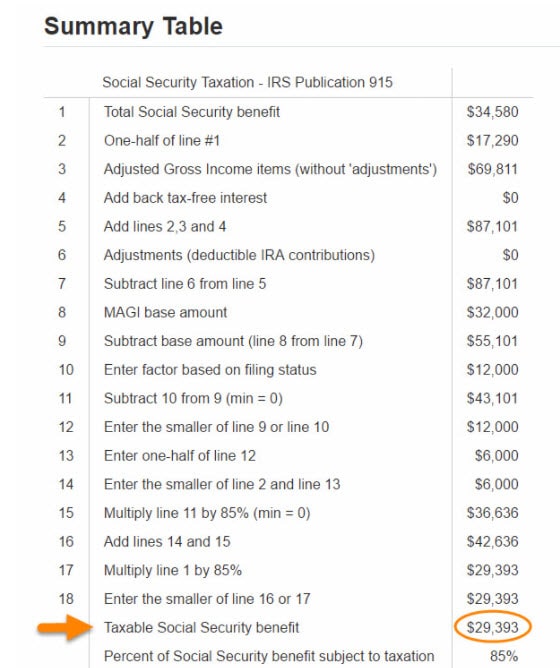

Calculator: How Much Of My Social Security Benefits Is Taxable

September 15, 2022Keywords: calculator, retirement, Social Security, tax planning

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises, but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free.

The Maximum Social Security Benefit In : How To Get It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

The maximum Social Security benefit in 2022 is $4,194 per month if retiring at age 70. The max Social Security benefit per month is $3,345 at full retirement at age $2,364 for retirement at age 62.

Recommended Reading: Social Security Administration Wichita Kansas

How To Maximize Your Social Security

Social Securitys formula makes qualifying for the maximum benefit tough. Not only will you need to have a 35-year work history, youll also need to have earned income at or above the annual taxable limit in all of those years. Thats no easy feat given the average American worker is earning about $51,000 per year, yet the maximum taxable limit for Social Security is $142,800 in 2021.

Nevertheless, there are strategies you can use to make sure you get the biggest benefit possible even if you dont qualify for the maximum Social Security amount.

For example, working at least 35 years eliminates zeros in your average monthly income calculation and delaying retirement may allow you to replace lower income earning years from the beginning of your career with higher earning years later in life, boosting your benefit, too.

You can also wait until age 70 to start receiving benefits to capture increases associated with delayed retirement credits. The difference between claiming benefits at age 62 and age 70 is substantial. For example, if your full retirement age is 67 and your full retirement benefit is $1,000, then youd only receive 70% of your full retirement age benefit, or $700 per month, if you claim at age 62. However, if you wait to claim until age 70, youd receive 124% of your full retirement benefit amount, or $1,240 per month. Thats 77% more money than youd collect at age 62.

How Much Do You Need To Make To Earn One Social Security Credit

Most people need 40 credits to qualify for Social Security retirement benefits. Workers can earn up to four credits per year.

In 2022, the amount needed to earn one credit is $1,510.

You can work all year to earn four credits .

Additionally, you can choose to earn enough for all four in a much shorter lengthof time.

Also, if you earn four credits a year, then you will earn 40 credits after 10 years of work.

Recommended Reading: Social Security Office In Denver

The High Cost Of Medicare Part B And Part D

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage.

Part B has a standard premium amount that most people pay each month. That amount changes from year to year, but its generally consistent for most Medicare enrollees.

However, the premiums for Part B and Part D can vary between individuals based on their income level.

If your income is above a specific limit, the federal government adds an extra charge to your monthly premium. This charge is known as the Income-Related Monthly Adjustment Amount . Think of IRMAA as a surcharge or a Medicare surtax, as some refer to it.

To determine IRMAA, Social Security looks at the modified adjusted gross income amount reported on your IRS tax return from 2 years ago to determine whether youll pay IRMAA. This charge may be applied to your Part B and Part D monthly premiums.

The following chart shows how Medicare calculates IRMAA based on income level:

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves. Part D monthly premiums can vary a great deal from one health insurance company to another.

To determine how much Part D plans may cost in your area, visit Medicare.gov to get the latest monthly premium costs for Part D plans. If youre a high-income earner, your Part D IRMAA charge is added to the premiums youll see quoted on Medicare.gov.

A Formula For Determining Taxable Social Security

Many people and financial planning software programs assume that singles with over $34,000 of income or married couples with over $44,000 of income will have 85% of their Social Security benefit taxed, but that isnt always the case. You can use the worksheet in IRS Publication 915, fill out a 1040, or use this formula to calculate the taxable portion of Social Security benefits.

Step 1: Determine Provisional Income

Step 2: Subtract the first threshold and multiply by .5.

Step 3: Subtract the second threshold and multiply by .35.

Step 4:Add them up.

Step 5: Calculate and apply the maximum.

Example

These clients are married, filing jointly, and have $75,000 of total income. None of it is tax-free . The IRA withdrawals alone are well over the second threshold.

|

Step 1: |

Also Check: Can You Get Credit Card Without Social Security Number

Tips For Saving For Retirement

- If youre feeling overwhelmed by the age and eligibility requirements for Social Security benefits, our Social Security calculator may help. After you fill in your info, well tell you what you can expect in annual benefits once you retire.

- In any retirement conversation, its important to be mindful of the retirement tax laws in the state you live in. Taking your states laws into account can make a significant difference as you plan for retirement.

- If you already have some money to spare, you could grow it with the help of a financial advisor. SmartAssets Free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.