Will You Work On A Part

Many people today are choosing to earn money as a freelancer or contractor in order to supplement their retirement savings. If you work part time and elect to start receiving Social Security benefits before you reach the full retirement age which is between 66 and 67 years old, depending on your birth year your Social Security benefit amount may be reduced based on your earnings.

If you will:

- Be under full retirement age for all of 2022, you are considered retired in any month that your earnings are $1,580 or less and you did not perform substantial services in self-employment.

- Reach full retirement age in 2022, you are considered retired in any month that your earnings are $4,210 or less and you did not perform substantial services in self-employment.

If youre retiring before reaching FRA but expect to earn more than $1,580 a month in income, and you will reach FRA sometime during the year you plan to retire, you should probably wait until after your birthday to retire and claim Social Security retirement benefits.

When Is The Best Time For You To Claim Social Security

Without a crystal ball, it may be impossible to know the exact optimal day to claim Social Security benefits. That being said, there are some common things to consider. If you are not in good health, claiming earlier might make sense. On the flip side, if your grandmother is still kicking, you are likely going to want to wait as long as possible to begin claiming Social Security benefits.

For the vast majority of retirees, delaying Social Security benefits as long as possible will generate more income throughout your lifetime. That is even more true for married couples. Not to make things more complicated, but Social Security maximization planning is even more valuable for married couples. The odds of at least one half of a married couple living a long time is substantial. For a married couple retiring at 65, there is a 50% chance that one will live to 92, and a 25% chance that one will make it to 97. Longevity is great, but it does subject retirees to more risk of inflation and depletion of other assets.

Other retirement income and assets should also be considered. If you have a large pension, or enough retirement assets to cover your standard of living throughout retirement, your Social Security choices are not quite as important. I doubt Warren Buffet spent much time thinking about when to claim Social Security. Actually, I take that back. He is frugal , and my guess is that he made a wise choice about when to claim Social Security.

What If I Delay Taking My Benefits

If you retire sometime between your full retirement age and age 70, you typically earn a “delayed retirement” credit for your own benefits . For example, say you were born in 1960, and your full retirement age is 67. If you start your benefits at age 69, you would receive a credit of 8% per year multiplied by two . This means your benefit would be 16% higher than the amount you would have received at age 67.

Also Check: Cleveland County Social Security Office

When A Spouse Dies

When one spouse dies, the surviving spouse is entitled to receive the higher of their own benefit or their deceased spouses benefit. Thats why financial planners often advise the higher-earning spouse to delay claiming. If the higher-earning spouse dies first, then the surviving, lower-earning spouse will receive a larger Social Security check for life.

When the surviving spouse hasnt reached their FRA, they will be entitled to prorated amounts starting at age 60. Once at their FRA, the surviving spouse is entitled to 100% of the deceased spouses benefit or their own benefit, whichever is higher.

How Long Will You Live

Of course, no one knows for certain how long they will live. The Social Security Administration has a rather sobering life expectancy calculator that shows at what age a person born on your birthday can expect to die, on average. Its based on your birthdate and doesnt factor in health, genetics, or lifestyle. If you expect to live only to age 75, for example, you might be inclined to take your Social Security benefit early so that you could enjoy it for a longer time. But if you live until age 90, taking Social Security retirement benefits early could cost you a lot of money. Heres how your lifetime benefit would be impacted by filing at different ages if your full retirement benefit is $1,000 a month:

At age 62, you would receive a total of $235,000 over your lifespan.

At age 65, you would receive $260,100.

At 67 that jumps to $276,000.

If you wait until age 70 it is $312,000.

So, if you expect to live a long life, waiting a few years to file could make a big difference in your total benefit.

Recommended Reading: $5 000 Social Security Loan

Do You Plan To Continue Working In Your 60s

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

You can maximize your benefits even if you work fewer hours or stop working.

You can maximize your benefits even if you work fewer hours or stop working.

Consider working in your 60s for an extra boost to your income and savings.

Consider working extra years in your 60s for an extra boost to your income and savings

Other Pensions Might Reduce Your Social Security Benefits

Your benefits will be affected if you have a pension from a job that didnt have Social Security taxes taken out of your paycheck. Common examples include people who worked for a public education system, railroad workers and Federal government employees hired before 1984 who are covered by the Civil Service Retirement System .

Two complicated provisions will affect your claiming strategy: the Windfall Elimination Provision and the Government Pension Offset . The WEP reduces your own benefits by a discounted factor based on how many years you worked in jobs that did not withhold Social Security taxes. The GPO reduces your spousal and survivor benefits by two-thirds of the amount of your noncovered pension.

Also Check: Social Security Office Natchez Ms

Will Social Security Be There When You Retire

Some people dont want to delay their benefit because they fear Social Security will run out of money.

The reports of Social Security running out of money, have often been exaggerated. The situation is not as bad as it seems, and Social Security will most likely be there when you retire. At worst, it may pay 78% of benefits.

Social Security releases a report each year on the trust fund called the OASDI Trustees Report. The most recent projections are that the trust fund will be depleted between 2031 and 2034 . The trust fund is declining because theres more money paying benefits than there is paying Social Security taxes.

But its important to remember that Social Security was built to be a pay as you go program, it wasnt meant to build up a trust fund.

The baby boomer generation was bigger than previous generations, and so when they entered the workforce there were more people paying into Social Security than people receiving benefits. This created a surplus. The government took that surplus and bought bonds with it which became the trust fund. Now that boomers are retiring, the situation is in reverse. There are more people receiving benefits than paying in, so the trust fund is getting drawn down.

Still, there are about ten years before the fund is projected to run out. That gives congress plenty of time to make adjustmentsand knowing our governmentwe can assume theyll use as much time as they can.

How Are Social Security Benefits Calculated

Knowing how your benefit is calculated is important for understanding what the best age is to apply for your benefit.

Once you understand how your benefit works, you can understand if working longer will increase your benefit or not. This also lays the foundation for understanding how different ages affect the benefit you receive.

Your benefit is based on your income history, and there are three steps:

Heres the process in more detail:

Your Social Security benefit in retirement is based on your highest thirty-five years of earnings.

First, they adjust each year for inflation and bring it into todays dollars. For example, if you made $25,000 in 1990, thats about $50,000 today. They do that for each year, and then they take the thirty-five highest years and average them. If youve worked less than thirty-five years, there will be some zeros in your calculation.

This means that each additional year of working can raise your benefit quite a bit.

Also, if you made less when you were younger, but now youre making much more, in this case, additional working years can raise your benefit as well. Its important to check on your earnings history from time to time, because there can be mistakes on the report. You have three years and three months to correct a mistake before its permanent.

The government will replace:

You May Like: Social Security Office In Eugene Oregon

A Guide On Taking Social Security

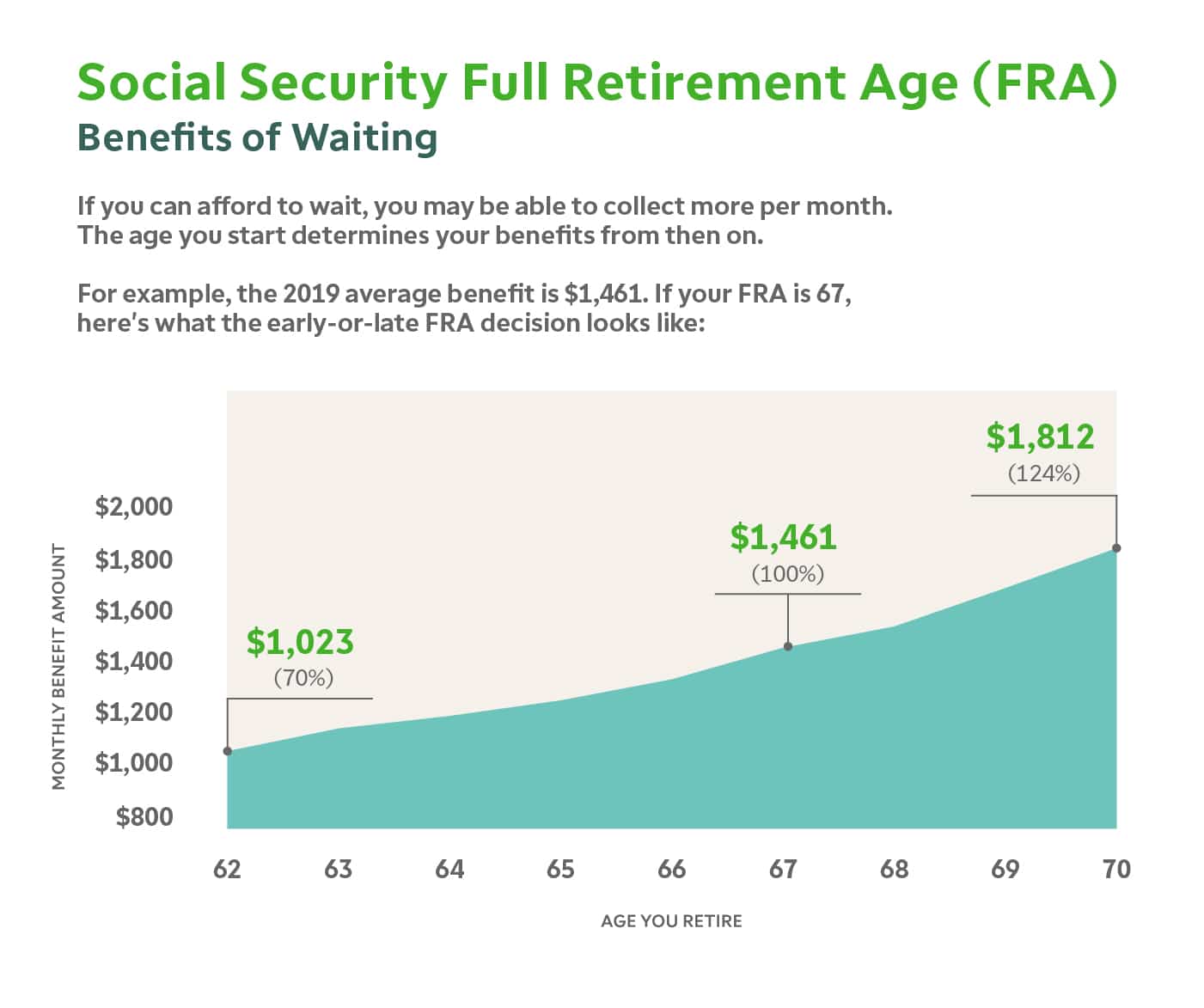

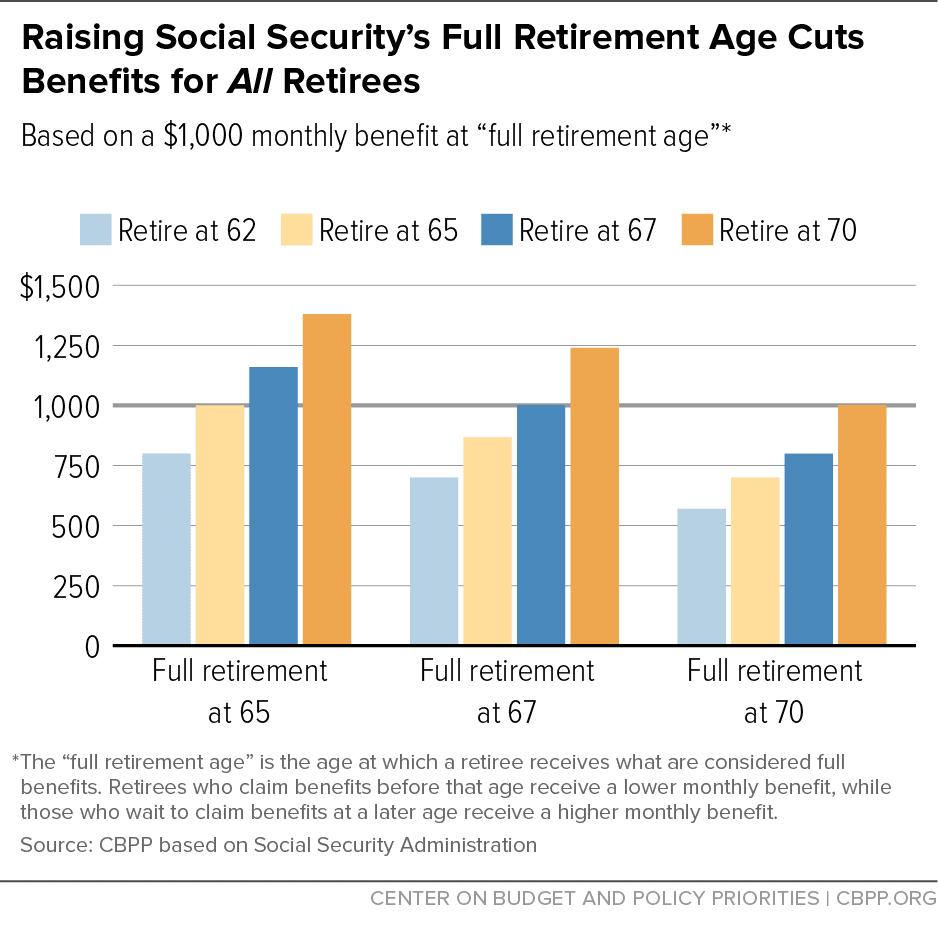

Deciding when to take Social Security depends heavily on your circumstances. You can start taking it as early as age 62 , or you can wait until you’ve reached full retirement age or age 70 based on your work history. While there’s no “correct” claiming age for everybody, the rule of thumb is that if you can afford to wait, delaying Social Security can pay off over a long retirement. Here are some guidelines to consider.

The No 1 Reason To Claim Social Security At Age 70

Waiting until 70 to claim Social Security benefits is widely lauded as a smart move for those who can afford it. This can be especially difficult if youre more than ready to retire at 62 or if you dont have huge personal savings to fall back on. Still, for those who can stick it out another eight years, waiting until 70 to file for benefits can have a big effect on the total amount you collect in retirement.

Also Check: Social Security Office In Madison Wisconsin

Medicare And Health Benefits

Retiring at age 65 allows individuals to be eligible for Medicare, otherwise early retirees will need to budget for out-of-pocket costs to purchase health insurance.

An individual applying for health insurance that complies with the Affordable Care Act pays an average of $456 per month in premiums. By contrast, in 2022, the standard Medicare Part B premium is $170.10 per month and it gets you coverage with a relatively low deductible of $233 a year.

To be well protected, consider prescription drug coverage and perhaps Medigapor Medicare Advantage. Prescription drug coverage premiums average $33 a month in 2022. Medicare Advantage premiums average $19 a month in 2022.

Medigap is private insurance designed to supplement traditional Medicare and prescription drug coverage. Note that if you don’t sign up for prescription drug coverage when retiring at age 65 along with Medicare, you can pay a higher penalty rate for it when you do sign up for the rest of your lifeunless you are covered by an employer drug plan.

Financial experts recommend that your retirement income should be about 80% of your final pre-retirement annual earnings.

There Are Merits To Claiming Benefits At Any Of These Ages So The Question Is Which One Is Right For You

When should you claim Social Security?

This is one of the most difficult questions to answer as you think about retirement. You can start benefits as early as 62 or wait as long as 70. And there’s advantages and disadvantages associated both with claiming ASAP or waiting as long as possible.

To help you decide which age is best for you, three Motley Fool retirement experts weigh in on the best reasons to claim Social Security at three popular ages: 62, 67, and 70.

Image source: Getty Images.

Recommended Reading: Lookup Person By Social Security Number

Taking Social Security: How To Benefit By Waiting

For those who are able to do so, it may make sense to wait even longer, because youll receive a larger monthly benefit even more than your full benefit. Every month past your full retirement that you delay, Social Security will increase your check by about 0.7 percent per month.

If your full retirement age is 66, then heres how much your check would increase:

| Retirement age | New benefit | A $1,000 check becomes |

|---|---|---|

| $1,320 |

So if your full retirement age is 66, then if you can wait two more years and claim benefits at age 68, youll increase your monthly check by 16 percent. In this case, if your full benefit were $1,000 a month, your new benefit would become $1,160 per month. And youll still receive cost of living adjustments on top of this amount, typically raising your payout a little each year.

Workers have other ways to grow their Social Security benefits, too, but its important to start early.

When Is The Best Time To File For Social Security Benefits

Reading time: 3 minutes

Deciding the age at which you will begin to collect Social Security is likely to be a big factor in your retirement planning. Many retirees look forward to the day that they can apply for the benefits theyve spent their whole careers paying for. However, if you have a substantial nest egg and dont need the extra funds immediately, it may be in your best interest to wait a few years before claiming your benefits.

Also Check: Social Security Office In Harrisburg Illinois

Im 70 Retired And My Husband And I Have Social Security Two 401s And An Annuity So We Live Comfortably So Do I Even Need My Financial Adviser Anymore

I dont see a point in continuing the relationship with my financial advisor. Can I drop him?

Question: Im 70 years old and fully retired 2 years ago. I am married, my husband has a pension, and we both have Social Security income that helps us live comfortably. I also have two 401 accounts and an annuity. I have been diagnosed with cancer and want to start drawing on my investments. My question is, I dont see a point in continuing the relationship with my financial advisor. Can I drop him? If so, how do I do that?

Answer: We are so sorry to hear about your diagnosis, and its certainly understandable that you are questioning whether or not to continue your relationship with your financial adviser. The answer to whether to drop him ultimately depends on such things as how good your adviser is and how much advanced planning is needed. And if you decide to drop him, the good news is that it is relatively easy to do so.

Should you drop your adviser?

One thing to consider here is whether you feel the financial plan you have in place is the best for both you and your husband both for now and if you pass away. Does it look at everything from Social Security survivors benefits to estate planning to tax planning to ensure your husband will be well taken care of?

Have an issue with your financial adviser or looking to hire a new one? Email .

Have an issue with your financial adviser or looking to hire a new one? Email .

Questions edited for brevity and clarity.

How To Decide When To Start Taking Social Security

It may seem like you should delay your benefits for as long as possible in order to get the most out of Social Security, but this isn’t the best decision for everyone.

To determine the most advantageous age for you to start Social Security, consider your life expectancy. If you have a terminal, chronic or progressive illness, it may make more sense to start claiming Social Security at 62 than it does to wait. Yes, you’ll get a smaller amount per check, but you won’t get any money at all if you choose to delay and then you die before ever claiming.

No one can say for certain how long they’re going to live, but you can estimate. The current average life expectancy in the United States is 78.6 years, but this may be too low of an estimate for many. One in four 65-year-olds today can expect to live past 90, according to the Social Security Administration, and one in 10 can expect to live past 95. If you’re reasonably healthy, you may want to go with a higher life expectancy estimate than someone who already suffers from health problems. Your family’s health history is also a factor, so be sure to factor in any genetic risks, too.

Once you have your estimated life expectancy, you can determine the best time to start Social Security by comparing the total amount of benefits you would receive over your lifetime if you start Social Security at different ages.

|

Current Age |

|---|

Recommended Reading: State Tax On Social Security