Learn About The Calculations That Determine Your Social Security Benefits

You probably expect to get some money from the government in retirement, but how much you get depends on the Social Security benefits formula. Many don’t understand how this formula works or when it applies, but it’s not too difficult to figure out as long as you’re comfortable with some basic arithmetic. Below, we’ll break it down step by step so you can better estimate how much money you’ll get from the program.

If You’re Not Sure Why You Received A Payment

If you receive a check or direct deposit payment from the Treasury Department and do not know what its for, contact the regional financial center that issued it. Only the agency that authorized the payment can explain why you received it.

If you received a check, look for the RFCs city and state at the top center. Then contact that RFC to find out which federal agency authorized the payment. It will be one of these:

If you received payment byelectronic funds transfer , or direct deposit, follow the directions under Find Information About a Payment.

Use the Treasury Check Verification System to verify that the check is legitimate and issued by the government.

What If I Delay Taking My Benefits

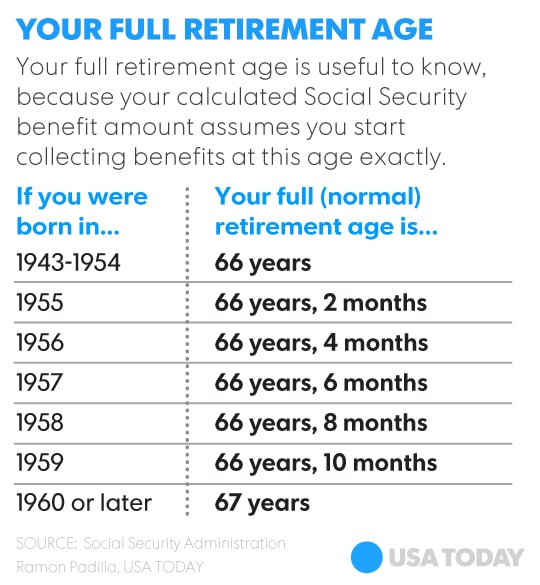

If you retire sometime between your full retirement age and age 70, you typically earn a “delayed retirement” credit for your own benefits . For example, say you were born in 1960, and your full retirement age is 67. If you start your benefits at age 69, you would receive a credit of 8% per year multiplied by two . This means your benefit would be 16% higher than the amount you would have received at age 67.

Also Check: Social Security Office Topeka Ks

Do You Expect To Have Additional Sources Of Retirement Income Beyond Social Security

Continue saving in the coming years.

Social Security won’t replace all of your pre-retirement income. On average, Social Security replaces 40 percent of a worker’s income. That means your retirement savings, pension, 401, or Individual Retirement Account will need to fill the gap. Claiming at your full Social Security benefit age or later can minimize this gap and maximize your monthly benefit. If you claim before your full retirement age, your monthly benefit could be reduced by as much as 30 percent.Learn more about saving for retirement.

You have an opportunity to continue growing your money.

If you can, get the highest monthly Social Security benefit possible by claiming at your full Social Security benefit age or later. If you claim before your full retirement age, your monthly benefit could be permanently reduced by as much as 30 percent. Also, take advantage of catch-up contributions to your 401 or Individual Retirement Account . Lastly, avoid losing your retirement savings to unnecessary tax penalties. If you withdraw your 401 or IRA savings before age 59½, you will likely face an early withdrawal penalty.Learn more about how retirement savings grow.

It’s a perfect time to start saving.

It’s never too late to start saving!

There are many ways to plan for a secure retirement outside of Social Security.

It’s never too late to start saving!

A type of retirement savings account offered by employers to help their employees save for retirement.

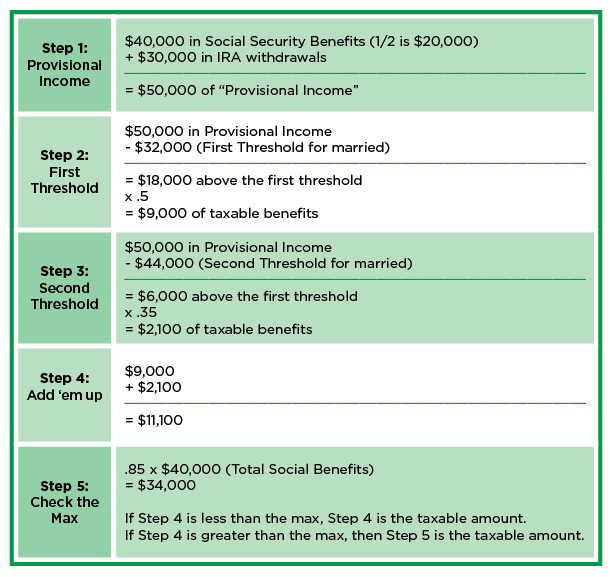

How Your Primary Insurance Amount Is Calculated

Once you have your AIME, you can calculate your primary insurance amount , the base rate for your Social Security payments. The PIA calculation relies on so-called âbend pointsâ that determine how much of your income will be replaced by Social Security benefits in retirement.

Think of bend points as similar to tax brackets, in that they determine a percentage of your benefits based on incremental buckets of earnings. There are three bend point buckets: one for 90% of income replacement, one for 32% and one for 15%.

These bend point buckets help give lower lifetime earners a higher percentage of income replacement, and higher lifetime earners a lower rate of income replacement, says Jim Blankenship, certified financial planner and author of âA Social Security Ownerâs Manual.

The dollar amounts of bend points are adjusted for inflation each year, but the percentages of each bend point are set by law and remain unchanged. AIME amounts are always rounded down to the nearest $0.10. For 2021, the bend points are:

⢠90% of the first $996 of your AIME, plus

⢠32% of your AIME between $996 and $6,002, plus

⢠15% of your AIME over $6,002

For a worker with an AIME of $6,250, the calculation would look like this:

⢠90% of $966 = $896.40, plus

⢠32% of $5,006 = $1,601.92, rounded down to $1,601.90, plus

⢠15% of $248 = $37.20

This worker would earn a monthly Social Security benefit of $2,535.50 .

You May Like: Is Medicare Deducted From Social Security

Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Getting A Social Security Number For A New Baby

The easiest way to get a Social Security number for your child is at the hospital after they are born when you apply for your childs birth certificate. If you wait to apply for a number at a Social Security office, there may be delays while SSA verifies your childs birth certificate.

Your child will need their own Social Security number so you can:

- Claim your child as a dependent on your income tax return

- Open a bank account in their name

- Get medical coverage for them

- Apply for government services for them

Read Also: Social Security Office On Cottage Grove

How Social Security Is Calculated Summary

Heres the bottom line about how Social Security is Calculated:

Every years earnings are indexed for inflation, and then the 35 highest are considered when calculating your benefit.

Next, the 35 highest inflation-adjusted years are added together and averaged, to arrive at your lifetime average Social Security earnings.

This amount is divided by 12 to determine your Average Indexed Monthly Earnings .

Lastly, once your monthly average is determined, it is applied to this formula to determine your Primary Insurance Amount .

A Guide On Taking Social Security

Deciding when to take Social Security depends heavily on your circumstances. You can start taking it as early as age 62 , or you can wait until you’ve reached full retirement age or age 70 based on your work history. While there’s no “correct” claiming age for everybody, the rule of thumb is that if you can afford to wait, delaying Social Security can pay off over a long retirement. Here are some guidelines to consider.

You May Like: Head Of Social Security Administration

Can Your Pia Change After You Reach Age 62

There are two things that affect your PIA after you reach age 62:

Why Is It Important To Have A Social Security Claiming Strategy

Back in 2015, MassMutual quizzed over 1,500 adults on relatively basic Social Security principles that they deemed were important to know in order to make well-informed claiming decisions. And the results didnt look good. Overall, 72 percent of adults failed the quiz. Even more alarming: 62 percent of those over the age of 50 failed.

With so much uncertainty regarding Social Security and different claiming strategies, it shouldnt come as a surprise that just 7 percent of men and 6 percent of women wait to claim benefits until after reaching their full retirement age . Whats more, only 2 percent of men and 4 percent of women wait until age 70 to collect Social Security distributionswhich would maximize their monthly benefit.

So why is it that important to maximize Social Security benefits? Well, for starters, Social Security payouts account for more than half of all income earned by 62 percent of retirees. But hang onit gets worse. Nearly 34 percent of retirees rely on Social Security benefits to account for 90 percent or more of their total retirement income .

Also Check: Social Security Office Baden Pa

Adjust Your Wages For Each Year For Inflation

The government uses the Average Wage Index to adjust your wages for inflation so it can accurately pick out the years you’ve earned the most. You can view the AWI for all previous years going back to 1951 on the Social Security Administration’s website.

The AWI you use to adjust your wages is the one that was in effect in the year you turned 60. You divide this AWI by the AWI for the year you’re adjusting wages for. The result is your index factor. Multiply this by your income as reported in your earnings record for that year to get your index-adjusted wages.

For example, if you turned 60 in 2021, you’d use the 2021 AWI of $60,575.07 as your benchmark. If you earned $50,000 in 2015 and you want to calculate your index-adjusted income for that year, you’d do the following:

If that’s a little too much math for you, you can skip the first step and go straight to the indexing factors. The Social Security Administration keeps lists of all the indexing factors for all years. You just have to enter the year you turn 60 and it will give you the index factors to use. Then all you have to do is multiply those indexing factors by your income for the appropriate year.

How Social Security Is Calculated

To calculate your benefit amount, Social Security looks at your entire work record. Here is how the Social Security benefits formula works:

First, every years earnings are indexed for inflation, and then the 35 highest are considered when calculating your benefit.

If you dont have 35 years of earnings, zeros will be used for the remaining years.

Second, The 35 highest inflation-adjusted years are added together and averaged, to arrive at your lifetime average Social Security earnings.

This amount is divided by 12 to determine your Average Indexed Monthly Earnings .

Third, once your monthly average is determined, it is applied to this formula to determine your Primary Insurance Amount .

The PIA is the benefit a person would receive if he/she elects to begin receiving retirement benefits at his/her full retirement age.

At this age, the benefit is neither reduced for early retirement nor increased for delayed retirement.

The formula used to compute the PIA reflects changes in general wage levels, as measured by the national average wage index.

The Social Security Administration releases a table each year showing the dollar amounts that go into the PIA formula .

Read Also: Social Security Office Port Arthur Texas

Beginning Benefits Before Fra

If you choose to begin to receive benefits before you reach your full retirement age, one or both of the following calculations will apply:

- 5/9 of 1%: Your benefits are reduced by 5/9 of 1% per month, up to a maximum of 36 months, depending on how many months you have until you reach FRA.

- 5/12 of 1%: If you are more than 36 months away from reaching FRA, the reduction above is applied, and then for the number of months greater than 36, the benefit is further reduced by 5/12 of 1% per month.

Therefore, if your FRA is age 66, your benefits would be reduced by 25% if you begin taking them at age 62. Find that figure by taking 5/9 of 1%, or 0.56 multiply by 36 months to get 20%. Then, 5/12, or 0.42, multiplied by the remaining 12 months, is 5% for a total of 25%.

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2022, the maximum amount of income subject to the OASDI tax is $147,000, capping the maximum annual employee contribution at $9,114. For 2023, the maximum amount of income subject to the tax is $160,200, capping the maximum annual employee contribution at $9,932.40. The amount is set by Congress and can change from year to year.

Read Also: What If You Lose Your Social Security Card

Can You Receive Retroactive Payments

Once the SSA approves your SSDI application and calculates your monthly benefit, you may be entitled to a back pay award. How many months of payments you will receive will depend on the date you applied for benefits and your disability onset date.

If you are applying for SSDI benefits, you need the assistance of a skilled Social Security disability lawyer to get your application approved and receive the benefits you deserve. To schedule a free consultation with a member of our legal team, fill out the online form on this page or call our Roswell office today.

|

Related Links: |

Effect Of Delaying Retirement Benefits

1Represents Full Retirement Age based on DOB January 2, 1960

2PIA = The primary insurance amount is the basis for benefits that are paid to an individual

That higher baseline would last for the rest of your retirement and serve as the basis for future increases linked to inflation. While it’s important to consider your personal circumstancesâit’s not always possible to wait, particularly if you are in poor health or can’t afford to delayâthe benefits of waiting can be significant.

Be aware that if you decide to wait past age 65, you may still need to sign up for Medicare. In some circumstances your Medicare coverage may be delayed and cost more if you don’t sign up at age 65. If you start Social Security benefits early, you’ll automatically be enrolled into Medicare Parts A and B when you turn age 65.

Your annual Social Security statement will list your projected benefits between age 62 to 70, assuming you continue to work and earn about the same amount through those ages. If you need a copy of your annual statement, you can request one or view it online on the Social Security Administration portal.

Recommended Reading: Social Security Income Phone Number

How Are Spousal Benefits Calculated For Social Security For Married People

If someone is married to a worker eligible for Social Security benefits, they may be able to claim spousal benefits based on their worker spouses earnings. Social Security spousal benefits are based on the worker spouses earnings and the age of the claiming spouse. Note that spousal benefits do not in any way decrease your spouses retirement benefit.

To qualify for Social Security spousal benefits:

- Both the higher-earning worker and the claiming spouse must be at least 62

- The couple must have been married for at least one year

- The higher-earning worker spouse must already be receiving their earned benefit

Depending on the age that the spouse claims, the benefits can range between 32.5%-50% of the worker spouses primary insurance amount . As with earned benefits, youll receive less than the full spousal benefit if you decide to claim before your full retirement age. But unlike earned benefits, you dont receive more if you wait to claim spousal past full retirement age. In fact youll actually be forfeiting some money by waiting longer.

If only one spouse worked, then the Social Security Administration calculates half of the worker spouses PIA and adjusts it based on the age of the claiming spouse.

Adjust Your Pia For The Age You Will Begin Benefits

The final amount of Social Security retirement benefit that you receive is based on the age when you begin benefits.

The earliest you can begin retirement benefits is age 62 . You will get more by waiting until a later ageas late as age 70to begin receiving benefits.

Of course, another complex formula is used to determine how much more you will receive if you wait.

This formula uses your Primary Insurance Amount calculated in the previous step. This is the amount you will get if you start benefits at your full retirement age . Your FRA can vary, depending on the year you were born. For people born between 1943 and 1954, as in our example, the FRA is age 66.

You May Like: Social Security Medicare Part B

When You Choose To Start Taking Social Security Benefits

The yearâand even the month within that yearâthat you choose to begin taking Social Security benefits affects how much you receive each month. You can start claiming Social Security benefits early as age 62, the current early retirement age. But you wonât get your full PIA. Itâll be reduced based on how many months you have until your full retirement age. This reduction can really add up, topping in at as high as 30% for particularly early claimers.

You can avoid these surcharges on your PIA, of course, simply by waiting to start payments until your full retirement age. This is generally between ages 66 and 67, depending on when you were born.

You can even add onto your base amount by delaying when you start benefits. After you reach full retirement age, you can boost your benefits by up to 8% of your PIA annually simply by not claiming Social Security. These benefit increases are known as delayed retirement credits, and you can accrue them up to age 70.

An important note: These benefit rate changes are performed to provide roughly the same cumulative benefit over a lifetime, assuming a roughly average lifespan. In other words, if you start Social Security earlier, youâll probably claim it for longer someone with the same lifespan who delayed payments would claim them for less time. To provide them the same total benefit, earlier payments must be smaller and later benefits have to be larger to catch up.