Benefit Amounts Vary Depending On Your Social Security Retirement Age

Your Social Security retirement age and the amount you receive varies depending on several factors. For example, the earliest age you can collect your Social Security retirement benefits is 62, but there is an exception for widows and widowers, who can begin benefits as early as 60. If you start collecting benefits early and continue to work, your benefits may be reduced.

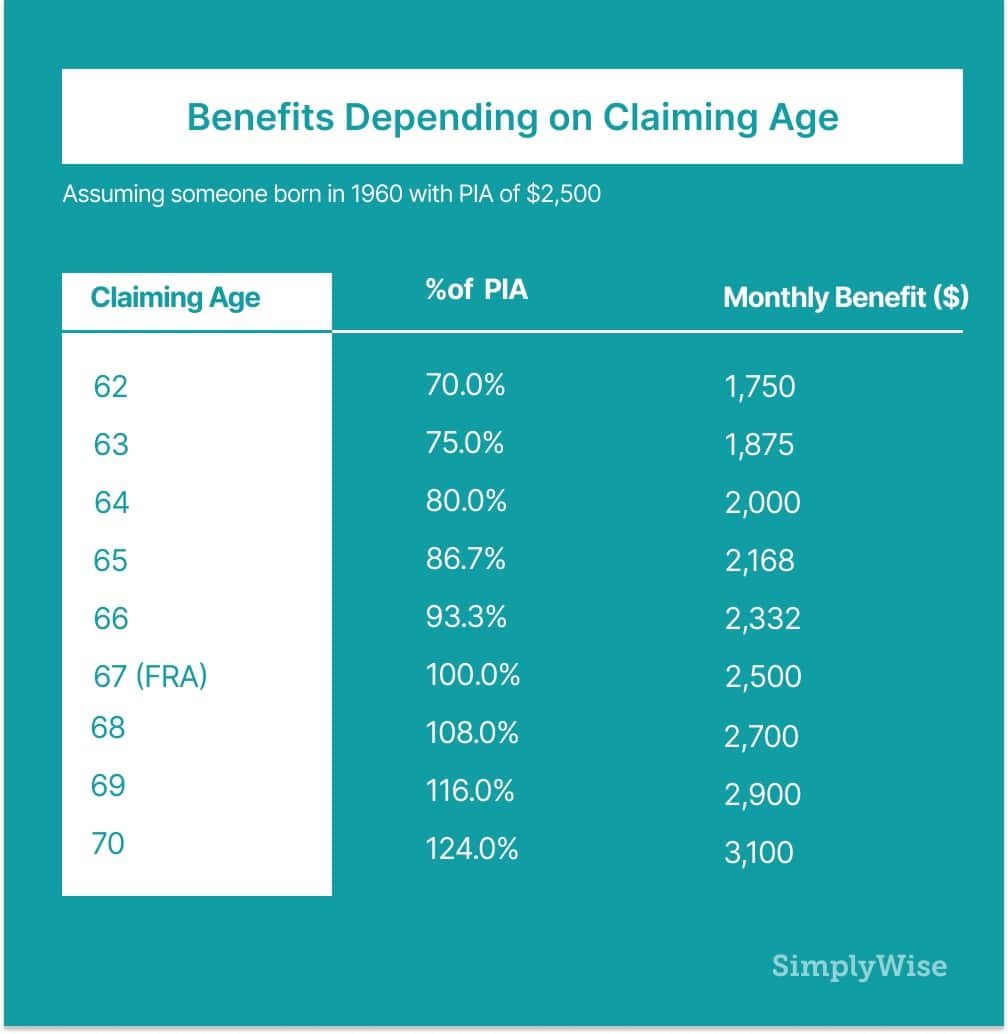

Here’s how this works with the basics on Social Security claiming ages from 60 to 70.

Timing And Your Health Coverage

Your health insurance coverage can also play a role in deciding when to claim Social Security benefits. Do you have a health savings account to which you would like to keep contributing? If so, note that if youre age 65 or older, then receiving Social Security benefits requires you to sign up for Medicare Part A, and once you sign up for Medicare Part A, youll no longer be allowed to add funds to your HSA.

The SSA also cautions that even if you delay receiving Social Security benefits until after age 65, you might still need to apply for Medicare benefits within three months of turning 65 to avoid paying higher premiums for life for Medicare Part B and Part D.

In 2022, the average monthly premium for Part D will be $33 per month versus $31.47 in 2021. If you enroll in a Medicare Advantage plan, the average monthly premium will be $19 per month in 2022 versus $21.22 in 2021. However, if you are still receiving health insurance from your or your spouses employer, you might not yet have to enroll in Medicare.

As of Dec. 26, 2021, Social Security offices are only open by appointment, and to get an appointment you need to be in a limited, critical situation. Most people will have to transact their business online, by phone, or through the mail.

Other Benefits Will Be Delayed If You Delay Your Old Age Security Payment

If you are not in receipt of the Old Age Security pension:

- you cannot get the Guaranteed Income Supplement

- your spouse cannot apply for the Allowance

Note: The Guaranteed Income Supplement and Allowance amounts dont increase when you delay receiving Old Age Security pension payments. You cannot receive the Guaranteed Income Supplement and your partner cannot receive the Allowance when you are not receiving the Old Age Security pension.

When monthly increases are not applied

If you decide to delay receiving the Old Age Security pension, you will not receive monthly increases during any month where you are:

- in federal prison as a result of a sentence of 2 years or longer

- outside Canada, have less than 20 years of residence in Canada and do not qualify under an international social security agreement

You May Like: Social Security Office On Buffalo

Filing For Early Retirement Benefits

For most people, it does not make sense to file for early retirement benefits at age 62 if you are already receiving SSDI because of a disability. Your disability payments equal your full retirement amount, and those who opt for early retirement receive reduced benefits.

Imagine that, at age 60, you suffer a back injury leading to a disability. You are approved for SSDI benefits, and you begin drawing an amount equal to your full retirement amount. When you reach age 62, nothing changes you continue to draw your full SSDI amount.

Once you reach your full retirement age, the SSA swaps you from SSDI to traditional retirement benefits. However, this occurs automatically, so you will not see a break in your benefits and do not need to do anything to ensure this happens.

For a free legal consultation, call

Youre Only Working Part Time

If you claim Social Security prior to your full retirement age while still holding down a part-time job, you might have your benefits reduced if your work income exceeds the annual limit. For 2022, if you are under full retirement age, your benefits go down by $1 for every $2 your income exceeds $19,560. If you reach full retirement age in 2022, your benefits go down by $1 for every $3 your income exceeds $51,960 prior to reaching full retirement age. If youre working part-time to help make ends meet, taking Social Security at 62 might make sense.

You May Like: Social Security Office Beaumont Texas

How To Calculate Social Security Benefits

Lets say your FRA is 66. If you start claiming benefits at age 66 and your full monthly benefit is $2,000, then youll get $2,000 per month. If you start claiming benefits at age 62, which is 48 months early, then your benefit will be reduced to 75% of your full monthly benefitalso called your primary insurance amount. In other words, youll get 25% less per month, and your check will be $1,500.

That reduced benefit wont increase once you reach age 66. Rather, youll continue to receive it for the rest of your life. It may go up over time due to cost-of-living adjustments , but only slightly. You can do the math for your own situation using the Social Security Administration Early or Late Retirement Calculator, one of a number of benefits calculators provided by the SSA that can also help you determine your FRA, the SSAs estimate of your life expectancy for benefit calculations, rough estimates of your retirement benefits, individualized projections of your benefits based on your personal work record, and more.

Although the cost-of-living adjustments announced each year are usually only slight increases, Social Security benefits will increase by 5.9% in 2022, marking the largest increase since 1982.

Can You Collect Social Security Retirement And Disability At The Same Time

Home » Frequently Asked Questions » Can You Collect Social Security Retirement and Disability at the Same Time?

In most cases, you cannot collect Social Security retirement and Social Security Disability Insurance at the same time. You may, however, qualify for Supplemental Security Income if you meet the strict financial criteria while drawing either Social Security retirement or SSDI benefits.

The Social Security Administration created the SSDI program to bridge the gap between when someone must leave the workforce due to a disability and when they can draw retirement benefits. For this reason, there is only one way to collect both retirement and SSDI at the same time.

Read Also: Social Security Office In Poteau Oklahoma

How Do You Qualify For Widows Benefits

Be at least age 60.Be the widow or widower of a fully insured worker.Meet the marriage duration requirementYou could get Social Security widow’s or widower’s benefits if:

- You meet one of the exceptions.

- Your deceased spouse had enough work credits.

- You are not getting a higher benefit on your own work record.

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Recommended Reading: Calculate Social Security Retirement Benefits

The Best Age For Social Security Retirement Benefits

As you get older, you start thinking more about retirement distributions than contributions. One of the biggest questions that near-retirees have is, What is the best age to start collecting Social Security benefits? Most take the benefits right away, but that isnt always the best option. You can start collecting Social Security benefits any time between ages 62 and 70. Lets take a look at how Social Security works, and what you need to know when deciding the best age for your retirement.

A financial advisor can help you optimize a plan for your retirement needs.

The best age for Social Security benefits depends on personal and financial factors, like your current cash needs, retirement plans, health and family history. Be sure you weigh the decision carefully and dont hesitate to find a financial advisor to talk to if need be. The age you choose to start taking Social Security will affect the monthly amount you receive for the rest of your life.

Why It Pays To File For Social Security At Fra

When you claim Social Security ahead of FRA, your benefits get reduced. And filing at age 62 means slashing your benefits by 25% to 30%, depending on your FRA. That’s a risky thing, because if you end up depleting your nest egg faster than expected, or your retirement living costs end up being higher than expected, you might need more income from Social Security to help compensate.

Social Security shortfall:Limiting benefits based on need could fix it. But is it fair?

Similarly, there’s a risk in delaying your filing beyond FRA — that you won’t end up living a long enough life for that to be your best financial move. See, delaying your claim will result in a higher monthly benefit. It won’t necessarily score you a higher lifetime benefit, though. To get that, you’ll generally need to live a pretty long life, and if you pass away in your 70s, delaying your filing will generally mean ending up with less Social Security income all in.

That’s why filing for benefits at FRA may be your safest bet. That way, your benefits aren’t reduced, but you also don’t have to wait too long to collect them. If you end up with health issues that shorten your life expectancy, you can at least take comfort in the fact that you didn’t wait too long to first start receiving your benefits.

Also Check: Social Security Offices In San Antonio

Retirement Age And Social Security

If you’re eligible for Social Security, you can start collecting your benefits as early as age 62, and you can also continue to work. Before you do so, it’s important to note that unless you’ve reached your full retirement age , you’ll be doubly penalized:

- If you earn over a certain amount, your benefits will be temporarily reduced.

If you can wait even longer to collect, you’ll also avoid being penalizedplus your benefit will increase another 8% for each year you delay, up to age 70. At that point, your benefit maxes out and there is no further incentive to delay.

The reduction in Social Security benefits for people who earn over a certain amount is based only on earned income. Unearned income, such as from pensions or investments, doesn’t count.

Can I Claim Spousal Benefits If I’m Divorced

You are eligible for dependents benefits if both you and your former spouse have reached age 62, your marriage lasted at least ten years, and you have been divorced for at least two years. This two-year waiting period does not apply if your former spouse was already collecting retirement benefits before the divorce.

You can collect benefits as soon as your former spouse is eligible for retirement benefits. He or she does not actually have to be collecting those benefits for you to collect your dependents benefits.

If you are collecting dependents benefits on your former spouse’s work record and then marry someone else, you lose your right to those benefits. You may, however, be eligible to collect dependents benefits based on your new spouse’s work record. If you divorce again, you can return to collecting benefits on your first spouse’s record, or on your second spouse’s record if you were married for at least ten years the second time around.

Recommended Reading: Lee County Social Security Office

Retirement Age For Those Born After 1937

Year Born 1960 or later 67 years

The system does provide for early retirement at age 62, but also offers higher benefits for people who wait to make their claims after reaching full retirement age. For more information, see Nolo’s article Social Security Benefits: Retirement, Disability, Dependents, and Survivors.

How Many Hours Can You Work On Social Security

If you are at full retirement age, you can work as much as possible and still receive your social security benefits. However, if you are younger than age 66 or 67, there is a cap on how much you can earn and receive in social security benefits. As of 2022, the Social Security Administration will deduct $1 from your benefits for each $2 you earn above $19,560.

Recommended Reading: Medicare Deduction From Social Security 2022

Tips For Ensuring A Comfortable Retirement

- If you want to build a retirement plan, a financial advisor can help you reach your retirement goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Save, save, save. To be able to put off taking Social Security benefits until youre 70, youll need to have enough stashed away to live off of until then. Our retirement calculator can help you figure out how much youll need to save to retire comfortably.

- Start saving early, and take advantage of employer matches. With our 401 calculator, you can see how much your 401 will be worth when you reach retirement.

- Think hard about where you want to retire. Not all states are equally tax-friendly to retirees. Use our retirement tax-friendliness tool to see how tax-friendly your home state is, and whether Social Security benefits are taxable at the state level there.

Spouses Who Dont Qualify For Their Own Social Security

Spouses who didnt work at a paid job or didnt earn enough credits to qualify for Social Security on their own are eligible to receive benefits starting at age 62 based on their spouses record. As with claiming benefits on your own record, your spousal benefit will be reduced if you take it before reaching your FRA. The highest spousal benefit that you can receive is half of the benefit that your spouse is entitled to at their FRA.

While spouses get a lower benefit if they claim before reaching their own FRA, they will not get a larger spousal benefit by waiting to claim after their FRAsay, at age 70. However, a nonworking or lower-earning spouse may get a larger spousal benefit if the working spouse has some late-career, high-earning years that boost their benefits.

Read Also: How To Freeze My Social Security Number

Applying To Delay Your First Payment

If you received a letter from us and want to delay your first payment:

Examples of delaying Old Age Security

Delaying 1 year

Michael turned 65 in July. If he decides to delay receiving the Old Age Security pension for 1 year, his monthly amount will increase by 7.2% to account for the 12-month deferral period.

Delaying 5 years

Rita will be turning 65 in December. If she decides to delay receiving the Old Age Security pension for the maximum deferral period of 60 months, her monthly amount will increase by 36% at age 70 .

Delaying with an earlier start date than the date of application

John could receive his Old Age Security pension in August and he decided to delay receiving it. In December of the next year, John applied for Old Age Security. He writes on his application that he would like his benefit to be effective as of October, 3 months earlier than his application date. His monthly benefit amount will then increase by 8.4% to account for the 14-month deferral period. The monthly increase does not apply to the period from October to December of the year he applied.

When Can I Start Collecting Social Security Retirement Benefits

The Social Security Administration used to consider 65 to be full retirement age for the retirement benefit. Benefits amounts were calculated on the assumption that most workers will stop working full time and will claim retirement benefits when they reach age 65.

Now that people are generally living longer, Social Security’s rules about what is considered full retirement age have changed. Age 65 is still considered full retirement age for anyone born before 1938. But full retirement age gradually increases from age 65 to 67 for people born in 1938 or later. For anyone born after 1960, the full retirement age is 67.

You May Like: Can You Open Bank Account Without Social Security Number

It Depends On The Type Of Benefit And Other Factors

Most people think of Social Security benefits as a monthly payment that you start getting in retirement and receive for the rest of your life. In fact, Social Security is an umbrella term for several federal benefits programs. One of the largest government programs anywhere in the world, Social Security is expected to have paid out more than $1 trillion to about 65 million Americans in 2020.

There are three key groups of people who receive Social Security benefits: retired workers, survivors of retirees, and people with disabilities and their families. How long does Social Security last? It depends on the type of benefit.