Spousal Benefit Reduction Due To Early Entitlement

If you file for a spousal benefit prior to your full retirement age, that spousal benefit will be reduced due to early filing. The reduction is 25/36 of 1% for each month early, up to 36 months. For each month in excess of 36 months, the reduction is 5/12 of 1%.

Example : Bobs full retirement age is 67. Bob files for his retirement and spousal benefits at age 65 . As a result, his spousal benefit will be reduced by or 16.67%.

The final calculation of Bobs spousal benefit will be 83.33% x . And to that, we would add Bobs own retirement benefit to find the total amount of his monthly benefit.

How Does The Social Security Administration Calculate Benefits

Benefits also depend on how much money youâve earned in life. The Social Security Administration takes your highest-earning 35 years of covered wages and averages them, indexing for inflation. They give you a big fat âzeroâ for each year you donât have earnings, so people who worked for fewer than 35 years may see lower benefits.

The Social Security Administration also makes annual Cost of Living Adjustments, even as you collect benefits. That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. Itâs a big perk that doesnât get a lot of attention.

If You’re Receiving Other Retirement Benefits

The calculation gets a bit more complicated if you are eligible to receive benefits from a government pension or foreign employer that is not covered by Social Security. In that case, you may still be eligible, but the amount will be reduced.

For example, if you have a government pension for which Social Security taxes are not withheld, the amount of your spousal benefit is reduced by two-thirds of the amount of your pension. This is known as a government pension offset.

For example, suppose you are eligible to receive $800 in Social Security spousal benefits and you also get $300 from a government pension each month. Your Social Security payment is reduced by two-thirds of $300, or $200, making your total benefit amount from all sources $900 per month + $300).

Also Check: Lansing Mi Social Security Office

Can You Switch From Your Social Security Benefit To A Spousal Benefit

Yes. If you begin collecting your own Social Security benefits at age 62 but your spouse keeps working for another few years, you are eligible to your spouses benefit after they retire if it is higher than your own. Thus, your spouse will get the maximum amount and you can file for 50% of the amount your spouse would receive at full retirement age.

How Do I Get Child In Care Spousal Benefit Backpay

I was declared disabled at age 14 and started receiving dac ssdi benefits through my Dad’s work record. At that time , my dad was alive and collecting retirement benefits. My mom received child in care spousal benefits from my Dad’s work record. At age 19, during a CDR, the SSA ruled that I was no longer disabled, and my disability benefits ended, as did my Mom’s Child in care spousal benefits. I appealed this.

I am 26 now. Just two weeks ago, my appeal was successful, and ssa decided that I actually have been continuously disabled all this time since age 14. I do not yet have access to what code was used to justify disability, I believe it would be solely physical in nature though, no mental impairment. My mom has lived in the same house as me this entire time, providing care that falls under the “child in care” definition . She has not earned income during this time. She has been under retirement age this entire time.

I received an ssa letter recently that my benefits would be half of my Dad’s retirement payment. However, I believe that this is wrongly calculated. Dad would get his full amount, and me and my mom should evenly split the remaining 70-80%ish, meeting the maximum family benefit. So my check shouldn’t be half, if they had the spousal benefits correct. I don’t know what the maximum family benefit is either, not sure how I’m supposed to know that. The calculation is awful.

Recommended Reading: Social Security Office In Elizabethtown Ky

Who Is Eligible To Collect Social Security Retirement Benefits

Workers who are at least age 62 and who have worked at least 10 combined years at jobs for which they paid Social Security taxes are eligible for Social Security retirement benefits. In many cases, spouses, widows and divorcees are eligible for Social Security retirement benefits based on a spouses or ex-spouses earnings history. Unmarried children 18 and younger can also get survivors benefits. You must be a U.S. citizen or lawful alien to collect benefits.

More Than Just Income: The Social Security Spousal Benefit And Medicare Coverage

If you are eligible for a Social Security spousal benefit, you are also entitled to premium free part A Medicare at age 65. The catch?

Youre entitled to Medicare only if your spouse is at least 62 years old.

If you are more than 3 years older than your spouse, you may have to buy Medicare Part A until your spouse turns 62. Thats when your premium-free benefit would start. The Part A monthly premium is $422 in 2018.

You May Like: Social Security Office In Vidalia

Social Security Spousal Benefit Rules Every Married Couple Should Know

Editor’s Note: This story originally appeared on The Penny Hoarder.

The benefits of marriage dont stop at love and companionship. In some situations, marriage can result in more Social Security benefits. If you stay married for at least 10 years, those benefits can last even if you get divorced.

But the rules for marriage and Social Security get complicated.

You dont automatically get more Social Security benefits just because youre married. Many, if not most, people will get the biggest benefit by claiming on their own work record.

But if your work history is limited and you marry someone who earns significantly more money than you do, you may get more from Social Security by claiming spousal benefits. Here are several things married couples cant afford not to know.

How Can I Switch From My Social Security Benefit To A Spousal Benefit

You can only switch from your benefit to the spousal benefit if your spouse has not begun receiving retirement benefits. You can claim your benefit based on your work history until your spouse files, and then you can switch to the spousal benefit. However, if you’re not at your full retirement age, you’ll get paid a reduced spousal benefit, which can be as low as 32.5% of your spouse’s primary insurance amount.

To monitor your benefits or change them, you can create an account on the Social Security site. It contains a wealth of information, and it allows you to make some changes online, although others require a phone call.

Recommended Reading: Alabama Social Security Office Phone Number

Spousal Benefits For Widows And Widowers

A widow or widower can receive up to 100% of a spouse’s benefit amount. That’s if the survivor has reached full retirement age at the time of the application.

The payment is reduced to somewhere between 71% and 99% of the deceased’s entitlement if the widowed person is at least 60 but under full retirement age.

Disabled people can apply as early as age 50. The agency has a streamlined application process to avoid delays in the first payment.

You may be eligible for benefits even if your spouse died long before reaching retirement age. Every employee racks up annual Social Security “credits” for working. If your spouse earned credits for at least 10 years, a spousal benefit has been earned.

It’s important to note that it pays to hold off until you reach your “full” retirement age to maximize the amount you will receive.

Also, if you are receiving spousal benefits and your spouse dies, you need to notify Social Security. Your spousal benefit of 50% of your partner’s benefit will convert to a survivor benefit of 100%.

And do it promptly. It’s not usually retroactive.

What Is The Maximum Benefit

The allowed Social Security retirement benefit for a spouse starts at 32.5% at age 62 and gradually increases to 50% of the amount that their spouse is eligible to receive at full retirement age, which is 66 or 67 depending on their birth year. Even if the spouse delays collecting Social Security until age 70, he or she still gets only 50% of their spouses full amount. So, it is important to claim benefits at your full retirement age, because that will be the most you are eligible to receive.

Note that the maximum benefit for a spouse is 50% of their spouses benefit. That means that your spouse would have had to earn a substantial amount more over his or her working life to make that benefit higher than your own individual benefit. Thus, if both partners are eligible for relatively similar benefits, it makes more sense for each partner to file individually at full retirement age or at age 70, if possible.

Widows and widowers may be able to receive up to 100% of the deceased spouse’s Social Security benefit. Social Security uses a formula for families with more than one eligible dependent to calculate maximum benefits.

Read Also: Lookup Person By Social Security Number

Are Social Security Benefits Taxable

If you have a lot of income from other sources, up to 85% of your Social Security benefits will be considered taxable income. If the combination of your Social Security benefits and other income is below $25,000, your benefits wonât be taxed at all. The amount of your benefits that is subject to taxes is calculated on a sliding scale based on your income. Money that Social Security recipients pay in income taxes on their benefits goes back into funding Social Security and Medicare.

If your retirement income is high enough that your benefits are taxable, how do you pay those benefits? You can ask Social Security for an IRS Voluntary Withholding Request Form if youâd like the government to withhold taxes from your Social Security benefits. Otherwise, youâre expected to file quarterly tax returns to pay these taxes over the course of the year.

That covers federal income taxes. What about state income taxes? That depends. In 12 states, your Social Security benefits will be taxed as income, either in whole or in part the remaining states do not tax Social Security income.

Calculate My Social Security Income

These days thereâs a lot of doom and gloom about Social Securityâs solvency – or lack thereof. And regardless of whether you think Social Securityâs future is secure, the fact remains that you shouldnât plan on living exclusively off your Social Security benefits. After all, Social Security wasnât designed to make up a retireeâs entire income.

Still, many people do find themselves in the position of having to live off their Social Security checks. And even if you have other income sources in retirement, Social Security can make up a significant part of your retirement income plan. That’s why itâs important to know all the rules surrounding eligibility, benefit amounts, taxation and more.

Do you need help managing your retirement savings? To find a financial advisor who serves your area, try our free online matching tool.

Also Check: What To Do When You Lose Your Social Security Card

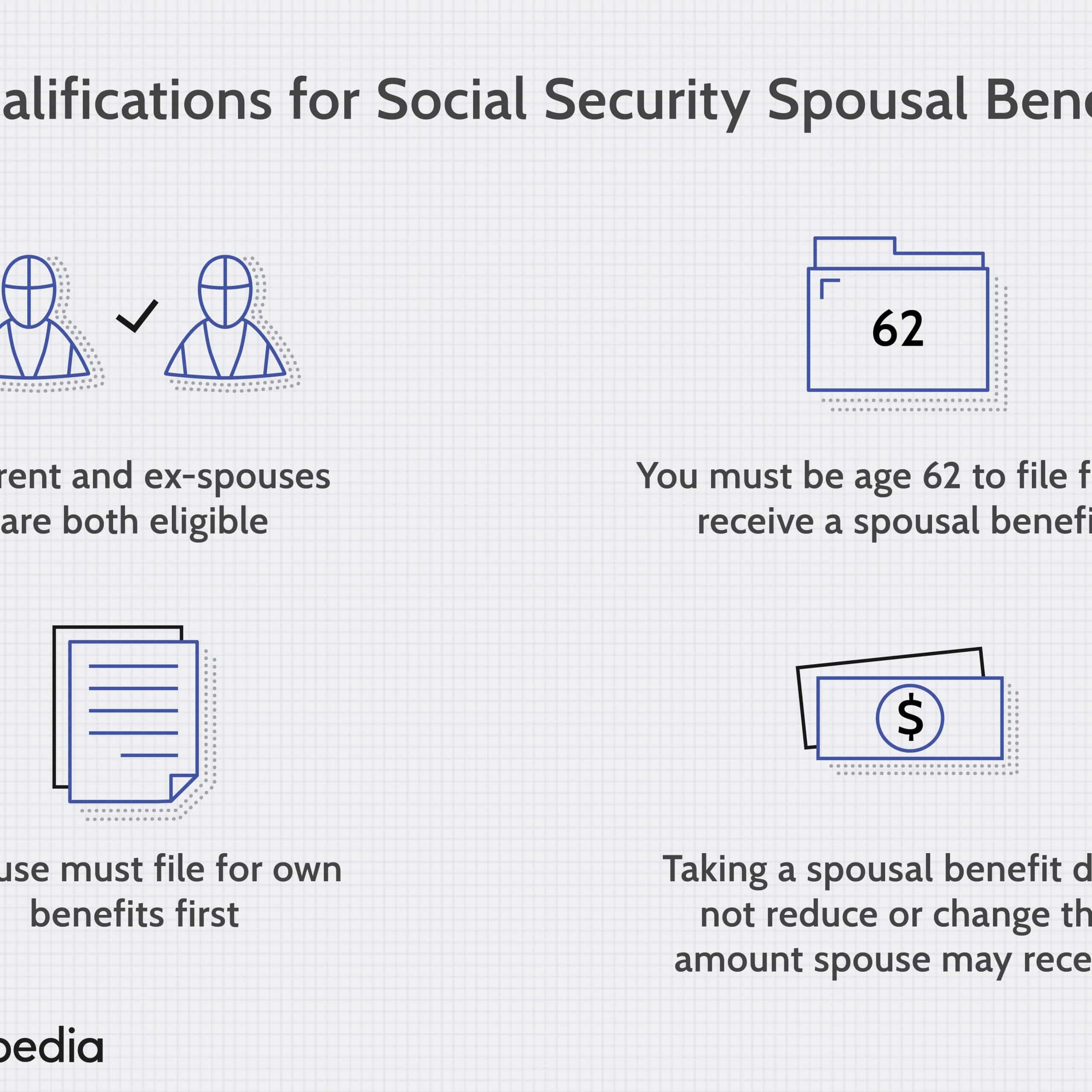

Who Qualifies For Social Security Spousal Benefits

If your spouse has filed for Social Security benefits, you can also collect benefits based on the spouse’s work record, if:

- You are at least 62 years old.

- Regardless of your age, if you care for a child who is entitled to receive benefits on your spouses record, and who is under age 16 or disabled.

When you apply for spousal benefits, you will also be applying for benefits based on your own work history. If you’re eligible for benefits based on your own earnings, and that benefit amount is higher than your spousal benefit, that’s what you’ll get. If it is lower, you’ll get the spousal benefit.

The Simple Formula For Figuring Out Dual Entitlement

Whats critical to understand with dual entitlement is that these are really two separate benefits all rolled into one. The easy way to understand how this may apply in your situation is a simple formula:

= Spousal Payment

If we go back to the husband and wife in our example, we know that half of the higher earners benefit amount is $1,000. We can then subtract the lower-earners benefit amount of $800 to see what the spousal payment would be: $200.

Now, you may be thinking, Devinif the result at the end of this calculation is still one half of the higher-earning spouses benefit, why does it matter?

Thats a good question. Heres my answer: its important to know the formula and how the calculation works because your own benefit and your spousal payment are NOT calculated the same when it comes to reductions for filing early or increases for filing later.

Let me show you what I mean.

Read Also: Cuts To Social Security Benefits

Calculating Spousal Benefits With Dual Entitlement

Calculating the spousal benefit for a spouse who also has their own Social Security benefit is an important process to understand. Your own Social Security benefit and your spousal payment are NOT calculated the same when it comes to reductions for filing early or increases for filing later.

Knowing the correct way to calculate your spousal benefits in this situation isnt something that a rare few need to worry about. According to the Congressional Research Service, there are 3.2 million individuals who are entitled to a social security benefit from their own work as well as a spousal benefit.

This situation is referred to as dual entitlement to benefits. In this article, well dive into calculating spousal benefits with dual entitlement so youll be able to accurately plan the amount of benefits you can expect to receive.

Social Security In The Us

Before Social Security , care for the elderly or disabled in the U.S. wasnt a federal responsibility if they werent cared for by family, it fell into the hands of municipalities or states. This changed in 1935 when the Social Security Act was first established in the U.S. by President Franklin Roosevelt. The first taxes were collected starting in January 1937, which enabled monetary assistance to qualified Americans with inadequate or no income. Originally, SS was just a program that paid out retirement benefits, but a 1939 change added survivors benefits for a retirees spouse and children. In addition, in 1956, disability benefits were added.

Today, SS in the U.S. plays a very important role in keeping a lot of older Americans out of poverty. For most Americans in retirement, it is their major source of income, and for a significant percentage, it is their only source of income, even though SS was never intended to be a full replacement of income. On average, SS pays lower-wage earners higher relative benefits than higher-wage earners. In addition, lower-wage earners tend to pay less tax and are more likely to receive social insurance disability income and survivor benefits. SS is sometimes referred to as Old Age, Survivors, and Disability Insurance .

Social Security Facts

Also Check: Age For Maximum Social Security Benefit

You May Like: Social Security Office In Tupelo Mississippi

Follow These Steps To Get Started:

Thats it! So create or sign in to your mySocial Security account and start planning for your future today!

Already have a mySocial Security Account?

Sign in to your account and scroll down to the Plan for Retirement section to start planning for your future.

How To Calculate A Social Securitys Spousal Benefit

If youre married to someone who works outside the home and contributes to Social Security through payroll tax, you might be entitled to a Social Security benefit based upon your partners income.

The maximum amount you will receive is 50% of their Primary Insurance Amount — this is the monthly income they are eligible to receive at full retirement age . However, you will only receive 50% of this amount if you postpone filing until you are full retirement age- currently 66.

If you file for a spousal benefit before age 66, the percentage you receive depends upon your age. Theres a two-stage process as to how Social Security calculates the reduction and it’s based upon how many months ahead of your FRA you are filing:

For the first 36 months before age 66 that you apply for a spousal benefit, your check is reduced by 25/36 of one percent. For each additional month that you file early, the reduction is 5/12 of one percent.

The following example illustrates how this applies. It assumes that your full retirement age is 66 and your partners PIA is $2,000/month.

Theres a calculator on the Social Security website that allows you to enter your information to find out how your spousal benefit will be affected if you file prior to your full retirement age.

Here are some other things you need to be aware of when claiming spousal benefits:

Coming Up Next week: Social Security and divorce: What it takes to collect on your exs earnings history.

Read Also: Social Security Blue Book For Disabilities