Adding Ssi To Your Ssdi Benefits

Once you are found unable to work due to medically severe impairments, the Social Security Administration will evaluate your finances to determine whether you are also eligible to receive Supplemental Security Income.

One of the initial factors that will be reviewed is how much countable income you receive on a monthly basis. For 2019, the maximum monthly countable income a single person could receive was $771 and for a married couple it was $1,157.

There are many items that are excluded for purposes of determining your countable income. For example, the value of Supplement Nutrition Assistance Programs you may receive does not count as income for purposes of the SSI program.

The other factor that Social Security must evaluate to determine your financial eligibility are your resources. Resources are things you own that can be used to pay for food or shelter: for example, money in bank accounts. Again, there are many items that you may believe to be resources that Social Security actually excludes from their calculations, such as the value of the home you live in. Therefore, even if you own your home or one personal vehicle, you may still be financially eligible for SSI.

What Is Ssdi And What Does It Do

SSDI is government insurance that pays benefits to disabled individuals and possibly to their family members. To qualify for SSDI, a person needs to have accumulated years of work credits like the work credits required to collect Social Security, as these credits are earned by paying Social Security taxes. A person can acquire up to four credits per year. Additionally, to qualify for SSDI, one must:

- Be unable to work because of a medical condition that will result in death or that will last for a minimum of one year

- Meet current SSA disability definitions

- Be younger than the SSAs full retirement definition.

Like Social Security, SSDI is funded through social security taxes that are paid by both employees and employers. That said, one could still be eligible for SSDI if a person suffers a disability before age 22 or for other more arcane reasons.

Is Di Out Of Sync With The Americans With Disabilities Act

The Social Security Advisory Board, which was created by Congress to advise the President, the Congress, and the Commissioner of Social Security, posed the question of whether the DI program and its test of disability is out of sync with the Americans with Disabilities Act . In April 2004, the Academy drew on findings of its Disability Policy Panel report, Balancing Security and Opportunity, to testify before the Board as follows:

The need for a disability wage-replacement program does not go away because we have the Americans with Disabilities Act . Nor is the need for such a program eliminated by advances in medicine, changes in the demands of jobs, new assistive technology, or other environmental accommodations. These developments may increase employment opportunities for some categories of individuals with disabilities. For example, the ADA expands opportunity for people who have highly valued skills whose main impediments to work had been based on discrimination, architectural barriers, or other impediments that the ADA alleviates. But other individuals may face increasing impediments to work as the work environment and demands of work change. For example, in an increasingly competitive world of work, emphasis on versatility and speed may impede employment prospects for people with mental impairments. Because the phenomenon of work disability will remain with us in a competitive economy, wage replacement programs remain essential.

You May Like: Social Security Administration Des Moines Iowa

How Social Security Benefits Affect Your Taxes

Once you start receiving Social Security benefits, depending on your total income and filing status, those payments may be taxable.

Those filing single with a combined income under $25,000 will not have their SS benefits taxed. Incomes between $25,000 and $34,000 will have benefits taxed at 50%. For incomes over $44,000, benefits will be taxed at 85%.While not a Social Security tax, the Additional Medicare Tax is applicable to those who earn more than $200,000. AMT is taxed at a rate of 0.9%.

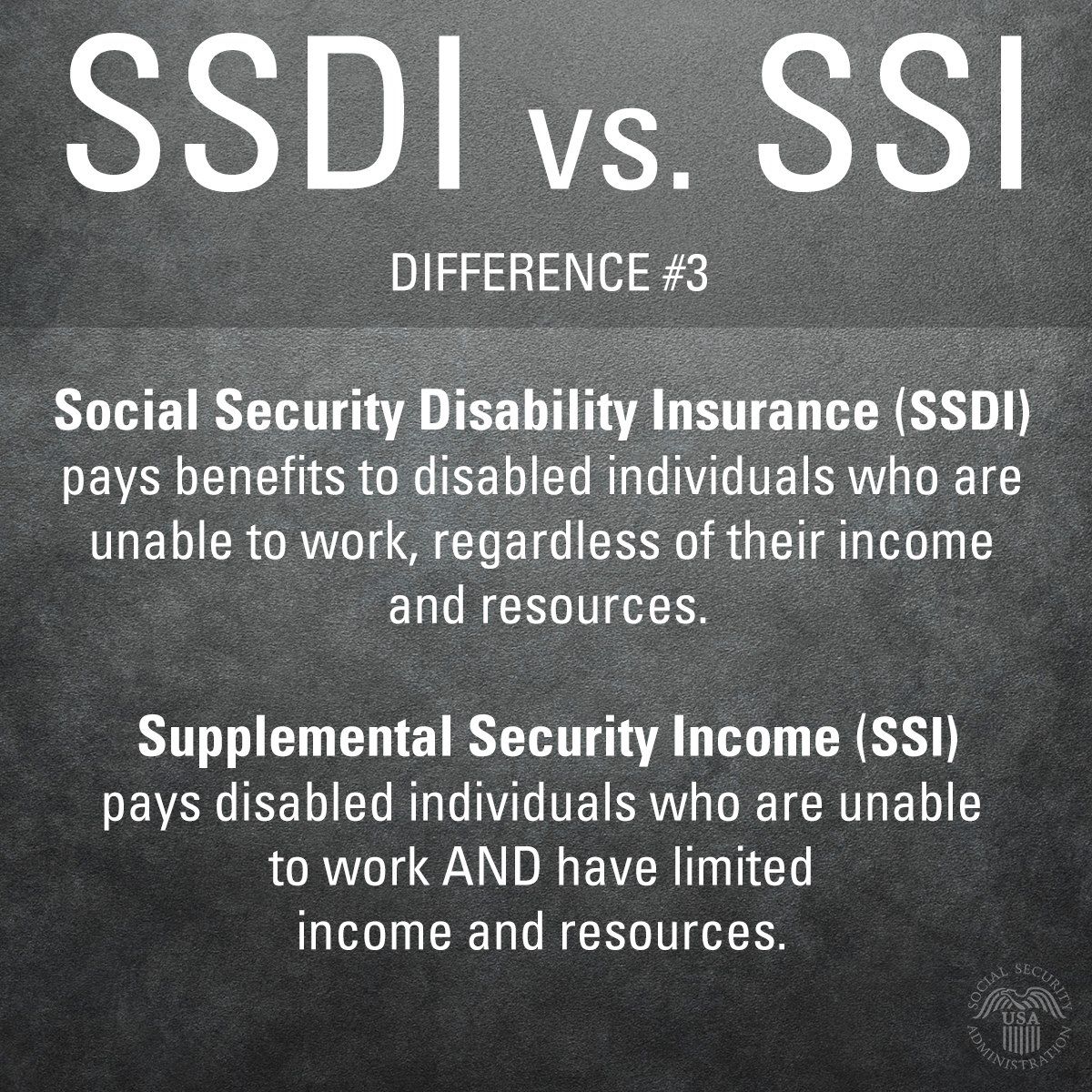

What Is The Difference Between Ssi And Ssdi

The main difference is that the evaluation of SSI is based on age / impairment and restricted income and assets, while the determination of SSDI is based on impairment and job credits. The financial policies are the main difference. Furthermore, a recipient of SSI should automatically apply for Medicaid in most cases. After 2 years of obtaining disability benefits, a person with SSDI will automatically qualify for Medicare.

Recommended Reading: Social Security Office Evansville Indiana

Get Help From An Experienced Ssi Claims Lawyers In Jacksonville

The Social Security and Supplemental Security Income Disability programs are the largest of several Federal programs that provide assistance to people with physical and/or mental disabilities. SSDI pays benefits to you and certain members of your family if you have worked long enough and paid Social Security taxes. SSI pays benefits solely based on financial need.

As noted, initial claims for these benefits are often denied by the SSA due to paperwork errors or insufficient medical evidence verifying a disability. There are a number of levels to the appeals system that leaves most people overwhelmed and frustrated.

At RITE Law, we started the firm for one reason to help those in Florida and elsewhere have the resources of a firm that was big enough to fight but small enough to care. At Rudolph, Israel, Tucker & Ellis , we have the resources and experience to go to trial when it is necessary, and we have the wisdom to advise you appropriately.

Without help from the Social Security disability benefits attorneys in Jacksonvilleon the RITE team, trying to make insurance claims can lead to a lot of frustration and time and money lost. When you turn to our firm, we spring into action, making sure every detail of your claim is addressed. We answer any questions you have and stand in your corner to give you the best opportunity to receive all the benefits you deserve.

How Has The Covid

Working people with disabilities experience disproportionate job loss, compared to workers without disabilities, during economic downturns,39 and SSI applications generally increase when the unemployment rate increases . This trend held during the Great Recession and subsequent economic recovery.40 One exception to the general trend is the period from 2003 to 2007, when SSI applications continued to rise despite falling unemployment.41 Possible explanations for this anomaly include factors such as the lagged effect of federal welfare reform leading TANF enrollees to switch to SSI and persistently high poverty rates.42 The same study also found that the likelihood of applying for SSI significantly increases during extended periods of high unemployment.43

Figure 7: Percent change in SSI Applications Filed by Adults Ages 18-64 and U.S. Unemployment Rates, 1991-2019

You May Like: Social Security Appointment Name Change

Health Care Coverage For Disability Beneficiaries

Individuals who are receiving Social Security disability insurance become eligible for Medicare after receiving DI for two years. Low-income individuals who receive SSI are generally eligible for Medicaid immediately. Health coverage is critically important for those receiving disability benefits, because individual insurance policies are likely to be unaffordable or unavailable to them. According to the Academy report, Balancing Security and Opportunity: The Challenge of Income Disability Policy, Many people with chronic health conditions or disabilities are at risk of very high health care costs. They often cannot gain coverage in the private insurance market, and even when they do have private coverage, it often does not cover the range of services and long-term supports that they need. Current gaps in health care coverage for people with disabilities limit their labor market options in several ways.

Is Social Security Getting A $200 Raise Per Month

We are pushing to include in Congress’ next stimulus package a $200 increase in the monthly benefit for all Social Security, Veterans, and Supplemental Security Income beneficiaries through the end of 2021. The two estimated that such a supplement would add $4,000 in the pockets of seniors and people with …

Don’t Miss: Social Security Office Griffin Ga

Qualifying For Ssi Benefits

The only way to know if you will qualify to receive Social Security benefits is to know what qualifications are required. When you are applying for benefits the number one thing an SSA worker will look at is your work history. Many people try to qualify for benefits but do not have work records available to the SSA. Unfortunately, this can lead to disqualification for people who have no work history. There are other qualifications that must be met before one can become qualified for benefits.

Some qualifications required by the Social Security Administration for benefits include working for a specific company or union for a specified period of time or having a job that pays at least the minimum wage. Another qualification required for many benefits programs is having a high school diploma or the equivalent. Some disability insurance companies require proof of work experience and education as well. These qualifications are listed on an individualized application that is filed with the local office.

One thing you should know about filing an application with the SSA is you will have to wait a while for the results. The SSA has a vast bureaucracy, and each case is processed slowly. Usually, it will take about 6 months to a year to be approved, but this is only standard. The longer it takes to process your claim the higher your chances of receiving a check. This is another reason why it is important to have as much work experience as possible when applying for SSI.

What Is Ssi And What Does It Do

SSI is meant to provide monetary assistance to Americans with very low incomes who are over 65, have a qualifying disability, or are blind. Additionally, to qualify for SSI, one must:

- Have a low income.

- Have very limited resources.

- Be a U.S citizen or a qualifying alien.

- Live in one of the 50 American States, the District of Columbia, or the Northern Mariana Islands.

- Not leave the United States for 30 or more consecutive days.

- Not be incarcerated or hospitalized.

- Meet other requirements.

Additionally, those applying for SSI will have to pass a means test that shows that they have extremely limited income and less than $2,000 of financial assets. A car and a primary residence do not count against this limit amount. In 2022, a monthly income of no more than $1,767 is necessary to qualify for SSI benefits.

Recommended Reading: Social Security Requirements For Disability

Whats The Difference Between Ssi And Regular Social Security

Learn how Social Security benefits differ from Supplemental Security Income, and how both federal benefits programs compare.

The Social Security Administration manages various safety net programs for qualified retired workers, people with disability, as well as spouses, children, and survivors of eligible workers. Two of the most prominent benefits programs are Social Security benefits and Supplemental Security Income.

Social Security benefits are payments made to eligible retired workers, people with disabilities, and dependents of eligible workers. You must have paid Social Security taxes to qualify for these benefits. On the other hand, Supplemental Security Income payments are paid to older retired workers and people with disabilities who have limited income and resources. You donât have to have worked in a covered job to be eligible for SSI benefits.

Whats The Difference Between Ssdi And Ssi

There are two federal programs that individuals can apply for when they become disabled and are unable to work. Figuring out the difference between these two programs can often be confusing. Here are some basic similarities. Both of these programs Social Security Disability Insurance and Supplemental Security Income are funded by the federal government to provide financial support for individuals who are disabled for 12 or more months. In both programs you are required to prove that you are not able to work as a result of a physical or mental condition. For both programs, you must also show that your condition is expected to last for at least 12 months or result in death.

So what is the difference between SSDI and SSI? The major difference between SSDI and SSI is the non-medical proof you must show to qualify.

SSDI is a federal insurance program of the government that is funded by your payroll taxes. That means if you are working and paying taxes, you are paying into this federal insurance program. Your eligibility for SSDI is based on whether you have worked for enough time and paid enough into the system. Generally, if you have worked for 5 of the past 10 years as of the date of onset of disability, you will qualify for SSDI. Younger claimants need to work for less time to become insured by SSDI. Your benefit amount is based on your earnings. By and large, the more you earned, the more benefits you will receive if you qualify for SSDI.

Recommended Reading: Lawyer For Social Security Disability

Which Pays More Ssi Or Ssdi

Home » FAQs » Social Security Disability » Which Pays More SSI Or SSDI?

The Social Security Administration provides two programs for those who are disabled: Supplemental Security Income and Social Security Disability Insurance . Those who qualify for disability benefits might wonder which one pays more.

First, lets talk about what SSI and SSDI cover. SSI benefits can provide extra money to low-income, low-asset adults and disabled children. SSDI is available for those who have earned Social Security-covered income and can no longer work.

Both SSI and SSDI can provide necessary income to those who need it. The amount that each pays depends on the individual.

What Are The Most Common Disabilities For Di Recipients

Many beneficiaries have multiple conditions. Of the nearly 9 million individuals receiving disabled worker benefits at the end of 2014, 31 percent had mental impairments as the main disabling condition, or primary diagnosis. Musculoskeletal conditions such as arthritis, back injuries and other disorders of the skeleton and connective tissues were the main condition for 32 percent of the disabled workers. These conditions were more common among beneficiaries over the age of 50. About 8 percent had conditions of the circulatory system as their primary diagnosis. Another 9 percent had impairments of the nervous system and sense organs. The remaining 20 percent includes those with injuries, cancers, infectious diseases, metabolic and endocrine diseases, such as diabetes, diseases of the respiratory system, and diseases of other body systems. Moreover, many beneficiaries have life-threatening conditions: about 1 in 5 men and nearly 1 in 6 women who enter the program die within five years.

Also Check: Can I Go To Any Social Security Office

How Are The Two Alike

There are some similarities between SSI and Social Security benefits as well.

1. Administration. SSA administers both programs.

2. Monthly payments. Both programs pay benefits on a monthly basis.

3. Disability standard. The standard for disability is the same in both programs, though the definition of disability for SSI purposes is slightly different for children.

In sum, the goal of the SSA is a noble one to help those in our country who are struggling and need a little assistance. Of course, as with any government program, however, there is a considerable amount of paperwork that needs to be done.

Because there is a lot riding on the information you provide to the SSA to obtain SSI benefits, you should consider getting the help of a qualified SSI claims lawyer in Jacksonville to help you navigate the application process.

Is The Social Security Definition Of Disability Out Of Date

The Social Security Advisory Board has asked whether the Social Security definition of disability should be changed in some fundamental way. The Academys Disability Policy Panel studied this question at length and reached the following conclusions:

Programs for people with disabilities should use definitions of disability as eligibility criteria that match the purpose of the program. A single, one-size-fits-all definition would not suit the varied needs of the highly diverse population of people with disabilities, nor would it match the particular purposes of different programs.

If the purpose of the program is to establish civil rights protections, a broad definition of disability, such as in the ADA is used: Disability means a physical or mental impairment that substantially limits one or more major life activities, a record of such an impairment, or being regarded as having such an impairment.

If the purpose is to define eligibility for vocational rehabilitation, then the legal definition of eligibility is based on need for and likelihood of benefiting from such services.

Programs that provide personal assistance or long-term care services generally define eligibility in terms of the need for those particular services, such as need for assistance with activities of daily living.

The Social Security test of work disability is very strict. A less strict test of inability to work would benefit people with partial disabilities and it would cost more.

Recommended Reading: Social Security Office Hartford Connecticut

How Much Does The Di Program Cost

In 2016, the disability insurance trust fund received $160 billion, mainly from the 1.185 percent tax on wages that workers and employers both pay. Total payments from the DI trust fund were $146 billion, mainly for benefits to disabled workers and their families, meaning that income exceeded outgo by $14 billion in 2016. The cumulative assets in the disability insurance trust fund totaled $46 billion at the end of 2016. Administrative expenses were 1.9 percent of outgo from the DI fund, and the remaining portion paid for benefits.

How Much Is The Disability Benefit

The disability benefit is linked through a formula to a workers earnings before he or she became disabled. The following figures show how the disability insurance benefits compare to prior earnings for a worker who became eligible for benefits in 2014 at age 55.

| Earnings Before Disability | Annual DI Benefit |

|---|---|

| 26% |

*Average indexed earnings

The average benefit paid to disabled workers in June 2017 was $1,172 a month or about $14,064 a year.

Read Also: Social Security Fraudulent Activity Call