Social Security Disability Benefits Play A Key Role

Social Security disability benefits are a critical piece of the SSAs operating activities and provide an essential financial bedrock for those unable to work. Having a disability can be both financially and emotionally draining, so its imperative that a backstop exists to support those unable to earn on their own.

If you are living with a disability, consult a medical professional to determine if your circumstances render SSDI payments necessary. Dont be shy about asking questions if you arent sure.

The Motley Fool has a disclosure policy.

With A Dependent Spouse Or Parent But No Children

Find the dependent status in the left column that best describes you. Then look for your disability rating in the top row. Your basic monthly rate is where your dependent status and disability rating meet.

If your spouse receives Aid and Attendance benefits,be sure to also look at the Added amounts table, and add it to your amount from the Basic monthly rates table.

| Dependent status |

|---|

Recommended Reading: Tax Benefit On Personal Loan

Fact #: Most Older Beneficiaries Rely On Social Security For The Majority Of Their Income

Social Security provides the majority of income to most older adults. For about half of this group, it provides at least 50 percent of their income, and for about 1 in 4 older adults, it provides at least 90 percent of their income, according to multiple surveys and the Census Bureau study.

Most retirees have modest incomes, save for some at the top of the income spectrum. Most low-income older Americans have very little pension income, if any, according to the U.S. Census Bureau study. Among retiree households in the bottom third of the income distribution, most received no pension income. About 1 in 4 of these households lived on less than $20,000 in 2015, and about half lived on $50,000 or less, according to an Social Security Administration study that also matches survey and administrative data.

Read Also: Divorced Military Spouse Retirement Benefits

Read Also: Social Security Administration Springfield Mo

Are Social Security Payments Taxed

Yes and No. First, we are attorneys and not CPAs. Any tax question should be directed at your CPA or your tax preparer.

Generally, the IRS will tax your SSDI benefits when half of your benefits, plus other income, exceeds an income threshold on your tax filing status.

If youre filing single, head of household, married filing separately, or qualifying widower, the threshold is $25,000.

If youre filing married and jointing, that threshold is $32,000. And if youre filing separately but lived with your spouse during the tax year, the threshold is $0

Supplemental Security Income Benefits are not taxable.

Note: Visit irs.gov to learn additional information on paying taxes social security benefits.

What Are The Maximum Social Security Disability Benefits In Mobile Alabama

Social security disability benefits are the payments that are provided to people who are unable to work due to a physical or mental condition. The federal government provides these benefits and they are available to residents of Mobile, Alabama.

The maximum social security disability benefit that an individual can receive is $2,788 per month. This amount is based on the individuals earnings history and the number of years that they have worked.

Recommended Reading: South Jordan Social Security Office

A New Tax System Act 1999

Payments made under the A New Tax System Act 1999 include:

- Family Tax Benefit Part A â for parents or carers to help with the cost of raising children.

- Family Tax Benefit Part B â for single income families or sole parents.

- Maternity Immunisation Allowance â for fully immunised children or those exempt from immunisation

- Child Care Benefit â for families to help with the cost of child care.

- Schoolkids Bonus for families for the cost of education for children in primary and secondary school.

Ssd Benefits And Investment Income

Income can be earned or unearned. Earned income is money that you make while actively working, for either an employer or yourself. It includes wages, salaries, tips, bonuses, net earnings from self-employment, contract work, certain royalties, and union strike benefits. This type of income counts against your monthly maximum for SSD eligibility.

Unearned income is money that you make or receive through something other than employment or active work, and it doesnt count against the monthly income limits.

Examples of unearned income include:

Some of our clients who receive SS disability checks also have investment income from financial documents , rental property, or other passive income sources, says Gantt.

Keep in mind that if you have investment income, the SSA is likely to want a closer look. Current technology helps flag questionable investment income info, says Gantt. I tell my clients who move in investment arena to expect questions and review.

One way to prepare for questions is to use an affidavit. Financial investments are generally passive by nature. For true passive income earnings, we encourage SSD clients to be prepared to sign affidavits that they took no action on the investment income subject that could convert the income to the earned legal category, says Gantt.

You May Like: Social Security Income Phone Number

Start Benefits At 70 Not At Full Retirement Age

You can start your retirement benefits as early as age 62, but doing so will reduce your monthly benefits by around 30%. Waiting past full retirement age can allow you to accrue delayed retirement credits, thus increasing your monthly payment. Your delayed retirement credits will max out at age 70. So, starting your benefits at 70 will result in the highest possible benefit amount. If you want to get the maximum amount possible from Social Security, you will need to wait until age 70 to start your benefits.

Is Real Estate Income Earned Or Unearned

Income from real estate investments can count as earned or unearned, depending on the situation. If you want to invest in real estate, you can buy real estate stocks, funds, and REITs without jeopardizing your benefits, as these investments provide a passive income source.

But what about buying physical real estate, such as a rental property? Actually, ownership of rental property without any activity has been approved and authorized in some cases we handled, says Gantt. However, most landlord-owners are also taking actions that push resultant income from passive to earned income.

Because real estate investments can be a bit of a gray area, we encourage clients to determine the passive vs. earned income appearance and proof considerations before starting investment income, says Gantt. are cautioned that active participation in rental property can lead to a finding that the existing disability has lifted, and are no longer SSD eligible.

If you are interested in investing in physical real estateand preserving your SSD benefits along the wayplan on speaking with an experienced disability attorney who can help ensure that any income remains passive. Otherwise, its best to stick with real estate stocks, funds, and REITs.

Don’t Miss: How To Get Taxes Taken Out Of Social Security

How To Maximize Benefits

To get the maximum benefit, you need to take three main steps.

Firstly, youll want to make sure that youve worked for at least 35 years.

If not, zeros will be averaged into your calculation for each year youre missing income under that threshold.

You must also earn the maximum wage taxable or more for at least 35 years.

The maximum wage taxable is $147,000 in 2022, but it changes each year as salaries increase.

Once your earnings exceed that wage cap, you dont get taxed on it for Social Security.

The third but perhaps easiest way to boost your benefits is to delay your claim.

You can start claiming at age 62, but this would result in a permanent 30% reduction of your benefits.

If your full retirement age is 66, youll get 100% of your monthly benefit if you start claiming then.

Or if you delay benefits for an additional 12 months, youll receive 108% while youll get 132% of the monthly benefit if you wait until 70.

You cant earn delayed retirement credits beyond age 70, so theres no point to delay your claim further than this.

You can also use the Maximize My Social Security tool by professor and economist Laurence J. Kotlikoff to help you boost your benefit amount as well.

You May Like: What Are Tax Benefits Of Roth Ira

Situations That Can Change The Maximum Benefit

As we just saw, if youre a person who lives alone, the maximum SSI benefit is $1,040.21 . The maximum is different if you are an eligible couple, if you live in someone elses household and you dont pay the full costs of food and shelter, or if you live in an institution, such as a hospital, nursing home, or prison.

Read Also: Social Security Disability Rules After Age 60

How Much Can I Earn On Social Security Disability In 2021

| Comments

Before you apply for Social Security Disability Insurance benefits, one of the many considerations youll need to make is whether disability benefits alone will provide you with enough financial support. The maximum disability benefit amount you can receive each month is $3,148. However, the average beneficiary will receive somewhere closer to $1,277 per month.

Of course, qualifying for SSDI benefits is contingent upon proving that you have a disabling condition which prevents you from making substantial income. But just because you are receiving disability benefits doesnt mean you arent allowed to generate any income. Read on to find out about 2021 SSDI income limits and how to maximize your monthly earnings and benefits.

The Maximum Social Security Benefit Amount

So, what is the maximum Social Security benefit? The maximum Social Security benefit amount in 2022 is $4,194. This number is published by the Social Security Administration, and this is the highest retirement benefit that you can earn each month. This amount can only be achieved by those who accrue delayed retirement credits by waiting until age 70 to start their benefits.

The maximum amount that someone can receive starting at full retirement age is $3,345, and the maximum amount for someone starting their benefits at age 62 is $2,364. In addition to your retirement age, other factors will also affect whether or not you earn the maximum. The number of years that you work and pay Social Security taxes will affect your payment amount as well as how much money you make while you are working.

While the maximum amounts discussed above are possible, the average American receiving Social Security retirement benefits gets far less than this. The average Social Security payment for a retired worker in August 2022 was $1,672.76. Since most beneficiaries are receiving far less than the maximum amount, most people need some tips on how to qualify for the maximum benefit amount.

Also Check: E Verify Social Security Number

Estimating Your Social Security Disability Amount

In 2022, the average SSDI payment for an individual is $1,358, but almost two-thirds of SSDI recipients receive less than that. And only 10% of SSDI recipients receive $2,000 per month or more.

The 2022 average monthly benefit for an SSDI recipient who has a spouse and children is $2,383.

Because benefit amounts depend on lifetime earnings, there’s a large range in how much Social Security pays. For instance, let’s look at age 55, the most common age disabilities start. For 55-year-olds who have worked their entire lives, Social Security typically pays $1,000 to $2,700. The benefits pay chart here shows you the ranges based on income.

Within those ranges, the amount you’ll receive will depend on the following:

- your average income over 35 years

- whether you paid self-employment taxes if you owned your own business or freelanced

- whether you worked in any jobs that didn’t pay into the Social Security system , and

- whether you took any years off work for child-rearing or long-term illness.

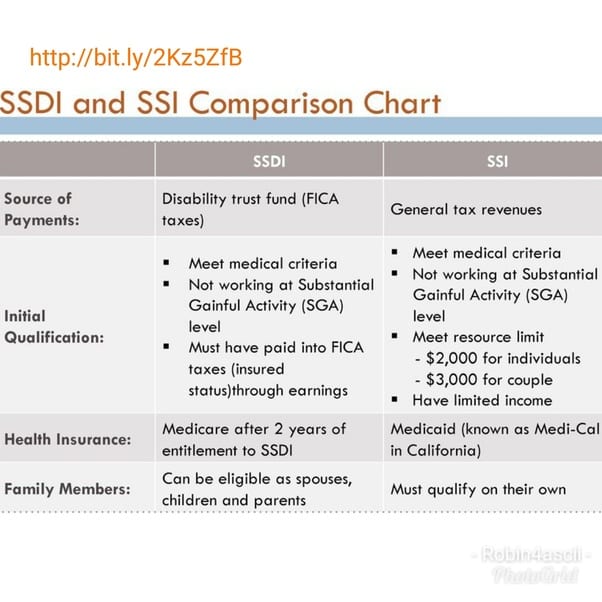

Health Care Coverage For Disability Beneficiaries

Individuals who are receiving Social Security disability insurance become eligible for Medicare after receiving DI for two years. Low-income individuals who receive SSI are generally eligible for Medicaid immediately. Health coverage is critically important for those receiving disability benefits, because individual insurance policies are likely to be unaffordable or unavailable to them. According to the Academy report, Balancing Security and Opportunity: The Challenge of Income Disability Policy, Many people with chronic health conditions or disabilities are at risk of very high health care costs. They often cannot gain coverage in the private insurance market, and even when they do have private coverage, it often does not cover the range of services and long-term supports that they need. Current gaps in health care coverage for people with disabilities limit their labor market options in several ways.

Read Also: Financial Help For Seniors On Social Security

Waiting Til Age 70 Yields The Highest Benefit But Only Big Earners Get The Max

Institutional Investor NewsFamily Wealth Report

A Tea Reader: Living Life One Cup at a Time

The maximum Social Security retirement benefit that you can receive depends on the age when you begin collecting and your earnings history, among other factors. In 2022, the maximum is $3,345 per month for someone who files at full retirement age at age 66. But $4,194 is the absolute highest benefit for those who qualify and delay claiming until age 70.

Recommended Reading: 529 Plan Texas Tax Benefit

How To Calculate Social Security Ssdi Benefits

To qualify for Social Security Disability Insurance benefits, you must have worked a minimum of five years within ten years, paying taxes into Social Security. You will not qualify for this benefit if you have not worked the equivalent of five full-time years or you have not paid into the system.

SSDI can get complicated. Two important questions when looking at SSDI benefits are:

Note: Just like any other insurance, you will eventually stop being insured once you stop paying for it.

Any disability insurance you qualify for through working and paying into the system will typically lapse five years after you stop working. To be eligible for DIB, you must prove you met the rules of disability before your disability insurance lapses. These timeframes are calculated for each individual based on their specific work history.

Social Security uses a formula to determine how much you should receive as your monthly SSDI benefit. SSDI payments average is $1,358 per month. The SSA has an online benefits calculator that you can use to estimate your monthly benefits.

The monthly SSDI you receive is based on your lifetime earnings paid into Social Security taxes. Social Security uses your average indexed monthly earnings or AIME to begin the process of calculating your monthly benefit.

There are several options on how you can find out what your PIA is from SSA:

Recommended Reading: How Much Of My Social Security Is Taxable In 2021

How Do You Know How Much Disability You Will Receive

You can see how much you are likely to receive if you are found disabled by looking at your MySSA account. This is a good rough idea of your monthly benefit amount.

This account will also tell you how much your eligible dependents can receive as well. However, if your date of disability was in the past, the account will not tell you precisely.

Disability Income From Other Sources

If you are receiving disability income from other sources, such as a private insurer or a provincial/territorial program, you may still be able to receive the CPP disability benefit. However, these other sources may change their payments if you are approved for the disability benefit through the Canada Pension Plan.

Contact your insurance company or social assistance program for details about your case.

Read Also: Social Security Administration San Diego

How Does Cost Of Living Affect Social Security Disability Payments

The Social Security Administration makes payment adjustments each year to people receiving Social Security disability benefits. The adjustment payments made through Social Security retirement, Social Security Disability Insurance , and Supplemental Security Income programs reflect cost-of-living adjustments. This COLA increase is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers. For 2021, the COLA adjustment is 5.9% for 2022.

Premium: How Much Makes Sense

A big deterrent to the purchase of private long-term disability coverage, especially for those starting out at an older age, is the premium, particularly when viewed in contrast to the benefit that may be received. Suppose a policy with a maximum two-year benefit coverage that will pay out $3,000/month or a maximum of $72,000 overall. How many years would it make sense for a 50-year-old to pay a premium of $3,000/year for this coverage? Would it make more sense to simply save $3,000/year instead, as a form of self-insurance? These are difficult choices to make. Ideally they would be made with the assistance of a financial advisor who can evaluate the whole financial picture and gauge the risks.

Also Check: Social Security Office Williamsburg Va

Ssa Announces New 2023 Maximum Social Security Benefit

You may have seen the cost of everything going up the past year. High inflation has led to the highest Social Security COLA in over 40 years.

getty

Maximizing your Social Security income should be a key part of your retirement plan. As Americans often enjoy longer retirements, the guaranteed lifetime income for Social Security is an even more important part of maintaining your financial security as you age. With a near record Social Security cost-of-living adjustment for 2023, the maximum Social Security benefits will increase again next year.

Read Also: How To Apply Social Security Retirement Benefits