Why Did I Get Two Social Security Checks This Month 2022

Asked by: Colton Kuhlman

The increase in these checks comes thanks to the fact that it is expected to help the beneficiaries so that they do not suffer losses as a result of inflation. In this way they help people maintain their purchasing power. COLA 2022 payments are delivered the second Wednesday of each month.

The Best Way To Make An Signature For A Pdf File On Ios Devices

To sign an application for extra help with medicare social security social security right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your application for extra help with medicare social security social security: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is equally efficient and powerful as the online tool is. Connect to a smooth web connection and begin executing documents with a legally-binding signature within a couple of minutes.

What Is The Medicare Part B Premium For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

You May Like: Social Security Windfall Elimination Provision

Ssa Extra Help Program

The Social Security Administrations Extra Help program is a need-based financial assistance program for patients on Medicare. Many people qualify for Extra Help and dont even know it.

Why Apply for Extra Help?

The Extra Help program may provide many benefits for patients struggling to cover the cost of their medications, including:

- Benefits estimated to be worth about $4,900 per year in drug coverage

- Copays between $0 and $8.50 for 2019

- No coverage gap

- No penalties for late Medicare Part D enrollment

Patients who are not enrolled in the Extra Help program and who are late to enroll for a Medicare plan will have a penalty applied to their monthly premium.

Extra Help Eligibility

Patients who are eligible for both Medicare and Medicaid are automatically enrolled in the Extra Help program by the Social Security Administration, and will receive a benefits letter in the mail.

If you arent automatically enrolled, you may still be eligible for Extra Help if you:

- Live in one of the 50 states or the District of Columbia

- Have resources limited to $14,390 for individuals, or $28,720 for married couples living together

- Have a monthly income limited to $1,581 for individuals, or $2,134 for married couples living together

Some people with higher incomes may still qualify for Extra Help. Visit the SSA website for more details.

How to Apply for Extra Help

Complete the online application for Extra Help at .

Social Security Bill Would Give Seniors An Extra $2400 A Year Here’s How It Would Work

Seniors and other Social Security recipients in the U.S. are being hit hard by inflation, which has outpaced increases in their benefits this year. Now, some lawmakers have a plan to boost Social Security payments by $2,400 per recipient annually, while also shoring up the program financially.

The Social Security Expansion Act was introduced June 9 by Rep. Peter DeFazio, a Democrat from Oregon, and Senator Bernie Sanders, an Independent from Vermont. The plan comes after the Social Security Administration earlier this month said Americans will stop receiving their full Social Security benefits in roughly 13 years without actions to shore up the program.

Social Security recipients receive one cost-of-living adjustment, or COLA, each year, which is based on inflation and is supposed to keep their benefits in line with rising prices. But this year, beneficiaries are seeing their purchasing power wane as inflation overtakes their latest COLA increase of 5.9%. Inflation in May rose 8.6% from a year ago, a four-decade high that pushed up the cost of food, shelter, energy and other staples.

The new bill would seek to lessen the strain on people collecting Social Security by boosting each recipient’s monthly check by $200 an annual increase of $2,400.

Here’s what to know about the Social Security Expansion Act.

Recommended Reading: Beaumont Tx Social Security Office

Would A Tax Increase Pay For All This

The bill would increase the Social Security payroll tax on higher-income workers. Currently, workers pay the Social Security tax on their first $147,000 of earnings. To be sure, most Americans earn less than that. But higher-income workers who make more than $147,000 annually don’t pay the Social Security tax on any earnings above that level.

Under the bill, the payroll tax would kick in again for people earning above $250,000. Only the top 7% of earners would see their taxes go up as a result, according to DeFazio.

However, there’s one quirk about this arrangement: It would create a “donut hole” in which earnings between $147,000 and $250,000 would not be subject to the payroll tax, Shedden noted.

The bill would also extend the Social Security payroll tax to investment and business income, an issue that could face resistance. “I’m leery about that,” she said. “Social Security was set up to be based on contributions on earned income, and this mixes up the basket of earned and unearned income.”

Extra Help For Prescription Drug Coverage

Extra help for prescription drug coverage is available for people with Medicare who have limited income and resources. If eligible for extra help, Medicare will pay for almost all prescription drug costs. Extra help provides a subsidy based on the amount of income and resources a person has.

Full Subsidy Benefits from Extra Help:

- Full premium assistance up to the premium subsidy amount

- Nominal cost sharing up to out-of-pocket threshold

- No coverage gap

Other Low Income Subsidy Benefits from Extra Help:

- Sliding scale premium assistance

- Reduced coinsurance

- No coverage gap

An individual who has Medicare and Medicaid does not need to apply for extra help from Social Security. An individual who is eligible for the Medicare Savings Program does not need to apply for extra help from Social Security. The MSP-eligible individual’s information is sent to CMS automatically for the extra help.

Eligibility specialists ask, “Can I screen you for eligibility for Medicare Savings Program since certification would include eligibility for extra help?”

If the caller does not want to be screened for MSP, refer the caller to the Centralized Benefit Services, 1-800-248-1078, for completion of subsidy application.

If an individual thinks personal information is being misused, call 1-800-MEDICARE .

Apply for extra help or get more information about extra help subsidy by calling Social Security at 1-800-772-1213 or visiting www.socialsecurity.gov.

Read Also: Cleveland County Social Security Office

How Do I Apply

To apply, youll need to complete Social Securitys application by:

- Applying online

- Applying at your local Social Security office

If you need additional support with completing this application, a caregiver can help on your behalf or by calling the number above. Once you apply, your application will be reviewed by Social Security, and then they will send you a letter to let you know if you qualify for Extra Help.

Why Did I Get An Extra Payment From Social Security This Month

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

Recommended Reading: Social Security Office Hartford Connecticut

More Help For Children Of Deceased Workers

Some people may not be aware that Social Security provides benefits to children of disabled or deceased workers if they are full-time students.

The legislation would raise the eligibility age for students to collect benefits to 22, provided the individual is a full-time student in college or a vocational school. Currently, the program ends for children of disabled or deceased workers when they turn 19 years old or before that age if they are no longer a full-time student.

The lawmakers say extending this benefit would help ensure that the children of deceased or disabled parents can continue their education beyond high school.

The New Tax All Workers In Spain Will Pay In 2023

From 2023, all salaried or self-employed in Spain will have to pay an extra tax to help fill up the country pension fund. Find out how much it will be and why Spanish authorities are introducing it.

From January 1st 2023, all workers in Spain, whether salaried or self-employed, must pay a new tax through their social security contribution to help fill up Spains pension fund a move that will affect over 20 million workers.

The Intergenerational Equity Mechanism , as its known, will be a small social security contribution intended to help balance pension financing between generations.

With Spains rapidly ageing population, declining birth rates, high levels of unemployment, the impending retirement of the baby boom generation and seriously scarce pension reserve funds, the Spanish state needs to recoup pension funds quickly in order to ensure the costs of future retirees.

You May Like: Who Can Legally Ask For Social Security Number

What Is Medicare Extra Help

Prescription drug coverage is important for anyone who is eligible for Medicare. But the cost of this coverage stops many people from getting it.

The Extra Help program can help you pay for your Medicare prescription drug costs. In this article youll learn what Extra Help specifically covers and find out if you qualify for this program.

Medicares Extra Help Program

At CenterWell Pharmacy, we understand paying for your prescription medicines can add up quickly throughout the year. This is why we work hard to by offering $0 copays on most generic 90-day prescriptions and finding low-cost alternatives for costly medicines.

However, for some, we understand that you need more help to stay on track with your care. So, we wanted to make sure you knew about Medicares Extra Help program. The Extra Help program provides added financial support to people with limited income and resources, as well as the following benefits:¹

- $0 or reduced drug coverage premiums and lower out-of-pocket costs

- No coverage gap

- No late enrollment penalty for

Recommended Reading: When Will The Social Security Office Open

Would Those Changes Fix The Program’s Funding Shortfall

Expanding the payroll tax would boost the Social Security Administration’s trust fund, ensuring its solvency through 2096, according to DeFazio.

Whether this bill moves forward or not, boosting payroll taxes in some fashion is viewed as a way to guarantee that current and future retirees don’t lose benefits after 2035.

For instance, the Congressional Research Service said in a 2021 report that “raising or eliminating the cap on wages that are subject to taxes could reduce the long-range deficit in the Social Security trust funds.”

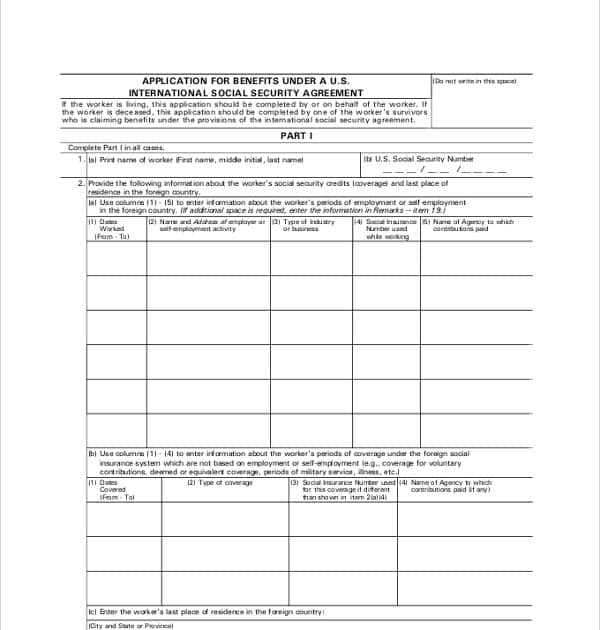

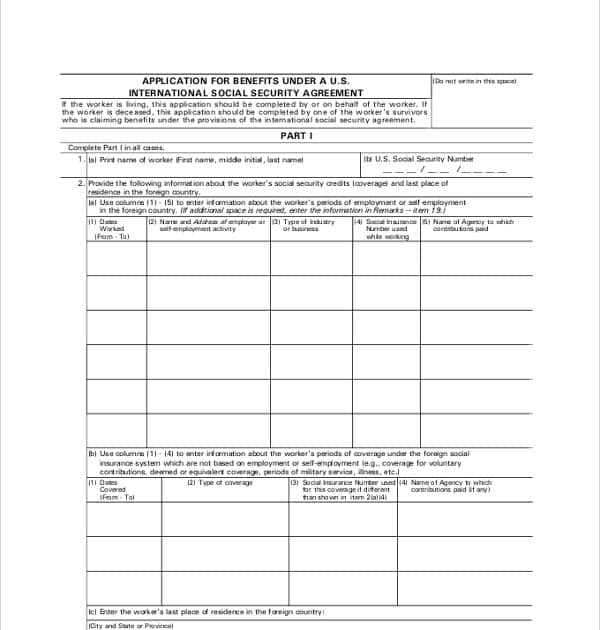

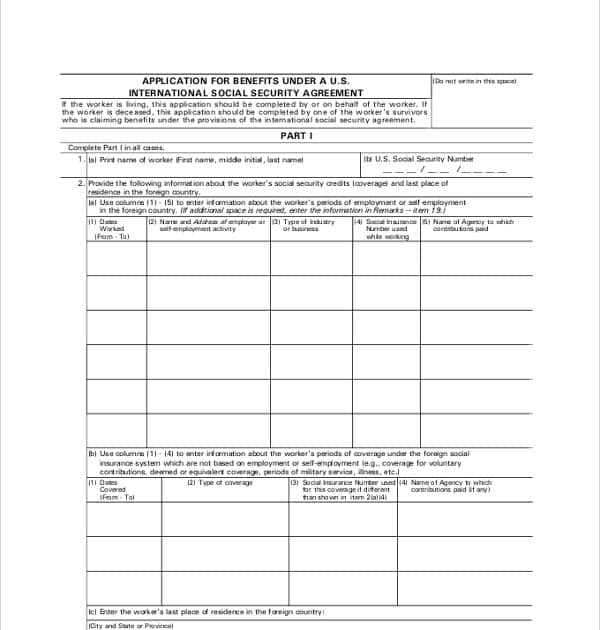

What Is This Application

This is an application for Extra Help with Medicare prescription drug costs. It does not enroll you in a Medicare prescription drug plan. To get that coverage, you will have to enroll directly with an approved Medicare prescription drug plan. If you need information about Medicare Prescription Drug plans or how to enroll in a plan, call Medicares toll-free number 1-800-MEDICARE or visit www.medicare.gov.

Recommended Reading: Does Pennsylvania Tax Social Security

What Is Medicare Limited Income Net Program

Medicare’s Limited Income NET Program, effective January 1, 2010, provides temporary Part D prescription drug coverage for low income Medicare beneficiaries not already in a Medicare drug plan including: Full Benefit Dual Eligible and SSI-Only beneficiaries on a retroactive basis, up to 36 months in the past and.

Who Gets Extra Help Automatically

You’ll get Extra Help automatically if you get:

- Full Medicaid coverage

- Supplemental Security Income benefits from Social Security

You’ll get a letter about your Extra Help. It tells you things like how much you’ll pay, and your new Medicare drug plan, if you don’t have one already.

If you dont automatically get Extra Help, you can apply for it:

Or call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

Recommended Reading: Is The Social Security Office Open To The Public

Do I Qualify For Extra Help With Medicare

You can qualify for the Extra Help program if both of these are true:

- Your income is $19,140 a year or less. Common examples of income are wages, pensions, and Social Security benefits. If youre married, your spouses income is counted, too, and the income limit goes up to $25,860.

- You have $14,610 or less in resources. Your resources are the things you own and how much they are worth. Common examples are your bank accounts, retirement accounts s), and any cash you have. Your home and vehicle are not counted. If youre married, the resource limit for Extra Help is $29,160.

Even if your income and resources are above these limits, you can still apply for the Extra Help program, because you might qualify for partial assistance. You may also be able to receive Extra Help if you meet one of these exceptions:

- You are supporting other family members in your household.

- You live in Alaska or Hawaii.

- You are an American Indian or Alaska Native.

If you have Medicaid or Supplemental Security Income , you are automatically included in the Extra Help program.

The Best Way To Create An Electronic Signature Right From Your Smartphone

Get application for extra help with medicare social security social security signed right from your smartphone using these six tips:

The whole procedure can last less than a minute. You can download the signed to your device or share it with other parties involved with a link or by email, as a result. Due to its multi-platform nature, signNow works on any gadget and any operating system. Use our signature solution and forget about the old days with affordability, security and efficiency.

Also Check: How To Find Someone By Social Security Number

A Benefits Boost: $200 Plus Cola Changes

Anyone who is a current Social Security recipient or who will turn 62 in 2023 the earliest age at which an individual can claim Social Security would receive an extra $200 per monthly check.

There are some additional tweaks that would boost benefits over the long-term. One of the primary changes would be to base the annual COLA on the Consumer Price Index for the Elderly , rather than the current index that the Social Security Administration uses for its calculation the Consumer Price Index for Urban Wage Earners and Clerical Workers .

The CPI-E more accurately reflects seniors’ spending patterns, according to experts on Social Security. For instance, it puts more weight on health care expenses, which can be considerable for senior citizens.

If the CPI-E had been used to index the annual COLA for Social Security, a senior who filed for Social Security benefits over 30 years ago would have received about $14,000 more in retirement than compared with the CPI-W, according to the Senior Citizens League.

The bill would also boost benefits for the lowest income earners in the U.S., who receive benefits under a program called the Special Minimum Benefit. Under the legislation, it would be indexed so that it is equal to about 125% of the federal poverty line, or about $1,400 a month. In 2020, the Special Minimum Benefit paid about $900 per month, according to the Social Security Administration.

What Are The Medicare Extra Help Income And Resource Limits For 2022

You should apply if you think you qualify but your income exceeds the limits. You may still be eligible for Extra Help when your income is over the limit in some scenarios. These cases include when you or your spouse:

- Provide financial support for other family members currently living with you

- Earn money by working

- Reside in Alaska or Hawaii

Resource limits also apply when determining your eligibility. To be eligible for partial Extra Help, your resources must be equal to or below $15,510 as an individual or $30,950 with burial expenses as a married couple living together. Without burial expenses, the resource limit for an individual is $14,010 and $27,950 for a married couple.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

To receive full Extra Help benefits, the resource limit with burial expenses for an individual is $9,900 and $15,600 for a married couple. Without burial expenses, the resource limit for an individual to receive full Extra Help benefits is $8,400 and $12,600 for a couple.

The following examples count as resources:

- Money in bank accounts

| $27,705 |

Read Also: Social Security Office In Portland Oregon