Access To Higher Education

Northampton, Massachusetts is home to five colleges including Amherst College, the University of Massachusetts at Amherst, and Hampshire, Mt. Holyoke and Smith. Retirees can take continuing education classes at all of these schools and participate in the Five College Learning in Retirement program. Additionally, Harvard University has a dedicated program called the Harvard Institute for Learning in Retirement dedicated to continuing education for seniors.

New Hampshire Taxes On Retirees

- Our Ranking: Not tax-friendly.

- State Income Tax Range: None. But there’s a 5% tax on dividends and interest in excess of $2,400 for individuals .

- Average Combined State and Local Sales Tax Rate: None.

- Median Property Tax Rate: $2,129 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

Residents of the Granite State pay no taxes on Social Security benefits, pensions or distributions from their retirement plans because there’s no general income tax. Though New Hampshire imposes a 5% tax on dividends and interest, the first $2,400 is exempt. There are also $1,200 personal exemptions available for residents 65 or older.

There’s no sales tax in New Hampshire, either. So, you can shop to your heart’s content without having to pay any tax .

Here’s the hitch: The median property tax rate in New Hampshire is the fourth-highest in the U.S. Some property tax relief is available for seniors, but the programs, run by towns and cities, are complex and not overly generous.

Age 65 Or Over Exemption

You’re allowed a $700 exemption if you’re age 65 or older before the end of the year. If filing a joint return, each spouse may be entitled to 1 exemption if each is age 65 or over on December 31 of the tax year.

To report the exemption on your tax return:

Recommended Reading: Social Security Pine Bluff Ar

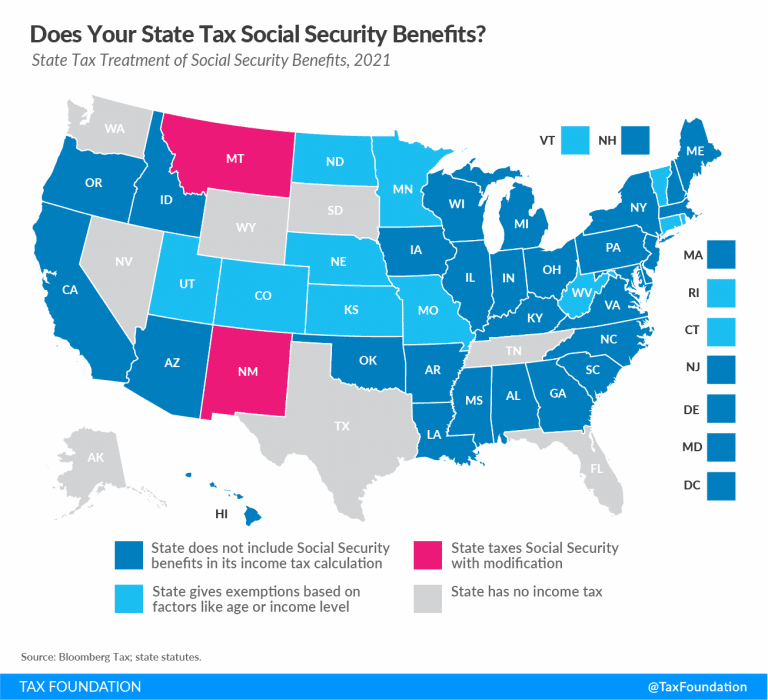

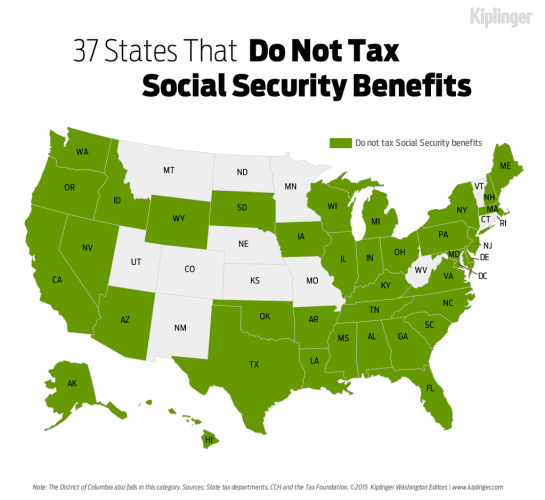

States That Don’t Tax Social Security Benefits

Many people are surprised to learn that they can end up having to pay federal income tax on their Social Security benefits. To add insult to injury, some states also require residents above a certain income threshold to pay state income tax on what they receive from Social Security. Yet the majority of states are kind enough not to tax Social Security, so it’s worth considering the issue in choosing where you want to live after you quit your job and start drawing your benefits.

How Do I Figure Out How Much Social Security Tax I Owe

As part of the process of filling out Form 1040, you’ll calculate your modified adjusted gross income . If you receive Social Security, half of your total benefit will be counted in that calculation. If the MAGI numbers exceed $25,000, for an individual filer, or $32,000, for a couple filing jointly, part of your Social Security income will be taxable.

Recommended Reading: Social Security Calculator Early Retirement

Iowa Taxes On Retirees

- Our Ranking: Least tax-friendly.

- State Income Tax Range: 0.33% 8.53% .

- Average Combined State and Local Sales Tax Rate: 6.94%.

- Median Property Tax Rate: $1,561 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Inheritance tax.

Property taxes in Iowa are no Field of Dreams: theyre as high as the corn. That’s the main reason why the Hawkeye State gets a poor tax rating for retirees. The median property tax rate in Iowa is the 11th-highest in the nation. That certainly doesn’t help homeowners in Iowa.

Income taxes are on the high end in Iowa, too. That’s especially so for retirees with an above-average income. Plus, over 200 school districts and Appanoose County add their own income taxes on top of the state-level tax. Fortunately, however, the top state income tax rate will go down over a period of years starting in 2023. A flat of 3.9% will apply beginning in 2026. Plus, beginning in 2023, all retirement income will be exempt from tax for people 55 and older .

Iowa sales taxes are about average. There’s also an inheritance tax in Iowa, which your heirs might have to pay.

Take Advantage Of Breaks Where You Can Get Them

In 37 states, you don’t have to worry about state income tax on Social Security. Yet even in some of the others, there are often things you can do. For instance, New Mexico has an exemption for some retirement income that lets you shelter Social Security if you choose to use it in that way. However, many residents use the exemption to protect IRA distributions or pension income instead.

Also, just because your benefits are taxable for federal purposes doesn’t mean that they will be even in states that tax Social Security. Many states have much higher thresholds for taxation than the IRS.

Retirees like to hold onto as much of their Social Security as they can, and dealing with taxes is never ideal. Knowing which states tax Social Security at the local level means you can take that into consideration in planning where you want to spend your retirement.

This article was written by Dan Caplinger from The Motley Fool and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to legal@newscred.com.

Recommended Reading: Hattiesburg Ms Social Security Office

What Is The Massachusetts Circuit Breaker Credit

Some seniors in Massachusetts are eligible for the Real Estate Tax Credit for Persons 65 and Older, also called the Circuit Breaker Credit. The credit refunds all property taxes paid, up to a maximum of $1,200. To be eligible, a senior has to meet four requirements.

First, the claimant must be at least 65 years old by Jan 1. Next, the claimant must own or rent his or her home and occupy it as a primary residence. Also, the claimant must have total income under $64,000 as a single filer, $80,000 as a head of household or $96,000 if filing jointly. Lastly, the assessed value of the home must be no more than $912,000.

Connecticut Taxes On Retirees

- Our Ranking: Least tax-friendly.

- State Income Tax Range: 3% 6.99% .

- Average Combined State and Local Sales Tax Rate: 6.35%.

- Median Property Tax Rate: $2,133 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Estate tax.

You dont need a mystic to tell you the Constitution State is a tax nightmare for many retirees but at least things are improving on the income tax front. Beginning in 2022, income from a pension or annuity is exempt for joint filers with less than $100,000 of federal adjusted gross income and other taxpayers with less than $75,000 of federal AGI . Starting in 2023, the state will also start phasing out taxes on distributions from traditional IRAs for retirees with a federal AGI below the same amounts.

Connecticut has the third-highest median property tax rate in the U.S., so the $10,000 cap on the federal tax deduction for state and local taxes stings a bit more here. The state offers property tax credits to homeowners who are at least 65 years old and meet income restrictions, though.

Connecticut also imposes an estate tax and a gift tax .

Recommended Reading: Is Social Security Going Away

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

California Taxes On Retirees

- Our Ranking: Tax-friendly.

- State Income Tax Range: 1% 13.3% .

- Average Combined State and Local Sales Tax Rate: 8.82%.

- Median Property Tax Rate: $742 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

California can be a difficult state to figure out when it comes to taxes on retirees. For instance, at 13.3%, the Golden State has the highest income tax rate in the country but that rate is for millionaires. For middle- and lower-income folks, the rates are much lower. And while California doesn’t tax Social Security income, most other forms of retirement income are fair game.

Sales taxes are relatively high, but the state’s median property tax rate is not. In the end, when you balance out all the pros and cons, California is actually a good state for most retirees when it comes to taxes, thanks mainly to the reasonable income tax rates for ordinary seniors.

- State Income Tax Range: Flat 4.4%

- Average Combined State and Local Sales Tax Rate: 7.77%.

- Median Property Tax Rate: $505 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

When it comes to property taxes, not only does Colorado have one of the lowest median tax rates in the country, but seniors may qualify for an exemption of up to 50% of the first $200,000 of property value. Other property tax breaks may apply, too.

Recommended Reading: Are The Social Security Office Open

Oklahoma Taxes On Retirees

- Our Ranking: Mixed.

- State Income Tax Range: 0.25% 4.75% .

- Average Combined State and Local Sales Tax Rate: 8.97%.

- Median Property Tax Rate: $892 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: None.

Oklahoma, O.K. Just O.K. See, there’s good news and bad news for retirees living in the Sooner State. Oklahoma doesn’t tax Social Security benefits. Residents can also exclude up to $10,000 per person of other types of retirement income. That’s certainly helpful.

But Oklahoma has the sixth-highest combined state and local sales tax rates in the nation, at an average of 8.97%. Both groceries and clothing are subject to sales tax, too.

Oklahoma falls right in the middle when the median property tax rates for all 50 states are compared. Plus, elderly homeowners may qualify for a rebate or tax “freeze” if their income is below a certain amount.

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Also Check: Social Security Office Cary Nc

Take Retirement Distributions Early

Instead of pushing distributions later, another method for saving money on taxes is to take these distributions earlier. Most retirement accounts allow for distributions without a penalty starting at age 59 1/2. You can wait until age 70 to start your Social Security benefits, so there is a ten-year period during which you can take distributions from your retirement account without any effect on the taxation of your Social Security benefits.

Minnesota Taxes On Retirees

- Our Ranking: Not tax-friendly.

- State Income Tax Range: 5.35% 9.85% .

- Average Combined State and Local Sales Tax Rate: 7.49%.

- Median Property Tax Rate: $1,106 per $100,000 of assessed home value.

- Estate Tax or Inheritance Tax: Estate tax.

The North Star State offers cold comfort on the tax front to retirees. Social Security benefits are taxable to the same extent as they are on your federal return, though taxpayers with taxable Social Security benefits can deduct some of their payments if their income is below a certain amount. There is also a special income tax deduction for certain senior citizens. But pensions are taxable, unless they’re from the military. Distributions from IRAs and 401 plans are taxed, too.

Property tax rates are slightly above average in Minnesota. But the state’s Senior Citizen Property Tax Deferral Program allows certain people age 65 or older to defer a portion of the property tax on their home.

Sales tax rates in Minnesota are above average, too. Plus, the state imposes an estate tax.

Recommended Reading: Social Security Office In Topeka Ks

Small Town Familiarity And Big

Vibrant Main Streets, eclectic boutiques, and local restaurants define small-town Massachusetts. The small-town charm of the state is perfectly balanced with the thriving city life of Boston. Often called the Hub of the Universe, Boston is one of the best places to live in the country. Boasting museums, ethnic restaurants, and theater productions, Boston is a melton pot of culture, attracting people of all ages from all over the world.

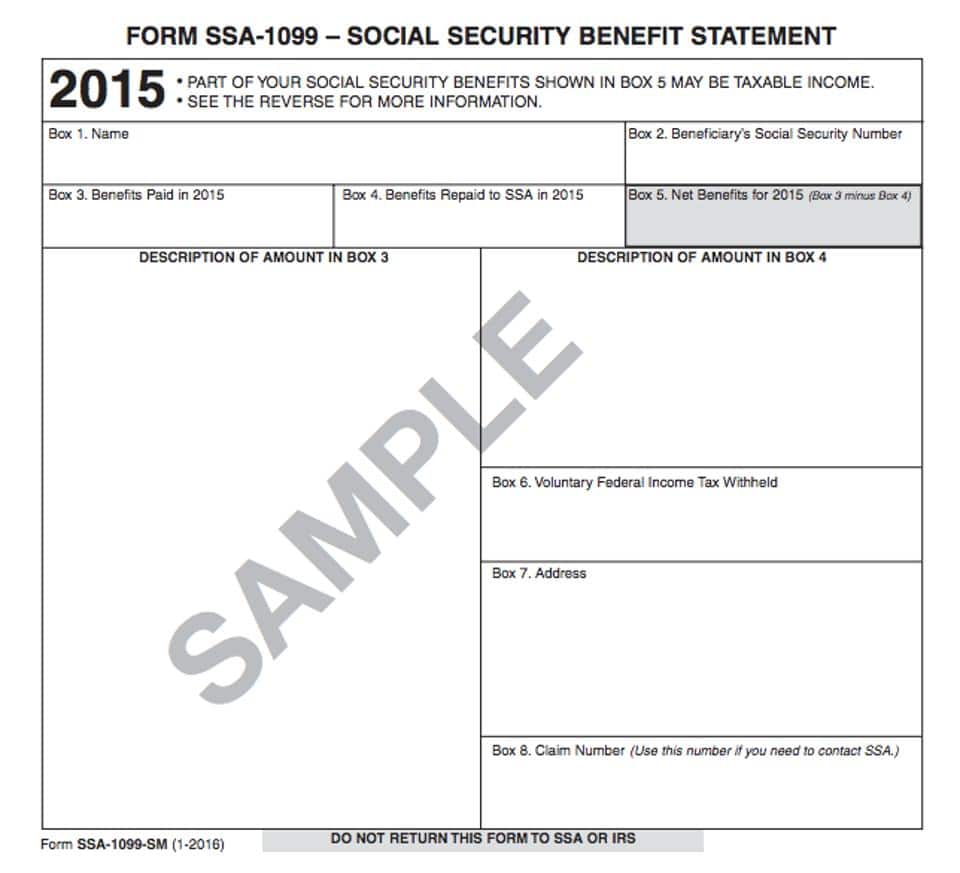

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Recommended Reading: Minimum Social Security Benefit At 65

Learn About Massachusetts Gross Adjusted Gross And Taxable Income

To calculate how much tax you owe, first calculate your Massachusetts gross income. Massachusetts gross income is federal gross income:

- Plus income excluded from federal income but included in Massachusetts income

- Minus income included in federal income but excluded from Massachusetts income, and

- Minus income excluded from both federal income and Massachusetts income.

Next, check what income you included in your Massachusetts gross income that you’re supposed to deduct on the appropriate Schedule, and then deduct the income.

Then, divide your Massachusetts gross income into 3 parts:

| Massachusetts AGI |

Your Massachusetts AGI affects:

- No Tax Status Fill out the Massachusetts AGI worksheet . If you’re required to file, you may still qualify for this status depending on your Massachusetts AGI.

- Limited Income Credit Fill out the Massachusetts AGI worksheet . If you’re required to file but do not qualify for NTS, you may still qualify for this credit depending on your Massachusetts AGI.

Taxes On Other Social Security Benefits

We have already discussed whether retirees will need to pay income tax on their Social Security retirement benefits, but what about other types of Social Security benefits? Are taxes due on disability benefits or SSI benefits? We will discuss the other types of Social Security benefits here and whether you will need to include those on your federal tax return.

Recommended Reading: Social Security Limits On Income 2022

Related Irs Forms And Publications

You can use IRS Publication 915 to estimate the amount of taxable Social Security income you will have.Qualified plan participants who also contributed to a deductible IRA must use the worksheets found in IRS Publication 590-A instead.

For those who filed as Married Filing Separately and lived at any time with a spouse during the year, IRS Publication 915 states that up to 85% of your Social Security may be taxable regardless of the sum.

When I Retire I Will Have 40 Credits Under Social Security Will My Social Security Pension Be Reduced Because I Will Receive A Pension From The Mtrs

If you have 40 credits under the Social Security system , then Social Security will use a modified formula to calculate your pension unless:

- you had 20 years of creditable service under the MTRS before January 1, 1986 or

- you were age 55 and had at least 10 years of creditable service before January 1, 1986 or

- you will have at least 30 years of substantial earnings under the Social Security system. For further information on substantial earnings, contact your local Social Security Administration Office or see more information on the Windfall Elimination Provision below.

If you do not meet any of these requirements, you will receive a reduced Social Security pension. In order to determine the amount of the reduction that applies to you, please contact the Social Security Administration at 800-772-1213.

Also Check: Social Security Offices In Milwaukee

How The West Taxes Social Security

Nine of the 13 states in the West don’t have income taxes on Social Security. Alaska, Nevada, Washington, and Wyoming don’t have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation. That leaves Colorado, Montana, New Mexico, and Utah, which impose taxes on Social Security for some individuals.

Can I Access My 1099 Online

Yesif you are currently receiving your own monthly retirement allowance, or survivor benefit, you may access your 1099 in MyTRS, our online member account system. Heres how:

Go to the MyTRS sign in page. If you have an account, Sign in and skip to step 6. If you do not have an account, click Create an account and continue to step 2. Review the MyTRS Terms of Service agreement. Make sure to scroll all the way down and click the Accept button. Enter your Date of Birth and Social Security number and click Next. Enter your username and password and click Next. Choose your security questions and click Next. Select your preferred method for Two-Factor Authentication code delivery method and click Next. Follow the instructions to enter your 2FA code. Once logged in, on your home page, click Documents . In the table listing your available documents, find your 2021 1099-R, which will have a date of 01/08/2022, and then click . If you have multiple 1099s, be sure to look for all 1099s with a date of 01/08/2022 to obtain your 2021 tax information. To exit MyTRS securely, please click Logout in the top right corner. In MyTRS, do NOT use your browsers Back or Refresh buttons, as they may disrupt your connection and cause your session to become invalid. To navigate within MyTRS, always use the links in the left margin.

You May Like: How To Get Someone’s Social Security Number