How To Calculate Social Security Ssi Benefits

Supplemental Security Income is for low or no-income individuals. It provides money for basic needs. SSI, at its core, is a welfare program for the disabled. For example:

- Individuals must have less than $2,000 in assets

- A married couple must have less than $3,000 in assets

Note: When calculating the assets for a married individual, SSA will count the working spouses income toward the $3,000 asset limit.

The monthly payment in the Social Security Disability Pay Chart shows the maximum an individual or a couple may receive. However, your payment may be less. SSA places income limits on people who receive SSI.

The monthly maximum SSI Federal Payments amounts for 2022:

- $841 for an eligible individual

- $1,261 for an eligible individual with an eligible spouse

- $421 for an essential person

Note: Maximum Federal Supplemental Security Income payment amounts increase with the cost-of-living increases that apply to Social Security benefits. The latest increase was 5.9 percent, effective January 2022.

Social Security Disability Benefits Pay Chart

| Recipient |

|---|

| $421 |

If you have earnings from a job or other sources of income, it may be deducted from the maximum SSI monthly benefit as shown in the pay chart. It may also result in a reduced payment to you. However, SSI does not count all income.

Examples of income that is not countable against you include the following:

Note: There may also be deductions because of your living arrangements (i.e., an adult getting free room and board.

How Do Social Security Claimants Know If They Have To Pay Tax

The SSA mails the statement every January and it summarizes how much you received in benefits the previous year.

If you have not received this form, or if you’ve misplaced it, you can request a new one using your online social security account.

Select the “replacement documents” tab and follow the instructions to order your new form.

If it turns out you do owe taxes on your benefits, you can opt to make quarterly estimated payments to the IRS, or you can choose to have federal taxes withheld when you initially apply for benefits.

You can choose to have either 7%, 10%, 12% or 22% of your monthly benefit withheld for taxes.

We also explain why the COLA increase is bad news for retirees and future claimants.

Will There Be An Increase In Ssdi Benefits In 2022

Early indications are that the COLA adjustment for 2022 will be significant. This is due to several factors, with a rising economy and demand with the COVID-19 pandemic seemingly subsiding. The consumer price index most recently rose 5% from the previous year, marking the most significant increase since 2008.

It was earlier estimated that the 2022 COLA would come in around a 4.7% increase, but given the new numbers that have been released, it could come in as high as 5.3%. If this held, it would be the highest increase in COLA since 2009 another time when the economy recovered from a severe setback. The continued rise in the market demand and price for vehicles, homes, and general goods point to this figure being realistic.

It should be noted that things could still change, as the final COLA number isnt decided upon until October. If demand subsides and things start to normalize or if there is another pandemic wave the number could go back down. But as of now, the 5.3% increase seems like a fair number.

You May Like: Social Security Office Hinesville Ga

Fact #: Social Security Provides A Foundation Of Retirement Protection For Nearly All People In The Us

97% of older adults either receive Social Security or will receive it.

Almost all workers participate in Social Security by making payroll tax contributions, and almost all older adults receive Social Security benefits. In fact, 97 percent of older adults either receive Social Security or will receive it, according to Social Security Administration estimates.

The near universality of Social Security brings many important advantages. It provides a foundation of retirement protection for people at all earnings levels. It encourages private pensions and personal saving because it isnt means-tested it doesnt reduce or deny benefits to people whose income or assets exceed a certain level. Social Security provides a higher annual payout than private retirement annuities per dollar contributed because its risk pool is not limited to those who expect to live a long time, no funds leak out in lump-sum payments or bequests, and its administrative costs are much lower.

Universal participation and the absence of means-testing make Social Security very efficient to administer. Administrative costs amount to only 0.6 percent of annual benefits, far below the percentages for private retirement annuities. Means-testing Social Security would impose significant reporting and processing burdens on both recipients and administrators, undercutting many of those advantages while yielding little savings.

Fact #: Social Security Benefits Are Modest

Social Security benefits are much more modest than many people realize the average Social Security retirement benefit in January 2022 was about $1,614 per month, or about $19,370 per year. For someone who worked all of their adult life at average earnings and retires at age 65 in 2022, Social Security benefits replace about 37 percent of past earnings. Social Securitys replacement rate fell as the programs full retirement age gradually rose from 65 in 2000 to 67 in 2022.

Most retirees enroll in Medicares Supplementary Medical Insurance and have Part B premiums deducted from their Social Security checks. As health care costs continue to outpace general inflation, those premiums will take a bigger bite out of their checks.

Social Security benefits are also modest by international standards. The U.S. ranks just outside the bottom third of developed countries in the percentage of an average workers earnings replaced by the public pension system.

Social Security is important for children and their families as well as for older adults. Over 6.5 million children under age 18 lived in families who received income from Social Security in 2019. That number included nearly 2.8 million children who received their benefits as dependents of retired, disabled, or deceased workers, as well as others who lived with parents or relatives who received Social Security benefits.

Social Security lifted 1.1 million children above the poverty line in 2020, as the chart shows.

Recommended Reading: Social Security Office Buford Ga

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Fact #: Social Security Provides A Guaranteed Progressive Benefit That Keeps Up With Increases In The Cost Of Living

Social Security benefits are based on the earnings on which people pay Social Security payroll taxes. The higher their earnings , the higher their benefit.

Social Security benefits are progressive: they represent a higher proportion of a workers previous earnings for workers at lower earnings levels. For example, benefits for a low earner retiring at age 65 in 2021 replace about half of their prior earnings. But benefits for a high earner replace about 30 percent of prior earnings, though they are larger in dollar terms than those for the low-wage worker.

Many employers have shifted from offering traditional defined-benefit pension plans, which guarantee a certain benefit level upon retirement, toward defined-contribution plans s), which pay a benefit based on a workers contributions and the rate of return they earn. Social Security, therefore, will be most workers only source of guaranteed retirement income that is not subject to investment risk or financial market fluctuations.

Once someone starts receiving Social Security, their benefits increase to keep pace with inflation, helping to ensure that people do not fall into poverty as they age. In contrast, most private pensions and annuities are not adjusted for inflation.

You May Like: Pikeville Ky Social Security Office

Is Your Condition Severe

Your condition must significantly limit your ability to do basic work-related activities, such as lifting, standing, walking, sitting, or remembering for at least 12 months. If it does not, we will find that you do not have a qualifying disability.

If your condition does interfere with basic work-related activities, we go to Step 3.

Contact Farmer & Morris Law Pllc Today

Farmer & Morris Law, PLLC helps clients in Rutherfordton, North Carolina, apply for Social Security Disability benefits and appeal denied claims. For a free consultation on your case and our services with a member of our team, call us today: .

We can discuss your case, what the monthly income limit currently is, and other questions you may have about the Social Security Disability system during this call.

Don’t Miss: Social Security Office In Eugene Oregon

Why We Have An Earnings Limit

Not long ago, a viewer on my YouTube channel asked me to give her a good reason why we have the Social Security earnings limit. The comments that followed showed how many viewers shared the belief that the earnings limit is unfair and should be eliminated.

In my response, I explained that the rationale behind the entire program of Social Security was to create a safety net. The original intent of the Social security program was not to supplement retirement income, but to keep the elderly out of poverty.

I also added that todays earnings limit is relatively generous compared to where the Social Security earnings limit began. The original Economic Security Bill President Roosevelt sent to Congress featured a very restrictive earnings limit.

That bill stated, No person shall receive such old-age annuity unless . . . He is not employed by another in a gainful occupation.

Whoa! This means that if you had even a single dollar in wages from a job, you could not collect a Social Security benefit at all.

Thankfully, the system we have in place today allows for individuals to have some earnings from work while they are receiving a Social Security benefit.

However, its very important to stay informed on the dollar amount of this limit because it changes every year.

For 2022, the Social Security earnings limit is $19,560. For every $2 you exceed that limit, $1 will be withheld in benefits.

2022 Social Security Earnings Limit

Will Social Security Disability Benefits Increase In 2022

For someone receiving social security disability benefits, every dollar received monthly matters. Disability benefits exist to help those who cannot work a regular job provide for their daily, weekly, monthly needs in addition to the needs of their families.

It is nearly impossible to increase the general percentage for benefits you are receiving, as the benefits amounts are tied directly to work history and the amount you have paid in. However, there are considerations for cost of living adjustments that happen every year. While it doesnt always increase, it is factored every year and worked through by the Social Security Administration .

Also Check: Does Social Security Count As Income For Obamacare

How Much In Taxes Does Social Security Withhold

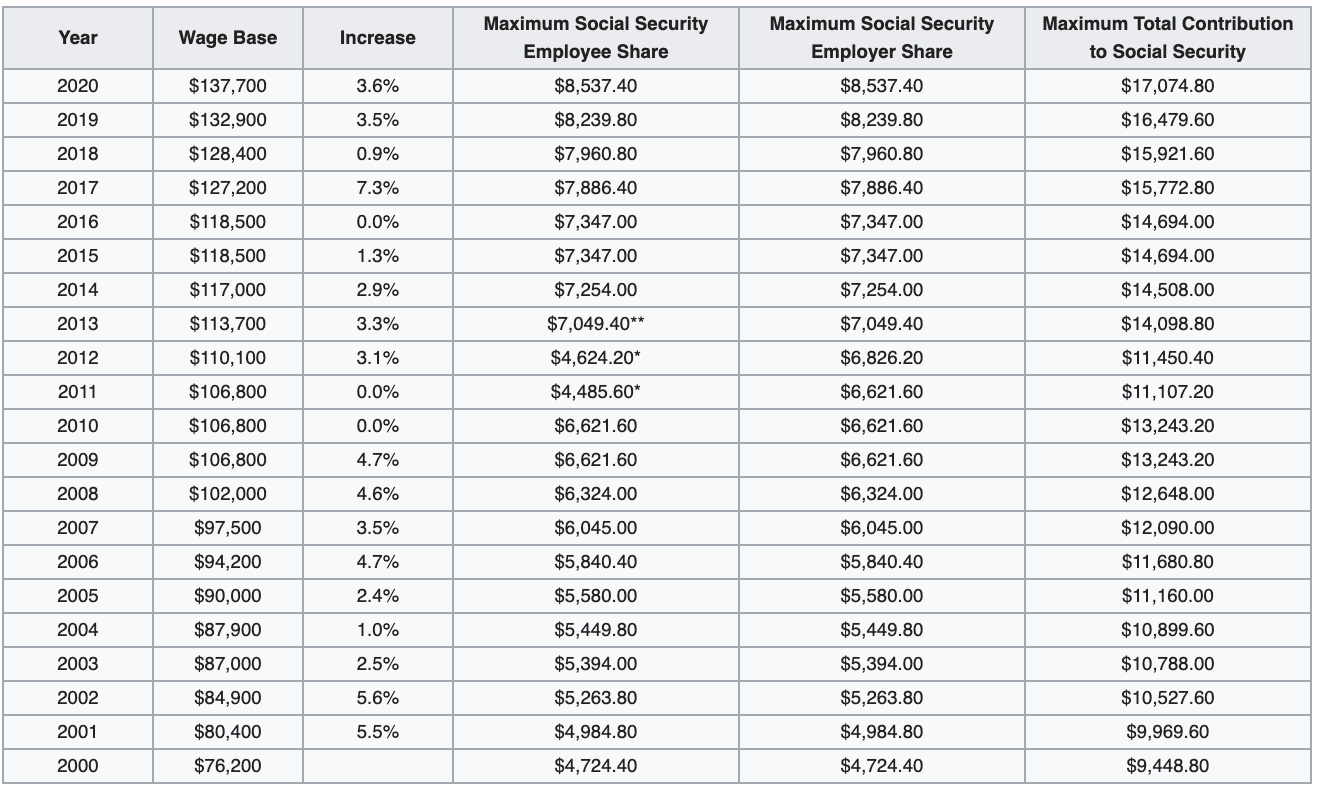

The maximum amount of earnings that is subject to the Social Security tax is $147,000 in 2022, up from $142,800 in 2021. There is no limit to the amount of income subject to the Medicare tax.

Note that the Social Security figures and limits for 2021 can be found in our 2021 COLA update.

Effective date: Jan 01, 2022

Limit On Substantial Gainful Activity

A person with a disability applying for or receiving SSDI can’t earn more than a certain amount of money per month by working this isn’t because of an income limit, but rather because the SSA wouldn’t consider that person disabled.

If you can do what the SSA calls “substantial gainful activity” , you aren’t disabled. A person who earns more than a certain monthly amount is considered to be “engaging in SGA,” and thus not eligible for SSDI benefits. In 2022, the SGA amount is $1,350 for disabled applicants and $2,260 for blind applicants.

The rules differ for business owners, since their monthly income may not reflect the work effort they put into their business. For more information, see our article on SGA for small business owners.

Recommended Reading: Social Security Office In Madison Tennessee

What’s The Disability Earnings Limit For The Blind And Non

The SGA, or earnings per month, must fall beneath the allotted amount for the individual to receive full disability payments. The 2022 limit of $1,350 applies to disabled individuals who are sighted.

There’s a higher limit for blind individuals. They must stay below the monthly earning level of $2,260 .

What We Mean By Disability

The definition of disability under Social Security is different than other programs. Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability.

We consider you to have a qualifying disability under Social Security rules if all the following are true:

- You cannot do work and engage in substantial gainful activity because of your medical condition.

- You cannot do work you did previously or adjust to other work because of your medical condition.

- Your condition has lasted or is expected to last for at least one year or to result in death.

This is a strict definition of disability. Social Security program rules assume that working families have access to other resources to provide support during periods of short-term disabilities, including workers’ compensation, insurance, savings, and investments.

Recommended Reading: Social Security Office Denton Tx

Social Security Disability Evaluation Process

Though there are some conditions that the SSA considers so severe that they automatically render an applicant disabled, many conditions require careful screening, including answering these five questions:

In addition, qualifying conditions must be expected to last at least one year or result in death.

Can You Do Any Other Type Of Work

If you cant do the work you did in the past, we look to see if there is other work you could do despite your medical impairment.

We consider your medical conditions, age, education, past work experience, and any transferable skills you may have. If you cant do other work, well decide you qualify for disability benefits. If you can do other work, well decide that you dont have a qualifying disability and your claim will be denied.

Read Also: How To Report Social Security Card Lost

Thank You For Sharing

If you employ someone who is receiving SSI, SSDI or Medicaid benefits, you may know that they are limited in the amount of income they are able to receive in a month to continue to receive their benefits. While many people dont necessarily need to keep their income payments and would like to work more and longer for you, they may need everything they can get from the Medicaid services they carry to have an independent life.

You may have had discussions with them in the past about wanting to have them for more hours or pay them what you actually think they are worth instead of limiting their working time and income, but they may have refused out of concern for what the change would do to their benefits.

What’s A Trial Work Period

Social Security also provides for a TWP , which allows disabled individuals to attempt returning to the workforce. The program enables someone to test whether they’re physically and mentally capable of going back to work without the threat of losing disability benefits.

A TWP can consist of up to nine months of work over a five-year period. The nine months dont have to be completed consecutively. For 2022, earnings of $970 will trigger a TWP month.

An EPE is also allotted for 36 months after the TWP is over. Some benefits can continue during this period if certain conditions are met.

Don’t Miss: Social Security Office Bear Me

Social Security Disability Benefits Will Increase In 2022

Social Security Disability Insurance and Supplemental Security Income benefits will increase by 5.9% for almost 70 million Americans. These increases to Social Security disability benefits will begin at the start of December 2021 and will also be made payable in January 2022.

Other adjustments will occur in January 2022 as a result of the increase in the national average wage index. The maximum amount of wages due for Social Security payroll tax in 2022 will also increase, and the exact amount for the retirement earnings test is also expected to change in 2022.