What If I Delay Taking My Benefits

If you retire sometime between your full retirement age and age 70, you typically earn a “delayed retirement” credit . For example, say you were born in 1955 and your full retirement age is 66 and 2 months. If you started your benefits at age 68, you would receive a credit of 8% per year multiplied by approximately two . This makes your benefit ~15% higher than the amount you would have received at age 66.

That higher baseline lasts for the rest of your retirement and serves as the basis for future increases linked to inflation. While it’s important to consider your personal circumstancesit’s not always possible to wait, particularly if you are in poor health or can’t afford to delaythe benefits of waiting can be significant.

If you decide to wait past age 65, you may still need to sign up for Medicare. In some circumstancesyour Medicare coverage may be delayed and cost more if you do not sign up at age 65.

Effect of late retirement on benefits

1.Represents Full Retirement Age based on DOB Jan. 2, 1955

2.PIA = The primary insurance amount is the basis for benefits that are paid to an individual

To review your situation, your annual Social Security statement will list your projected benefits at age 62, full retirement age, and age 70, assuming you continue to work and earn about the same amount until age 62, full retirement age, or age 70 before retiring. If you need a copy of your annual statement, you can request one from the Social Security Administration .

Social Security In The Us

Before Social Security , care for the elderly or disabled in the U.S. wasn’t a federal responsibility if they weren’t cared for by family, it fell into the hands of municipalities or states. This changed in 1935 when the Social Security Act was first established in the U.S. by President Franklin Roosevelt. The first taxes were collected starting in January 1937, which enabled monetary assistance to qualified Americans with inadequate or no income. Originally, SS was just a program that paid out retirement benefits, but a 1939 change added survivors benefits for a retiree’s spouse and children. In addition, in 1956, disability benefits were added.

Today, SS in the U.S. plays a very important role in keeping a lot of older Americans out of poverty. For most Americans in retirement, it is their major source of income, and for a significant percentage, it is their only source of income, even though SS was never intended to be a full replacement of income. On average, SS pays lower-wage earners higher relative benefits than higher-wage earners. In addition, lower-wage earners tend to pay less tax and are more likely to receive social insurance disability income and survivor benefits. SS is sometimes referred to as Old Age, Survivors, and Disability Insurance .

Social Security Facts

How To Calculate Life Expectancy

One needs to follow the below steps to calculate the Life Expectancy.

Step #1 Find out the current age of the individual.

Step #2 Determine the gender of the individual as the second step

Step #3 Find the life expectancy figure from the above table based on current age and gender.

Step #4 Now, determine the individuals lifestyle habits, whether they are a smoker or non-smoker.

Step #5 Make adjustments if it determines whether the individual is a smoker or non-smoker then, we can ignore this step. The life expectancy determined in step 3 will be the final figure, which needs to be added to the current age.

Step #6 If the individual were a smoker, then this resultant figure after adjustment would be the life expectancy figure, and that figure will be added to the current age.

Also Check: Social Security Office Columbus Oh

How A Social Security Break

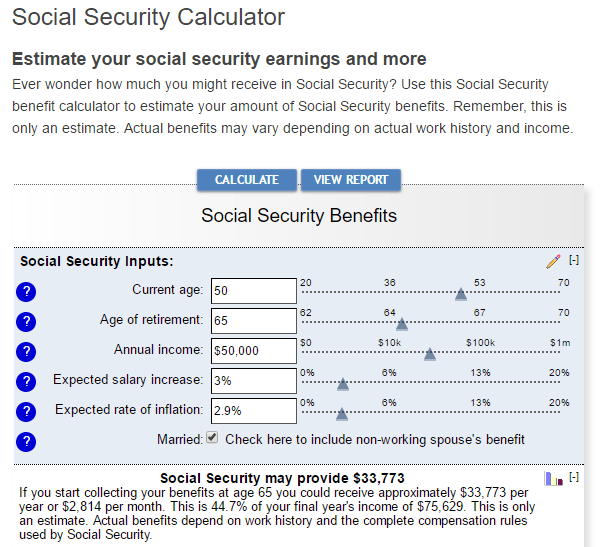

Figuring out the right time to start taking Social Security benefits isnt always a straightforward process. A Social Security break-even calculator can help you get some perspective on the numbers so you know what you stand to gain or lose by taking benefits earlier versus later.

Social Security break-even calculators help you find the best age to start taking retirement benefits. They do this by comparing your cumulative Social Security retirement benefits paid at age 62, your full retirement age and at age 70 and estimating how long it would take the benefits paid at age 70 to break even with benefits paid to start at age 62.

Heres a simple calculation to give you an idea of how a Social Security break-even calculator works. Say that you have the option to begin receiving $1,200 a month in benefits at age 62. Youd receive $1,700 in benefits if you wait until full retirement age at 66. Or you could receive $2,200 a month in benefits by delaying them until age 70.

The break-even point represents when the cumulative benefits even out. So if you wait until age 70 to start taking benefits, it would take you until age 79 to break even with the benefit amount youd receive if you started taking them at age 62. If you were to start receiving benefits at age 66, it would take you until age 75 to break even with the benefits youd receive if you started them at 62.

The 10 Best Life Expectancy Calculators

Lifetime expectancy calculators use data to help assess how long you yourself are going to live. These calculators offer no guarantees of accuracy, but they might help you come up with a life expectancy that is perhaps more realistic for you.

Some of the best life expectancy calculators include:

Livingto100: This calculator is based on data from the New England Centenarian Study, the largest study in the world of people who live to 100. The Livingto100 calculator asks you almost 50 questions to determine how long you might live. The particularly nice thing about this detailed life expectancy calculator is that it gives you personalized feedback on each data point about why it is important to your longevity.

Blue Zones Vitality Compass: The Vitality Compass is the life expectancy calculator from Blue Zones. Blue Zones is a publisher dedicated to uncovering the best strategies for longevity based on places in the world where higher percentages of people enjoy longer lives.

Blueprint Income: The Blueprint Income life expectancy calculator has a great, easy to use interface and interesting outputs.

It was developed by Dean Foster, the William H. Lawrence Professor at the University of Pennsylvanias Wharton School of Business. This calculator uses a detailed statistical analysis of NIH-AARP data and is sometimes called the Wharton Life Expectancy Calculator.

Recommended Reading: Nevada Mo Social Security Office

Heres Another Longevity Calculator Thats Worth A Look

For a more complete assessment, Blueprint Income has a robust longevity calculator developed by the University of Pennsylvania that you may want to give a try.

It includes questions about your age and physique, life events, fitness and lifestyle. Youll get a customized life expectancy based on 400,000 data samples from the National Institutes of Health.

What If I Continue Working In My 60s

Many people whose health allows them to continue working in their 60s and beyond find that staying in the workforce keeps them young and gives them a sense of purpose. If this sounds like something youâd like to do, know that working after claiming early benefits may affect the amount you receive from Social Security. Why? Because the Social Security Administration wants to spread out your earnings so you donât outlive them. If you claim Social Security benefits early and then continue working, youâll be subject to whatâs called the Retirement Earnings Test.

If youâre between age 62 and your full retirement age, and youâre claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly. For 2022, the Retirement Earnings Test Exempt Amount is $19,560/year . If youâre in this age group and claiming benefits, then every $2 you make above the Exempt Amount will reduce by $1 the Social Security benefits youll receive.

Contrary to popular belief, this money doesnât disappear. It gets credited back to you with interest in the form of higher future benefits. You may hear people grumbling about the Social Security âEarnings Taxâ, but itâs not really a tax. Itâs a deferment of your benefits designed to keep you from spending too much too soon. And after you hit your full retirement age, you can work to your heartâs content without any reduction in your benefits.

You May Like: Disadvantages Of Social Security Disability

Read Also: Whats The Difference Between Social Security And Ssi

Do You Expect To Have Additional Sources Of Retirement Income Beyond Social Security

Continue saving in the coming years.

Social Security won’t replace all of your pre-retirement income. On average, Social Security replaces 40 percent of a worker’s income. That means your retirement savings, pension, 401, or Individual Retirement Account will need to fill the gap. Claiming at your full Social Security benefit age or later can minimize this gap and maximize your monthly benefit. If you claim before your full retirement age, your monthly benefit could be reduced by as much as 30 percent.Learn more about saving for retirement.

You have an opportunity to continue growing your money.

If you can, get the highest monthly Social Security benefit possible by claiming at your full Social Security benefit age or later. If you claim before your full retirement age, your monthly benefit could be permanently reduced by as much as 30 percent. Also, take advantage of catch-up contributions to your 401 or Individual Retirement Account . Lastly, avoid losing your retirement savings to unnecessary tax penalties. If you withdraw your 401 or IRA savings before age 59½, you will likely face an early withdrawal penalty.Learn more about how retirement savings grow.

It’s a perfect time to start saving.

It’s never too late to start saving!

There are many ways to plan for a secure retirement outside of Social Security.

It’s never too late to start saving!

A type of retirement savings account offered by employers to help their employees save for retirement.

Finally How Does The Stock Market Figure Into The Equation

Generally speaking, the U.S. stock market has been on a record-setting run, but its ongoing performance is never a sure thing. What goes up can go down eventually, and a declining portfolio could have an impact on a retirees cash flow needs. If a retiree gets to a point where the declining value of their portfolio cannot sustain their cash flow requirements, then it would be an appropriate time to consider taking Social Security benefits earlier than previously planned.

Yes, deciding when to take Social Security is complicated, but its still a decision that is often integral to retirement planning. Its also a decision that many retirees seem to disregard. According to Employee Benefit Research Institutes 2018 Retirement Confidence Survey, only 23% of workers try to maximize their benefits by planning when to claim Social Security.

So, once youve determined your break-even age, I encourage you to take the next steps: Consider your individual circumstances, get some guidance, and make a plan. It could make a difference of tens of thousands for you over the years.

Dont Miss: How To Report Social Security Card Lost

Don’t Miss: Background Check Free With Social Security Number

See How Successful Advisors Are Demonstrating Their Ongoing Value To Clients

Instead of telling you what you should be doing as an advisor, our Kitces Summit guests are all practicing financial advisors who will show you what actions theyve taken to demonstrate their upfront and ongoing financial planning value to clients.

Your client gave you 62 pages of Wills and trusts?What do you do next?Learn how to review them quickly and identify potential issues and opportunities.

I write about financial planning strategies and practice management ideas, and have created several businesses to help people implement them.

Join over 52,045 fellow advisors now

…& receive a free copy of our report:

Quantifying the Value of Financial Planning Advice

This browser is no longer supported by Microsoft and may have performance, security, or missing functionality issues. For the best experience using Kitces.com we recommend using one of the following browsers.

Log in to Kitces.com to complete the purchase of your Course

To complete this Course purchase, you must log in to your Kitces.com account, or create a Reader account if you don’t already have one.

Login to Kitces.com

Set up a free Reader Account to save articles and purchase courses.

To complete this Course purchase, you must log in to your Kitces.com account, or create a Reader account if you don’t already have one.

Login to Kitces.com

Life Expectancy Calculator Example

Mr. Vivek, aged 29, has been living in Delaware since birth. He is 69 inches tall, weighs around 180 pounds, and has never reported any medical or health issues. He is currently staying single and doesnt drink, but he has a habit of smoking sometimes, which is the only habit he cannot escape from. He has started his own business, and he has a family dependent upon him. He is looking for a life insurance policy, and the company has received the request from his side and the details of his life and lifestyle.

The company wants to calculate the life expectancy for Mr. Vivek and accordingly wants to calculate the life insurance premium for the policy insured for $500,000.

Note the company has a policy for adjusting the life expectancy by ten years if the person turns out to be a smoker.

Based on the above information, you are required to calculate Life Expectancy.

Solution:

We are given below details about Mr. Vivek.

Based on his current age, which is 29, we can determine above the remaining number of years he is expected to live, which is 48.63 further, he is a smoker, and the adjustment factor is 10, which will reduce the life expectancy.

Now we can use the formula below to determine the individuals life expectancy.

Life Expectancy = C+ X F

- = 29 + 48.63 10

Therefore, the life expectancy per the above calculation is 67.63 years.

Don’t Miss: Can I Contact Social Security By Phone

What If I Change My Mind

If you receive Social Security benefits at a reduced rate, but then change your mind, you have the option of withdrawing your application and paying back to the government what you’ve already received . Then, you could restart benefits at a later date to take advantage of a higher payout. But you are limited to one withdrawal per lifetime.

For example, let’s say you elected to receive early benefits at age 62, but then decided to go back to work at age 63. You could withdraw your Social Security application within the first 12 months of receiving benefits, pay back the years’ worth of benefits you received, go back to work, and then wait until a later age to restart your benefit checks at a higher level.

For important details about repaying benefits please read the SSA publication If You Change Your Mind.

What Is The Average Life Expectancy

While life expectancy in the United States has dropped slightly, Americans are living longer than any previous generation a lot longer.

The average life expectancy for a 65-year-old American is now 18 more years on average for men. And, women can expect to live around 20.6 more years. That means that according to the Social Security Administration the average 65 year old man will live until 83 and the average woman will live until almost 86. But at least half of us will live even longer a lot longer.

And there is a twist, the longer we live, the longer we will live. A longer life begets an even longer life. While, a 65-year-old American man can expect to live to almost 83, an 85 year old man can expect to live past 90 on average.

And further good news is that we are living healthier and more robust lives. Old people now feel younger and more vital. We are doing more at older ages.

Recommended Reading: Social Security Office Rockland Maine

How Does A Break Even Calculator For Social Security Work

The basic premise of a break even calculator is based on the way Social Security benefits are calculated, where the earlier you file the lower your benefit will be. Waiting longer can get you a higher benefit amount but by filing at a younger age, youll receive more benefit checks in total.

This is why you need to understand the break even point. If you file later, your benefit will be higher. When compared to the same life expectancy as filing early, youll receive larger checks but for fewer months.

The age at which filing early versus filing later results in the same amount of cumulative payments is your break even age.

For example, lets use a very basic benefit amount that doesnt include any cost of living adjustments. Lets assume that your full retirement age benefit is $2,000:

- If you file at 62 you would receive $1,400

- If you wait until age 70, you would receive $2,480

Using simple math you can see that the total benefits you would receive in each scenario would be equal, or break even, at 80 years and 4 months. For every year you live beyond this age, the choice to file later is the winner as youll have more money by waiting to claim benefits than you would have if you filed early.

But what if you dont expect to live until 80 years and 4 months? Youd actually be better off by filing for benefits sooner.

Factor In Mortality And Marriage

Of course, the trick to coming out ahead by starting to collect social security later is to live long enough to reach the breakeven age.

Whether or not you will be able to do that, though, is impossible to know. The Social Security Administration does provide a life expectancy calculator that can provide some general guidance. For example, according to this calculator, a 62-year-old male can expect to live to age 83.6. In the example given earlier, the breakeven age for coming out ahead by delaying collecting social security was 80, so on average it would make sense for a person in that situation to delay collecting social security to earn the maximum benefit.

However, the life expectancy calculator is based on average life spans. Your health and family history are also important considerations in estimating how your life span is likely to relate to the average.

It also makes a difference if you are married. Survivor benefits for spouses are increased if you delay when you start to collect social security. So, if you are married, there is a better chance that at least one of you will live long enough to reach the breakeven age. According to the Social Security Administration, a married couple at age 65 today has a 50-50 chance of at least one spouse living till age 90.

You May Like: How To Freeze Your Social Security Number