Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2022. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

Are There Ways To Avoid Social Security Tax

Not everyone has to pay the Social Security tax. If you are a nonresident alien, either as a student or an employee of a foreign government, then you wont have to worry about paying. Furthermore, if you are part of a religious group that opposes the receipt of Social Security benefits, then you wont have to pay either.

However, these are all rare circumstances. Plus, these people wont receive Social Security benefits in retirement. If you want to avoid paying the Social Security tax but still receive benefits when you retire, you should know that the amount youve paid into the system determines your benefits to some degree.

Converting Savings Into A Roth Ira

One strategy to reduce the taxes you pay on your Social Security income involves converting traditional 401 or IRA savings into a Roth IRA, says Shailendra Kumar, director at Fidelitys Financial Solutions.

Not everyone can contribute to a Roth IRA or Roth 401 because of IRS-imposed income limits, but you still may be able to benefit from a Roth IRAs tax-free growth potential and tax-free withdrawals by converting existing money from a traditional IRA or a workplace retirement savings account into a Roth IRA. This process of converting some of your IRA or 401 into a Roth IRA is known as a partial Roth conversion.

You can choose to convert as much or as little as you want of your eligible traditional IRAs. This flexibility enables you to manage the tax cost of your conversion, adds Kumar. A Roth IRA or Roth 401 can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they wont impact the taxation of your Social Security benefit. This is an important aspect of a Roth account that most people are not aware of.

Remember: The amount you convert is generally considered taxable income, so you may want to consider converting only the amount that could bring you to the top of your current federal income tax bracket. You also may want to consider basing your conversion amount on the tax liability you may incur, so you can pay your taxes with cash from a nonretirement account. Consult a tax professional for help.

Don’t Miss: Medicare Deduction From Social Security 2022

Are My Social Security Benefits Taxable

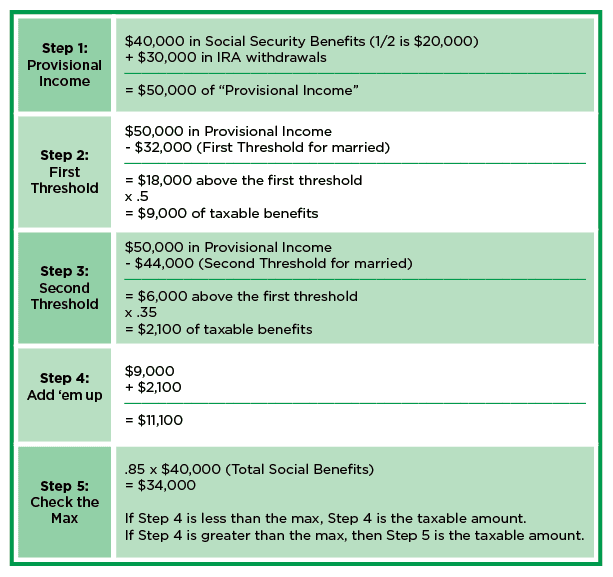

As a very general rule of thumb, if your only income is from Social Security benefits, they wont be taxable, and you dont need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

If youre married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

The IRS offers a worksheet to calculate taxable benefits.

Also Check: When Should I Get My Tax Refund 2021

Other Payroll Tax Items You May Hear About

-

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

-

SUTA tax: The same general idea as FUTA, but the money funds a state program. Employers pay the tax.

-

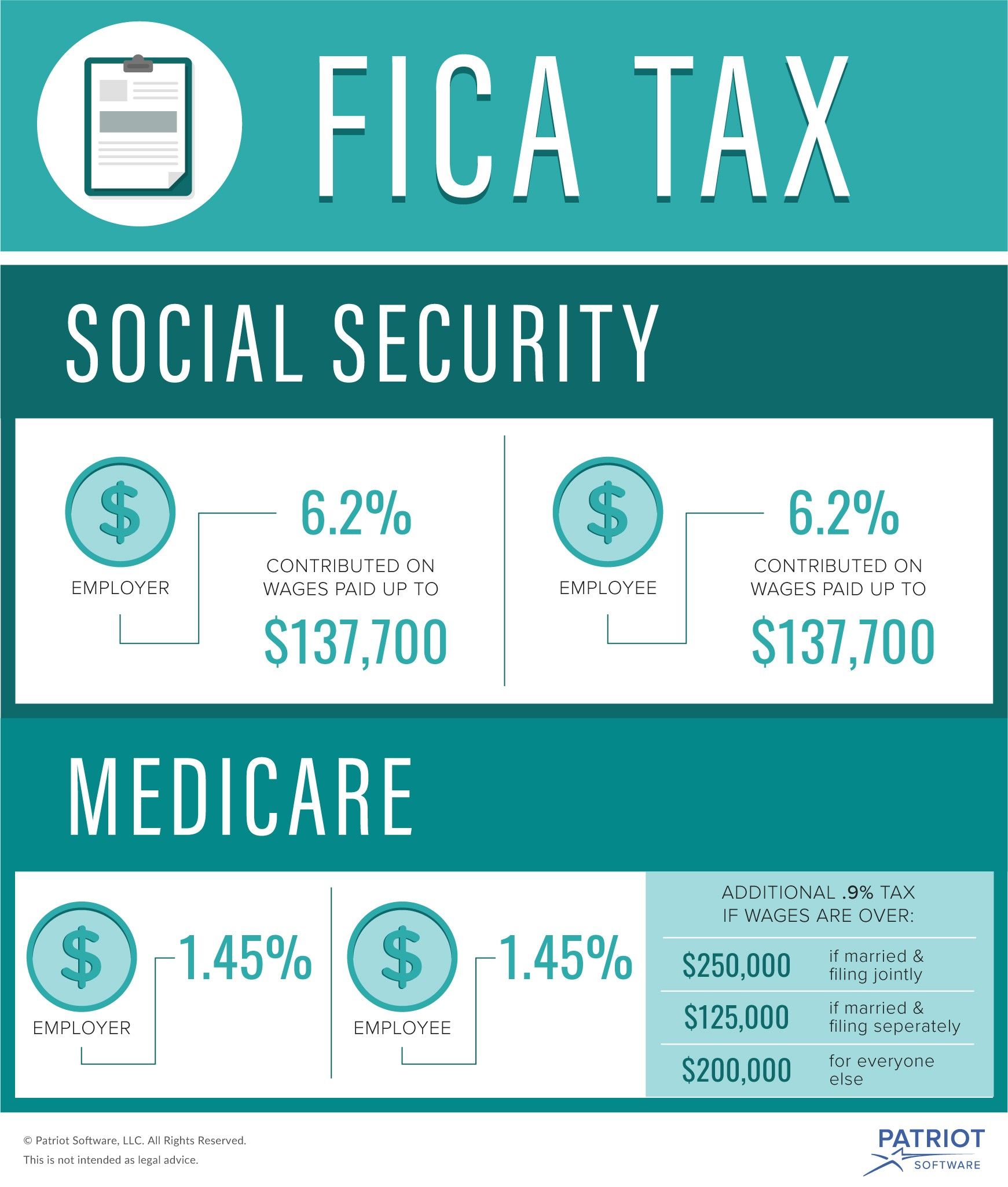

Self-employment tax: If you work for yourself, you may also have to pay self-employment taxes, which are essentially the full load of Social Security and Medicare taxes. Thats because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing. Because you may not be receiving a traditional paycheck, you may need to file estimated quarterly taxes in lieu of withholdings.

Don’t Miss: Social Security Disability Earnings Limit 2022

Public Servants And Social Security

In the beginning, Social Security didnt cover any public sector employees. However, over the years, many states dropped their own pension plans and adopted coverage agreements with the Social Security Administration. However, there are still several states who do not participate in Social Security. Instead, they have their own state-run pension plan. For workers in these states, the rules for collecting a non-covered government pension and Social Security can be confusing and maddening.

Thats especially true if youve paid into the Social Security system for enough quarters to qualify for a benefit. Its quite common too. Many individuals find themself in this situation for a variety of reasons. For example, Firefighters often work second jobs where they pay social security tax. Police Officers will often retire at an early age and move on to another covered job. Many teachers came to education as a second career, after theyd spent years working in a job where Social Security taxes were withheld.

Social Security Wage Base 2022

Now, onto the good stuff. The Social Security withholding limit.

Only withhold and contribute Social Security taxes until an employee earns above the wage base. Stay up-to-date with the annual Social Security wage base because it generally changes each year.

The 2022 Social Security wage base is $147,000.

After an employee earns above the annual wage base, do not withhold money for Social Security taxes. And, dont contribute anything else.

Not all employees will earn above the withholding limit. If an employee does not meet this wage base, continue withholding and contributing year-round.

The maximum Social Security contribution in 2022 is $9,114 .

If you withhold more than $9,114 , you surpassed the wage base and must reimburse your employee.

Remember that the amount you withhold for each employee is based on how much they earn.

- Eliminate the need for manual calculations

- Say goodbye to accidentally withholding above the Social Security wage base

- Enjoy free USA-based support

Read Also: Social Security Office In Ann Arbor

Is Social Security Based On The Last 5 Years Of Work

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you dont have 35 years of work, the Social Security Administration still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account to shield your withdrawals from income tax. Take out some retirement money after youre 59½, but before you retire to pay for expected taxes on your Social Security before you begin receiving benefit payments. You might also talk to a financial planner about a retirement annuity.

Also Check: Social Security Calculator For Couples

Definition Ofsocial Security Contributions

Social security contributions are compulsory payments paid to general government that confer entitlement to receive a future social benefit. They include: unemployment insurance benefits and supplements, accident, injury and sickness benefits, old-age, disability and survivors’ pensions, family allowances, reimbursements for medical and hospital expenses or provision of hospital or medical services. Contributions may be levied on both employees and employers. Such payments are usually earmarked to finance social benefits and are often paid to those institutions of general government that provide such benefits. This indicator relates to government as a whole and is measured in percentage both of GDP and of total taxation.

If Social Security Is Your Only Income

You almost certainly won’t have to pay federal income tax on your Social Security benefits if they are your only source of income. That means your Social Security income probably isn’t taxable if you never got around to investing in a 401, if you don’t rent out a property for profit, or if you’ve given up working entirely. These are just examplesthe point is that you have no other form of income from any source.

In some cases, this might mean you don’t even have to file a tax return. You should always check with a tax professional, though, before you skip filing altogether.

Recommended Reading: Social Security Office Killeen Tx

The Social Security Tax Wage Base

All wages and self-employment income up to the Social Security wage base are subject to the 12.4% Social Security tax. The wage base is adjusted periodically to keep pace with inflation. It was increased from $132,900 to $137,700 in 2020 and to $142,800 for 2021. Heres how it broke down year by year from 2012 to 2021:

| Social Security Wage Base by Year |

|---|

| 2021 |

How Much Is Social Security Tax

The Social Security tax is part of the FICA taxes withheld from your paychecks. For 2022, the total Social Security tax rate is 12.4% on a workers first $147,000 in wages. The wage base is set by Congress and may change annually.

These are the most recent Social Security wage bases.

| Tax Year | |

|---|---|

| 2017 | $127,200 |

If you work for an employer, youll be on the hook for 6.2% of your pay. Your boss will kick an additional 6.2% and submit the combined 12.4% to the federal government.

If youre self-employed, youre responsible for the entire 12.4%. The IRS offers a self-employment tax deduction that can lessen the sting.

Read Also: Social Security Monthly Payment Calculator

How Is My Social Security Tax Calculated

Calculate Social Security and Medicare Matches Multiply the employees gross wage by 7.65 percent. This is the amount of your companys Social Security and Medicare tax matching contribution.

How is Social Security calculated?

Social Security benefits are based on your lifetime earnings. Your actual earnings are adjusted or indexed to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

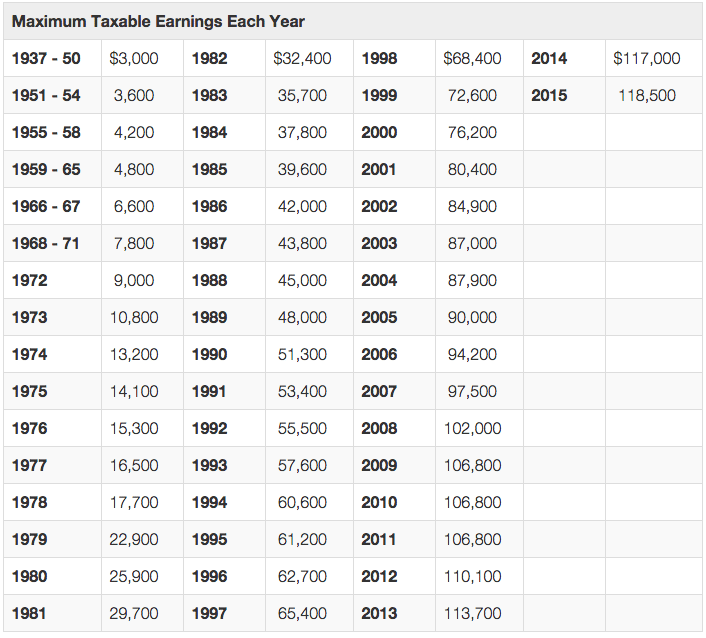

History Of Social Security Tax Limits

The Social Security tax rate rarely changes, as employees have been paying 6.2% since 1990 however, unlike the tax rate, the Social Security tax limit is adjusted annually.

The federal government increased the Social Security tax limit in 10 out of the past 11 years. The largest increase was in 2023 when it was raised almost 9% from $147,000 in 2022 to $160,200 in 2023.

You May Like: National Committee To Preserve Social Security And Medicare

What Is Social Security Tax Rate For 2020

The Federal Insurance Contributions Act tax rate, which is the combined Social Security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2020 up to the Social Security wage base. The maximum Social Security tax employees and employers will each pay in 2020 is $8,537.40.

What is the Social Security tax rate in Texas?

For Social Security tax, withhold 6.2% of each employees taxable wages up until they have earned a total of $142,800 for the year. As an employer, you also need to pay this tax. For Medicare tax, withhold 1.45% of each employees taxable wages up until they have reached a total earning of $200,000 for that year.

Raising Or Eliminating The Tax Cap

Raising or even eliminating the cap on taxable wages would mitigate the erosion of the Social Security tax base. Rising inequality, driven by rapid wage growth among the highest earners, means a greater proportion of wages are above Social Securitys tax cap.

There is precedent for either approach. Policymakers have raised the Social Security payroll tax cap many times, and they eliminated the Medicare payroll tax cap in 1994. Two prominent deficit-reduction committees have proposed raising the tax cap so that it covers 90 percent of all earnings and then pegging it to that level in the future. Others have proposed eliminating the tax cap altogether.

Changes to the tax cap would affect only the highest-earning workers. In any given year, about 6 percent of workers earn more than the current tax cap. Over a lifetime, 20 percent of workers earn more than the tax cap for at least one year. Most of these workers have high lifetime earnings and thus also receive relatively high Social Security benefits. Raising the payroll tax cap to fund Social Security benefits is broadly popular, even among the highest earners about half of millionaires support raising the cap.

Raising the tax cap could affect Social Security benefits as well, as policymakers would face a choice about how to account for any newly taxed earnings specifically, whether and how to include them as part of the average indexed monthly earnings, or AIME, used to calculate benefits. There are three options here:

Recommended Reading: What If You Lose Your Social Security Card

Can You Cut Your Social Security Taxes

There are a few ways you can affect how much tax you pay on Social Security, most of which tie into decisions about taking retirement plan withdrawals as taxable income. Apart from that, though, most older Americans don’t have much flexibility with their tax planning. For them, knowing what tax rate will apply can simply help them prepare for what they’ll have to pay the IRS at tax time.

The Motley Fool has a disclosure policy.

What States Do Not Tax Social Security Income

According to the Tax Foundation, 37 states and the District of Columbia do not levy income tax on Social Security income: Alaska, Alabama, Arizona, Arkansas, California, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, Wisconsin, Wyoming, and the District of Columbia.

Read Also: Social Security Office In Colorado Springs

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance youll have to boost the overall tax efficiency of your retirement income plan. Heres how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while youre collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

States That Tax Social Security Benefits

You may have dreamed of a tax-free retirement, but if you live in one of the states that tax social security, your benefits could take a hit.

Are Social Security benefits taxable? You can bet your bottom dollar they are at least by the federal government, which taxes up to 85% of your benefits, depending on your income. But do states tax Social Security? Unfortunately, a dozen states can tack on additional taxes of their own.

States have different ways of taxing Social Security, too. It can be age-based, such as in Colorado where people under 65 may owe taxes on Social Security benefits but older people generally dont. But other states tax Social Security benefits only if income exceeds a specified threshold amount. For example, Missouri taxes Social Security benefits only if your income tops $85,000, or $100,000 for married couples. Then theres Utah, which includes Social Security benefits in taxable income, but allows a tax credit for a portion of the benefits subject to tax. Other states have different methods of taxing your Social Security check.

The state-by-state guide to taxes on retirees is updated annually based on information from state tax departments, the Tax Foundation, and the U.S. Census Bureau. Income tax rates and related thresholds are for the 2022 tax year unless otherwise noted.

Recommended Reading: Social Security Office Springfield Mo

Withholding On Social Security Benefits

You can elect to have federal income tax withheld from your Social Security benefits if you think you’ll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2022. You’re limited to these exact percentagesyou can’t opt for another percentage or a flat dollar amount.

If you’d like the government to withhold taxes from your Social Security income, file Form W-4V, the Social Security Withholding Tax Form. This will let the Social Security Administration know exactly how much tax you would like to have withheld.

Read More On Social Security

This is an increase from the previous amount of $142,800 in 2021 and means that workers on high salaries will be paying tax on more of their income.

The tax rate for 2022 earnings sits at 6.2% each for employees and employers.

So individuals earning $147,000 or more in 2022 would contribute $9,114 to the OASDI program, and their employer would contribute the same amount, according to the Social Security Administration.

For those who are self-employed, the OASDI tax rate is 12.4%.

You May Like: Social Security Office Corpus Christi Tx