Lost Or Stolen Federal Payments

Report your lost, missing, or stolen federal check to the agency that issued the payment. It’s usually one of these paying agencies. If your documentation indicates it’s a different agency, and you need its contact information, look in the A-Z Index of U.S. Government Departments and Agencies.

To get an update on your claim, contact the Treasury Department Philadelphia Financial Center at 1-855-868-0151, option 1.

How Your Primary Insurance Amount Is Calculated

Once you have your AIME, you can calculate your primary insurance amount , the base rate for your Social Security payments. The PIA calculation relies on so-called âbend pointsâ that determine how much of your income will be replaced by Social Security benefits in retirement.

Think of bend points as similar to tax brackets, in that they determine a percentage of your benefits based on incremental buckets of earnings. There are three bend point buckets: one for 90% of income replacement, one for 32% and one for 15%.

These bend point buckets help give lower lifetime earners a higher percentage of income replacement, and higher lifetime earners a lower rate of income replacement, says Jim Blankenship, certified financial planner and author of âA Social Security Ownerâs Manual.

The dollar amounts of bend points are adjusted for inflation each year, but the percentages of each bend point are set by law and remain unchanged. AIME amounts are always rounded down to the nearest $0.10. For 2021, the bend points are:

⢠90% of the first $996 of your AIME, plus

⢠32% of your AIME between $996 and $6,002, plus

⢠15% of your AIME over $6,002

For a worker with an AIME of $6,250, the calculation would look like this:

⢠90% of $966 = $896.40, plus

⢠32% of $5,006 = $1,601.92, rounded down to $1,601.90, plus

⢠15% of $248 = $37.20

This worker would earn a monthly Social Security benefit of $2,535.50 .

If You’re Not Sure Why You Received A Payment

If you receive a check or direct deposit payment from the Treasury Department and do not know what its for, contact the regional financial center that issued it. Only the agency that authorized the payment can explain why you received it.

If you received a check, look for the RFCs city and state at the top center. Then contact that RFC to find out which federal agency authorized the payment. It will be one of these:

If you received payment byelectronic funds transfer , or direct deposit, follow the directions under Find Information About a Payment.

Use the Treasury Check Verification System to verify that the check is legitimate and issued by the government.

Also Check: Social Security Office In Des Moines Iowa

How To Get A Copy Of Your Social Security Statement

The SSA mails out Social Security Statements to follks age 25 and over before their birthdays during their 25, 30, 35, 40, 45, 50, 55, and 60 years. For those age 60 until retirement, the SSA will send out statements every year. You can also go online to get a copy of your statement or view it online. Go to www.ssa.gov/mystatement/ and open an account with Social Security to view your statement.

Beginning Benefits Before Fra

If you choose to begin to receive benefits before you reach your full retirement age, one or both of the following calculations will apply:

- 5/9 of 1%: Your benefits are reduced by 5/9 of 1% per month, up to a maximum of 36 months, depending on how many months you have until you reach FRA.

- 5/12 of 1%: If you are more than 36 months away from reaching FRA, the reduction above is applied, and then for the number of months greater than 36, the benefit is further reduced by 5/12 of 1% per month.

Therefore, if your FRA is age 66, your benefits would be reduced by 25% if you begin taking them at age 62. Find that figure by taking 5/9 of 1%, or 0.56 multiply by 36 months to get 20%. Then, 5/12, or 0.42, multiplied by the remaining 12 months, is 5% for a total of 25%.

Don’t Miss: Do Employers Need Social Security Number For Background Check

Fact #: Social Security Lifts Millions Of Older Adults Above The Poverty Line

Without Social Security benefits, about 4 in 10 adults aged 65 and older would have incomes below the poverty line, all else being equal, according to official estimates based on the 2021 Current Population Survey. Social Security benefits lift more than 16 million older adults above the poverty line, these estimates show.

An important study on retirement income from the U.S. Census Bureau that matches Census estimates to administrative data suggests that the official estimates overstate older people’s reliance on Social Security. The study finds that in 2012, 3 in 10 older adults would have been poor without Social Security, and that the program lifted more than 10 million older adults above the poverty line.

No matter how it is measured, its clear that Social Security lifts millions of older adults above the poverty line and dramatically reduces their poverty rate.

How Much Social Security Income Is Taxable

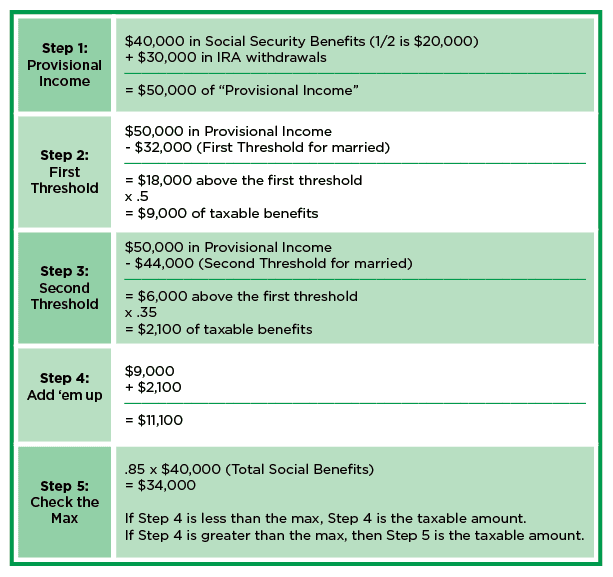

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Read Also: I Need The Number To The Social Security Office

Apply The Social Security Benefits Formula

Once you know your AIME, you can plug it into the Social Security retirement benefits formula as outlined above. But remember to choose the correct formula for your age. You should use the one that was in effect in the year you turned 62 regardless of whether you signed up for benefits at that age.

The results you get from this step will give you your PIA. If you choose to sign up at your FRA, that’s also how much you’ll get for a benefit. But if you sign up before or after your FRA, there are a few extra steps to calculating your monthly benefit.

Your May Have To Pay Taxes On Social Security Benefits

Most people know that Social Security is funded by a tax on earnings, currently 6.2% for the employee . But some retirees dont realize that you may well have to pay income tax on Social Security benefits when it comes time to claim them. Benefits lost their tax-free status in 1984, and the income thresholds for triggering tax on benefits havent been increased since then.

It doesnt take a lot of income for your Social Security benefits to be taxed. Your benefits wont be taxed if your provisional income is less than $25,000 if youre single or $32,000 if youre married. If youre single and your provisional income is between $25,000 and $34,000, or married filing jointly with provisional income between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. If your provisional income is more than $34,000 on a single return or $44,000 on a joint return, up to 85% of your benefits may be taxable.

The Social Security Administration says about 40% of beneficiaries pay taxes on their benefits. Since the thresholds arent adjusted for inflation, the number of beneficiaries who pay taxes on Social Security benefits increases every year. The Social Security Trustees annual report estimates that taxes on Social Security will total $45.1 billion in 2022, up from $34.5 billion in 2021.

You may also have to paystateincome taxes on your Social Security benefits. See our list of the 12 States That Tax Social Security Benefits.

Recommended Reading: How Long Does It Take To Get Social Security Disability

Myth #: You’ll Never Get Back All The Money You Put Into The Program

Everyone’s situation is different, but if you live a long time, you may collect more than you contributed to the system.

Due to the complexity of claiming strategies and number of variables involved, the SSA no longer offers a break-even calculator on its website. Social Security is designed to provide a safety net of income for the retired, the disabled, and survivors of deceased insured workers. The contributions you and your employers make during your working years provide:

While the government does not have a specific account set aside just for you with your FICA contributions , one of the most powerful features of Social Security is that it provides an inflation-protected guaranteed income stream in retirement, ensuring against the risk you’ll outlive your savings. Even if you live to 100 or more, you’ll continue to receive income every month. And, if you predecease your spouse, your spouse also receives survivor benefits until their death.

Checklist For Your Social Security Claiming Strategy

- Know your numbers. Find out your FRA, earnings history, and estimated benefits.

- Stay current. Sign up for your most current statements on SSA.gov.

- Do the math. Use calculators on SSA.gov to check out your monthly benefit options.

- Get the facts. Don’t succumb to myths use primary resources such as SSA.gov.

Recommended Reading: Bill To Increase Social Security Benefits

Social Security Calculation Step : Aime Calculation

Now, all you have to do is extract the highest 35 years of indexed earnings.

If youre still working and dont have 35 years, youll need to estimate what your future earnings will be and apply the indexing factors just as you would for actual historical earnings. This is where you can start to play around with the numbers to see the various impacts of retiring early, or working later or maybe having variable earnings close to retirement.

Once you have your highest 35 years in the last column, you just need to sum them up and divide by 420. You divide by 420 because thats the number of months in 35 years and we need to get your average earnings expressed as a monthly number.

Once you do this, congratulationsyou have your AIME and have finished the first step of the calculation. Its downhill from here.

NOTE: If you die before accumulating 35 years of earnings, there is an alternate calculation. See my article If You Die Early: How To Calculate Social Security Survivors Benefits.

Other Pensions Might Reduce Your Social Security Benefits

Your benefits will be affected if you have a pension from a job that didnt have Social Security taxes taken out of your paycheck. Common examples include people who worked for a public education system, railroad workers and Federal government employees hired before 1984 who are covered by the Civil Service Retirement System .

Two complicated provisions will affect your claiming strategy: the Windfall Elimination Provision and the Government Pension Offset . The WEP reduces your own benefits by a discounted factor based on how many years you worked in jobs that did not withhold Social Security taxes. The GPO reduces your spousal and survivor benefits by two-thirds of the amount of your noncovered pension.

Also Check: Social Security Office Waycross Ga

Impact Of Changing The Cola Index

A January 2019 report by the U. S. Government Accountability Office found that changing to one of these alternative indexes would have a relatively small impact on benefits in a given year but could become significant over time.

A change would have the most profound impact on low-income retirees who are on Social Security for an extended period. The report said that using a chained CPI over 30 years would result in a decrease in benefits of about 6 percent for a low-income household. Switching to the CPI-E would increase income for that household by about 4 percent. Thats because low-income households rely more heavily on Social Security, which makes up about 81 percent of their retirement income.

In contrast, for high-income households, the chained CPI would decrease total retirement income by about 1 percent, and using the CPI-E would increase it by about 1 percent over that same 30 years. High-income households rely on Social Security for only about 15 percent of their overall retirement income, according to the report. These households are more likely to have other sources of income, such as pensions, investments and retirement annuities.

The Social Security Administration has estimated that changing to the chained CPI would push about 456,000 people into poverty by 2050 and changing to the CPI-E would lift about 238,000 people out of poverty by 2050.

Join Thousands of Other Personal Finance Enthusiasts

Back Payments And Retroactive Payments Are Often Included Once You Are Approved

When you are approved for SSDI or SSI, you are often approved with back payments or retroactive payments included. Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away.Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

Recommended Reading: Social Security Office Des Moines Ia

Is There A Maximum Benefit

Yes, there is a limit to how much you can receive in Social Security benefits. The maximum Social Security benefit changes each year. For 2022, itâs $4,194/month for those who retire at age 70 . Multiply that by 12 to get $50,328 in maximum annual benefits. If that’s less than your anticipated annual expenses, youâll need to have additional income from your own savings to supplement it.

How Are Spousal Benefits Calculated For Social Security For Married People

If someone is married to a worker eligible for Social Security benefits, they may be able to claim spousal benefits based on their worker spouses earnings. Social Security spousal benefits are based on the worker spouses earnings and the age of the claiming spouse. Note that spousal benefits do not in any way decrease your spouses retirement benefit.

To qualify for Social Security spousal benefits:

- Both the higher-earning worker and the claiming spouse must be at least 62

- The couple must have been married for at least one year

- The higher-earning worker spouse must already be receiving their earned benefit

Depending on the age that the spouse claims, the benefits can range between 32.5%-50% of the worker spouses primary insurance amount . As with earned benefits, youll receive less than the full spousal benefit if you decide to claim before your full retirement age. But unlike earned benefits, you dont receive more if you wait to claim spousal past full retirement age. In fact youll actually be forfeiting some money by waiting longer.

If only one spouse worked, then the Social Security Administration calculates half of the worker spouses PIA and adjusts it based on the age of the claiming spouse.

Read Also: Social Security Ticket To Work 2021

Using Your Benefit Estimates

As your statement will show, your Social Security retirement benefits will vary depending on when you claim them before or after your full retirement age . The longer you wait to start receiving payments, the higher your benefit amount will be.

However, it’s not always better to wait until your full retirement age to claim your Social Security benefits. If you need your Social Security benefits for living expenses, or you have a health condition that makes it unlikely that you will live past age 75 or so, you may be better off collecting your benefits sooner rather than later. You can use a calculator at the Social Security website to see which retirement age makes the most financial sense for you .

For comprehensive practical information about how and when to claim Social Security benefits, see Social Security, Medicare & Government Pensions, by Joseph Matthews with Dorothy Matthews Berman .

You could be eligible for up to $3,345 per month In SSDI Benefits

Don’t Forget The Social Security Earnings Test

The only important caveat to the strategy of receiving Social Security benefits and working at the same time is the Social Security Earnings Test – where ongoing earned income can partially or fully reduce retirement benefits if they are taken early. So you cannot retire at 62 and still work, or earned income above the Earnings Test threshold will reduce the retirement benefits. The strategy of working while getting Social Security benefits is only viable after reaching full retirement age . On the other hand, beyond that point, it really is possible for each subsequent year of work in someone’s late 60s or even 70s and beyond, to be receiving Social Security benefits while working and have those benefits recalculated for the future based on another year of work !

So what do you think? Have you ever counseled a prospective retiree to keep working after 66 not just to delay Social Security benefits, but to increase their earnings in order to be eligible for a higher calculated benefit? Would you consider the strategy in the future? Please share your thoughts in the comments below!

Also Check: When Does Social Security Disability Convert To Regular Social Security