The Future Of Social Security

Social Security has been a huge success. It provides benefits to 44 million Americans who are elderly, disabled or survivors of deceased workers. More than three-fifths of the elderly derive the majority of their income from Social Security. Without the programs benefits, half of the elderly would live in poverty. Social Security also provides families of active workers with a form of life insurance worth more than $12 trillionmore than all private life insurance currently in force.

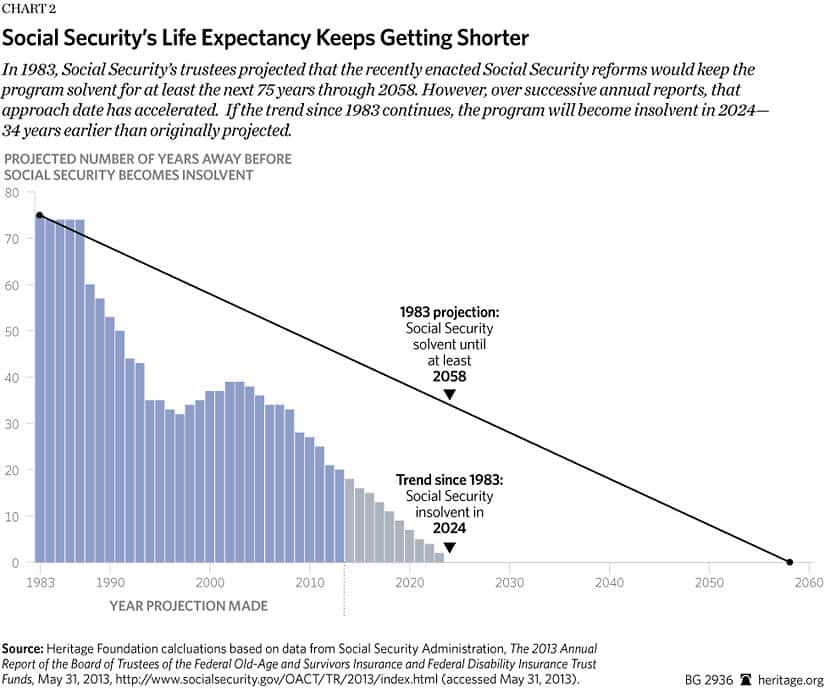

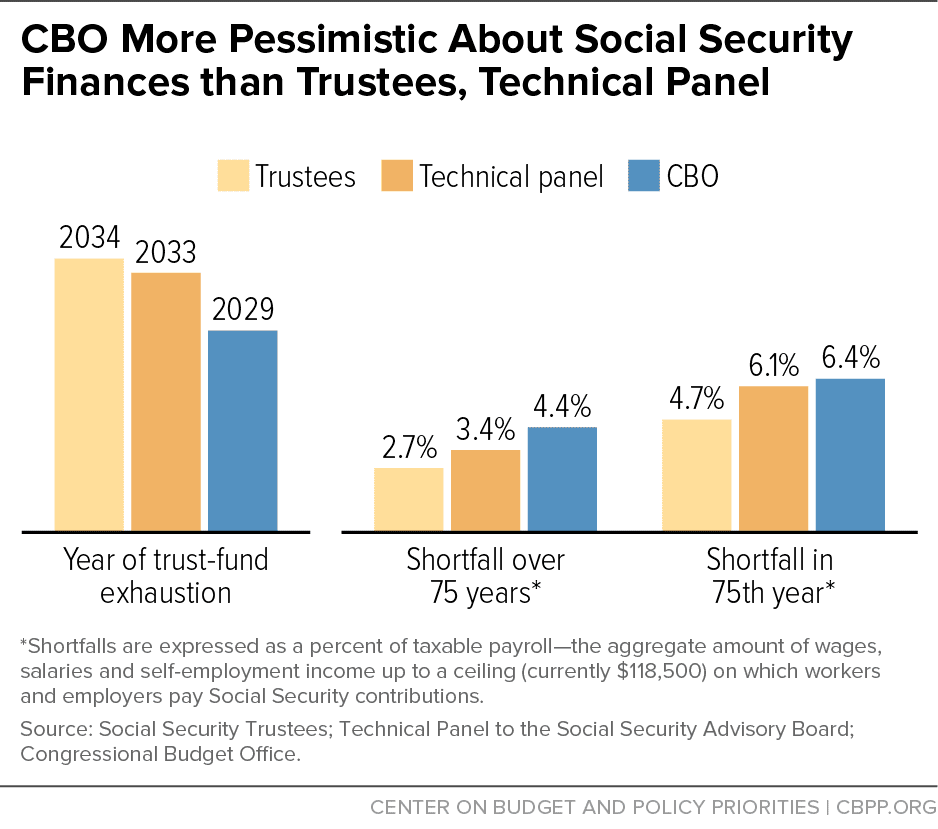

Its accomplishments notwithstanding, the current system has to change. The number of beneficiaries will double over the next four decades while the number of workers who pay the taxes that support the system will grow by only 17 percent. Although the programs receipts now exceed its expenditures by more than $100 billion a year and it is adequately funded for the next three decades, the revenue will cover only 70 percent to 75 percent of promised benefits after 2029.

But before we succumb to bull-market frenzy, everyone should insist on answers to three questions: Would the returns on personal accounts actually exceed what a reformed Social Security could deliver? Would benefits under a privatized system be safe? Would these privatized alternatives reliably fulfill the current programs crucial social functions?

The Retirement Age Could Go Up

In 1983, Congress raised the full retirement age to 67, a change that is still getting phased in today.

Some experts say bumping up the retirement age now is not out of the question, especially as many people work and live longer.

This change may be gradually phased in. Adjustments could also be made so those who are forced to retire at the earliest age of 62 don’t see a drastic reduction in benefits.

Still, advocates for expanding the program generally oppose this change because it is a benefit cut.

Benefits Could Be Cut

The funding shortfall could be solved by cutting benefits for all Social Security beneficiaries including those who are currently receiving benefits or simply cutting benefits for future Social Security beneficiaries. If nothing is done until 2034 or 2035, however, all benefits would need to be reduced by 22%.

Read Also: Social Security Office Cary Nc

Uncertainty Of The Future

Projections of cost and income for the OASDI program are inherently uncertain. This uncertainty is thought to increase for more extended periods into the future. The trustees attempt to illustrate the nature and extent of uncertainty in the annual reports in several ways. Mentioned earlier are the high-cost and low-cost alternatives to the intermediate sets of assumptions. These alternatives provide scenarios in which the principal assumptions used for projecting the financial status of the program are assumed to collectively differ from the best estimate in either a positive or negative direction. Each parameter is assumed to differ by a plausible amount from the intermediate expectation, so it is unlikely that all parameters will differ in the same direction. As a result, the three alternative projections produce a broad range for the prospects of the program.

The range of cost rates projected for the OASI and DI programs under the three alternatives in the 2009 Trustees Report are shown in Chart 6. Trust fund levels expressed as a percent of annual program cost were presented earlier for the three alternative projections. Projected income rates are shown based on the intermediate alternative II assumptions only, as these rates vary little across the three alternatives.

2009 Social Security Trustees Report,2009 Social Security Trustees Report,

How Should This Affect Your Plans

Increases in the full retirement age are likely and have been put into effect in the past. Tax increases seem almost inevitable, particularly if Americans are even lukewarm to the idea. Slashing benefits will undoubtedly be unpopular, although the most pragmatic solution is likely a combination of all three.

The Social Security system is a system with many moving and changing parts. While it may be underfunded now, it has been overfunded in the past and likely will again. Adjusting to the times is par for the course.

However, focusing on what is in your control is always a stellar option amongst the uncertainty. While Social Security has been a stalwart for many Americans in retirement, it is hardly the only option.

For those planning on Social Security being a significant source of their retirement, there is still ample time for legislation to be passed and change to be implemented. While Congress handles Social Security, future beneficiaries would be wise to pay more mind to their other investments. Payroll and Social Security taxes are automatically taken from wages, although employer-sponsored 401s and IRAs allow more autonomy.

Despite these additional options to save for retirement, many Americans do not take full advantage.

While speculation and educated guesses are a routine part of any investment, predicting what Social Security will be like in a decade with certainty is almost as vain as predicting what the stock market will be doing in 2032.

Don’t Miss: Social Security Earnings Limit 2021

Social Security Changes To Know About For Fall 2022

The concept behind Social Security has remained essentially the same since it was conceived back in 1935. However, the specific details regarding funding, payout amounts and other factors are subject to change on an annual basis.

Learn: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

As we head into fall, its an important time for Social Security because this is when the annual cost-of-living adjustment will be calculated. Beyond that, its also important to be aware of important deadlines and developments that may affect Social Security moving forward. Here are the things every current and future Social Security beneficiary should be aware of in fall 2022.

Falcon Heavy Is Back After Three Years: Where And When To Watch Spacexs Mega

Combined income is your adjusted gross income plus nontaxable interest plus half of your social security benefits.

Another decision that has helped to save on costs is the elimination of social security strategies such as file-and-suspend and restricted application. The Bipartisan Budget Act of 2015 eliminated these strategies effective April 30, 2016. A relatively small percentage of recipients utilized these choices. These two strategies reduced available reserves. The federal government also saw these strategies as an unintended loophole and therefore chose to eliminate it. This elimination has also simplified the available choices for taking social security.

Social security will likely exist in the future. However, one should expect a noticeably smaller payment than what current and past recipients receive or have received. Per a recent Social Security Trustees report, future recipients can expect a 21% benefit cut that can grow to 27%. Current new recipients are likely to experience a reduction in future payments if they live long enough . In conclusion, maximizing savings by contributing as much as possible to a 401/403 account, an IRA, and also even a taxable account is imperative for a future in which social security will be a smaller component of an individuals future retirement resources.

Recommended Reading: How Long Does It Take To Apply For Social Security

Retiring On Social Security Alone

Most people find it extremely difficult to retire on Social Security alone. One simply needs to look at the average Social Security payments to quickly see why this is the case. The average Social Security retirement benefit payment in America is just over $1,500 per month. By the time an individual pays for household bills and other necessities, there is often barely enough left over for food. This is why many Americans in the elderly demographic suffer financially. Unfortunately, many of them rely completely on Social Security for their income, and they are often not able to make ends meet.

Consider the fact that people who rely completely on Social Security already struggle, and then think about the current options for changing Social Security. You can see why the options to reduce benefits or reduce COLA increases are not popular. While this is not an easy decision, the Biden administration must take the lead and create a solution to the Social Security solvency issue. If left unsolved, a benefit cut will be unavoidable within approximately the next 15 years.

Don’t Rely On It As The Chief Way To Feather Your Nest

What will Social Security look like when you retire? Many Americans have lost hope that there will be much left to see. According to a 2022 Gallup poll, 40% of those surveyed said they worry about the Social Security system a great deal, while 31% said they worry about it a fair amount. Among those not yet retired, 33% were still counting on Social Security to be a major source of retirement income.

So what will Social Security realistically look like in the future? Should workers be concerned?

Recommended Reading: Social Security Office Kingsport Tennessee

What If I Delay Taking My Benefits

If you retire sometime between your full retirement age and age 70, you typically earn a “delayed retirement” credit for your own benefits . For example, say you were born in 1960, and your full retirement age is 67. If you start your benefits at age 69, you would receive a credit of 8% per year multiplied by two . This means your benefit would be 16% higher than the amount you would have received at age 67.

How Does Social Security Cola Affect Future Retirees

Any cost-of-living adjustments may or may not affect the benefit amount for future recipients, depending on when they apply for Social Security. To understand how this works, it’s important to first understand how the SSA calculates retirement benefits.

The basis for your Social Security benefit is a figure known as your average indexed monthly earnings, or AIME. To arrive at your AIME, the program takes the actual earnings for each year you worked and adjusts the years earlier in your career to bring them closer to what you earned after age 60. It then averages the 35 years of highest indexed earnings and divides that number by the 12 months of the year. The resulting figure is your AIME. The administration applies a specific formula, based on your first year of eligibility, to the AIME to arrive at your PIA.

Here’s the bottom line: You only receive COLA adjustments if you apply for retirement benefits after age 62. Specifically, you get adjustments for any years between your first eligibility and your filing date. If you claim Social Security right when you turn 62, you may not get any of those adjustments.

Even if you don’t receive any previous COLA increases, your Social Security benefits indirectly take inflation into account. The process of indexing wages to arrive at a PIA means the program is adjusting lower-earning years upward to calculate your benefit. In fact, on average, , according to the SSA.

You May Like: Social Security Office Laurel Mississippi

What’s Full Retirement Age

Full retirement age is when you’re eligible to receive full Social Security benefits. Your full retirement age depends on your birth year: For anyone born in 1960 or later, full retirement age is 67. For those born in 1955 through to the end of 1959 , full retirement age ranges between 66 and 2 months and 66 and 10 months. If you were born before 1955, you’ve already reached age 66 and full retirement age.

The Program Isn’t Going To Disappear But You Still Need To Brace For Some Changes

Social Security isn’t what it once was. The program used to be able to pay benefits for seniors, disabled workers, and their families without issue. But rising life expectancies and a greater number of retirees with fewer young workers to replace them has cast doubt on the future of the program.

This isn’t a comforting thought to those who depend on their Social Security checks to pay their bills, but the news isn’t as dire as you might think. Here’s why you don’t have to worry about Social Security disappearing in your lifetime.

Image source: Getty Images.

Don’t Miss: Social Security Office On Terry Parkway

Changes To Medicare Premiums

Although Medicare is technically an independent program separate from Social Security, the SSA actually handles enrollment for Medicare. Many seniors also have their Medicare premiums deducted directly from their Social Security payments.

In 2022, Medicare Part B premiums rose by the largest amount in history, with a 14.5% increase. This more than offset the 5.9% COLA for 2022, which was the highest in 40 years. Fears are mounting that a 2023 increase in Medicare premiums could more than offset the potential double-digit COLA increase in 2023 as well.

As of now, experts are predicting that the 2023 Medicare increase wont be as high as in 2022. However, no one will know until the Medicare premium is announced in October 2022, about the same time as the 2023 COLA will be revealed.

What If I Take Benefits Early

If you choose to take your own Social Security benefit before your full retirement age, be aware that the benefit is permanently reduced by five-ninths of 1% for each month. If you start more than 36 months before your full retirement age, the worker benefit is further reduced by five-twelfths of 1% per month for the rest of retirement.

For example, let’s assume you stop working at age 62. If your full retirement age is 67 and you elect to start benefits at age 62, the reduced benefit calculation is based on 60 months. So, the reduction for the first 36 months is 20% and then another 10% for the remaining 24 months. Overall, your benefits would be permanently reduced by 30%.

Also Check: Social Security Office In Lumberton North Carolina

The Full Retirement Age Could Increase

Because tax hikes arent popular, Congress will more likely raise the full retirement age for Social Security benefits, Roseman said. That means younger generations will have to work longer before they can start collecting benefits.

Currently, the age at which you can collect full retirement benefits ranges from 65 if you were born in 1937 or earlier, to 67 if you were born in 1960 or later.

There Will Not Be Dramatic Changes To Social Security

Despite the possibility of a decrease in benefits down the road, there are important reasons why dramatic changes will not be made to Social Security. First and foremost, it would be economically catastrophic to eliminate Social Security. Many retirees and future retirees rely entirely on Social Security as their primary source of income. So, to remove its financial benefits would be inhumane and cause irreparable financial implications to the United States government.

It is also political self-annihilation for the U.S. to consider eliminating the Social Security program. In a country that continues to face dramatic political polarization, Social Security is one of the only bipartisan issues that neither party is willing to touch.

Social Security changes are happening in general because the program is outdated. The reason these benefits are changing now and the changes that we are seeing are related to three significant factors: COLA , FICA and FRA .

Also Check: Social Security Disability Spousal Benefits

Further Increases In Retirement Age

Another possibility would be an increase in the age at which you gain eligibility for full retirement benefits. This age is already 66 or 67, depending on the year in which you were born. Raising the full retirement age beyond 67 years old would likely not sit well with many Americans, especially since this age was just raised recently. This particular option is not very likely to happen soon, but it is a possibility that it could occur in the long run.

Roth Ira Income Limits

Contributions to Roth IRAs are limited and can be phased out, depending on how much income you earn and your tax filing status.

The income phase-out range for single filers is $129,000 to $144,000 for 2022. For married couples filing jointly, the income phase-out range is $204,000 to $214,000. So if a married couple earns more than $214,000 in 2022, they can’t contribute to a Roth.

Read Also: Lookup Person By Social Security Number

How Much More Should You Save

A retiree who had higher earnings in their lifetime could see a 22% reduction in Social Security benefits in 2034 if no changes are made to the system. Hereâs what you might need to cover from your own savings to make up that amount.

Current monthly benefit: $3148Reduced monthly benefit: $2455

Note: For a retiree whose earnings equaled or exceeded Social Securityâs maximum taxable income and filed at full retirement age. Source: Social Security Administration

Many proposals have been floated to strengthen Social Security, says Gal Wettstein, senior research economist at the Center for Retirement Research at Boston College. But itâs likely that todayâs workers will rely less and less on Social Security as a key piece of their retirement income strategy, even after a fix is implemented. âFor younger savers especially, the money you personally save and invest is likely to continue to play a larger role in determining your financial security in retirement than Social Security,â says Jeremy Kaneer, director, Retirement and Personal Wealth Solutions at Bank of America. Using the four steps outlined below, your advisor can help you develop a plan designed to create the income youâll need in retirement.

âThe money you personally save and invest is likely to continue to play a larger role in determining your financial security in retirement than Social Security.â

Submitting

Thank you. A representative will be in contact shortly.

When To File A Social Security Tax Return

Filing a social security tax return is based on your gross income. If your income is below the taxable limit, you do not need to file a return. If your income is above the taxable limit, you may file a return or request a reduction to reduce the amount of tax due. There is an additional filer-fee for this return.

Also Check: Social Security Office In Colorado Springs