How To Calculate The Social Security Breakeven Age

Your Social Security breakeven age is the point in your life when the total of those lower benefits comes to equal the total of benefits that you would have received if you had waited to take your benefits at FRA, or even later.

For example, if you were born in 1960, your FRA is 67. If you choose to begin receiving Social Security income at age 62, which will be in 2022, then your FRA benefit will be reduced by 30%. Assuming that the full monthly benefit would be $1,000, you will be left with a monthly Social Security check of only $700.

If a co-worker with the same birth date and similar earnings history elects to receive their benefit at FRA five years later, then their benefit will be $1,000 each month. For the first five years, you received a total of $42,000 , while your co-worker received nothing, so you are ahead. Once your co-worker starts receiving benefits, however, they get $300 more each monthor $3,600 more each yearthan you do. So when will your co-worker catch up to you in total benefits?

Lets divide the amount by which you are ahead by the higher amount per year that your co-worker receives. The answer is when you are both 78 years and eight months, or 11.67 years after your FRA. After this point, your co-worker will earn more over their lifetime than you will.

Using This Retirement Calculator

-

First, enter your current age, income, savings balance and how much you save toward retirement each month. Thats enough to get a snapshot of where you stand.

-

Want to customize your results? Expanding the Optional settings lets you add what you expect to receive from Social Security , adjust your spending level in retirement, change your expected retirement age and more.

-

Hover over or tap on the color bars in your results panel to get further insight into where you stand.

-

You can adjust your inputs to see how various actions, like saving more or planning to retire later, might affect your retirement picture.

|

no account fees to open a Fidelity retail IRA |

||

Account minimum |

||

|

when you invest in a new Merrill Edge® Self-Directed account. |

Promotioncareer counseling plus loan discounts with qualifying deposit |

Promotionno promotion available at this time |

Social Security: 5 Things Gen Z Should Know

It might be awhile before Gen Zers enter their retirement years, but its never too early to start learning about Social Security. The earlier Gen Zers understand how Social Security works, the more they will be able to benefit from this program. Here are five things Gen Zers should know about Social Security.

Also: 5 Best Southern Cities To Retire on a Budget of $1,500 a Month

Don’t Miss: Social Security Office In Vidalia

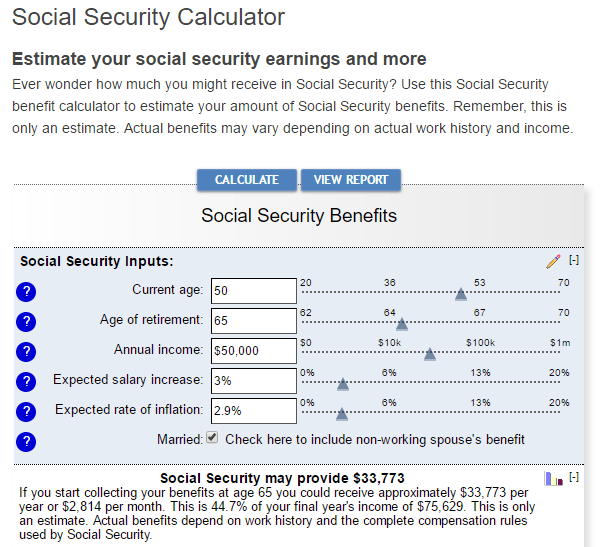

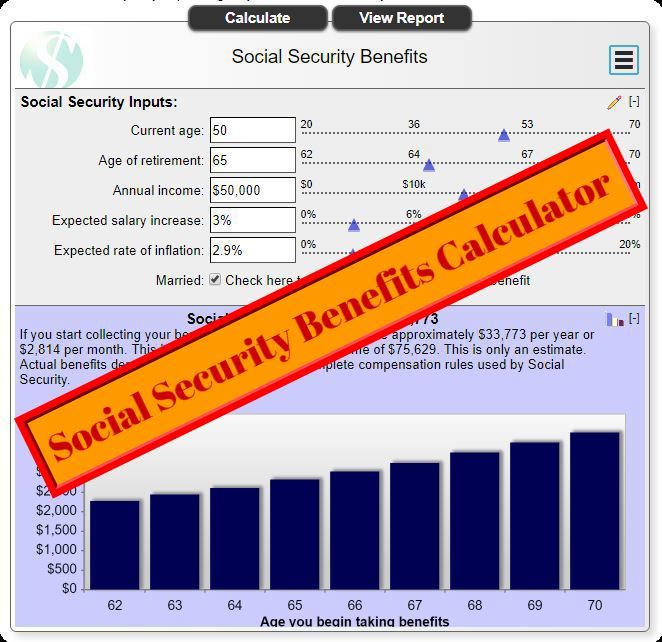

How To Estimate Your Social Security Income

Two facts are knownSocial Security benefits are not guaranteed, and some changes will be necessary to keep the system solvent in the future as millions of baby boomers who have paid in for decades now retire and begin to receive their Social Security benefits. Though these facts create uncertainty, its also true that the quality of your retirement depends on your planningand you must start planning somewhere.

A good starting point is to figure out the dollar amount of the retirement benefits to which all of your years of Social Security contributions entitle you under current law. There are four ways to do this:

On March 17, 2020, all Social Security offices were closed completely due to the COVID-19 pandemic. As of October 14, 2021, they are open, but the website states that most Social Security services do not require a visit to an office. People may also transact their business online, by phone, or through the mail.

What About Taxes On Social Security

Social Security benefits may be taxable, depending on your “combined income.” Your combined income is equal to your adjusted gross income , plus non-taxable interest payments , plus half of your Social Security benefit.

As your combined income increases above a certain threshold , more of your benefit is subject to income taxâup to a maximum of 85%. For help, talk with a CPA or tax professional.

In any case, if you’re still working, you may want to postpone Social Security either until you reach your full retirement age or until your earned income is less than the annual limit. In no situation should you postpone benefits past age 70.

Recommended Reading: New Orleans Social Security Office

Do You Plan To Continue Working In Your 60s

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

You can maximize your benefits even if you work fewer hours or stop working.

You can maximize your benefits even if you work fewer hours or stop working.

Consider working in your 60s for an extra boost to your income and savings.

Consider working extra years in your 60s for an extra boost to your income and savings

Social Security For Spouses And Survivors

Spousal benefits are available to current or widowed spouses aged 62 or older. Applications for spousal benefits are not valid until the other spouse files for their own benefits. It is possible for a non-working spouse to be eligible for a spousal benefit based on their working spouse’s benefit. Based on the working spouse’s age of retirement, the spousal benefit can be up to half of the working spouse’s benefit.

A widow or widower can collect a survivor benefit as early as age 60, given that the marriage lasted more than nine months. This requirement is waived if the widow or widower has a child under the age of 16. In the case where both individuals in a married couple are receiving SS benefits, and one dies, the widow or widower can continue receiving their own benefit or their spouse’s, but not both. It is also possible for a widow or widower to switch benefits in retirement. For instance, if the deceased spouse was scheduled to receive larger benefit amounts at age 70, the widow or widower can first file for their own benefits, then claim their former spouse’s benefits later in order to maximize payments.

A person who is divorced, who was married for more than 10 years and has not remarried, can receive benefits based on their ex-spouse’s work history as long as the divorced person meets all of the following conditions:

The ex-spouse’s benefits can also be claimed even if the ex-spouse has not filed for their own benefits, as long as both parties are above age 62.

Read Also: How Can I Avoid Paying Taxes On Social Security

Social Security Calculation Step : Adjust For Filing Age

The easy way to look at it is to think about it in annual numbers.

Your benefit will be lower if you file at 62 and higher if you file at 70.

If you file after your full retirement age, your benefit will increase by 8% per year. If you file in the 3 year window immediately prior to your full retirement age your benefit will decrease by 6.66% per year of early filing. For anything more than 3 years before your full retirement age, your benefit will decrease by an additional 5%.

A lot of people dont want to retire on their birthday so its important to break this down by a monthly amount.

Primary Insurance Amount Calculation

For 2022, the SSA established the first bend point as $1,024 and the second bend point as $6,172. Using the AIME from the earlier example of $10,141 and the bend points, we can calculate the primary insurance amount .

Below are the steps to calculating the PIA:

- Multiply the first $1,024 of the person’s AIME by 90% = $921.60

- Subtract the 1st and 2nd bend point and multiply that difference by 32% = $5,148*.32 = $1,647.35*

- Subtract the 2nd bend point amount from the total AIME amount and multiply the difference by 15%. = $3,969*.15 = $595.35

*Please note that the calculation results are required to be rounded down to the next lower multiple of 10 cents.

- The PIA is the sum of the three calculation results: = $3,164.30

*The multipliers90%, 32%, and 15%are set by law and do not change annually. The bend points are inflation-indexed but only through age 62. PIA is effectively locked in at age 62.

Don’t Miss: Attorneys For Social Security Disability

The Downside Of Claiming Early: Reduced Benefits

Consider the following hypothetical example. Colleen is 62 as of 2022. If Colleen waits until age 67 to collect, she will receive approximately $2,000 a month. However, if she begins taking benefits at age 62, she’ll receive only $1,400 a month. This “early retirement” penalty is permanent and results in her receiving 30% less year after year.

However, if Colleen waits until age 70, her monthly benefits will increase another 24% over what she would receive at her FRA, to a total of $2,480 per month.1 If she were to live to age 89, her lifetime benefits would be about $112,000 more, or at least 24% greater, because she waited until age 70 to collect Social Security benefits.2

Can I Use The Calculator To Figure Out Social Security Disability Insurance And Supplemental Security Income

No. SSDI is aimed at people who cant work because they have a medical condition expected to last a year or more or result in death. Your SSDI benefits last only as long as you suffer from a significant medical impairment while not earning significant other income.

SSI is a separate program for people with little or no income or assets who are 65 or older, as well as for those of any age, including children, who are blind or who have disabilities. The maximum monthly SSI payment for 2022 is $841 for a single person and $1,261 for a couple. But some states add to that payment, and you may receive less than the maximum if you or your family has other income. Get more information about SSDI and SSI from the Social Security Administration.

Also of Interest

Don’t Miss: Social Security Disability Online Application

Retiring Early From Rising Income Above The Highest 35 Years Of Earnings

On the other hand, if the prospective retiree has more than 35 years of historical earnings, but not all of those prior years were as high as today, there may still be some prospective impact to retiring early. In this case, its because the additional years of work are replacing prior years in the calculation of the highest 35 years of benefits. Which means eliminating them from the projection by retiring early loses out on some opportunity for increasing benefits.

For instance, the chart below shows the historical earnings of an individual who has been in his peak earnings years since a big promotion in his mid 50s, and is trying to decide whether to retire early at age 60. His current Social Security statement projects his retirement benefits to be $2,374.24, which implicitly assumes he will keep earning his $110,000/year salary until full retirement age, which means 6 more years of knocking out his $40,000/year earnings from back in his 20s.

Of course, the reality is that the prior $40,000/year of earnings will still be included in his Social Security benefits, if he stops working early and doesnt replace them with later earnings. However, that means at the margin, each year he continues to work replaces an old $40,000/year salary with a new $110,000/year salary, a $70,000 difference that increases the 35-year AIME average by $70,000 / 35 = $2,000/year .

Defining The Social Security Break

Your Social Security break-even age represents, in theory, the ideal point in time to apply for benefits in order to maximize them. Remember, you can begin taking your benefits at age 62 at a reduced amount. But by taking your benefits at this earlier age, youll receive more Social Security checks over your lifetime assuming you reach your desired life expectancy.

On the other hand, delaying your benefits past full retirement age increases them year over year until you reach age 70. Currently, the full retirement age for most people is either 66 or 67 years old, based on Social Security Administration guidelines. If you wait until age 70 to start claiming your benefits, youd receive 132% of your regular monthly benefit amount. So the trade-off is receiving fewer checks from Social Security but the ones you do get would be larger.

Your break-even age is the point at which youd come out ahead by delaying Social Security benefits. Your actual Social Security break-even age can depend on the number of benefits youre eligible to receive, your tax situation and things like how inflation might affect the purchasing power of your benefits.

Don’t Miss: How To Pay Social Security Tax Self Employed

What If I Change My Mind

If you receive Social Security benefits at a reduced rate but then change your mind, you have the option of withdrawing your application within the first 12 months of receiving benefits and paying back to the government what you’ve already received . Then, you could restart benefits at a later date to take advantage of a higher payout. Be aware that you’re limited to one withdrawal per lifetime.

For example, let’s say you elected to receive early benefits at age 62 but then decided to go back to work at age 63. You could withdraw your Social Security application, pay back the years’ worth of benefits you received, go back to work, and then wait until your full retirement age to restart your benefit checks at a higher level.

Once you reach full retirement age, another option is to voluntarily stop benefits at any point before age 70 to receive delayed retirement credits . Benefits will automatically restart at age 70 at a higher amountâunless you choose to start taking benefits before then. Note that when you withdraw your application or stop your benefits after full retirement age, you must specify if your Medicare coverageâif you have itâshould be included in the withdrawal.

Bridge To Medicare At Age 65

Remember that while you are eligible for reduced Social Security benefits at 62, you won’t be eligible for Medicare until age 65, so you will probably have to pay for private health insurance in the meantime. That can eat up a large chunk of your Social Security payments.

Read Viewpoints on Fidelity.com: Your bridge to Medicare

Also Check: My Wallet Was Stolen With Social Security Card

How To Calculate Social Security Benefits

This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHows legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.There are 10 references cited in this article, which can be found at the bottom of the page. This article has been viewed 70,220 times.

Understanding how much youll receive each month in Social Security benefits is a big part of retirement planning. The average is around $16,000 a year, but the actual amount youll receive depends on how much money youve put into the system. The Social Security Administration and other groups have online calculators that can help you estimate your benefits, but to calculate them more exactly youll have to calculate your average indexed monthly earnings to find your primary insurance amount. This amount must then be adjusted up or down to account for the age you decide to retire.XResearch source

Also Check: Ga State Health Benefit Plan For Retirees 2022

% Of Full Retirement Age Calculator

When planning when to file for Social Security, its helpful to know how much your benefit will be increased, or decreased, based on the month you file.

This calculator will tell you two things:

- your full retirement age

- the percent of your benefit you can expect to receive based on your chosen filing age.

The math behind this calculator is based on the calculations used by the Social Security Administration.

If you file at your full retirement age, youll receive the full benefit.

If you file before your full retirement age your benefit will be reduced. You can file as early as age 62, but doing so could result in a benefit reduction of up to 30%. The monthly reduction percentage is 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

If you file after your full retirement age, you can receive delayed retirement credits up until age 69 & 11 months. These delayed retirement credits will increase your full retirement age benefit by 2/3 of 1% per month that you delay.

Thankfully, you dont need to remember all this math. Just use the calculator below.

Recommended Reading: Social Security Office In Elizabethtown Ky