History Of Social Security Tax Limits

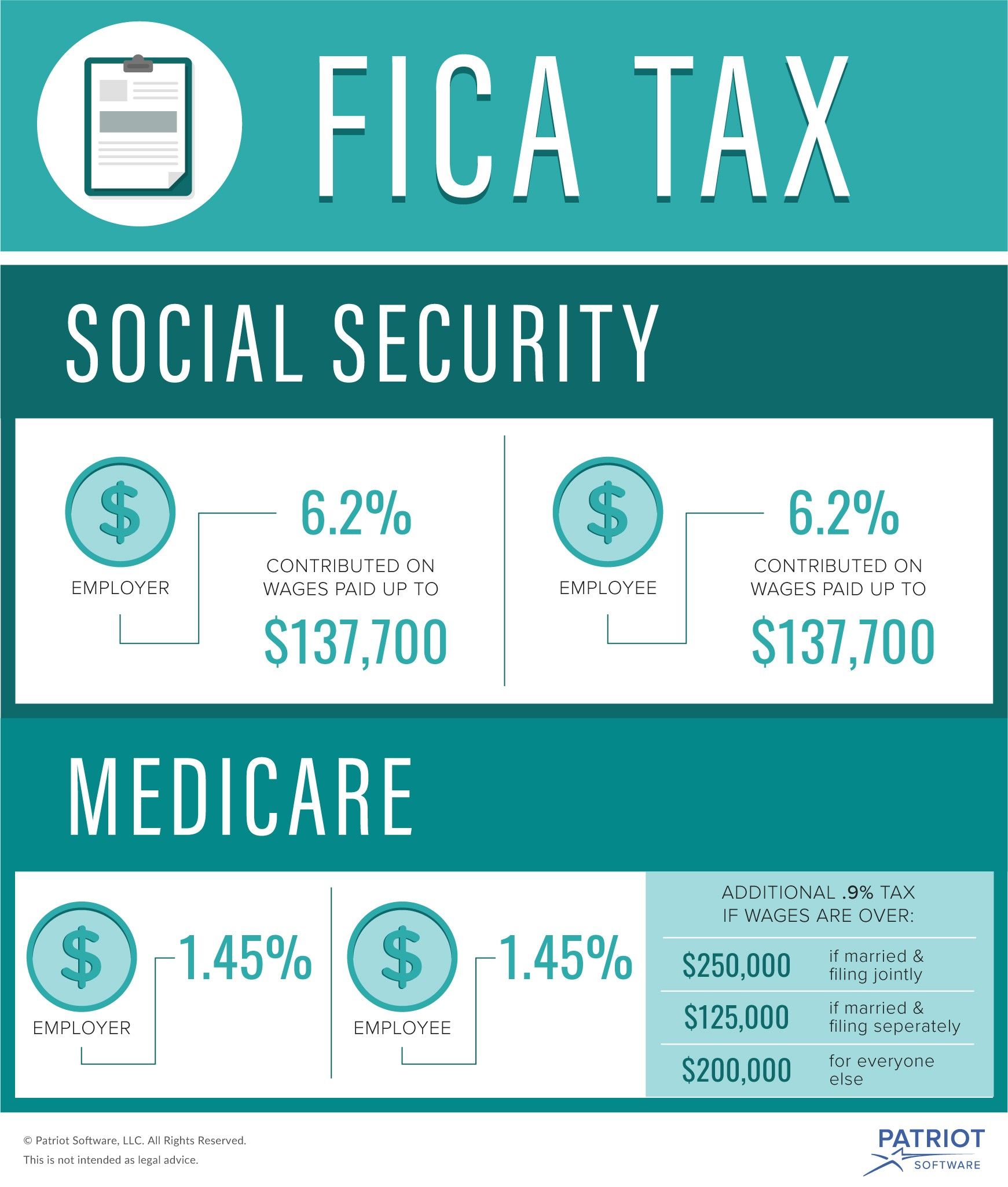

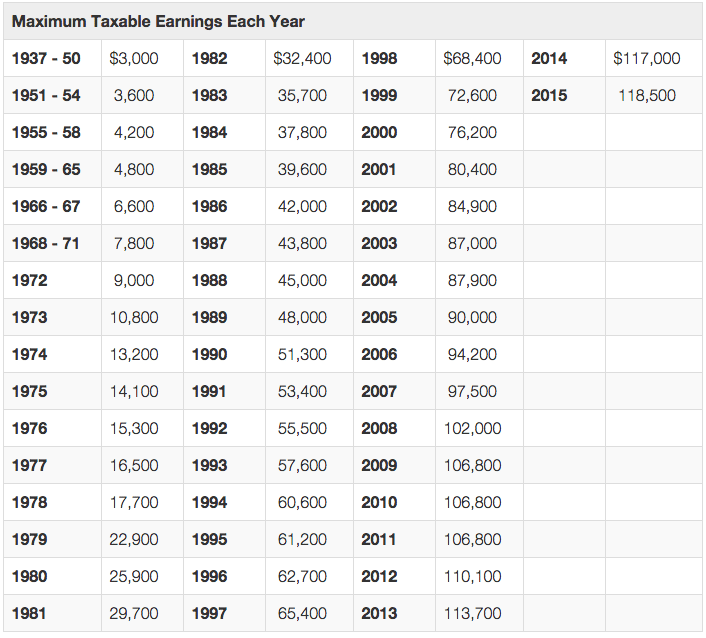

The Social Security tax rate rarely changes, as employees have been paying 6.2% since 1990. However, unlike the tax rate, the Social Security tax limit is adjusted annually.

The federal government increased the Social Security tax limit in 10 out of the past 11 years. The largest increases were in 2020 and 2021 when the limit increased by 3.6% and 3.7%, respectively. In 2022, the increase will be 2.9%.

How To Calculate Your Social Security Tax

If youre planning to tap into your Social Security retirement benefits this year, you can figure out how much of it will be taxed based on how you file and your income amount.

When January rolls around you should receive an SSA-1099 form from the IRS. This form basically tells you how much Social Security youve received for the entire year and youll use it to calculate how much youll owe in Social Security taxes.

Calculator: How Much Of My Social Security Benefits Is Taxable

September 15, 2022Keywords: calculator, retirement, Social Security, tax planning

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises, but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free.

Also Check: Spousal Benefit Calculator Social Security

Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January detailing your benefits during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security website.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2021. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

You May Like: 1800 Number For Social Security

Social Security 202: Latest Announcements And Info To Know Now

Find: 5 Things You Must Do When Your Savings Reach $50,000

For that, they can thank an 8.7% cost-of-living adjustment designed to help seniors and other beneficiaries deal with a soaring inflation rate that is also the highest in 41 years. Heres a roundup of the latest announcements and other information you should know.

Vermonts Social Security Exemption

Vermonts personal income tax exemption of Social Security benefits reduces tax liabilities mainly for lower- and middle-income Vermonters who are retired or disabled. It does this by excluding from taxable income all or part of taxable Social Security benefits reported on the federal Form 1040, U.S. Individual Income Tax Return, which are included in federal AGI. The exemption does not exclude other types of income.

For those who are married filing jointly and civil union partner filing jointly, the exemption applies in full up to an AGI of $60,000, phases out between $60,000-$70,000, and does not apply to filers with AGI greater than or equal to $70,000. For all other filing statuses, the Vermont exemption applies in full to an AGI up to $45,000. It then phases out smoothly for filers earning between $45,000-$55,000. It does not apply to filers with AGI greater than or equal to $55,000. The exemption reduces a taxpayers Vermont taxable income before state tax rates are applied.

Table 2 illustrates how the Vermont exemption is applied by filing status and income level. Graph 1 shows the percentage of taxable Social Security benefits that are exempt from Vermont taxable income based on filing status and AGI.

Also Check: Break Even Calculator For Social Security

What If Social Security Is My Retirement Plan

Do everything possible to keep that from happening. Americans are trying to correct that flawed strategy, though theres plenty of room for improvement.

The countrys retirement score was 83, according to the 2021 Fidelity Investments biennial Retirement Savings Assessment study a three-point improvement over a similar study done three years earlier. That score falls into the good zone. That score means the typical saver was on target to have 83% of the income Fidelity estimated they will need for retirement.

Thats up dramatically from a score of 62 in 2005, but the study also revealed that half of the 3,100 people surveyed probably wont have enough to cover essential retirement expenses.

A 2019 report by The Motley Fool is even grimmer. It found the average retirement savings for American families with some savings was just $65,000.

As insufficient as that number is, there are many other Americans who are headed for disastrous retirements in terms of financial aspects because of their lack of savings. One in four Americans have zero retirement savings, and among the others who are putting money away are likely under-saving. Coupled together, that meant the median for all U.S families was just $5,000 in savings.

Social Security cannot make up for that shortfall. The only strategy is to get your financial house in order and start saving more.

9 MINUTE READ

How To Balance Your New Cola Benefit With Other Income Sources

Many Social Security recipients need the 8.7% COLA just to pay the bills, while others with more wealth built up can simply put it toward savings or discretionary spending. In either case, its important to balance your new COLA benefit with other income sources, experts say.

Regardless of the size of your Social Security increase in 2023, the monthly payment is not intended to be the sole source of income in retirement. It should be complemented with other sources such as retirement accounts, regular savings accounts and other investments. Aim for a mix of income sources, and if you are still investing keep your portfolio balanced between stocks, bonds and funds so that all your eggs are not in one basket.

If you want to develop new income streams to add to your Social Security payment, there are quite a few options. These include not only investing, but also finding side gigs that can bring in more money.

More From GOBankingRates

You May Like: Social Security Office Champaign Il

Can I Pay These Taxes Myself

If you do not fill out Form W-4V and specifically ask to have taxes withheld, they will not be. You are responsible for paying them yourself.

Every January, you will receive IRS Form SSA-1099 in the mail. This is your Social Security Benefit Statement. It shows your total earnings in disability benefits for the previous year. When you file your federal income tax return, you must list the amount from your SSA-1099 as income. As mentioned above, your total income from all sources determines if any portion of your benefits are taxable.

If you wish to pay your taxes yourself but do not want to bear the risk of coming up short at the end of the year, you have a third option. You can make quarterly estimated payments to the IRS. If you come up a little bit short, you pay the difference at tax time. If you overpay, you receive a tax refund.

History And Rationale For Taxing Social Security Benefits

For more than four decades, Social Security benefits were not subject to income tax. The Treasury Departments rationale for not taxing Social Security benefits was that the benefits under the Act could be considered as gratuities, and since gifts or gratuities were not generally taxable, Social Security benefits were not taxable.

Former Social Security Commissioner Robert M. Ball long argued that, since Social Security is an earned benefit, it should be taxed like other earned benefits, such as employer pensions. Workers pay income tax on private pensions to the full extent that their benefits exceed their contributions, with no income thresholds.

As a leading member of the Greenspan commission on Social Security in 1982-83, Ball had an opportunity to promote this idea. The subsequent Social Security Amendments of 1983 provided that up to 50 percent of benefits would be taxable for beneficiaries with incomes above certain levels. A decade later, the Omnibus Budget Reconciliation Act of 1993 provided for the taxation of up to 85 percent of benefits for individuals with modified AGI above somewhat higher thresholds. The provision has since remained unchanged.

Don’t Miss: At What Age Is Social Security Not Taxable

Minimize Withdrawals From Your Retirement Plans

Money that you pull from your traditional IRA or traditional 401 will count as income in the year that you withdraw it. So if you can minimize those withdrawals or even not withdraw that money at all, it will help you get close to the tax-free threshold. Of course, this may not apply if youre forced to take a required minimum distribution that pushes you over the edge.

If youre not forced to take an RMD in a given year, consider taking money from your Roth IRA or Roth 401 instead and avoid generating taxable income.

Also Check: License To Do Taxes

What Is Social Security

Social Security is a federal program that pays monthly benefits to retirees, surviving spouses and children, and disabled people. An average of 65 million Americans collect Social Security monthly.

The money for Social Security, as well as Medicare, comes from a tax that every working American pays. It’s a 7.65% tax on every paycheck, or a 15.3% tax for self-employed people that covers both the employee and the employer portions. That tax is levied on the first $147,000 of a worker’s income in 2022.

So, while workers pay a tax to fund the Social Security program, other people are benefiting by collecting a monthly check. Those benefit checks are then often taxed as income, returning a portion of the money to the federal government.

Also Check: Social Security Monthly Payment Calculator

What Is Supplemental Security Income

Social Security Disability Insurance benefits and SSI benefits differ based on who receives them and why. SSI recipients do not need to meet the same disability or work credit requirements like those who receive Social Security Disability Insurance benefits.

Generally, SSI payments go to the elderly, blind, or disabled. Also, SSI benefit recipients often qualify for Medicaid assistance automatically.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

What Is The Social Security Tax

The Social Security tax is one reason your take-home pay is less than your income. The tax of 6.2% is deducted from your pay and appears on your paycheck stub either as FICA or Fed OASDI/EE. Your employer also pays 6.2%, making for a total Social Security tax of 12.4% per employee. Read on to learn what the pay-stub acronyms stand for, whether the self-employed have to pay the tax and if theres any way to avoid paying it.

Social Security is one of the largest government programs in the U.S., accounting for just under a quarter of federal spending. Roughly one in four Americans are collecting some kind of Social Security retirement benefit each month, and all of the money has to come from somewhere. Thats where the Social Security tax comes in.

You May Like: Social Security Office In Sedalia Missouri

How Much Is Taxable

Generally, up to 50% of benefits will be taxable. However, up to 85% of benefits can be taxable if either of the following situations applies.

- The total of one-half of the benefits and all other income is more than $34,000 .

- You are filing Married Filing Separately and lived with your spouse at any time during the year.

Who is taxed. Benefits are included in the taxable income for the person who has the legal right to receive the benefits.

Example: Lisa receives Social Security benefits as a surviving spouse who is caring for two dependent children, Christopher, age 9, and Michelle, age 7. As dependents of their deceased father, Christopher and Michelle also receive Social Security benefits. The benefits for Christopher and Michelle are made payable to Lisa. When calculating the taxable portion of the benefits received, Lisa uses only the amount paid for her benefit.

The amounts paid for Christopher and Michelle must be added to each childâs other income to see whether any of those benefits are taxable to either of the children.

Withholding. You can choose to have federal income tax withheld from Social Security or Railroad Retirement benefits by completing Form W-4V, Voluntary Withholding Request.

Make Sure Youre Taking Your Maximum Capital Loss

If youve invested in stocks or bonds and have a loss on paper, you might want to sell and realize that loss so you can claim it as a tax deduction. The process is called tax-loss harvesting, and it can net you a sizable deduction from your income.

The tax code allows you to write off up to a net $3,000 each year in investment losses. A write-off first reduces any other capital gains that youve incurred throughout the year. For example, if you have a $3,000 gain on one asset but a $6,000 loss on another, you can claim a deduction for the full $3,000 net loss.

Any net loss beyond that $3,000 has to be carried forward to future years, at which point it can be used. And even if you cant realize the full value of that net loss, it can still make sense to realize some loss, especially if it pushes your Social Security benefit into the tax-free area.

Tax-loss harvesting works only in taxable accounts, not special tax-advantaged accounts such as an IRA.

Read Also: North Carolina Social Security Office

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Can I Retire With Just Social Security

Social Security has a negative rate of return as a savings programthat really sucks. Youre basically putting your money into a program that gives you less than what you put in. Ugh. FolksSocial Security is not a retirement program.

It’s also important to note that, right now, Social Security is only funded until 2034. So, its not a smart idea to bank on that as your sole source of income when you retire, or heaven forbid, become disabled and cant work.

We recommend you have more than Social Security benefits. Lookwe know that might sound impossible for some. But its not!

The fact is, Social Security was never meant to fully support you in retirementits meant to supplement your retirement income. Youve got to make a plan for your future and treat Social Security as the icing on the cake. And its never too early or too late to start saving for retirement. Its what smart people do. Our SmartVestor program can connect you with a trustworthy pro who can help you reach your investing and retirement goals.

Read Also: Social Security Office San Francisco

Withholding On Social Security Benefits

You can elect to have federal income tax withheld from your Social Security benefits if you think you’ll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2021. You’re limited to these exact percentagesyou can’t opt for another percentage or a flat dollar amount.

If you’d like the government to withhold taxes from your Social Security income, file Form W-4V, the Social Security Withholding Tax Form. This will let the Social Security Administration know exactly how much tax you would like to have withheld.

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

You May Like: Social Security Office Kennett Mo