Va Survivors Pension Benefit Rates

Learn about VA Survivors Pension benefit rates. If you qualify for this benefit as a surviving spouse or dependent child, well base your payment amount on the difference between your countable income and a limit that Congress sets .

-

Your countable income is how much you earn, including your salary, investment and retirement payments, and any income you may have from your dependents. Some expenses, like non-reimbursable medical expenses , may reduce your countable income.

-

Your MAPR amount is the maximum amount of pension payable to a Veteran, surviving spouse, or child. Your MAPR is based on how many dependents you have and whether you qualify for Housebound or Aid and Attendance benefits. MAPRs are adjusted each year for cost-of-living increases. You can find your current MAPR amount using the tables below.

Example: Youre a qualified surviving spouse with one dependent child. You also qualify for Aid and Attendance benefits. Your yearly income is $10,000.

Your MAPR amount = $18,867Your VA pension = $8,867 for the year

Read Also: County Of Orange Employee Benefits

You Don’t Have To Work A Day In Your Life To Claim This Benefit

When you think of Social Security, you probably think of retired workers, but there are a lot of people who claim benefits despite never working in their lives. As long as you’re married to a qualifying worker, you can receive a Social Security spousal benefit.

But it might not go as far as you’d expect. Here’s how to figure out what you might get.

To Wait Or Not To Wait

Consider taking benefits earlier if . . .

- You are no longer working and cant make ends meet without your benefits.

- You are in poor health and dont expect the surviving member of the household to make it to average life expectancy.

- You are the lower-earning spouse, and your higher-earning spouse can wait to file for a higher benefit.

Consider waiting to take benefits if . . .

- You are still working and make enough to impact the taxability of your benefits.

- Either you or your spouse are in good health and expect to exceed average life expectancy.

- You are the higher-earning spouse and want to be sure your surviving spouse receives the highest possible benefit.

Recommended Reading: Huntsville Alabama Social Security Office

The Two Exceptions To Know Around The 1 Year Marriage Requirement

Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

Exception 1

If you marry someone who is the natural mother or father of your child, the one year requirement is waived.

Be the natural mother or father of the workers biological son or daughter i.e., this requirement is met if a live child was born to the number-holder and claimant although the child need not be alive.

Exception 2

The 1-year requirement is also waived if you were entitled to Social Security benefits on someone elses work record in the month before you were married.

An example of these benefits would be spousal benefits, survivor benefits or parents benefits.

For example, lets assume you will be eligible for a spousal benefit from your ex-husband Joe. If you remarry, you wouldnt have to wait the full 12 months to get a spousal benefit from your new spouse. Instead, youd be immediately eligible.

This topic is closely related to the Social Security Survivor Benefit. Ive written an in-depth but easy-to-understand article titled Social Security Survivor Benefits: The Complete Guide to Who Gets What and How to Calculate It if you want to learn more.

Retroactive Application For Mother/father Benefits

When you file for mother/father benefits, you can backdate your application by up to 6 months , thereby allowing you to receive a lump sum for months for which you were eligible for a benefit but simply had not yet filed for such.

A reader writes in, asking:

I often hear how smart it is to wait until I turn 70 to begin taking my SS benefit. But I have also read that there is a maximum possible benefit. How can I be sure that I wont run into that maximum before age 70?

This is a common misunderstanding of what is meant by a maximum benefit. There are two different maximum benefits that you might read about , but, to be clear, neither one gets in the way of you waiting until age 70 to file for your retirement benefit.

That is, there is no rule that stops you from accumulating delayed retirement credits due to having run into some maximum. Said yet another way, your own maximum retirement benefit, for a given level of earnings history, will occur if you file at age 70, not prior to age 70.

You May Like: Does California Tax Social Security

What About My Ex

Spousal benefits for divorced spouses are affected by the Bipartisan Budget Act, too. Previously, divorced spouses who were married for 10 years or more could claim reduced auxiliary benefits from their exs record when they reached age 62, or full auxiliary benefits when they reached full retirement age, all while letting their own benefits grow. Thats no longer the case as of April 30, 2016.

If youre divorced and you turn 62 on or before January 1, 2016, you can still file a Restricted Application and receive your divorced spousal benefits, waiting until age 70 to claim your primary retirement benefits. But those who arent in that age group will no longer be able to claim spousal benefits without claiming their primary benefits. Like still-married spouses, ex-spouses will be assumed to be claiming all their benefits when they first file.

Note that a divorced spouse married for 10 years or more can claim full auxiliary benefits on their exs record at any age if he or she is caring for the dependent minor child of the ex-spouse.

Also, the divorced spousal benefit for people whose ex-spouses are still alive is lower than the divorced widows benefit.

If you remarry, it doesnt keep your ex from being eligible to claim benefits on your record. But having an ex who is claiming benefits on your record wont keep your new spouse from being able to claim benefits either.

Dont Miss: At What Age Do Medicare Benefits Start

What Happens If The Deceased Received Monthly Benefits

If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months.

For example, if the person died in July, you must return the benefits paid in August. How you return the benefits depends on how the deceased received benefits:

- For funds received by direct deposit, contact the bank or other financial institution. Request that any funds received for the month of death or later be returned to us.

- Benefits received by check must be returned to us as soon as possible. Do not cash any checks received for the month in which the person dies or later.

Read Also: Boston Medical Center Employee Benefits

Recommended Reading: Is The Social Security Office Open To The Public

Social Security For Retirement

The biggest determinant of retirement benefit amount is lifetime earnings since the benefit is based largely on the average of a persons 35 highest-earning years. Because the SS tax is regressive, in retirement, lower-income earners will have a higher portion of their SS retirement benefits paid out in relation to their lifetime earnings than higher-income earners. Another important determinant of benefit amount is the age at which a person applies for retirement benefits.

SS is designed to replace about 40% of the average American workers pre-retirement income. This value is dependent on each individuals work history higher-income earners will receive larger SS checks than lower-income earners, but the check will be a smaller percentage of their pre-retirement income. SS is not intended to be a sole source of retirement income, and as such, it is advisable to have other forms of income in retirement. This can take the form of anything from rental property income to annuities, mutual funds, or even tax-shielded retirement plans such as a 401 and/or IRAs.

Full Retirement Age

When to Apply for Social Security Retirement Benefits

- The immediate need for cash

- Life expectancy

- Relative age, income, and health of spouse

Social Security Credits

You May Like: When Do Social Security Benefits Become Taxable

How To Use The Social Security Benefits Calculator

Not sure where to start? Let us help you:

Read Also: Social Security Office Fayetteville Ga

The File And Suspend Strategy

Prior to 2016, workers could file for benefits , then suspend their own benefits in order to maximize their credits for deferred filing. This so-called file and suspend strategy meant that a lower-income partner could take advantage of spousal benefits while the primary earner accrued delayed retirement credits, thereby increasing their benefit amount.

However, this “have your cake and eat it, too” loophole was closed with the Bipartisan Budget Act of 2015, which took effect in April 2016.

While it is still possible to file for benefits and then suspend payments temporarily, any other benefits that would normally be available on your account are no longer payable during such suspensions.

Spousal Benefits For Widows And Widowers

A widow or widower can receive up to 100% of a spouse’s benefit amount. That’s if the survivor has reached full retirement age at the time of the application.

The payment is reduced to somewhere between 71% and 99% of the deceased’s entitlement if the widowed person is at least 60 but under full retirement age.

Disabled people can apply as early as age 50. The agency has a streamlined application process to avoid delays in the first payment.

You may be eligible for benefits even if your spouse died long before reaching retirement age. Every employee racks up annual Social Security “credits” for working. If your spouse earned credits for at least 10 years, a spousal benefit has been earned.

It’s important to note that it pays to hold off until you reach your “full” retirement age to maximize the amount you will receive.

Also, if you are receiving spousal benefits and your spouse dies, you need to notify Social Security. Your spousal benefit of 50% of your partner’s benefit will convert to a survivor benefit of 100%.

And do it promptly. It’s not usually retroactive.

Don’t Miss: Social Security Office In Monroe Louisiana

Calculate My Social Security Income

These days thereâs a lot of doom and gloom about Social Securityâs solvency – or lack thereof. And regardless of whether you think Social Securityâs future is secure, the fact remains that you shouldnât plan on living exclusively off your Social Security benefits. After all, Social Security wasnât designed to make up a retireeâs entire income.

Still, many people do find themselves in the position of having to live off their Social Security checks. And even if you have other income sources in retirement, Social Security can make up a significant part of your retirement income plan. That’s why itâs important to know all the rules surrounding eligibility, benefit amounts, taxation and more.

Do you need help managing your retirement savings? To find a financial advisor who serves your area, try our free online matching tool.

Avoiding Accidental Retroactive Applications

When you file a Social Security application online, the application asks when you want your benefits to start. Similarly, if you file by phone or in person, the SSA employee with whom you speak is supposed to ask when you want your benefits to start. But there have been cases in which the SSA employee doesnt ask. Instead, they just start the applicants benefit immediately, with the maximum possible retroactivity . And, in some cases, thats not what the applicant actually wanted.

So its always important to be clear about exactly when you want your benefit to begin .

You May Like: Social Security Office Wyandotte Mi

They Range From Simple To Sophisticated

Social Security is a government program serving about 65 million people, so you might use one word to describe it: complicated. Hats off to the Social Security Administration , though. It produces one of the best government websites, using plain English to explain its rules. It also has plenty of calculators and worksheets to help.

We pulled together some of our favorites. Keep this list handy next time youre sifting through the maze of Social Security rules and regulations. You won’t need all 11, but some of them will likely help answer some of your questions as you start to plan.

How Do Social Security Spousal Benefits Work

Youre eligible for spousal benefits if youre married, divorced, or widowed, and your spouse is or was eligible for Social Security. Spouses and ex-spouses generally are eligible for up to half of the spouses entitlement. Widows and widowers can receive up to 100%.

You can claim benefits based on your own work history or on that of your spouse. Youll automatically get the larger amount.

If you are no more than three months away from age 62, you can apply online or by phone. If you plan to put off applying to get the largest payment possible, wait until youre no more than three months from full retirement age. Thats 66 or 67, depending on your year of birth.

You May Like: States That Don T Tax Social Security

You May Like: Social Security Office Shelby Township

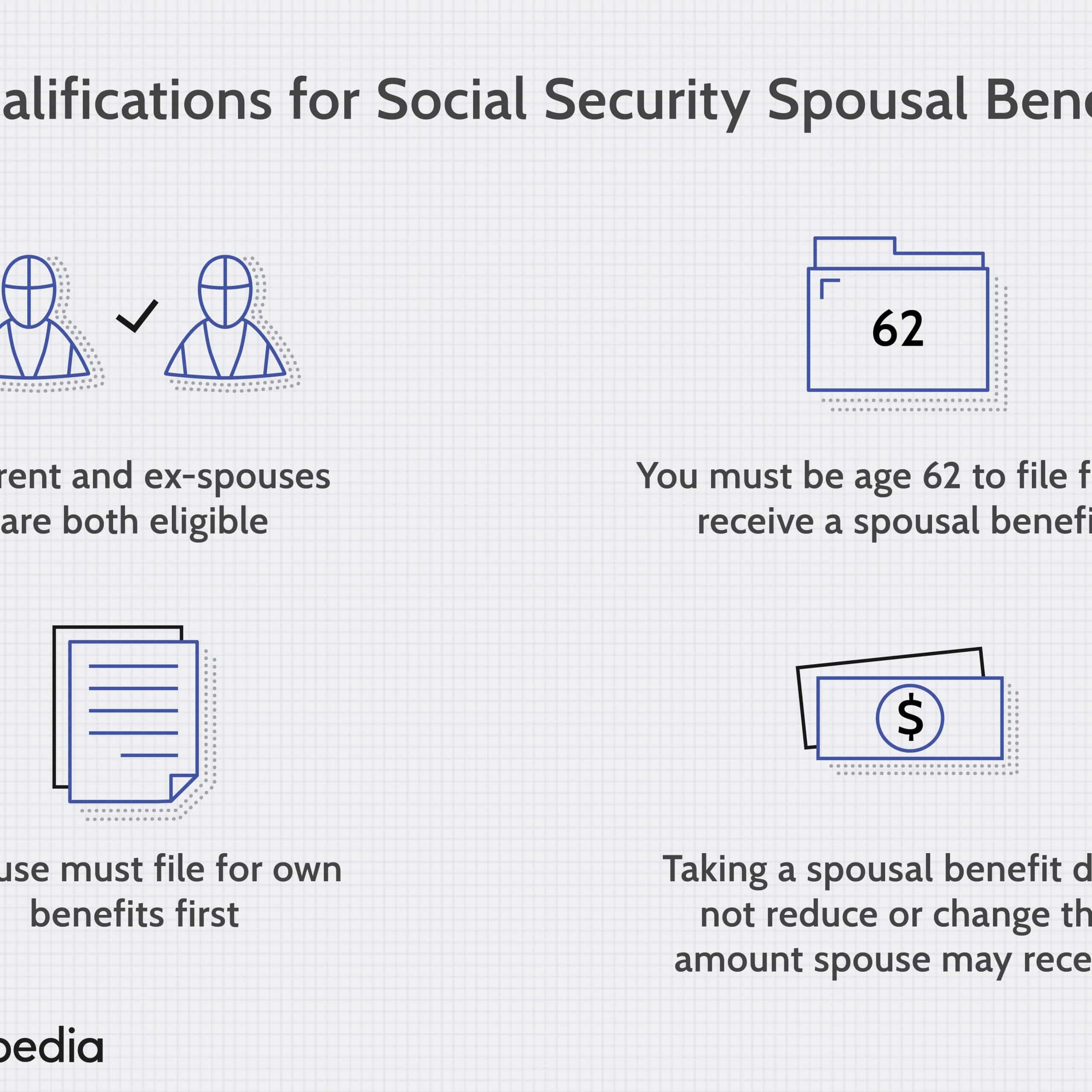

What Does It Take To Qualify For Social Security Spousal Benefits

Unlike most rules related to Social Security, the rules for the spousal benefit entitlement are pretty straightforward and easy to understand.

If youve been married to your current spouse for at least one year, youre eligible for a spousal benefit under their work record.

Pretty simple, right?

You may also qualify for the spousal benefit If youre divorced but the marriage lasted for at least 10 years and youre not currently married.

Can You Switch From Your Social Security Benefit To A Spousal Benefit

Yes. If you begin collecting your own Social Security benefits at age 62 but your spouse keeps working for another few years, you are eligible to your spouses benefit after they retire if it is higher than your own. Thus, your spouse will get the maximum amount and you can file for 50% of the amount your spouse would receive at full retirement age.

Read Also: What Can Someone Do With My Social Security Number

Read Also: Bloomington Indiana Social Security Office

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Who Qualifies For Widow Benefits

Generally speaking, a widow or widower may qualify for survivor benefits if the individual is at least 60 years old and has been married to the deceased individual for at least nine months at the time of death. Other qualifications can include being the surviving spouse of a Social Security beneficiary from whom you are divorced.

Don’t Miss: Taxes On Social Security 2021

How Much Could You Receive

The amount you receive as a surviving spouse or common-law partner will depend on:

- whether you are younger or older than age 65

- how much, and for how long, the deceased contributor has paid into the CPP

We first calculate the amount that the CPP retirement pension of the deceased is, or would have been, if the deceased had been age 65 at the time of death. Then, a further calculation is done based on the survivors age at the time of the contributors death.

Who Can File For Social Security Spousal Benefits

To be eligible for spousal benefits, you must be married, divorced or widowed, and your spouse either is or was eligible for Social Security.

The spouse must be at least 62 years old or have a qualifying child a child who is under age 16 or who receives Social Security disability benefits in his or her care.

Both opposite-sex and same-sex married couples are eligible for Social Security spousal and dependent benefits. So are some individuals in legal relationships such as civil unions and domestic partnerships. And those who were married for at least 10 years and have been divorced for at least two years also can apply.

Spouses can claim benefits based on their own work history or their spouses work history. They will automatically collect whichever amount is larger, but not both.

You May Like: What Are My Ss Benefits When I Retire

Read Also: Can I Get Va Pension And Social Security