Secure Retirement Your Way

So what can someone do when retirement is 20, 30, or even 40 years away? The best plan is to start saving now. Take advantage of the time you have and save as much as you can in your 401 or individual retirement accounts , traditional or Roth.

The typical 401 plan automatically deducts your pre-tax contribution from gross earnings in each paycheck, reducing taxable income for the year. 401 plans also defer taxes on the accumulated gains until the money is withdrawn.

Be sure to contribute enough to get your employers full match, even if it is a small percentage. Otherwise, youre passing up free money. Even if your company does not match contributions, 401 plans are a good deal. You get a tax break on the contribution, your funds grow on a tax-deferred basis, and you’ll be able to deposit much more than you can in an IRA.

What Can Congress Do About Social Security’s Funding Issue

Munnell notes that there are two ways for Congress to solve the current long-term funding issue. The Social Security administration can either cut benefits for people or increase tax revenue.

Cutting benefits could mean reducing benefits for everyone or increasing the full retirement age again. Congress could also pass legislation that would increase tax revenue for the Social Security administration by raising the payroll tax rate or by increasing the Social Security payroll tax income limit from $147,000.

The last time Social Security faced a reserve deficit was 1983. The solvency issue was resolved through bipartisan legislation that, among other changes, increased the full retirement age from 65 to 67 over time and charged income tax on Social Security benefits

Recently, House Democrats introduced the Social Security 2100 Act which would increase Social Security benefits for low-income workers, change the price index the cost-of-living-adjustment is tied to and reapply the payroll tax rate to individuals making more than $400,000.

Since legislation regarding Social Security cannot be passed through reconciliation , any legislation would require support from both Democrats and Republicans, says Romig.

“All we need is political will and that is something in scarce supply, even in the best of times. 2034 to a congressperson is a long time away So there’s no incentive on the part of the people in Congress to solve this problem before it is imminent,” says Munnell.

Will Social Security Be Around When You Retire What Every Generation Should Know

Farnoosh Torabi

Social Security is top of mind for many.

Recently, a significant cost-of-living increase to benefits was announced to help ameliorate the toll high inflation is taking on many seniors’ wallets. And prior to this week’s midterm elections, we started hearing about how some Republican politicians want to throw these federal benefits on the chopping block.

“This is an ideological battle that’s been going on for 85 years,” says William Arnone, CEO of the National Academy of Social Insurance, a nonpartisan organization that aims to educate the public on Social Security’s benefits.

Just like other employed Americans, I’ve been dutifully paying into Social Security since my first gig in high school . I’m sure I speak for my generation when I say that if the government decides to strip us of our monthly paychecks in retirement — watch out, Uncle Sam. You’ll find us protesting in the streets, brandishing our walking canes.

I recently asked my Instagram followers to drop me their related questions and found there’s a lot of confusion regarding the fate of one of the few social insurance programs in this country. I’ll break down some of their questions below, then offer some insight on what each generation might expect from Social Security in the future.

Don’t Miss: Why Did I Get Two Social Security Checks This Month

Retire Early Get Less Retire Later Get More

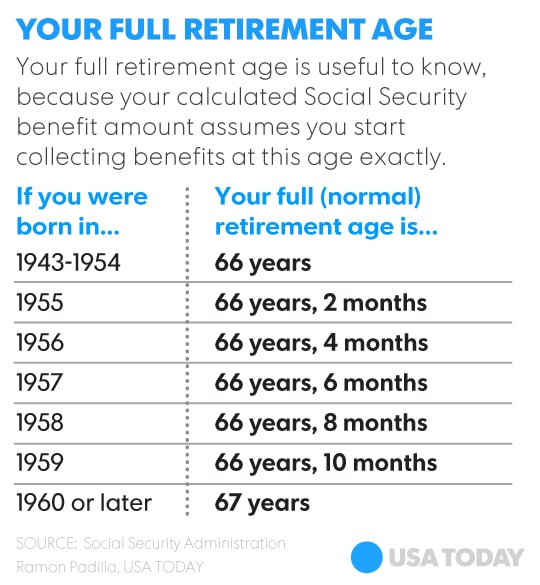

In 2000, Congress raised the full retirement age to help offset the financial costs of increasing life expectancies among Americans.

For those born in 1937 and earlier, full retirement remains at age 65. However, for those born after 1937, the full retirement age increases incrementally until those born in 1960 and after will have to wait until age 67 to receive full benefits.

Despite this, anyone who has paid into the system for at least 10 years can start receiving benefits as early as the first full month after reaching age 62. However, accessing benefits at 62 will permanently decrease the amount you may receive each month by 20 to 30 percent. Conversely, if you delay taking benefits past your full retirement age, your monthly benefits will increase until you turn 70 and reach the maximum benefit amount.

The decision to receive Social Security benefits before full retirement age is contingent on individual circumstances. Even the month in which you choose to begin benefits may make a difference. In addition, other benefits may be available if you are eligible. Not everyone has the financial flexibility to defer Social Security benefits, but if youre considering it, you must compare the advantage of increased monthly benefits against the cost of receiving benefits for fewer years.

Other Pensions Might Reduce Your Social Security Benefits

Your benefits will be affected if you have a pension from a job that didnt have Social Security taxes taken out of your paycheck. Common examples include people who worked for a public education system, railroad workers and Federal government employees hired before 1984 who are covered by the Civil Service Retirement System .

Two complicated provisions will affect your claiming strategy: the Windfall Elimination Provision and the Government Pension Offset . The WEP reduces your own benefits by a discounted factor based on how many years you worked in jobs that did not withhold Social Security taxes. The GPO reduces your spousal and survivor benefits by two-thirds of the amount of your noncovered pension.

Don’t Miss: How To Lock Social Security Number

Exceptions To The Wep & Gpo

The WEP and GPO may not apply in some cases, meaning that some workers who receive pensions can also receive their full Social Security benefits. The rules are complicated, and we’ll provide a few general exceptions here, including how you may be able to avoid the GPO by paying Social Security taxes near the end of your career. Get in touch with the SSA or a financial advisor if you have questions.

It Depends On Your Risk Tolerance

Finally, in addition to your age and income, theres a third factor at play: Your risk tolerance.

Im not talking about the tolerance for portfolio volatility sort of risk tolerance. Im talking about your tolerance for having to make real sacrifices. How much of a problem will it be if your income ends up being less than youd planned on? Are there expenses you can easily cut? Can you go back to work if necessary?

The more flexibility you have with your spending, and the more ability you have to increase your income if necessary, the less danger there is in betting that Social Security will be there, in its current form, when you reach the age at which you could claim benefits.

Read Also: Social Security Office In Chatsworth

Even If You Do Your Own Retirement Saving Social Security Can Still Impact Your Finances

2020 was projected to be the first year since 1982 that Social Security paid out more in benefits than it took in. The last time Social Security paid out more than it took in, Congress passed legislation that increased the retirement age and made a portion of Social Security benefits taxable. The legislation signed into law by President Reagan in 1983 passed with bipartisan support todays deeply divided political climate makes similar compromises much more difficult.

Legislation has been proposed at various times over the last several decades. One of the more intriguing proposals was made by former President George W. Bush, which aimed to partially privatize the system and allow personal Social Security accounts. Americans who opted in would have the option to invest a portion in the market. Investment options may have looked similar to the funds in the Thrift Savings Plan . There are only a handful of funds available, but their returns have been comparable to various index funds and target date funds available elsewhere.

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:

- Direct Express debit card – a pre-paid debit card. Get help by calling the Go Direct Helpline at .

Make Changes to an Existing Direct Deposit Account:

On Go Direct’s FAQ page, learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.

Also Check: Social Security Disability Income Limits

How Is Social Security Financed

In order to understand why Social Security is facing a long-term financing issue, it’s important to know how Social Security works. First off, Social Security is funded through payroll tax deductions. These payroll taxes are taken directly out of an employee’s paycheck and are paid by both employees and employers. In 2022, payroll taxes apply to up to $147,000 of an individual’s annual income.

The payroll tax rate for Social Security is 6.2%. This means that employees pay 6.2% and employers pay 6.2%. Self-employed people will pay the entire payroll tax rate of 12.4%.

When a worker pays their Social Security payroll tax, that money doesn’t go to a specific Social Security fund allocated just for them. Current workers are paying into a system that pays for the benefits of all current retirees.

In 2022, for every dollar you pay in Social Security payroll tax, 85 cents goes towards the Social Security trust fund that pays monthly benefits to current retirees and their families , according to the Social Security Administration. The other 15 cents goes to a trust fund that pays benefits to people with disabilities and their families

In recent years, there has been an excess of reserves in the Social Security Trust Fund: the amount of money that the Social Security administration collects through payroll taxes exceeds the amount of money the administration pays out in benefits.

Three Things To Keep In Mind

For most people, Social Security benefits will represent a portion of their income during retirement yearsnot their sole source of income. It’s important to be aware of three important factors that will affect the amount of Social Security benefits you will eventually receive:

- When you choose to begin taking benefits

- Whether or not your benefits are taxed

- Whether or not you continue working

You May Like: Social Security Office Decatur Alabama

Will Social Security Run Out Before I Retire

While there are a lot of questions about the future of Social Security, the fact is that it is highly unlikely the program will ever actually run out of money. The federal government founded the Social Security program during the Great Depression. The program provides money to people after theyve retired. A tax that everyone pays while they are working provides most of the funds in the program. Todays retirees use money todays workers are paying tomorrows retirees use money tomorrows workers will pay. For more help with Social Security and any other financial questions, consider working with a financial advisor.

Your May Have To Pay Taxes On Social Security Benefits

Most people know that Social Security is funded by a tax on earnings, currently 6.2% for the employee . But some retirees dont realize that you may well have to pay income tax on Social Security benefits when it comes time to claim them. Benefits lost their tax-free status in 1984, and the income thresholds for triggering tax on benefits havent been increased since then.

It doesnt take a lot of income for your Social Security benefits to be taxed. Your benefits wont be taxed if your provisional income is less than $25,000 if youre single or $32,000 if youre married. If youre single and your provisional income is between $25,000 and $34,000, or married filing jointly with provisional income between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. If your provisional income is more than $34,000 on a single return or $44,000 on a joint return, up to 85% of your benefits may be taxable.

The Social Security Administration says about 40% of beneficiaries pay taxes on their benefits. Since the thresholds arent adjusted for inflation, the number of beneficiaries who pay taxes on Social Security benefits increases every year. The Social Security Trustees annual report estimates that taxes on Social Security will total $45.1 billion in 2022, up from $34.5 billion in 2021.

You may also have to pay state income taxes on your Social Security benefits. See our list of the 12 States That Tax Social Security Benefits.

Read Also: Social Security Office St Louis

What Social Security Would Look Like In 2035 With This Change

An increase in the payroll tax rate could take different forms. Currently, the total payroll tax is allocated equally between the employee and the employer. The tax increase could be allocated equally among employers and employees or allocated more to the employer to hide the tax hike from taxpayers.

A legislative proposal called the Social Security 2100 Act from Rep. John Larson favors the latter option. It would raise the federal payroll tax rate by 6.2% for employers, and would only raise taxes on employees making more than $400,000. The bill has gained some support but so far has stalled in Congress, Politico reported.

Who Pays For Social Security

If you have a job, then you do. On your paycheck, youll see a deduction marked FICA. Thats an acronym for the payroll tax known as the Federal Insurance Contributions Act. As you work and pay FICA taxes, that money goes into the trust fund that will someday pay for your Social Security benefits.

For most employees, the Social Security tax rate is 6.2 percent of their wages up to an annual maximum, in 2023, of $160,200 . Their employer matches that contribution by paying another 6.2 percent on the workers behalf. In total, an amount equivalent to 12.4 percent of each employees paycheck is paid into their Social Security account. Its a similar structure to an employer-matched 401, except its not optional.

A lot of people dont realize that the payroll tax is just a contribution to a retirement account, similar to an I.R.A., Ms. Shedden said. Its not like other federal government taxes. Its going directly towards your future retirement plan.

To see how much youve accrued throughout your working years, you can log into your account on the Social Security Administrations website and see the numbers, along with your projected benefits.

Also Check: Social Security Office In Poteau Oklahoma

Where Does The Money Go

When you pay Social Security taxes, the money is deposited into two financial accounts known as trust funds in the U.S. Treasury. One is the Old-Age and Survivors Insurance Trust Fund, which pays benefits to retirees and survivors of deceased workers. The other is the Disability Insurance Trust Fund, which pays benefits to workers who have become disabled. These accounts can be used only to pay benefits and program administrative costs the government cant dip into them or borrow from them for any other purposes.

The money in both trust funds is invested in Treasury bonds, which are guaranteed by the government. The trust funds earn interest on the bonds they hold, and when those bonds reach maturity or are needed to pay benefits, the Treasury Department redeems them.

You Can Undo A Social Security Benefits Claiming Decision

There arent many times in life you can take a mulligan. But Social Security offers you the chance for a do-over. Lets say you claimed your benefit, but now regret the decision and wish you had waited. During the first 12 months of claiming benefits, you can withdraw your application. You will have to repay all of the benefits youve received, along with any spousal benefits, but when you restart benefits, youll receive a larger amount, just as you would have if you had delayed filing in the first place.

If it has been more than 12 months since you filed for Social Security, you cant withdraw your application and restart benefits at a later date. But early retirees who have returned to the workforce are not totally out of luck: Once you reach full retirement age, you can suspend benefits until age 70. This will enable you to earn delayed-retirement credits of 8% a year . This can add up to tens of thousands of dollars for many people, says William Meyer, chief executive of Social Security Solutions.

Also Check: Louisville Ky Social Security Office

Social Security And Life Expectancy

So back to the funding for Social Security. Retirement at full benefits has been adjusted from 65 to 67. The next question is: What is the life expectancy for US males? Right now, it stands at about 73 . So, the average worker has twenty years of retirement funds after working forty years. According to this calculation, the average retiree will have six nineyears from retirement to his wooden overcoat. What will be done with the funds for the remaining thirteen years?

Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Also Check: Can Husband And Wife Both Collect Social Security