Can I Collect My Ex Husband’s Social Security If He Is Remarried

Can I collect Social Security as a divorced spouse if my ex-spouse remarries? Yes. … Your status as a partner in that unit stands, whether or not your ex-husband or ex-wife marries again. However, if you remarry and become part of a new marital unit, your eligibility for benefits based on the previous unit ends.

Only In Certain States Or If Your Income Exceeds The Federal Limits

A Tea Reader: Living Life One Cup at a Time

Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of people who receive Social Security benefits do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for the program have little or no additional income.

Ssa And The Ssdi Application

If youd like to initiate the SSDI process at a local Social Security office, contact Social Security at the general information line 1-800-772-1213. Explain to the SSA representative that you want to apply for disability income benefits. The representative will schedule an in-person or telephone appointment.

Ask the representative about the information required to complete the application. He or she can have the needed forms and paperwork mailed to you before the appointment takes place. The checklist of required documents will be included in the SSA packet.

You May Like: Social Security Office In Murfreesboro Tn

Do Seniors On Social Security Have To File A Tax Return

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. These filing rules still apply to senior citizens who are living on Social Security benefits. If Social Security is your sole source of income, then you don’t need to file a tax return.

Social Security And Federal Taxes

Even though Social Security money comes directly from the federal government, some of it will be going back to Uncle Sam in the form of federal income taxes. Social Security is treated as regular income for the purpose of taxes. When it comes time to file for taxes, any money you earned including Social Security, money from retirement plans, pension payments and anything you earn from working after you are technically retired will be totaled up to determine your taxable income. Youll then be slotted into a tax bracket and your tax burden calculated.

Recommended Reading: Social Security Office Ann Arbor

Refund Of Erroneous Withholdings

Q. My company moved its office from Delaware to Ohio last year. I had an employment contract and the company paid me according to this contract, although my employment was terminated this year. They have taken Delaware State income tax out of my payments for part of this year. I would like to know under these circumstances why they continue to take out Delaware state tax and what if any tax liability I have, considering I do not live in Delaware and have not worked in Delaware this year. If there is any tax liability, please provide me details of why and tell me how to calculate Schedule W, which clearly shows there is no apportioned Delaware income when no days are worked in Delaware for a non-resident.

A. You must file a non-resident tax return to receive a refund of erroneously withheld Delaware income taxes if you did not live or work in the State of Delaware at any time during the taxable year.

You must attach to your Delaware return certification from your employer that:

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income besides your Social Security, you wont owe taxes on it. However, if youre an individual filer with at least $25,000 in gross income, including Social Security for the year, then up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more , then up to 85% may be taxable.

Recommended Reading: When Did They Start Taxing Social Security

Does Irs Tax Social Security

Taxpayers who receive Social Security payments are reminded by the IRS that they may be required to pay federal income tax on a part of those benefits. Monthly retirement, survivor, and disability payments are included in Social Security benefits. Supplemental security income payments are excluded since they are not taxable.

State Taxes On Disability Benefits

Most states do not tax Social Security benefits, including those for disability. As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, of your disability benefits are taxable.

Also Check: Social Security Disability Phone Number Florida

Planning For Gifts And Bequests

As you look ahead, you may be thinking about giving some of your assets to family members or friends, which is often beneficial to both you and them as long as you can afford to live comfortably on your remaining retirement income.

Transferring wealth is often a good way to avoid incurring estate taxesand that’s in turn good because these taxes can take a larger bite of your assets than even the highest income tax rate. In addition, some states impose inheritance taxes at various rates on what your heirs receive from your estate.

But the good news is that prior to your death, you can make gifts to whomever you wishand you can do so up to a certain amount without paying taxes. The IRS ceiling for individuals and married taxpayers changes from time to time.

In addition, you can make larger gifts tax-free to your beneficiaries over the course of your lifetime. You have to follow IRS rules carefully to comply with the lifetime exclusion provisions. For more details, read the instructions for IRS Form 709.

There are pros and cons to making tax-free gifts. On the upside, giving the money away reduces your taxable estatethat is, what will be subject to estate taxes when you diewhile also helping your beneficiaries. But on the downside, once the gift is given, if you need access to that money later in your retirement, it’s gone.

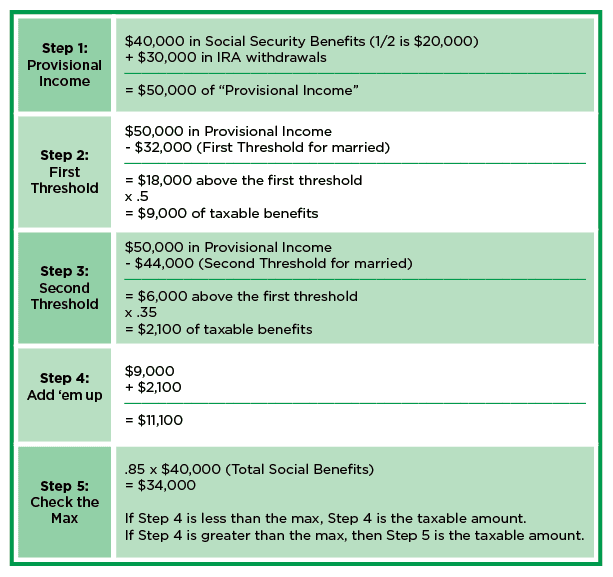

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2021, according to the Social Security Administration.

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either a) half of your annual Social Security benefits or b) half of the difference between your combined income and the IRS base amount.

The example above is for someone who is paying taxes on 50% of his or her Social Security benefits. Things get more complicated if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Also Check: Both Social Security And Medicare Apex

Request For Copies Of Returns

Q. How do I request a copy of a tax return I have filed?

A. In order to give you this information, please provide your social security number, name, your filing status for that year, the amount of refund or balance due, and your address on the return at that time. You may email your request by clicking the personal income tax email address in the contact file, or contact our Public Service Bureau at 577-8200.

Is Social Security Taxable

Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401 or a part-time job, then you should expect to pay some income taxes on your Social Security benefits. If you rely exclusively on your Social Security checks, though, you probably wont pay taxes on your benefits. State taxes on Social Security, on the other hand, vary from state to state. Regardless, it can be helpful to work with a financial advisor who can help you understand how different sources of retirement income are taxed.

Read Also: Social Security Income Phone Number

When Seniors Must File

For tax year 2021, unmarried seniors will typically need to file a return if:

- you are at least 65 years of age, and

- your gross income is $14,250 or more

However, if your only income is from Social Security benefits, you don’t typically include these benefits in your gross income. If this is the only income you receive, then your gross income for taxes equals zero, and you typically don’t have to file a federal income tax return.

But if you do earn other income including certain tax-exempt income, then each year you must determine whether the total exceeds the filing threshold.

- For tax years prior to the 2018 tax year , these amounts are based on the year’s standard deduction plus the exemption amount for your age and filing status.

- Beginning in 2018, only your standard deduction is used since exemptions are no longer part of calculating your taxable income under the new tax law passed in late 2017.

For the 2021 tax year,

- If you are married and file a joint return with a spouse who is also 65 or older, you must file a return if your combined gross income is $27,800 or more.

- If your spouse is under 65 years old, then the threshold amount decreases to $26,450.

- Keep in mind that these income thresholds only apply to the 2021 tax year, and generally increase slightly each year.

Social Security Retirement Benefits Vs Ssi

Supplemental Security Income benefits are considered to be assistance, which means they aren’t taxable. Like welfare benefits, they don’t have to be reported on a tax return. However, the IRS differentiates between Social Security retirement benefits and SSI paymentsSSI payments are not taxable, but benefits may be. Retirement benefits are sometimes completely non-taxable, but it depends on a retirees other sources of income.

Unlike Social Security, which you pay into over the course of your working years, SSI isn’t funded by taxes contributed by you. Rather, it’s funded by the federal governments tax revenues.

The distinction can be confusing, because its possible for someone over age 65 to collect both SSI and Social Security retirement benefits. The Social Security Administration oversees both programs, and beneficiaries use the same application for both payments.

Don’t Miss: Social Security Office Sikeston Mo

Social Security Benefits In : 5 Big Changes Retirees Should Plan For

Inflation has been sky-high over the last year, so its a good thing that the Social Security Administration is boosting its cost of living adjustment for benefit checks in 2023.

Its just one of many changes announced by Social Security recently.

Here are some key changes to Social Security happening next year and what you need to know.

How Social Security Works

The Social Security Administration provides much-needed benefits for tens of millions of American citizens. For many people, Social Security is the sole or main source of financial support. In 2020, the average Social Security retirement pension beneficiary receives $1,514 a month, while the average disability payment recipient gets $1,259 a month. Millions of Americans also get survivor benefits through the SSA as a result of their qualifying dependent relationship with a current or former Social Security beneficiary.

Social Security benefits from all sources are generally paid on a monthly basis, with either direct deposit or paper checks delivered to all recipients in the country. Unlike some government benefits, such as SNAP, Social Security benefits are not earmarked for any particular purpose, but may be saved, invested and spent like any other form of income.

Read Also: Social Security Office Brownwood Tx

When To Include Social Security In Gross Income

There are certain situations when seniors must include some of their Social Security benefits in gross income. If you are married but file a separate tax return and live with your spouse at any time during the year, then 85% your Social Security benefits are considered gross income which may require you to file a tax return.

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security benefit plus all of your adjusted gross income, plus all of your tax-exempt interest and dividends, exceeds $25,000, or $32,000 if you are married filing jointly.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Don’t Miss: Find My 401k With Social Security Number

Learn More With Gerald

Gathering all the necessary documents to file your taxes might seem like a lot of work, but preparing beforehand will make the process much easier. With Gerald, you can easily document and track your expenses throughout the year, making tax time much simpler.

Gerald is a buy now pay later app that offers several great features to help you get organized. From our bill tracker, which keeps you paying on time every time, to our handy cash advances that help you cover bills when you come up short, Gerald can support you in getting your finances in order. Download the Gerald app today and create your account to get started!

Put Your Household Bills on Autopilot and Get an Instant Cash Advance with Gerald.

Ways To Avoid Taxes On Benefits

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. However, this may not be a realistic goal for everyone, so there are three ways to limit the taxes that you owe.

- Place retirement income in Roth IRAs

- Withdraw taxable income before retiring

- Purchase an annuity

Recommended Reading: Social Security Office Liberty Mo

Delaware Resident Working Out Of State

Q. Im considering taking a job in Maryland. I know the states do not have a reciprocal agreement. How does the credit work for taxes paid to another state? Will I owe County taxes in MD?

A. If you are a resident of Delaware who works in Maryland, you may take credit on line 10 of the Delaware return for taxes imposed by other states. You must attach a signed copy of your Maryland return in order to take this credit.

Even though you may not be liable for Maryland County Taxes, Maryland imposes a Special Non-resident tax on their non-resident income tax return.

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account to shield your withdrawals from income tax. Take out some retirement money after youre 59½, but before you retire to pay for expected taxes on your Social Security before you begin receiving benefit payments. You might also talk to a financial planner about a retirement annuity.

You May Like: Social Security Office Winder Ga