Do Medicare Advantage Premiums Come Out Of My Social Security Check

About half of Medicare Advantage plans have $0 premiums, but if you do have a premium, you can deduct it right from your Social Security check. This is your choice, as it is not required to come from the Social Security check.

Please note: If you choose a Medicare Advantage plan, you still must pay the Medicare Part B premium. So, you’d have two premiums coming out of your Social Security check.

Read More: 10 Things Medicare Advantage Plans May Cover That Original Medicare Doesnât

Will Medicare Premiums Deduct From My Social Security Check

Social Security will automatically deduct your Medicare Part B premiums from your monthly Social Security Income check. So, you do not need to worry about paying your premium manually each month.

The amount that comes out of your Social Security check will depend on your annual income. Remember, the standard Medicare Part B premium amount changes annually and high earners will pay a higher premium.

If you do not have Social Security, Medicare will send you a quarterly bill. You can also contact Social Security directly to enroll in automatic payments and pay your premiums quarterly.

Additionally, Social Security can deduct your Medicare Part D drug plan premium. Depending on the effective date, you may need to make premium payments directly for a couple of months before premium withholding begins.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Social Security Benefits And Medicare Part B Premiums From 2000 To 2018

Social Security benefits and Medicare Part B premium amounts are adjusted annually using different methods, which typically has resulted in a higher percentage increase in Medicare Part B premiums than in Social Security benefit increases. Specifically, Social Security benefits are adjusted for inflation annually by COLAs. The Social Security COLA is a measure of general inflation based on the CPI-W. By contrast, Medicare Part B premiums are adjusted annually to account for changes in Medicare program expenditures for covered medical services. Medicare Part B premiums represent a percentage of the actual costs of the program, and thus premiums rise as health care costs rise. The annual percentage increase in Social Security benefits and Medicare Part B premiums for years 2000 to 2018 is shown in Figure 1.

Since 2000, Social Security COLAs have ranged from 0.0% to 5.8% with an average Social Security COLA of 2.2%. There was no Social Security COLA increase in 2010, 2011, or 2016 and only a relatively small Social Security COLA in 2017.

Since 2000, the Social Security annual COLA has resulted in a cumulative benefit increase of approximately 50%, considerably less than the Medicare Part B premium growth of close to 195%.58

Recommended Reading: Social Security Office Pensacola Florida

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $170.10 in 2022. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2022 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

Why Is Medicare Sending Me A Bill

If you get help with Medicare costs through a state Medicaid program, such as a Medicare Savings Program, then your Medicare premiums may be paid for by the state. … In this case, your Medicare plan will send you a bill for your premium, and you’ll send the payment to your plan, not the Medicare program.

You May Like: How To Freeze My Social Security Number

Is Medicare Part B Based On Income

Medicare premiums are based on your modified adjusted gross income, or MAGI. … If your MAGI for 2020 was less than or equal to the higher-income threshold $91,000 for an individual taxpayer, $182,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2022, which is $170.10 a month.

Who Is Eligible For Medicare

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. Its also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease .

While everyone who is eligible can get Medicare when they turn 65, not everyone qualifies for premium-free Medicare. To get Medicare Part A benefits without paying a premium, you must also:

- Be eligible for or currently receive Social Security or Railroad Retirement Board benefits

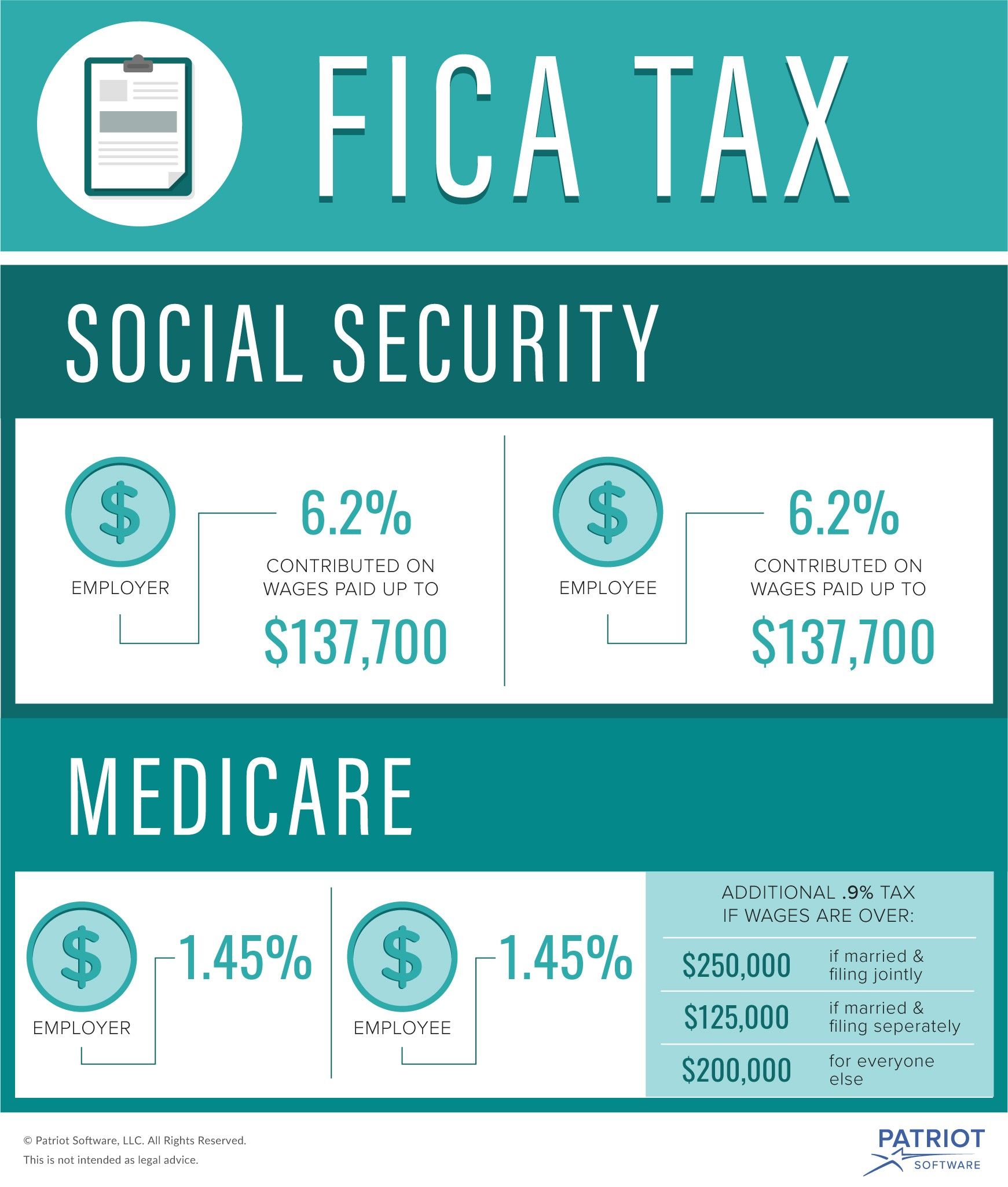

- Have worked and paid FICA taxes for a specified number of quarters of coverage

The number of quarters you must work to qualify for premium-free Part A varies based on your age and health conditions. For people who qualify by turning 65, its 40 QCs, which are typically earned in 10 years of work people with disabilities accrue credits slightly differently based on when their disability began. If you dont have enough QCs, you can choose to purchase Medicare Part A coverage for an amount based on how many quarters youve worked.

If you dont sign up for Medicare when you first become eligible, you may have to pay a 10% late-enrollment penalty for a specified period.

Read Also: Greenville South Carolina Social Security Office

How Much Is Deducted From Social Security For Medicare Part A

For most people, Medicare Part A hospital insurance is premium-free. This doesnt mean it is actually free, because you still have to pay your deductible, co-insurance, and other out-of-pocket costs. However, you will have no monthly premium fees if you qualify.

You are eligible to receive premium-free Part A coverage at age 65 if:

- You or your spouse paid Medicare taxes for ten years or longer

- You already receive Social Security retirement benefits or Railroad Retirement Board benefits

- You are eligible for these benefits but havent yet received them

- You or your spouse had Medicare-covered employment through the government

You can also get premium-free Part A if you are under 65. This will happen if you have received Social Security or Railroad Retirement Board disability benefits for over 24 months, or if you have end-stage renal disease and meet certain other qualifications.

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

How Much Is Medicare Per Month For Seniors

Those who are enrolled in Medicare but aren’t yet collecting Social Security have to pay those premiums directly. Those who are receiving Social Security, meanwhile, have their Part B premiums deducted from their benefits. This year, the standard monthly Medicare Part B premium costs seniors $148.50 a month.

Also Check: Social Security Office In Kennett Missouri

How Much You Need To Retire At 55

Retiring at age 55 will take some careful financial planning, but if youre a diligent saver and/or earn a healthy income, you may be able to achieve that goal. While retiring at age 55 may seem like a dream to many, there are financial risks involved in hanging up your work boots that early in life.

The biggest risk is that you outlive your money, so its important to calculate just how much you should save if you want to retire at 55. But there are other financial issues surrounding an early retirement at age 55 that you should be aware of. Heres a look at how much you might need to retire at 55, what ancillary problems you might have to deal with and steps you can take to help you achieve this goal.

Medicare Tax And Why You Pay It

Summary:

Once you become eligible for Medicare, the tax is automatically deducted from your paycheck on a monthly basis. Over each calendar year, you will see this as a tax on your earnings, including wages, tips, certain Railroad Retirement Tax Act benefits, and self-employment earnings that fall above a certain level. There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Also Check: Free Legal Aid Social Security Disability

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Fact #: Social Security Is Particularly Important For People Of Color

Social Security is a particularly important source of income for groups with low earnings and less opportunity to save and earn pensions, including Black and Latino workers and their families, who face higher poverty rates during their working lives and in old age. The poverty rate among Black and Latino older adults is roughly 2.5 times as high as for white seniors. There is a significant racial retirement wealth gap, leading older adults of color to face more retirement insecurity than their white counterparts. Black and Latino workers are less likely to be offered workplace retirement plans, and they are likelier to work in low-wage jobs with little margin for savings. Social Security helps reduce the economic disparities between older white adults and older adults of color.

Don’t Miss: Someone Stole My Social Security Number

Medicare Part B Premiums

Beneficiaries enrolled in Medicare Part B must pay premiums .35 By law, individuals receiving Social Security benefits have their Medicare Part B premiums automatically deducted from their benefit checks.36 In 2017, approximately 75% of Medicare Part B enrollees had their Medicare Part B premiums deducted from their monthly Social Security benefit checks.37 Those not receiving Social Security are billed by Medicare,usually on a quarterly basis.38Individuals who are enrolled in Medicare Part B but do not receive Social Security may include individuals who are waiting to reach full retirement age and individuals who spent their careers in employment that was not covered by Social Security, including certain federal, state, and local government workers.

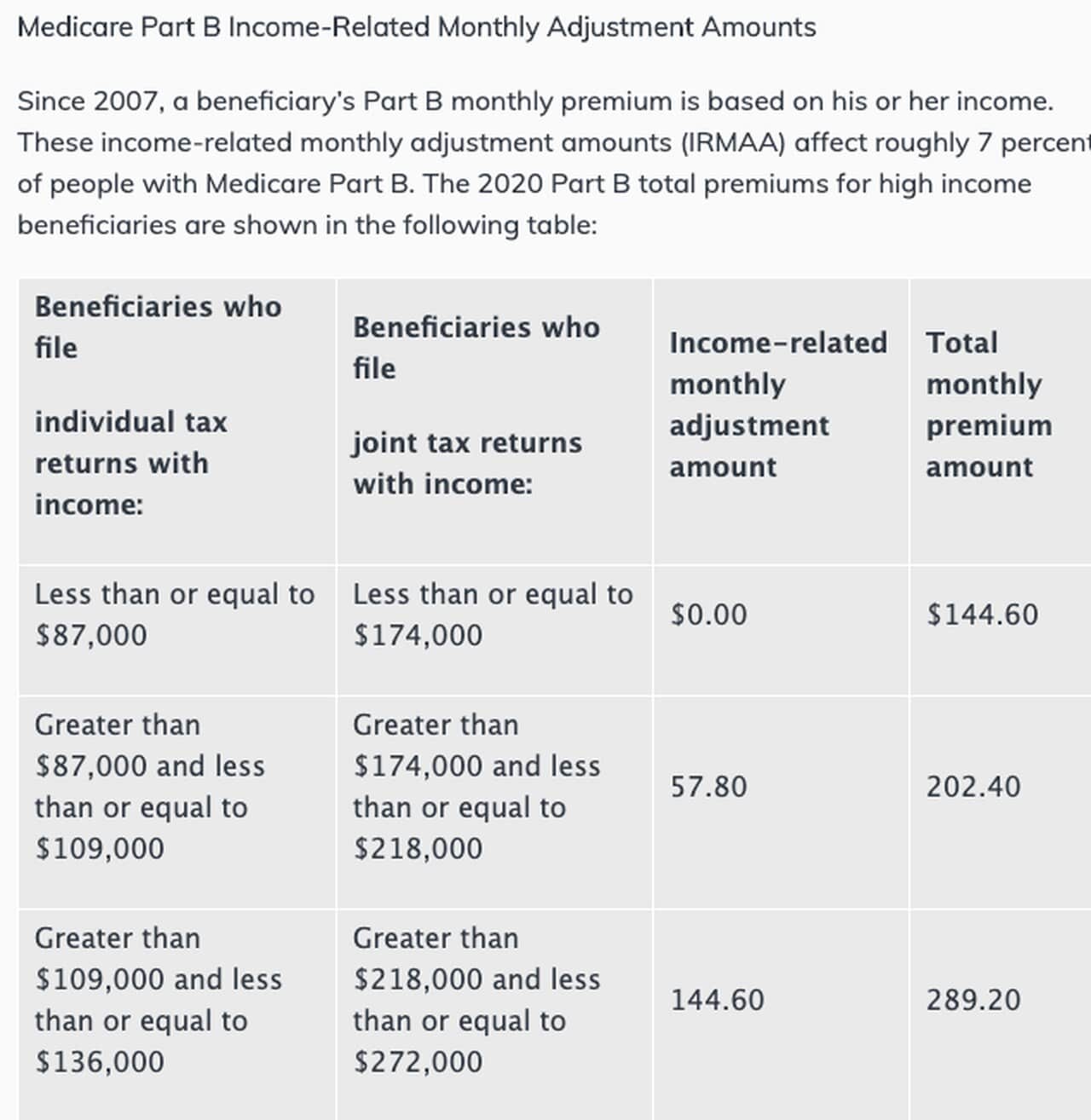

The standard monthly Medicare Part B premium in 2018 is $134.00. This premium applies to individuals with a modified adjusted gross income of $85,000 or less and to couples with a MAGI of $170,000 or less.42 Enrollees earning more than those respective amounts pay higher premiums based on their income, as shown in Table 1.

Table 1. Medicare Part B Premiums, 2018

|

Modified Adjusted Gross Income a |

|

|

428.60 |

Notes: Each member of a couple pays the applicable premium. Lower thresholds are rounded up to the nearest dollar and upper thresholds are rounded down to the nearest dollar.

Medicare Taxes And Benefits

Medicare is a United States federal health insurance program that reduces the cost of healthcare services. Medicare plans cover people age 65 or older, younger people who meet eligibility requirements, and individuals with certain diseases. You are eligible for premium-free Medicare Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years.

Donât Miss: Is Keystone 65 A Medicare Advantage Plan

You May Like: Social Security Office Liberty Mo

What Happens With My Medicare If I Retire At Age 55

Your Medicare isnt technically affected if you retire at age 55, but you still wont be able to access its coverage until you reach age 65 unless you have a qualifying disability. That leaves you with 10 full years until you get government health coverage, so youll have to factor private insurance into your budget for at least that long.

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Recommended Reading: Social Security Office In Toledo Ohio

Q: How Can I Tell If My Employer Is Withholding Social Security And Medicare Taxes From My Paycheck

Social Security provides benefit payments to supplement the income of retirees, disabled persons, and families in which a spouse or parent dies. Medicare provides health insurance for people aged 65 and over, as well as some people with disabilities.

Generally, employers are required to withhold Social Security and Medicare taxes from your paycheck in order to pay for these social programs. Employers also are required to match paycheck withholding amounts for Social Security and Medicare. This match means your employer pays the same amount you do every pay period for Social Security and Medicare withholding. Taxes withheld from your paycheck may be called employee withholding and taxes matched by your employer may be called company match.

How Much Do Part A Premiums Cost

If you paid Medicare taxes for under 30 quarters, the Part A premium is $499 in 2022. Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits. In that case, you will not have to worry about money being taken out for now.

You May Like: Social Security Office In Victoria Texas

Do I Have To Pay For Medicare

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays. Learn more about help with costs.

Medicare Wage Limit In 2022

For 2022, the wage base increases to $147,000 for Social Security and remains unlimited for Medicare. For Social Security, the tax rate is 6.20% for both employers and employeesemployees, and therefore the Maximum Social Security tax that can withheld from wages is found by multiplying these together: 147,000 x 6.20 = $9,114. For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

Recommended Reading: Social Security Disability Payment Schedule

Medicare Part B Premiums For Those Held Harmless

Whether a beneficiary is held harmless or not depends on the amount of the standard Medicare Part B premium increase relative to the amount of his or her Social Security COLA in a given year.

The Medicare Part B premium an individual pays when held harmless may affect his or her future Medicare Part B premium amounts. For example, an individual held harmless in a year with no Social Security COLA may pay an increase in Medicare Part B premiums in a later year in which he or she is not held harmless, even if the standard Medicare Part B premium does not increase.

Table 2. Illustration of the Activation of the Hold-Harmless Provision for a Hypothetical Individual Over Time

|

Year |

|

0.35k |

CRS analysis based on data in 2018 Medicare Trustees Report and 2018 Social Security Trustees Report.

Notes: This chart assumes the individual is eligible for the hold-harmless provision .

a. COLA = Cost-of-living adjustment.

b. This amount is based on the average monthly Social Security benefit amount for a retired worker in 2008 , increased annually by the Social Security COLA.

c. Increase from the previous year.

d. The standard Medicare Part B premium is the premium amount paid by enrollees not held harmless and not subject to high-income-related premiums.

e. Increase from previous year. A negative value indicates a decreased premium.

The Wealthy Can Get A Higher Maximum Social Security Benefit

In 2021, well-to-do retirees can net quite a bit more each month. According to the Social Security Administration, the maximum monthly benefit at full retirement age will increase to $3,148 in 2021, up by $137 from 2020.

Thats an extra $1,644 a year for lifetime upper-income earners during retirement.

On the other hand, The maximum amount of wages taxed for Social Security will be $142,800 in 2021, up from $137,700 in 2020.

Dont Miss: What Is The Medicare G Plan

Recommended Reading: What Is The Social Security Phone Number