Do Seniors Pay Taxes On Social Security Income

Up to 50% of Social Security benefits are taxed on income from $25,000 to $34,000 for individuals or $32,000 to $44,000 for married couples filing jointly. Up to 85% of benefits are taxable if the income level is over $34,000 for individuals or $44,000 for couples. 2.

What income is taxable in California?

California state tax rates and tax brackets

| Tax rate |

|---|

| $824.02 plus 6% of the amount over $33,421 |

Do seniors get a tax break in 2020?

For example, a single 64-year-old taxpayer can claim a standard deduction of $12,550 on his or her 2021 tax return . But a single 65-year-old taxpayer will get a $14,250 standard deduction in 2021 .

Can I Use My 401 Plan If I Am Unemployed

If you’re unemployed and meet certain criteria, you may not be subject to early withdrawal penalties. Workers age 55 to 59½ can access 401 funds only without penalty if they are laid off, fired or quit. However, this only applies to assets in a current 401 plan . Money in a former 401 plan is not covered. This means the individual would have to wait until age 59½ to begin withdrawing from their entire nest egg without being assessed the 10 percent IRS penalty. Remember, regardless of when you take distributions from a 401 plan, California residents will also be taxed on this money.

Unemployed individuals can also receive substantially equal periodic payments , a method of distributing funds from an IRA or other qualified retirement plan prior to age of 59½ without IRS penalty. This may be an alternative to claiming unemployment benefits, but these withdrawals will still be taxed as income.

Ultimately, however, any money you take out of a 401 or other retirement plan, regardless of the reason, will decrease the long-term value of your portfolio and set you back in your ultimate retirement savings goals. That’s why drawing down from a 401 plan should be an option for true emergencies only.

Is Social Security Income Taxable In California

Social security benefits, including survivor and disability benefits, are not taxed by the state of California. However, you will pay federal income taxes on your social security benefits at your tax bracket.

Social security taxes are collected in the form of a payroll tax that FICA or SECA mandates. This tax applies to self-employed and employed taxpayers who work in a job covered by social security. The taxes collected are used to fund social security benefits.

You May Like: Social Security Office Billings Mt

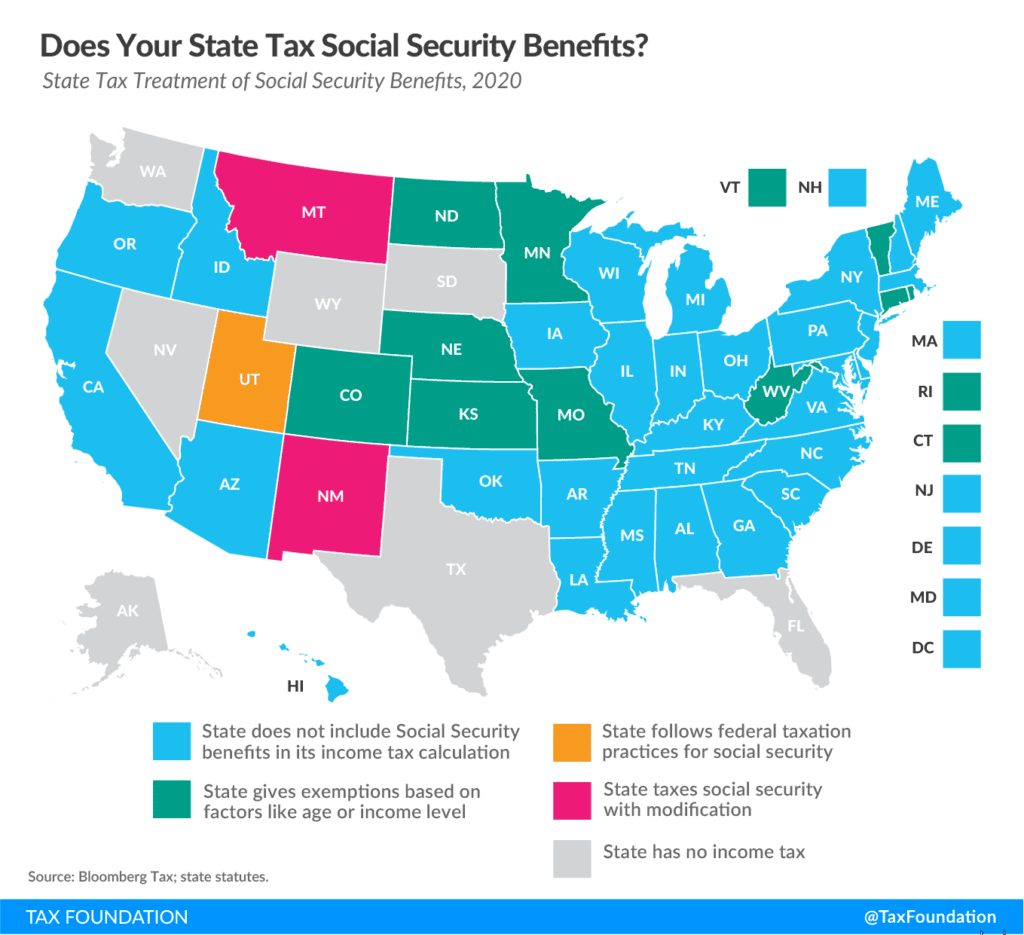

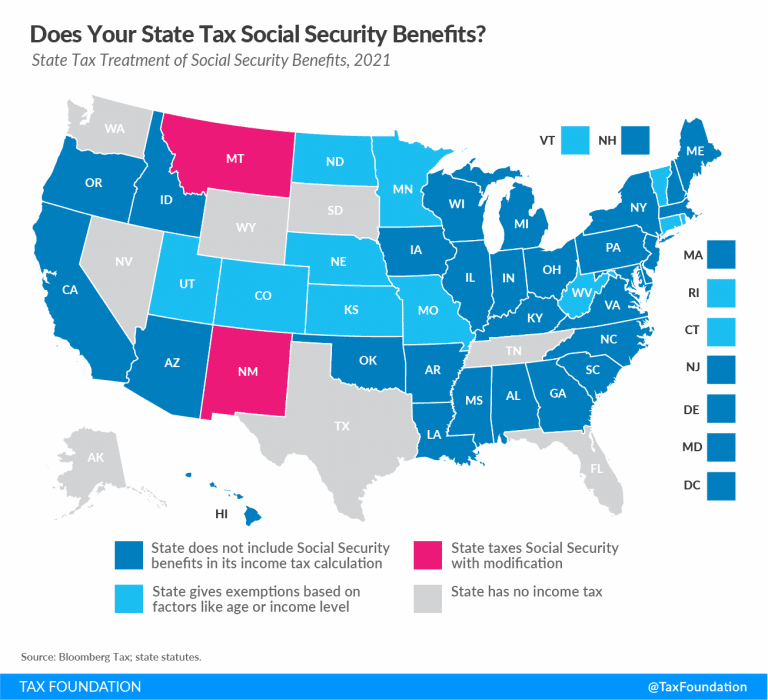

All The States That Dont Tax Social Security

It can be a rude awakening to many retirees to learn that the federal government, in certain circumstances, taxes Social Security benefits. Even more surprising to some is that certain individual states also apply their own income tax to Social Security payouts. Fortunately, not many states fall into this category. Even those that do tax Social Security often provide exemptions or ways to reduce or eliminate the tax, typically based on age or income. Heres a list of the states that dont tax Social Security.

Read Next: 5 Things You Must Do When Your Savings Reach $50,000

How To Minimize Taxes On Your Social Security

If your Social Security benefit is relatively fixed, albeit with small annual increases, you really have only two avenues left to get into that tax-free zone: reducing tax-exempt interest or adjusted gross income. And since most people dont have tax-exempt interest, youre left with one option.

Therefore, the secret is to reduce your adjusted gross income in order to prevent provisional income from triggering a tax on Social Security, says Kelly Crane, president and chief investment officer at Napa Valley Wealth Management in St. Helena, California.

Here are a few ways to reduce your adjusted gross income to get into the tax-free zone:

Also Check: Tax On Social Security Disability Benefits

Also Check: When Can You Claim Social Security

What Is Not Taxable In California

Sales Tax Exemptions in CaliforniaMedical devices such as prosthetics are exempted from sales tax. In addition, certain groceries, hot beverages, some types of farm items, and certain alternative-energy device are also considered to be exempt from the California sales tax.

Know How And When Social Security Is Taxed

If your benefits are your sole income, its unlikely you will owe taxes on them. If you receive any other income or take distributions from some retirement plans, however, you may have to pay taxes on your Social Security benefits.

Theres a relatively simple calculation to find out if your benefits are taxable. Begin by taking the total benefit you receive each year and dividing it in half. For example, say you receive $14,400 annually in Social Security benefits. One-half would be $7,200. Add that amount plus any nontaxable interest, such as interest from certain state or municipal bonds, to your adjusted gross income. Now compare it to what is called your base amount.

The current base amount is $25,000 for those who are single, head of household or a qualifying widow or widower, and $32,000 for married people filing jointly. Income above that base amount may be taxable.

Read Also: Us Social Security Administration Bakersfield Ca

When Is Social Security Income Taxable

To determine when Social Security income is taxable, youll first need to calculate your total income. Generally, the formula for total income for this purpose is: your adjusted gross income, including any nontaxable interest, plus half of your Social Security benefits.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Then youll compare your total income with the base amounts for your filing status to find out how much of your Social Security income is taxable, if any.

Youll see that you fall into one of three categories. If your total income is:

- Below the base amount, your Social Security benefits are not taxable.

- Between the base and maximum amount, your Social Security income is taxable up to 50%.

- Above the maximum amount, your Social Security benefits are taxable up to 85%.

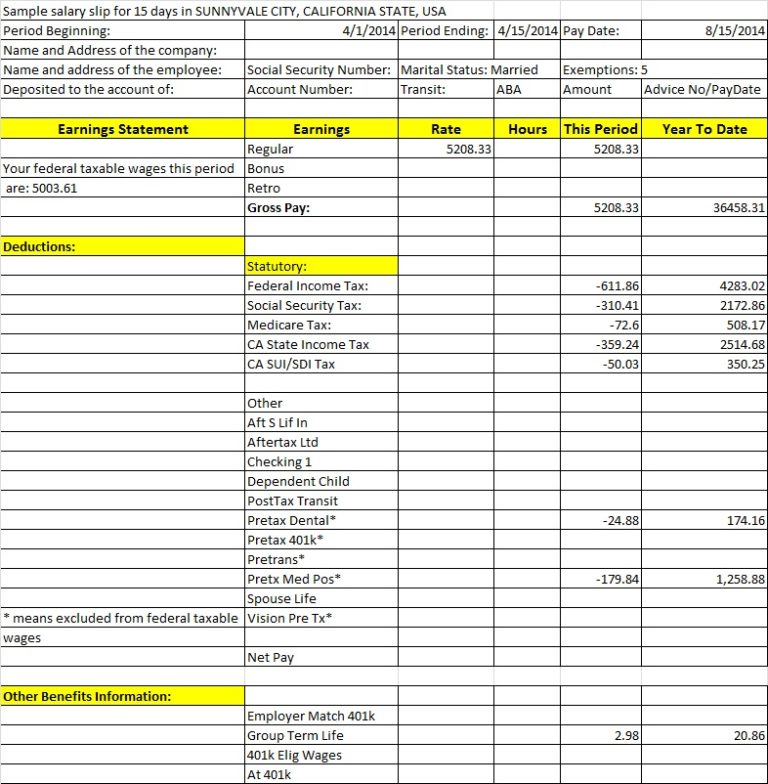

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Also Check: What Can Someone Do With Social Security Number

Will I Have To Pay Taxes On My Social Security

Every week, Allworth Financials Amy Wagner and Steve Sprovach answer your questions. If you, a friend, or someone in your family has a money issue or problem, feel free to send those questions to.

B.V. in Milford: I saw that Ill get more in my Social Security check next year. But will I have to pay taxes on it?

Answer: Potentially. It depends on what Social Security calls your “combined income.” But well address that in a bit. First, lets talk about that cost of living adjustment.

As you mention, Social Security beneficiaries will get an 8.7% boost to their monthly payments in 2023, the largest increase in 40 years. According to the Social Security Administration, this means the average recipient will get about $145 more in their check each month. But this large increase is obviously due to higher inflation. So when all is said and done, we just want to point out that its basically a wash yes youre getting more, but youre also spending more these days.

So, with that said, earning more from Social Security could mean youll have either have to start paying taxes on your benefit or pay more if youre already doing so.

C.S. in Clermont County: Im 63, claiming Social Security , and have legal custody of my 5-year-old granddaughter. Can she get any of my Social Security?

Answer: Actually, yes as long as certain criteria are met.

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

Read Also: Bergen County Social Security Office

Retirees In The South Get A Free Pass With Social Security Except In One State

All but one of the 16 states of the South are tax-friendly when it comes to Social Security. Florida, Tennessee, and Texas don’t charge state income taxes generally, which makes Social Security taxation largely a moot point. But most of the other states in the region Alabama, Arkansas, Delaware, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, and Virginia also have a blanket exemption on taxing Social Security. West Virginia is the only exception it uses the federal rules to determine what gets included in state income taxes.

Only 11 States Actually Levy A Tax On Social Security Benefits

Social Security benefits are a vital source of income for many retired Americans. However, as with any income, the federal government is able to tax Social Security benefitshow much depends on the retirees income. Generally speaking, this is all that Social Security recipients in most parts of the United States will have to pay.

However, this isnt always the case. While most states dont tax Social Security, 11 states do.

Heres what to know.

Recommended Reading: Social Security Office In Toledo Ohio

How The West Taxes Social Security

Nine of the 13 states in the West don’t have income taxes on Social Security. Alaska, Nevada, Washington, and Wyoming don’t have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation. That leaves Colorado, Montana, New Mexico, and Utah, which impose taxes on Social Security for some individuals.

Spousal Tax Relief Eligibility Explorer

Many married taxpayers file a joint tax return because of certain benefits this filing status allows. If you did so, you may be held responsible for monies due, even if your spouse earned all of the income – And this is true even if a divorce decree states that your spouse will be responsible for any amounts due on previously filed joint returns.

To qualify for Spousal Relief, you must meet certain conditions.

Recommended Reading: Social Security Office Crown Point

Stay Informed With Our Free Newsletter That Helps You Hold Your Leaders Accountable

Lawmakers tried to aid some low-earners who may not file taxes by increasing payments for people receiving CalWorks benefits, a program for needy families. They also increased benefits for people who receive Supplemental Security Income a state-supplemented version of social security benefits for senior or disabled people who would otherwise not qualify for, or have extremely small social security payments.

The boosts for people in those two programs are good, said Trinh Phan, a senior staff attorney focused on economic security at Justice in Aging, which advocates for low-income older adults. But, she said, the budget package still leaves out some people who are very low-income.

For example, someone getting by just on Social Security Disability Insurance could miss out on this rebate and the boosts to CalWorks and Supplemental Security Income: They might earn little enough that they dont have to file taxes, but if they dont have kids they likely wont qualify for CalWorks. And, if their disability benefits pay more than $1060.21 per month, they wouldnt qualify for Supplemental Security Income either, said Phan.

These States Are Still Sending Out Tax Rebates Find Out How To Claim Yours

California isn’t expected to finish mailing out “inflation relief checks” until January 2023.

You might not be getting a Christmas bonus this year, but many states are giving residents a bonus tax refund or stimulus check to help them cope with ongoing inflation. Some have finished sending out funds, but many others are still issuing payments.

Massachusetts only began returning $3 billion in surplus tax revenue in November. The payments, equal to about 14% of a individual’s 2021 state income tax liability, are expected to continue to be issued at least through about Dec 15.

South Carolina started issuing for up to $800 in October and will continue through the end of the year. The income tax rebates were approved by state lawmakers as part of this year’s $8.4 billion budget.

Your state could be sending out a rebate or stimulus check, too. See if you qualify and how much you could be owed. For more ontax credits, see if you qualify for additional stimulus or child tax credit money.

Also Check: Social Security Office Of Disability Adjudication

How High Are Sales Taxes In California

California has the highest state sales tax rate in the country at 7.25%. That is the minimum you will pay anywhere in the state, but local taxes as high as 2.50% mean you will likely pay an even higher rate. Overall, the average rate you can expect to pay in California is 8.82%.

The good news is that not all goods are taxable. In fact, a number of exemptions are designed specifically to benefit seniors and retirees. That includes an exemption for prescription drugs and an exemption for most types of groceries.

Some Disabled Californians Feel Abandoned By Newsoms Golden State Stimulus

About a quarter of Americans over 65 live in households where 90% of the family income is Social Security, according to the Social Security Administration. The average retired worker benefit in California is about $1,500 per month, or $18,000 per year. The average SSDI benefit is about $1,300 per month, or $15,600 per year.

Some low-income Californians wont receive the rebate, Department of Finance spokesperson H.D. Palmer said. But he pointed out that many people who arent required to file taxes still choose to do so, sometimes to receive other benefits distributed through the system. In 2020, an additional 500,000 low-income tax returns were filed in California, Palmer said in a statement, presumably to qualify for a Golden State Stimulus payment or perhaps even a federal relief payment. Palmer also pointed to other forms of financial assistance in the budget, such as $1.4 billion in aid for people with unpaid utility bills.

Still, some arent impressed.

This sucks, said Brooke Hamlin, an 81 year-old who lives off of Social Security retirement benefits in San Rafael. She said she gets by on less than $20,000 per year, padded out with food stamps and Meals on Wheels. Its arranged so that the poorest, neediest people dont get it, Hamlin said.

Read Also: Social Security Office Richmond Kentucky

Are All Kinds Of Social Security Income Taxable

All social security benefits are taxable in the same way. This is true whether theyre retirement, survivors, or disability benefits. Take note that Social Security benefits paid to a child under his or her Social Security number could be potentially taxable to the child, not the parent. Note: Supplemental Security Income, or SSI, is a non-taxable needs-based federal benefit. It is not part of Social Security benefits and does not figure into the taxable benefit formula.

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

California Doesn’t Tax Social Security Benefits But It’s Part Of Federal Income How Is Social Security Subtracted From Income On State Return

The taxable portion of your Social Security benefits is automatically adjusted when the information transfers over from the federal return to the state. On your CA return, this will show as a subtraction to income on Schedule CA. Your itemized deductions are also automatically adjusted for the allowable California deductions.

For the car registration feesCalifornia law is the same as federal law regarding the deduction allowed. Therefore, if you itemized your deductions on your federal return and claimed a deduction for the vehicle license fee, no adjustment to your California return is needed on schedule CA. See this link:

Don’t Miss: Social Security Disability Review Status