Key Issues And Billions Of Dollars In Limbo

Top priority issues for both chambers, including additional funding for K-12 schools, long-term care facilities, health care programs and public safety remained in limbo Saturday as lawmakers reached standstills in negotiations.

As of Saturday evening, few state government spending bills had been made public. And only a plan to increase funding for higher education had reached either chamber for a vote.

Lawmakers passed a budget last year that runs through 2023, so they don’t have to do anything in the hours remaining before their deadline. But legislative leaders and the governor on May 16 announced that they’d reached a broad agreement to spend about $8 billion of the state’s $9 billion budget surplus on tax cuts and credits, as well as $4 billion in new spending for various state programs.

And they handed down to committee chairs spending targets that should guide their negotiations in the final week of the session.

For some, those targets helped forge deals. But for the majority, compromise remained elusive, leaving additional spending for public schools, police agencies, health and human services programs and transportation services in question with dwindling time left to get their work done.

“I don’t know what else to do,” Sen. Roger Chamberlain, R-Lino Lakes, said before gaveling out a committee discussion on K-12 education spending over questions from Rep. Jim Davnie, DFL-Minneapolis. “We don’t have days and days. We hardly have hours.”

Where Can You Hunt Sandhill Cranes In Mn

The hunting area includes portions of Kittson, Roseau, Marshall, Pennington, Red Lake and Polk counties. Hunters are limited to two birds in one day and are subject to a possession limit of four birds. Because sandhill cranes are migratory birds, the U.S. Fish and Wildlife Service regulates their harvest.

Federal Income Tax On Monthly Benefit

Your retirement benefit is subject to federal income taxes.A portion of your benefit is not taxable if:

-

Payroll deductions were contributed to the plan before January 1983.

-

Voluntary payments were made to the plan to obtain retirement credit using after-tax monies .

Federal law allows you to exclude the portion of your monthly benefit that is not subject to income taxes until the excluded amount equals the taxes you already paid. MSRS calculates the number of months to which the exclusion applies and reports the remaining amount to you on Form 1099-R. For federal tax questions, contact the IRS at 1-800-829-1040.

Recommended Reading: Social Security Office Of Disability Adjudication

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

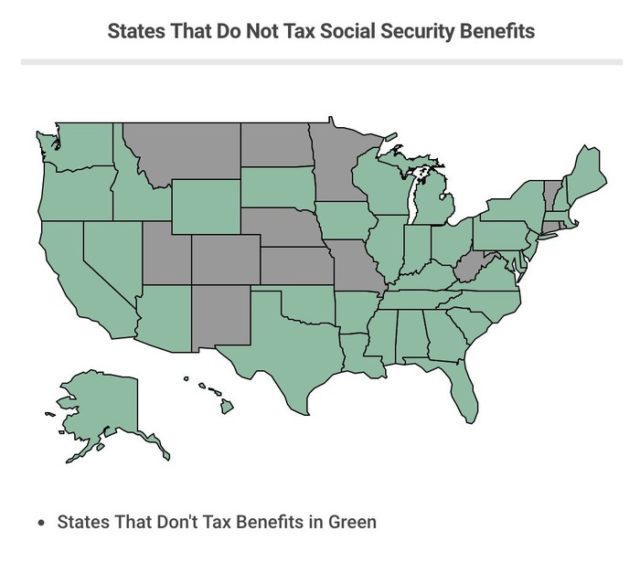

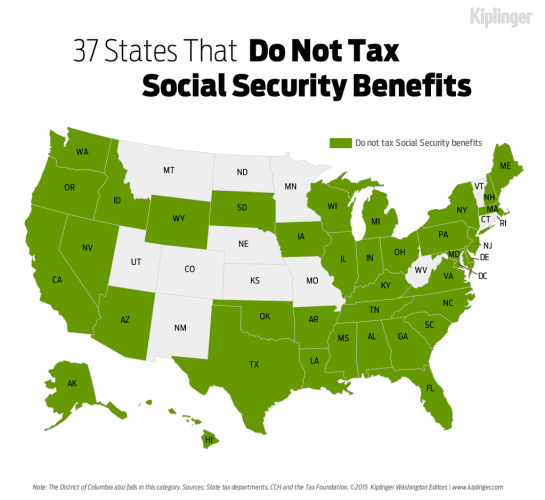

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

Recommended Reading: Social Security Earnings Limit 2021

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance youâll have to boost the overall tax efficiency of your retirement income plan. Hereâs how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while youâre collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

Read Also: Memphis Tn Social Security Office

Why Does Minnesota Tax Social Security Benefits

MINNEAPOLIS Minnesota is just one of 13 states that tax Social Security benefits. On Thursday, Minnesota Senate Republicans announced a plan to do away with that.

“It’s a punishing tax, we’ve already paid tax on it once,” said Sen. Roger Chamberlain , chair of the Senate tax committee. “The goal is to reduce the burdens on all Minnesotans so they can stay here, work here, create a productive life here and drive this economy.”

Dennis, Mark, Steven and Ruth all e-mailed WCCO to ask: Why does Minnesota tax Social Security benefits? Good Question.

“Because it’s income and we tax income in the state of Minnesota,” says Jay Kiedrowski, a fellow at the University of Minnesota’s Humphrey School who teaches public finance.

Minnesota’s tax system is a progressive one so the percentage someone pays on their Social Security benefits depends on how much they make. Higher earners pay more. According to the Minnesota Department of Revenue, about half of the people who receive Social Security benefits don’t pay taxes on them.

Minnesota will tax up to 85% of Social Security income for the highest earners and 50% for middle-income earners. People who earn less than $25,000 pay no state Social Security taxes in Minnesota.

Minnesota began taxing Social Security benefits in 1985 after the federal government began taxing them at the federal level.

“It was simply conformity with the federal tax code, which we did in those days routinely,” said Kiedrowski.

Also Check: Can I Go To Any Social Security Office

Is 2020 The Year Minnesota Gets Rid Of Taxes On Social Security

ST. PAUL Thereâs probably not a single person in the Legislature who doesnât want to eliminate state taxes on Social Security, said DFL Rep. Paul Marquart, chairman of the House Taxes Committee.

But itâs not clear if that will happen in full this session.

Minnesota is one of 14 states that taxes Social Security, according to an report. The taxes vary by âadjusted gross income and other criteriaâ and benefits in other states may be subject to federal taxes depending on income.

Senate Republicans have made elimination of all Minnesota taxes on Social Security income part of their Vision 2020 plan.

Democrats control the House and the executive branch, and Republicans hold the Senate. The session started Tuesday and ends in mid-May.

Lawmakers reduced state taxes on Social Security benefits in 2017 and 2019.

Right now 60% of Social Security benefits are not taxed, Marquart said. Couples whose only income comes from Social Security do not pay any taxes on those benefits.

âI think itâs going to have to be phased in ultimately. We want to get there, get to the next 40%,â Marquart said.

RELATED: St. Cloud dementia group hopes to launch national model, revolutionize care

Faq: Does Minnesota Tax Social Security And Pensions

Can you buy a Federal Duck Stamp at the post office?

PORTLAND If youre a wildlife enthusiast and still need to purchase your hunting license, look no further than your local Post Office, where the Federal Duck Stamps are currently on sale.

Does the post office sell Federal Duck Stamps?

Duck Stamps may be purchased through any of the following way: Online through The Postal Store® on USPS.com®. Under the Collectors Zone, Product Type, select Federal Duck Stamps on the left hand menu.

Where can you buy Federal Duck Stamps?

Duck stamps are sold at post offices nationwide and at many NWRs and sporting goods stores. Electronic versions of the duck stamp can also be purchased online visit https://www.fws.gov/birds/get-involved/duck-stamp/e-stamp.php for more information.

My name is Jennifer and I’m proud to be part of the original founding members of the amazing project, ViewHow.comI have been involved with the project for more than 3 years and it has greatly expanded my knowledge in so many areas of life, and my mission is to help you do the same.

About ViewHow.com

ViewHow.com was founded by a group of authors and experts with a great desire to improve the available online information about various important and interesting topics. No subject is too small for us to care about it, if you find it interesting, so do we!

Also Check: What Are The 3 Types Of Social Security

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is âit depends.â

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . Thatâs because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you wonât have to pay taxes on it. But if you have at least moderate income, youâll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, itâs never 100%. Thatâs considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

Are Other Forms Of Retirement Income Taxable In Minnesota

All other retirement income is taxable in Minnesota. But if you’re 65 or older, you can deduct as much as $9,600 of your retirement income, or $12,000 for married filers. However, if you file single and your income is higher than $33,700 or your file joint and your income is higher than $42,000, then you’re not eligible for this deduction. All other retirement income you receive while living in Minnesota will be taxed at the rates outlined in the table above.

Read Also: Free Legal Aid Social Security Disability

Ui Trust Fund Fix/frontline Worker Pay

After months of negotiating, the House and Senate were able to agree on replenishing the states Unemployment Insurance Trust Fund and provide bonuses to frontline workers. The agreement also puts $190 million into the COVID response account that Governor Walz can use to cover emergent needs related to the pandemic.

The states UI Trust Fund was drained during the pandemic and owed the federal government more than $1 billion. The agreement repaid the federal government and restores the UI Trust Fund to pre-pandemic levels using a combination of American Rescue Plan Act funds and the states surplus. Without action, Minnesota employers would have been required to replenish the UI Trust Fund through a surcharge and significantly increased base rates, which would have been reflected in the first quarter payment due April 30th. The state will refund or credit excess payments made by employers who paid the higher rate after receiving their statements in March.

Employers in a frontline sector must provide notice to employees advising them who may be eligible for a frontline worker payment and how to apply for benefits. This notice must be provided no later than 15 days after the application window opens and be in a form approved by DOLI. Notice must be provided using the same means an employer normally uses to provide notice to their employees and must at least be as conspicuous as:

Senator Limmer Launches Final Repeal Of Social Security Income Tax

ST. PAUL, MN Senator Warren Limmer recently introduced a bill to fully eliminate Minnesotas tax on Social Security income.

Our states $7.7 billion budget surplus shows Minnesotans are being heavily overtaxed. With the surplus in mind, now is the perfect time to finally repeal the tax on Social Security checks once and for all, Limmer said. Eliminating this tax is a promise I made to my constituents and a policy I have been pushing for years. The Social Security income tax hits seniors hard, as they are already on fixed incomes. It is long overdue to give our most vulnerable people a permanent tax break.

Eliminating this tax would help prevent retirees from leaving Minnesota for states that do not tax Social Security benefits. Currently, Minnesota is one of only 12 states that still tax social security benefits.

The Minnesota Department of Revenue estimates that eliminating the Social Security income tax would provide $540 million in tax relief for Minnesotan seniors in the first year. Furthermore, this tax relief would increase in future years. For the next two-year budget period, the additional two-year tax relief estimate is $1.19 billion.

Senate Republicans have been phasing out taxes on Social Security income since 2017.

Facts about Social Security income taxes:

Read Also: Social Security Office In Lubbock Texas

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Senate Passes Historic Ongoing Permanent Tax Relief For Minnesota Families

Fresh off passing the largest tax cut in state history last month, Minnesota Senate Republicans yesterday approved a second round of historic tax relief for working families and small businesses.

The bill includes the top two tax priorities for Senate Republicans this year a full exemption of the Social Security benefits from state taxes and a significant reduction of the lowest income tax rate and builds on the previous historic tax bill with additional relief aimed at helping working families afford daily life under the pressure of out-of-control inflation.

Rising costs are devastating our family budgets, Senator Gary Dahms said. Our bill provides historic tax relief and eliminates the unfair tax on Social Security income. Minnesota is one of the highest tax states in the country and its time we give meaningful permanent ongoing tax relief to Minnesota families.

Senate Republicans top two tax priorities for the year are the marquee items in the second tax bill:

TAX RELIEF FOR FAMILIES

With inflation spiraling out of control and the cost of basic necessities becoming more and more unaffordable, the Senates second tax cut bill provides badly needed relief for working families.

SUPPORT FOR SMALL BUSINESSES AND ENTREPRENEURS

The Senates second tax cut bill continues Republicans support for the small businesses that are the lifeblood of communities across the state by making it easier to operate in Minnesota.

OTHER PROVISIONS

Donât Miss: Social Security Office In Miami

Also Check: Social Security Offices In San Antonio

State Income Tax On Monthly Benefit Payment

You must pay state income taxes on the portion of your monthly benefit that is subject to federal taxes. Some states do not require state income tax withholding.

Currently, Minnesota does not mandate that state taxes be withheld from your pension or disability benefit. Starting December 2022, the default withholding will be single and no allowances . You can choose alternate tax withholding by completing a Form W-4MNP. We are unable to withhold state taxes for residents of any other state.

Despite Mirroring The Federal Tax Schedule On Social Security Benefits As Recently As 2016 These Four States Have Made Strides To Become Tax

Despite being the most successful and important social program in the U.S., Social Security can come with its fair share of surprises for eligible beneficiaries — and they aren’t always positive. For instance, the newest annual report from the Social Security Board of Trustees projects that the program will begin paying out more than it collects in revenue by 2020, which would be the first time that’s happened since 1982.

With each passing year, Social Security’s net-cash outflow is forecast to grow, ultimately culminating in the complete exhaustion of its nearly $2.9 trillion in asset reserves by 2035. If no additional revenue is raised or expenditure cuts are made, retired workers could be facing an across-the-board benefit cut of up to 23%.

Image source: Getty Images.

Recommended Reading: Does Mn Tax Social Security