File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

How To Withhold Taxes From Your Social Security Check

If you have to pay taxes on your Social Security benefits, you likely dont want to be hit with a big tax bill at the end of the year. For most people, this is not an issue during their working years. Your employer automatically withholds all the proper payroll taxes from your check. For self-employed individuals, you must pay quarterly taxes to the IRS. However, income taxes are not automatically withheld from your Social Security check each month. Rememberhow Social Security works? You pay taxes during your working years and receive benefits each month upon retirement. However, no income taxes are withheld from those monthly benefit payments. So, is there a way to have these taxes withheld from your check so that you arent stuck with a big bill at the end of the year? The answer is yes!

You will need to complete Form W4-V and file it with the Social Security Administration. This is the Voluntary Withholding Request form, and this notifies the Social Security Administration to begin withholding taxes from your benefits. You may choose to have taxes withheld at a few different rates. Your options include tax rates of 7%, 10%, 12%, and 22%. You should select the percentage that works best for your personal financial situation. Consider consulting with a tax professional if you have any questions about which amount should be withheld. When planning your monthly budget, remember that Medicare premiums will most likely be withheld from your Social Security check.

You May Like: Taxes On Social Security 2021

When You Have To Include Some Social Security As Taxable Income

Only if your countable income is above those threshold numbers do things get complicated. The general rules that apply to Social Security taxation are as follows:

- For single filers with countable incomes between $25,000 and $34,000 and joint filers with incomes between $32,000 and $44,000, up to half of your benefits can be included in taxable income.

- For single filers with countable incomes above $34,000 and joint filers with incomes above $44,000, up to 85% of benefits can get treated as taxable income.

However, there are a couple of nuances here. First, the actual percentage of your Social Security that you have to include in taxable income can vary widely, and while it can’t exceed 50% or 85% for the respective categories above, it can be quite a bit below that. For instance, if you’re single and your countable income was $25,002, then only $1 of your Social Security income would be subject to tax.

Second, even once you do this calculation, it only tells you how much of your benefits you have to include in your income. To find out how much tax that will produce, you also have to know your marginal income tax rate.

Federal Taxation Of Social Security Benefits And Effect On Vermont

At the federal level, the personal income of a Social Security beneficiary determines how much of the Social Security benefits are taxed. This taxable portion of Social Security benefits may become part of a Vermonters Adjusted Gross Income at the federal level. Federal AGI flows through to Vermont and becomes the starting point for determining Vermont taxable income.

The Vermont exemption allows income-eligible taxpayers to subtract all or part of federally taxable Social Security benefits from their AGI. This means that the federally taxable portion of Social Security benefits is eliminated or reduced for Vermont income-eligible taxpayers receiving Social Security benefits.

For a breakdown of the federal taxation of Social Security benefits, see the table below. For more on federal taxation of Social Security benefits, please read this overview by the Social Security Administration.

| Table 1: Federal Taxation of Social Security Benefits by Income and Filing Status |

|---|

| Single/Separate/Widow/HoH |

| Up to 85% |

You May Like: How To Withhold Taxes From Social Security

What Is Social Security

Social Security is a federal program that pays monthly benefits to retirees, surviving spouses and children, and disabled people. About 65 million Americans collect Social Security monthly.

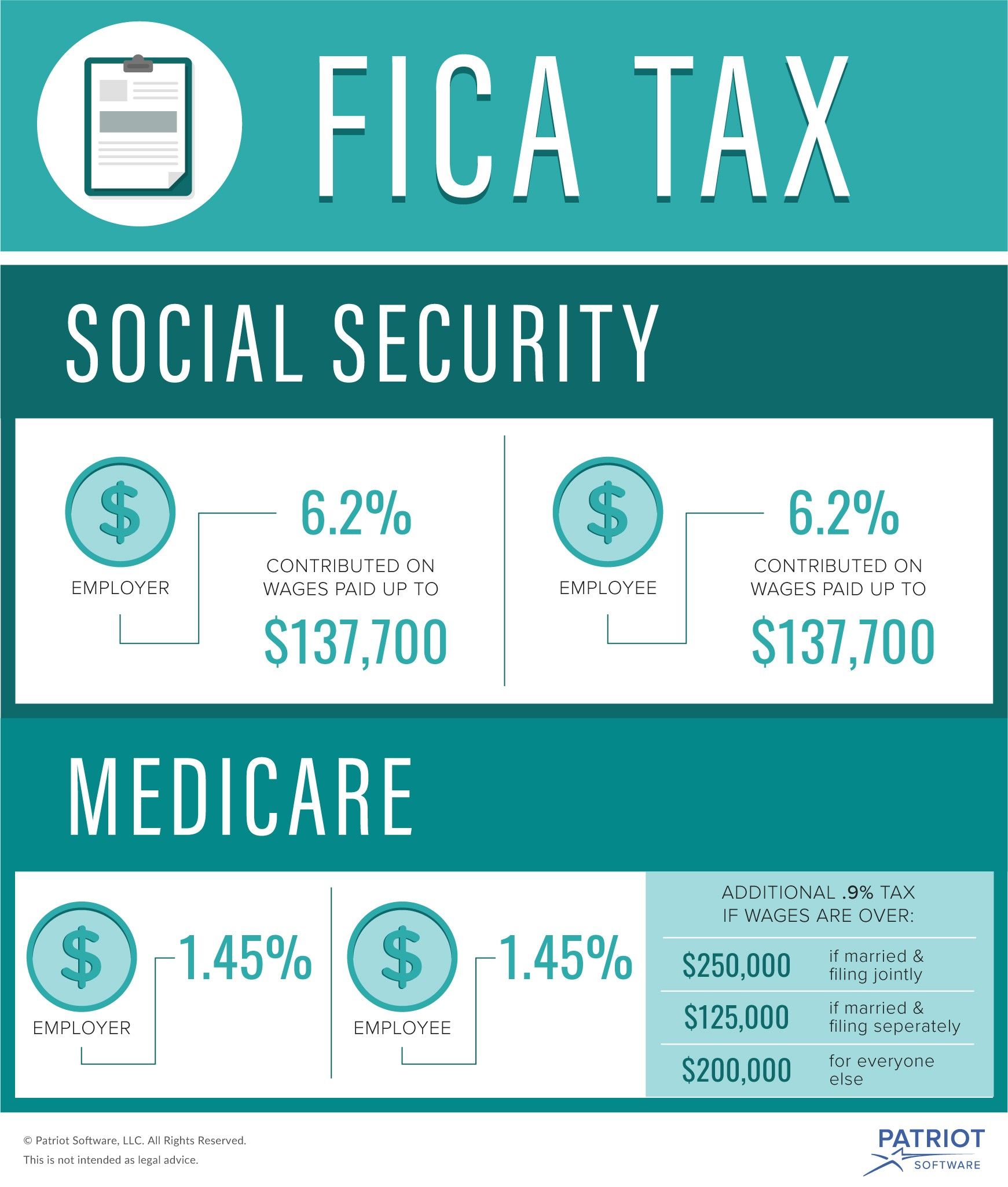

The money for Social Security, as well as Medicare, comes from a tax that every working American pays. It’s a 7.65% tax on every paycheck that is matched by employers. Self-employed people cover both the employee and employer portions. That tax is levied on the first $147,000 of a worker’s income in the 2022 tax year.

So, while workers pay a tax to fund the Social Security program, other people are benefiting by collecting a monthly check. Those benefit checks are then often taxed as income, returning a portion of the money to the federal government.

Take Retirement Distributions Early

Instead of pushing distributions later, another method for saving money on taxes is to take these distributions earlier. Most retirement accounts allow for distributions without a penalty starting at age 59 1/2. You can wait until age 70 to start your Social Security benefits, so there is a ten-year period during which you can take distributions from your retirement account without any effect on the taxation of your Social Security benefits.

Read Also: Social Security Office St Louis County

How Much Of Your Social Security Is Taxable

Its possible and perfectly legal to avoid paying taxes on your Social Security check. In fact, only about 40 percent of recipients pay any federal tax on their benefit.

But heres the caveat: To receive tax-free Social Security, your annual combined, or provisional, income must be under certain thresholds:

- $25,000, if youre filing as an individual

- $32,000, if youre married filing jointly

For married filing separately, the Social Security Administration simply says that youll probably pay taxes on your benefits.

Your combined income consists of three parts:

- Your adjusted gross income, not including Social Security income

- Tax-exempt interest

- 50 percent of your Social Security income

Add those amounts up and if youre under the threshold for your filing status, you wont be paying federal taxes on your benefit.

Even if youre above this threshold, however, you may not have to pay tax on your full benefit. You may pay taxes on only 50 percent of your benefit or on up to 85 percent of it, depending on your combined income.

- For individual filers:

- Combined income between $25,000 and $34,000, up to 50 percent of your benefit is taxable

- Combined income above $34,000, up to 85 percent of your benefit is taxable

Taxes On Benefits Support Social Security And Medicare

The proceeds from taxing Social Security benefits provide an increasingly important source of income for both Social Security and Medicare.

- The revenue from taxing up to 50 percent of Social Security benefits is devoted to the two Social Security trust funds. In 2019, this will provide an estimated $36.9 billion in income to the Old-Age and Survivors and Disability Insurance trust funds, or about 3.5 percent of their total income. Since the income thresholds are not indexed for inflation, taxes on benefits will grow to 7.4 percent of Social Security income by 2028.

- The revenue from taxing 50 to 85 percent of Social Security benefits is devoted to Medicares Hospital Insurance trust fund. This will represent $24.1 billion, or 7.4 percent, of HI income in 2019 and 12.4 percent of income by 2028.

The taxation of benefits will provide almost $1 trillion to the Social Security and Medicare trust funds over the next ten years. Without this income, the programs would face greater funding shortfalls and earlier reserve depletion dates.

Don’t Miss: Social Security Office Topeka Ks

Is Social Security Disability Taxable

You may need to pay taxes on your Social Security Disability Insurance benefits. This can happen if you receive other income that places you above a certain threshold. But, because SSDI requires you to be disabled and have limited income to be eligible, you might not have other income to exceed this threshold.

Common examples for when your Social Security Disability Insurance benefits may be taxable are if you receive income from other sources, such as dividends or tax-exempt interest, or if your spouse earns income. If this describes your situation, you will need to know the thresholds for when your SSDI becomes taxable.

The IRS states that your SSDI benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status:

- Single, head of household, qualifying widow, and married filing separately taxpayers: $25,000

For example, if you are married and file jointly, you can report up to $32,000 of income before needing to pay taxes on your SSDI benefits. If you earn more than these limits for these tax filing statuses, you have two different benefit inclusion rates that can apply.

For 2022:

- As a single filer, you may need to include up to 50% of your benefits in your taxable income if your income falls between $25,000 and $34,000.

- Up to 85% gets included on your tax return if your income exceeds $34,000.

For married couples who file jointly, you’d pay taxes:

Social Security Counts As Income And There Are Limits That Make The Benefits Susceptible To Taxation

Some people will need to pay federal income tax on Social Security benefits, depending on the total income that they receive from a private retirement account or, in the case of surviving beneficiaries, possible employment. There is a limit to your combined income, and those with a combined income under $25,000 a year will not have to pay taxes on their Social Security benefits.

However, for individuals and married couples earning above this threshold, you will more than likely have to pay some tax.

For those with a combined income between $25,000 and $34,000 a year, the Social Security Administration may be able to levy a tax upon fifty percent of your benefits. Finally, with an income over $34,000 , one can be taxed up to eighty-five percent of their Social Security benefits. Married couples who file separately will likely pay taxes on their benefits.

Read more on the 2023 COLA:

Don’t Miss: Social Security Office In Trussville

Minimize Withdrawals From Your Retirement Plans

Money that you pull from your traditional IRA or traditional 401 will count as income in the year that you withdraw it. So if you can minimize those withdrawals or even not withdraw that money at all, it will help you get close to the tax-free threshold. Of course, this may not be possible if youre forced to take a required minimum distribution that pushes you over the edge.

If youre not forced to take an RMD in a given year, consider taking money from your Roth IRA or Roth 401 instead and avoid generating taxable income.

The Future Of Social Security Taxation

There have been a few proposals to eliminate the taxation of Social Security benefits, but with a looming shortfall in 2034, dont hold your breath for any proposal succeeding that would reduce revenues for the SSA. Taxes on Social Security benefits are probably here to stay.

Instead of waiting on the unlikely elimination of these taxes, start building a plan to potentially reduce or eliminate these taxes.

A Roth IRA is a good place to start. It is probably the most valuable tool for minimizing Social Security taxes. Why? Roth distributions are not included in your combined income!

If you think you may eventually be subject to taxes on your Social Security benefit, consider building a pool of money in your Roth account. You may be able to contribute to a Roth IRA up to $6,000 .

Check with your retirement plan at work, as well, to see if they offer a Roth option. Using a Roth in 2022 will allow you to put in up to $20,500 per year .

Finally, you may want to consider converting traditional IRAs to Roth IRAs. Theres certainly a lot to consider when doing so, but since the tax benefits could extend beyond the tax free nature of the Roth, this could be a winning move.

As a next step in your learning about this topic, you should consider joining the nearly 400,000 subscribers on my YouTube channel! This is where I break down the complex rules and help you figure out how to use them to your advantage.

You May Like: Social Security Benefits For Disabled Veterans

Beneficiary Families Filing A Tax Return And Owing Income Tax On Benefits

Chart 1 shows the projected percentage of Social Security beneficiary families that will file a tax return and the percentage that will owe income tax on their benefits over the period 20102050.MINT projects that about 72 percent of beneficiary families will file an income tax return through 2030, after which the proportion will fall slowly to about 68 percent by 2050. The decline after 2030 reflects assumptions of both a change from price indexing to wage indexing for tax brackets after 2023 and a reduction in the rate of growth in retirement income from pensions and other nonSocial Security sources.

As noted earlier, some beneficiaries who file income tax returns do not pay taxes on their benefits because their modified AGI does not exceed the taxable threshold. MINT projects that the proportion of beneficiary families that will owe income tax on their benefits will increase from about 47 percent in 2010 to 52 percent in 2015 and to 58 percent in 2030, then will fall slightly to about 56 percent by 2050. Here too, the projected decline after 2030 reflects the assumption of both the change from price indexing to wage indexing for tax brackets and a slowing rate of growth in retirement income from nonbenefit sources.

Social Security Disability Benefits

So,is Social Security disability taxable? We are sure to sound like a broken record by now, but disability benefits can be taxable depending on the total income of the beneficiary. The rules for the taxability of Social Security disability benefits are the same as the rules regarding retirement benefits. Currently, the thresholds are the same as well. Some taxes will be due if the combined income of an individual is more than $25,000. Likewise, married couples with a combined income of more than $32,000 will owe taxes on their disability benefits.

Also Check: Social Security Office Ann Arbor

Applying Tax Brackets To Social Security Income

It’s impossible to come up with a single rule that will cover every situation involving income taxes and Social Security benefits. However, you can come up with some general observations that can provide some color to the question. For instance:

- The highest rate that you’ll pay in federal income taxes on your benefits is 31.45%. That rate applies if you’re in the top 37% income tax bracket, and the maximum 85% of benefits gets included as taxable income.

- It’s common for seniors who have incomes that are not too far above the thresholds to be in the 12% tax bracket. So that would work out to a 6% tax rate if 50% of your benefits is subject to tax, or a 10.2% tax rate if 85% of your benefits gets taxed.

- Those with incomes in between can expect to have the majority of their benefits subject to tax. That assumption produces tax rates that range from 11% for those in the 22% bracket who have half their Social Security subject to tax, to 29.75% for those in the 35% bracket with 85% of their benefits taxed.

Those numbers are rarely going to be exactly the same for you, but they should give you a sense of where you’re likely to land in your own tax situation.

Reducing Your Taxes On Social Security Benefits

Now that you know how Social Security benefits are taxed and when you will owe taxes on them, you are likely trying to think of ways to reduce your tax obligation. There are ways that you can reduce the amount of tax you will be required to pay on your Social Security benefits. Here are three of the most common methods.

Read Also: What Can Someone Do With Social Security Number

Change Is Always Possible

Its not hard to understand why the solvency of Social Security has been the center of a growing national debate over the past few years. Its simple economics.

More people are retiring than entering the workforce, which will eventually reduce the ratio of workers to retirees to 2-to-1 . In addition, people are living much longer in retirement, sometimes decades longer.

Under the pressure of possible insolvency, Congress has debated several Social Security reform measures in recent years. While no new legislation has been passed, the possibility continues to exist for dramatic revisions to this social insurance system to come about in the future, changing how Social Security factors into your retirement planning.

To learn more about your benefits, visit the Social Security website at www.ssa.gov.

Also Check: Age For Social Security Retirement Benefits