After 9 Years Of Being A Sahd/blogger

Not at all, life is a dream in early retirement. Even if I stop working completely today, Id still receive $2,446 in Social Security retirement benefit when I turn 67. Thats not bad at all.

Mrs. RB40 should also receive $1,718 in benefits at 67 if she stops working now. Thats $4,164 per month extra for our household. That should cover our core living expenses. If we keep lifestyle inflation down, were set. Mrs. RB40 isnt quite ready to retire yet so Ill update this once per year.

Meanwhile, we will keep working to increase our passive income. Once our passive income surpasses our expense consistently, then well be set for life. Any Social Security Benefits will be gravy. My father-in-law uses his Social Security Benefits as a donation fund. Id love to do the same when were 67. I think thats a great idea.

Have you checked your Social Security statement lately? Are you counting on it to fund your retirement?

If you made it to the end, go check out this post Are you worth more than you earned? You already have the earning data so might as well figure out if youre worth more than you earned.

*Sign up for a free account at Personal Capital to help manage your investment accounts and net worth. I log in almost every day to check on my accounts and cash flow. Its a great site for DIY investors. Take charge of your finance so you dont have to depend on Social Security in your old age!

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Recommended Reading: Social Security Office In Greenville Mississippi

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

How Much Of My Social Security Is Taxable In 2022

As of 2022, the social security tax rate is divided equally between the employer and the employee. Each one of these two parties is obliged to pay 6.2% for the Social Security tax. The Social Security tax limit is revaluated each year and the Social Security tax limit 2022 specifically will be up to $147,000. This means that the taxable social security was increased from what it previously was set at, which was $142,800. This further means that the maximum Social Security tax any employee will be called to pay from their pay check is $9,114.

Also Check: Social Security Office In Bloomington Indiana

How To Compute Taxable Part Of Social Security Benefits

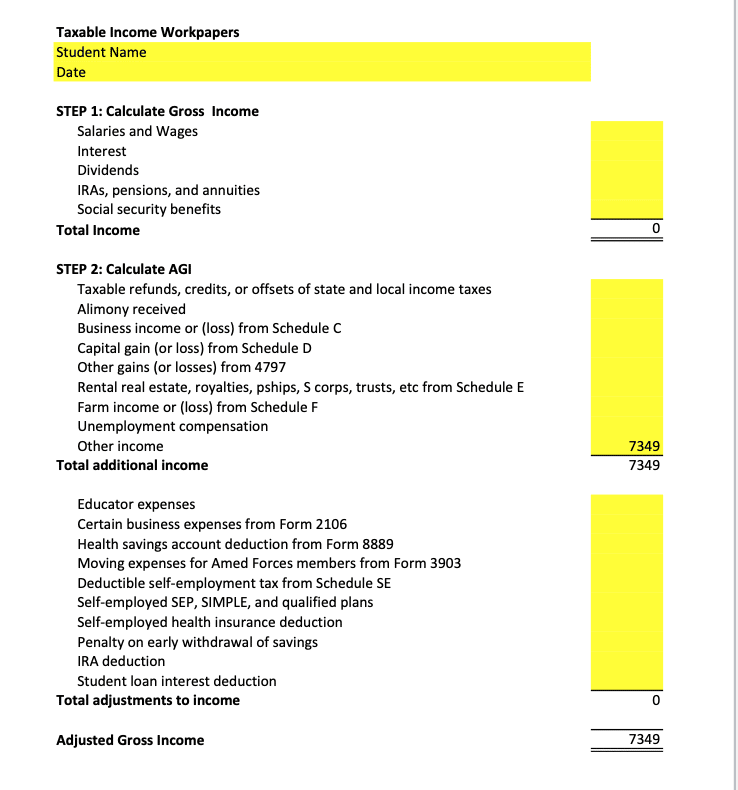

If you want to compute whether the amount of social security you received is taxable and if taxable, how much, then the first step is to find provisional income .

The provisional income or combined income can be found by Adding Adjusted Gross Income plus Nontaxable interest plus 50% of the social security benefits

Then compare the provisional income with the base amount which is as under for year 2021 & 2022:

| Single , Head of Household and Married filing separately | ||

|---|---|---|

| SS benefit less than $25K, there is no taxable amount out of SSB | SS benefit less than $32K, there is no taxable amount out of SSB | Fully Taxable .There is no base exemption available |

| If SS benefit is between $25K & $34K then , taxable portion is 50 % of your SS benefits | SS benefit is between $232K & $44K then , taxable portion is 50 % of your SS benefits | |

| If SS benefit exceeds $34K then, taxable portion is 85% of your SS benefits | f SS benefit exceeds $44K then, taxable portion is 85% of your SS benefits |

For precise computation of taxable amount out of social security benefit use Worksheet 1, of Pub 915

You May Like: How Does Social Security Determine Your Benefit

Where And How Do You Report Social Security Tax

Most employers must report FICA taxes and federal income tax withholding on a quarterly basis using Form 941, Employers Quarterly Federal Tax Return. Report the total amount withheld and contributed for Social Security for all employees.

Some employers can use Form 944, Employers Annual Federal Tax Return, to report Social Security taxes withheld and contributed. The annual form also reports Medicare and federal income taxes. The IRS notifies applicable employers if their business qualifies to use Form 944. Typically, applicable employers are those with a total federal income, Social Security, and Medicare tax liability of less than $1000 annually. Do not use Form 944 unless the IRS tells you to.

After you complete the appropriate form, mail it to the IRS. Use the IRS Form 941 website to determine where to file your quarterly return. Annual filers can use the IRS Form 944 website for more information on where to mail their return.

By January 31 each year, you will give each of your employees a Form W-2. This form lists the amount of all the employment taxes you withheld from their wages during the previous year.

You will also submit Form W-2 and Form W-3to the Social Security Administration, which records the taxes withheld for the year. Forms W-2 and W-3 must be filed by January 31. You may also have to submit these forms to the state tax agency.

Dont Miss: How Much Tax Per Dollar

You May Like: Social Security Office In Albany Georgia

What Is Social Security

Social Security is a federal program that pays monthly benefits to retirees, surviving spouses and children, and disabled people. About 65 million Americans collect Social Security monthly.

The money for Social Security, as well as Medicare, comes from a tax that every working American pays. It’s a 7.65% tax on every paycheck that is matched by employers. Self-employed people cover both the employee and employer portions. That tax is levied on the first $147,000 of a worker’s income in the 2022 tax year.

So, while workers pay a tax to fund the Social Security program, other people are benefiting by collecting a monthly check. Those benefit checks are then often taxed as income, returning a portion of the money to the federal government.

How Much Is Social Security Taxed At Full Retirement Age

Even if you work past full retirement age, you still have to make applicable Social Security contributions on your income however, if you work past full retirement age, you can also increase the amount of Social Security benefits you receive.

Once you start receiving Social Security benefits, your income will determine if you pay income tax on part of your Social Security income.

Recommended Reading: How Much Social Security Is Taxable Calculator

When Is Social Security Income Taxable

To determine when Social Security income is taxable, youll first need to calculate your total income. Generally, the formula for total income for this purpose is: your adjusted gross income, including any nontaxable interest, plus half of your Social Security benefits.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Then youll compare your total income with the base amounts for your filing status to find out how much of your Social Security income is taxable, if any.

Youll see that you fall into one of three categories. If your total income is:

- Below the base amount, your Social Security benefits are not taxable.

- Between the base and maximum amount, your Social Security income is taxable up to 50%.

- Above the maximum amount, your Social Security benefits are taxable up to 85%.

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

Read Also: Social Security Spousal Benefit Calculator

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

At What Age Is Social Security Not Taxable

For Social Security benefits to stop being taxable, you will need to fit certain prerequisites. In most cases, after you reach the age of 64 you can access your Social Security benefits without having to pay taxes on them. However, there is one small caveat to this. If even after the age of 62 you are depending on income other than the one you get from your social security benefits to sustain a major part of your life then you may be required to continue paying taxes on your social security benefits even after the age of 62.

Dont Miss: How To File California State Taxes

Also Check: Do I File Taxes On Social Security

Employers Must Share Fica Payments With Employees

RyanJLane / Getty Images

Every person working in the United States as an employee must have FICA taxes withheld from every paycheck by law. FICA taxes include taxes for both Social Security and Medicare, and it is shared by employees and employers, so half of the tax is deducted from your paychecks when you work as an employee. The other half, an amount equal to the total deducted from employee paychecks, must be paid by your employer.

The following provides a step-by-step guide on how to calculate FICA taxes.

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

You May Like: What Will Happen When Social Security Runs Out

How Much Of Your Social Security Income Is Taxable

Social Security payments have been subject to taxation above certain income limits since 1983. No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

However, regardless of income, no taxpayer has all their Social Security benefits taxed. The top level is 85% of the total benefit. Heres how the Internal Revenue Service calculates how much is taxable:

- The calculation begins with your adjusted gross income from Social Security and all other sources. That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and other taxable income.

- Tax-exempt interest is then added.

- If that total exceeds the minimum taxable levels, then at least half of your Social Security benefits will be considered taxable income. You must then take the standard or itemize deductions to arrive at your net income. The amount you owe depends on precisely where that number lands in the federal income tax tables.

Combined Income = Adjusted Gross Income + Nontaxable Interest + Half of Your Social Security Benefits

The key to reducing taxes on your Social Security benefit is to reduce the amount of taxable income you have when you retire, but not to reduce your total income.

How Much Do You Get For Social Security Retirement

How much you get for Social Security retirement benefits will depend on a number of factors, including your income, how long you worked and when you retired. One thing youll need to consider when getting your retirement benefits or when planning for Social Security retirement is that it may be taxed.

If you have a combined income but are filing as an individual, your benefits arent taxed if your benefits are below $25,000. If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed.

For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest. Other wages that may be applied to this include self-employment income, wages, capital gains and dividends or other investment income from interest, annuities, pensions, rental property profits, municipal bond interest and withdrawals from retirement accounts such as IRAs, 403 and 401 accounts. Roth IRA withdrawals dont count toward combined income.

Also Check: Social Security Disability Appeal Process