State Taxes On Social Security Benefits

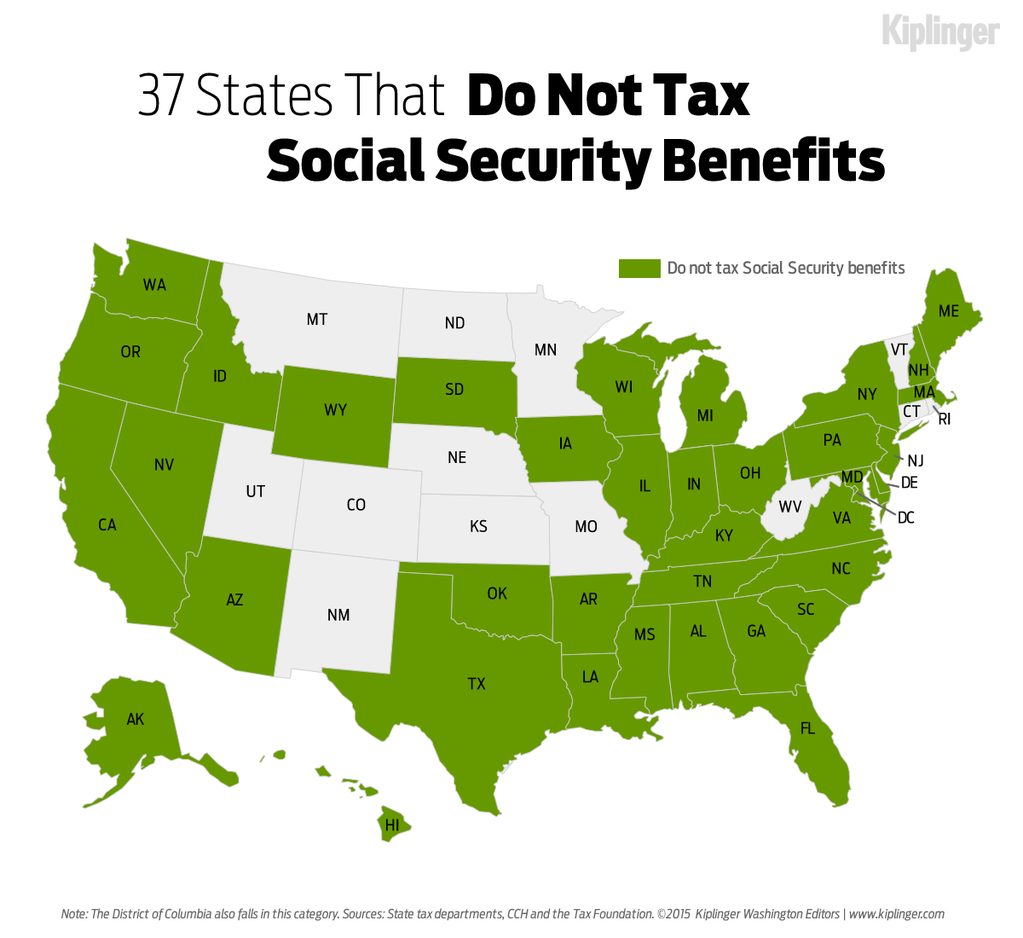

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

History And Rationale For Taxing Social Security Benefits

For more than four decades, Social Security benefits were not subject to income tax. The Treasury Departments rationale for not taxing Social Security benefits was that the benefits under the Act could be considered as gratuities, and since gifts or gratuities were not generally taxable, Social Security benefits were not taxable.

Former Social Security Commissioner Robert M. Ball long argued that, since Social Security is an earned benefit, it should be taxed like other earned benefits, such as employer pensions. Workers pay income tax on private pensions to the full extent that their benefits exceed their contributions, with no income thresholds.

As a leading member of the Greenspan commission on Social Security in 1982-83, Ball had an opportunity to promote this idea. The subsequent Social Security Amendments of 1983 provided that up to 50 percent of benefits would be taxable for beneficiaries with incomes above certain levels. A decade later, the Omnibus Budget Reconciliation Act of 1993 provided for the taxation of up to 85 percent of benefits for individuals with modified AGI above somewhat higher thresholds. The provision has since remained unchanged.

Taxing Social Security Benefits Is Sound Policy

Social Security beneficiaries with higher incomes pay income tax on part of their benefits. Those with incomes below $25,000 pay no tax on benefits, while those with the highest incomes pay tax on as much as 85 percent of their benefits. This arrangement is sound for several reasons:

- The substantial proceeds from taxing Social Security benefits are credited to the Social Security and Medicare trust funds, strengthening the programs financing.

- The taxation of benefits is broadly progressive, since people with low incomes pay nothing and the tax rate on benefits increases with income.

- As an earned benefit, Social Security should be subject to tax, like other earned benefits, such as employer pensions.

- Social Securitys tax treatment is more favorable than that of private defined-benefit pensions, primarily because of the protections for low-income beneficiaries.

Recommended Reading: Social Security Office In Richmond Va

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: Social Security Office Laredo Tx

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

Are Social Security Benefits Taxable

Up to 50% or even 85% of your Social security benefits are taxable if your provisional or total income, as defined by tax law, is above a certain base amount. Your Social Security income may not be taxable at all if your total income is below the base amount.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

You May Like: Social Security And Medicare Tax Rates

Know The Earnings Limits

Those hoping to work in retirement need to be especially careful if they’re planning to claim Social Security benefits early. Even if youâre just working part-time, itâs important to consider how that continuing income will affect your benefits.

The SSA caps how much you are allowed to earn if you start taking your benefits before full retirement age, which is 66 for most baby boomers. For the most recent annual earned income cap, view the current annual contribution limits. For every $2 you earn over the limit, the SSA withholds $1 off the top of your benefits. Once you reach the year that you’ll turn full retirement age, the earned income cap goes up, and for every $3 you go over, itâs a $1 withholding during the months until your birthday.

There is some good news, however: Because the penalty is determined by your individual earned income, if you retire early but your spouse doesn’t, your spouse’s earned income will not be factored into the earnings limit. Additionally, when you reach your full retirement age, the earnings limit disappears and Social Security will recalculate your benefit amount if you were negatively impacted by the earnings limit.

Keep in mind, if you file your tax return jointly, your spouse’s earnings will be included when calculating your combined income for purposes of determining the taxation of your benefits.â1

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2021. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

Recommended Reading: Social Security Office Parkersburg Wv

How Much Of Your Social Security Is Taxable

Its possible and perfectly legal to avoid paying taxes on your Social Security check. In fact, only about 40 percent of recipients pay any federal tax on their benefit.

But heres the caveat: To receive tax-free Social Security, your annual combined, or provisional, income must be under certain thresholds:

- $25,000, if youre filing as an individual

- $32,000, if youre married filing jointly

For married filing separately, the Social Security Administration simply says that youll probably pay taxes on your benefits.

Your combined income consists of three parts:

- Your adjusted gross income, not including Social Security income

- Tax-exempt interest

- 50 percent of your Social Security income

Add those amounts up and if youre under the threshold for your filing status, you wont be paying federal taxes on your benefit.

Even if youre above this threshold, however, you may not have to pay tax on your full benefit. You may pay taxes on only 50 percent of your benefit or on up to 85 percent of it, depending on your combined income.

- For individual filers:

- Combined income between $25,000 and $34,000, up to 50 percent of your benefit is taxable

- Combined income above $34,000, up to 85 percent of your benefit is taxable

Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

Don’t Miss: Social Security Break Even Chart

Create A My Social Security Account

To see all of your Social Security benefits online, you’ll first need to create a My Social Security account. Here’s what to do.

1. Go to ssa.gov on your browser and select my Social Security.

2. Next, click Create an Account.

3. You’ll be prompted to sign in with your ID.me account or login.gov account unless you created an account before Sept. 18, 2021. Note that you’ll need to create one of those accounts if you don’t have one.

4. Once you have an account, you’ll need to agree to the terms of service to continue.

5. Next, you’ll need to verify your identity. The Social Security Administration will send a one-time security code to your email that you’ll need to enter within 10 minutes to continue to your account.

You should now have access to all of your Social Security statements and other details online.

How Much Of Your Social Security Income Is Taxable

Social Security payments have been subject to taxation above certain income limits since 1983. No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

However, regardless of income, no taxpayer has all their Social Security benefits taxed. The top level is 85% of the total benefit. Heres how the Internal Revenue Service calculates how much is taxable:

- The calculation begins with your adjusted gross income from Social Security and all other sources. That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and other taxable income.

- Tax-exempt interest is then added.

- If that total exceeds the minimum taxable levels, then at least half of your Social Security benefits will be considered taxable income. You must then take the standard or itemize deductions to arrive at your net income. The amount you owe depends on precisely where that number lands in the federal income tax tables.

Combined Income = Adjusted Gross Income + Nontaxable Interest + Half of Your Social Security Benefits

The key to reducing taxes on your Social Security benefit is to reduce the amount of taxable income you have when you retire, but not to reduce your total income.

You May Like: Social Security Office Toms River Nj

Are Taxes Taken Out Of Social Security Checks

Asked by: Floyd Larson

Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income. The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. … The IRS has an online tool that calculates how much of your benefit income is taxable.

Do Seniors On Social Security Have To File Taxes

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. These filing rules still apply to senior citizens who are living on Social Security benefits. If Social Security is your sole source of income, then you don’t need to file a tax return.

You May Like: Social Security Office In Victoria Texas

Are Taxes Taken Out Of Disability Benefits

Home » Frequently Asked Questions » Are Taxes Taken Out of Disability Benefits?

Taxes are not taken out of disability benefits whether its for Social Security Disability Insurance and Supplemental Security Income . The Social Security Administration will never automatically withhold taxes. In fact, in many cases, you do not have to pay federal income taxes on these benefits at all. Pennsylvania also does not tax SSDI or SSI benefits.

However, if you receive SSDI benefits and also have substantial additional income from investments and rental property, you may need to pay taxes. There are limits on how much you can make without filing taxes. Additional income can push you over this limit.

Certain State And Local Government Workers

State or local government employees, including those working for a public school system, college, or university, may or may not pay Social Security taxes. If they’re covered by both a pension plan and Social Security, then they must make Social Security contributions. But if they’re covered solely by a pension plan, then they dont have to contribute to the Social Security system.

You May Like: Social Security Office In Enid Oklahoma

To Find Out If Their Benefits Are Taxable Taxpayers Should:

- Take one half of the Social Security money they collected during the year and add it to their other income.

Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement age. Take a chunk of money out of your retirement account and pay the taxes on it. Then, you can use it later without pushing up your taxable income.

This means you could withdraw funds a little earlyor take distributions, in tax jargonfrom your tax-sheltered retirement accounts, such as IRAs and 401s. You can make penalty-free distributions after age 59½. This means you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes you will pay that year. The goal is to pay less tax by making more withdrawals during this preSocial Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and other sources. Be mindful, too, that at age 72, youre required to take RMDs from these accounts, so you need to plan for those mandatory withdrawals.

You May Like: Social Security Offices Las Vegas Nv

Withholding Taxes For Disability Benefits

If you believe you may need to pay taxes on your disability benefits, you can ask the SSA to withhold a percentage of your monthly payment. This instance works in the same way as an employer withholding taxes from your check. Doing so is not a requirement but may be a good idea if you worry about putting enough aside to pay your taxes at the end of the year.

For a free legal consultation, call

When Is Social Security Income Taxable

To determine when Social Security income is taxable, youll first need to calculate your total income. Generally, the formula for total income for this purpose is: your adjusted gross income, including any nontaxable interest, plus half of your Social Security benefits.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Then youll compare your total income with the base amounts for your filing status to find out how much of your Social Security income is taxable, if any.

Youll see that you fall into one of three categories. If your total income is:

- Below the base amount, your Social Security benefits are not taxable.

- Between the base and maximum amount, your Social Security income is taxable up to 50%.

- Above the maximum amount, your Social Security benefits are taxable up to 85%.

Recommended Reading: How Much Is Taken Out Of Social Security For Medicare