How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

A Look At How It Works

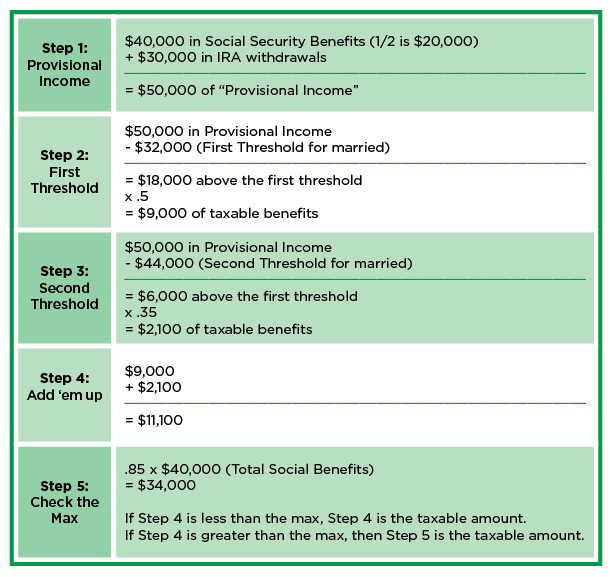

Now that we know how to calculate provisional income and the various taxation thresholds, we can determine how much of a hypothetical Social Security recipient’s benefit will be taxed. Let’s say a married couple takes $35,000 in distributions from their 401, plus they’re getting $40,000 in Social Security benefits. They don’t receive any tax-exempt interest.

This means their provisional income would be $35,000 + which equals $55,000. Using the taxation chart above, we know the first $32,000 is completely tax-free.

From there, we can see that 50% of any income over $32,000 and under $44,000 is going to be taxed. It’s important to note that this doesn’t mean that income in that range is taxed at 50%, but rather, half of the income in that range is subject to taxation. In other words, this couple will be paying taxes on $6,000 of their Social Security income within that range .

Finally, they made $11,000 over $44,000, which means 85% or $9,350 will be taxed.

Therefore, out of the couple’s total Social Security income of $40,000, only $15,350 is subject to taxation. Once again, this doesn’t mean they’ll be paying $15,350 in taxes, but rather that this is the only portion of their benefit that will be taxed.

How To Report Your Social Security Income

Each January, you will receive a Form Social Security 1099, SSA-1099, that shows the total benefits you received for the previous year and the total amount you are required to report to the IRS on your federal tax return.

If you misplaced your form, you can download a copy by creating a free online account with the Social Security Administration.

You will report the amount in Box 5 of Form SSA-1099 and the total amount on line 6a of your Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The amount considered taxable income depends on what other income you earned during the year, which you should note on line 6b of Form 1040 or Form 1040-SR.

Remember: The taxable amount of your benefits is based on your filing status and combined income. If you need to calculate the taxable amount of Social Security benefits, you can use this worksheet.

Read Also: How To Freeze My Social Security Number

Receive The Cola Increase

Finally, it is important to remember that you do not have to do anything to receive the COLA increase. All beneficiaries will see an increase in their Social Security without applying for it. Another element to keep in mind in all of this is to remember that after the increase we can reach the reportable minimum, so pay attention to your taxes so you dont make financial mistakes.

Knowing how the Social Security Administrations payment schedule is organized, you will have no trouble getting organized with your finances. That is why the SSA sends out payment dates at the beginning of the year. In this way, all beneficiaries who have an accepted benefit can have complete control over what money will enter their bank accounts and when this will occur.

To contact Social Security, you can call the toll-free number, 1-800-772-1213, or go to your local Social Security office. Our phone lines are open from 7 a.m. to 7 p.m., Monday through Friday. You can also write to them at the following address Social Security Administration, Office of Public Inquiries, Windsor Park Building, 6401 Security Boulevard, Baltimore, MD 21235-6401.

Social Security Increase In 2023

One of the most expert groups on the subject of the COLA increase is The Senior Citizens League . This group forecasts a 10.1% Social Security increase by 2023. This forecast is quite possible seeing the large increase in overall prices in the past few months. It is still too early to be sure of the total increase, but it is quite possible that it will be something close to that percentage.

We will not have the final figure until October. In any case, all the experts say that this increase could be negative for some Social Security recipients. This is because it could increase the taxes paid every month. With a higher benefit it is possible to reach the maximum monthly income threshold.

So that would mean we would have a Social Security increase of $159 at most. Given that this figure is for maximum SSA benefits, most likely not everyone will be able to get it. Normal in such cases, due to the average benefits, is to raise around $120 more per month for COLA.

As the increase is expressed as a percentage, remember that your Social Security benefit will increase depending on the monthly amount. If you collect a maximum of $4,194 per month, you will get a higher COLA increase. This increase is not so that pensioners have more money to spend each month, but so as not to lose their purchasing power during inflation.

Read Also: Protect Your Social Security Number

Taxing Social Security Benefits Is Sound Policy

Social Security beneficiaries with higher incomes pay income tax on part of their benefits. Those with incomes below $25,000 pay no tax on benefits, while those with the highest incomes pay tax on as much as 85 percent of their benefits. This arrangement is sound for several reasons:

- The substantial proceeds from taxing Social Security benefits are credited to the Social Security and Medicare trust funds, strengthening the programs financing.

- The taxation of benefits is broadly progressive, since people with low incomes pay nothing and the tax rate on benefits increases with income.

- As an earned benefit, Social Security should be subject to tax, like other earned benefits, such as employer pensions.

- Social Securitys tax treatment is more favorable than that of private defined-benefit pensions, primarily because of the protections for low-income beneficiaries.

To Find Out If Their Benefits Are Taxable Taxpayers Should:

- Take one half of the Social Security money they collected during the year and add it to their other income.

Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

Don’t Miss: Social Security Office In Miami

How Much Of Your Social Security Is Taxable

Its possible and perfectly legal to avoid paying taxes on your Social Security check. In fact, only about 40 percent of recipients pay any federal tax on their benefit.

But heres the caveat: To receive tax-free Social Security, your annual combined, or provisional, income must be under certain thresholds:

- $25,000, if youre filing as an individual

- $32,000, if youre married filing jointly

For married filing separately, the Social Security Administration simply says that youll probably pay taxes on your benefits.

Your combined income consists of three parts:

- Your adjusted gross income, not including Social Security income

- Tax-exempt interest

- 50 percent of your Social Security income

Add those amounts up and if youre under the threshold for your filing status, you wont be paying federal taxes on your benefit.

Even if youre above this threshold, however, you may not have to pay tax on your full benefit. You may pay taxes on only 50 percent of your benefit or on up to 85 percent of it, depending on your combined income.

- For individual filers:

- Combined income between $25,000 and $34,000, up to 50 percent of your benefit is taxable

- Combined income above $34,000, up to 85 percent of your benefit is taxable

Planning Around The Taxability Of Social Security Benefits

Planning strategies should be done based on marginal tax rates, which means the leaps in marginal tax rates from including Social Security benefits can and should be a material factor in planning – especially since the rates have the greatest impact on those whose income is relatively modest and may not realize they are exposed to 27.75% marginal tax rates when they “thought” they were in just the 15% or 25% tax brackets.

For many clients, though, the rates are at least partially unavoidable. In many situations, there simply is not enough income flexibility to spread income out to stay below the thresholds. Although notably, for some clients, the best thing to do is to actually accelerate income and lump it together after all, additional income beyond the point that the maximum 85% of Social Security benefits are taxable is subject to only a 15% tax bracket, which is far better than leaving the income until next year when it may be taxed at 27.75% due to the phase-in of Social Security benefits. In fact, in some cases it might even be worthwhile to trigger a bit of additional Social Security benefits taxation just to reach the cap and then add more income beyond it at a current tax bracket!

Join over 51,881 fellow advisors now

Read Also: Brockton Ma Social Security Office

How Much Of My Social Security Benefits Will Be Taxed

Q. I have been collecting Social Security since turning 66 four years ago. This past year in 2021, I collected $30,671.40. I also have a pension from that was $23,216.04. I am still working as well as a consultant and made just over $107,000. I also had to take out $14,000 from one of my IRAs and I paid $2,800 in federal taxes. With that said, how much of my Social Security will be taxed?

Still working

But it is different for federal tax purposes.

If your total gross income including otherwise tax-exempt municipal bond interest exceeds $25,000, you begin to pay federal tax on your Social Security benefits on a sliding scale that eventually reaches a maximum of 85%, said Neil Becourtney, a certified public accountant and tax partner with CohnReznick in Holmdel.

A formula is used where one calculates their provisional income which is defined as the sum of 50% of Social Security benefits, plus tax-exempt interest, plus other items included in your adjusted gross income, he said.

For single taxpayers, Social Security benefits escape federal taxation if provisional income is less than $25,000. For provisional income between $25,000 and $34,000, up to 50% of Social Security benefits are taxable. If provisional income exceeds $34,000, up to 85% of benefits will be taxable, Becourtney said.

Email your questions to .

Note to readers: if you purchase something through one of our affiliate links we may earn a commission.

How The Math Works

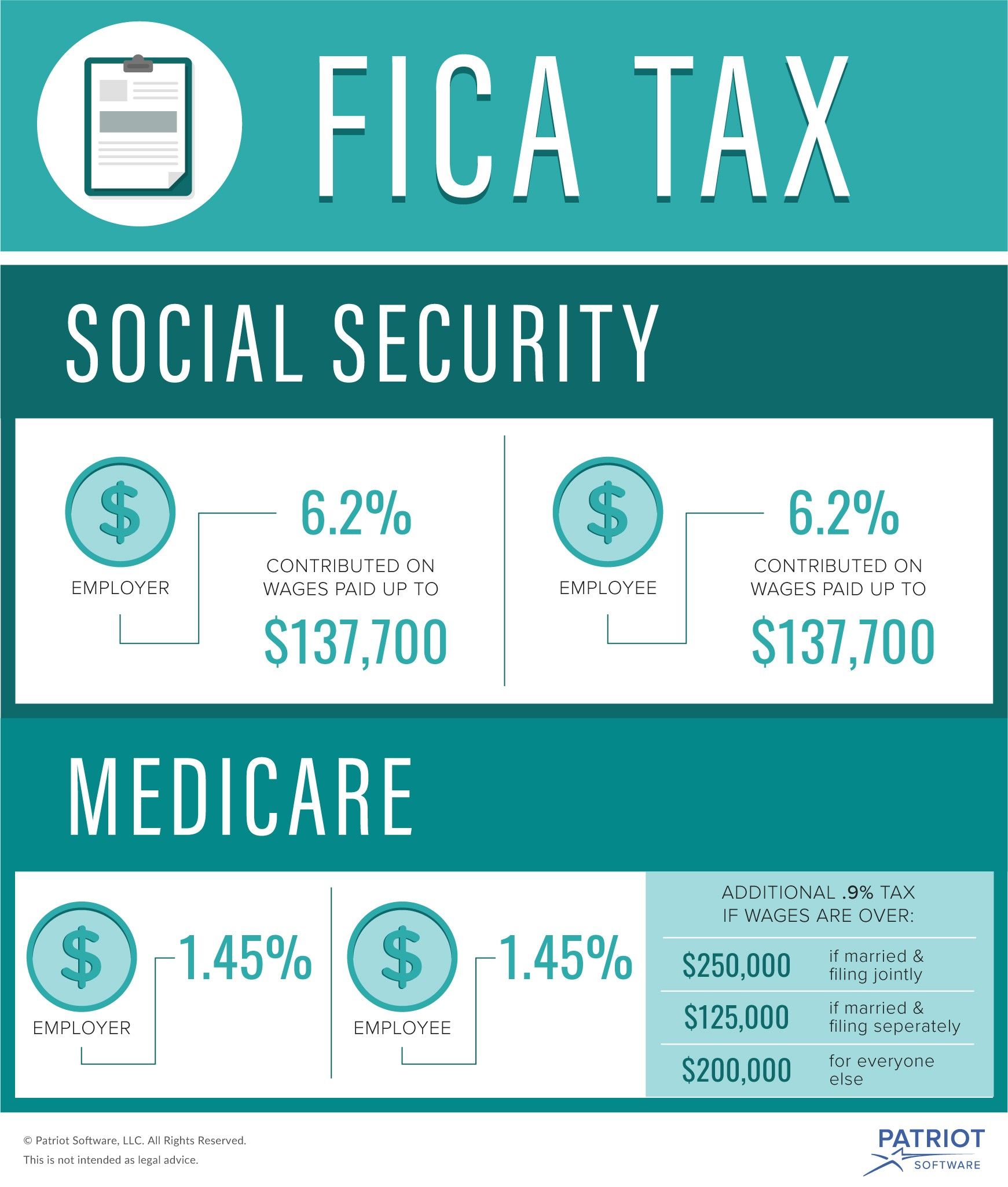

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.

Also Check: Social Security Offices In Colorado

Are Social Security Benefits Taxable

Up to 50% or even 85% of your Social security benefits are taxable if your provisional or total income, as defined by tax law, is above a certain base amount. Your Social Security income may not be taxable at all if your total income is below the base amount.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

What Home Improvements Are Tax Deductible 2021

Until December 31, 2021, you may claim a tax credit for energy-efficient modifications to your house, such as energy-efficient windows, doors, skylights, roofs, and insulation,Washington adds. Air-source heat pumps, central air conditioning, hot water heaters, and circulating fans are among the other changes.

Read Also: Social Security Office In Victoria Texas

How Much Social Security Is Taxable

If you are planning to retire, its important to take into account all costs you will incur including how much Social Security is taxable.

Taxes from Social Security are a surprise to many retirees who are unaware of the factors that determine whether your monthly benefit will be taxable.

Fortunately, it is not hard to understand how much Social Security is taxable.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Social Security Ticket To Work Program

How To Minimize Taxes On Your Social Security

If your Social Security benefit is relatively fixed, albeit with small annual increases, you really have only two avenues left to get into that tax-free zone: reducing tax-exempt interest or adjusted gross income. And since most people dont have tax-exempt interest, youre left with one option.

Therefore, the secret is to reduce your adjusted gross income in order to prevent provisional income from triggering a tax on Social Security, says Kelly Crane, president and chief investment officer at Napa Valley Wealth Management in St. Helena, California.

Here are a few ways to reduce your adjusted gross income to get into the tax-free zone:

How Much Of Your Social Security Income Is Taxable

Social Security payments have been subject to taxation above certain income limits since 1983. No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

However, regardless of income, no taxpayer has all their Social Security benefits taxed. The top level is 85% of the total benefit. Heres how the Internal Revenue Service calculates how much is taxable:

- The calculation begins with your adjusted gross income from Social Security and all other sources. That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and other taxable income.

- Tax-exempt interest is then added.

- If that total exceeds the minimum taxable levels, then at least half of your Social Security benefits will be considered taxable income. You must then take the standard or itemize deductions to arrive at your net income. The amount you owe depends on precisely where that number lands in the federal income tax tables.

Combined Income = Adjusted Gross Income + Nontaxable Interest + Half of Your Social Security Benefits

The key to reducing taxes on your Social Security benefit is to reduce the amount of taxable income you have when you retire, but not to reduce your total income.

You May Like: Social Security Office Opelousas La

How To Plan For Social Security Taxes

A balanced approach to distribution is the best way to plan for Social Security taxes, says Freitag. Keep in mind that too much emphasis on one type of distribution or another is not the way to go.

It is better to have a mix of income streams in retirement, he says. As an example, if all your income is taxable, then adding Social Security just makes it worse across the board.

Just Started Collecting Social Security Here’s How To Know Whether You’ll Owe Taxes On It

Roughly 1 in every 2 older adults will pay federal income taxes on a portion of their Social Security benefits for the 2020 tax year.

To be sure, this usually happens only if you have other substantial income in addition to your Social Security benefits, such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return, according to Uncle Sam.

Also Check: Greenville South Carolina Social Security Office