How To Check If Someone Is Using My Identity

Theres no one step you can take to definitively prove identity theft. Rather, youll need to check a few different areas that could indicate it.

- Track bills. Know what bills you owe and when theyre due. If youve stopped getting a bill that you used to receive regularly, it could be a sign that someone has changed your billing address, a red flag for identity theft.

- Check bank account statements. You should review your bank account statements regularly if you see unknown purchases, that could be a sign that your identity has been stolen.

- Check credit reports. Similarly, monitor your from all three credit-reporting bureaus for any unknown accounts or inaccurate information. Your credit score isnt enough information to check for identity theft rather, youll need the complete credit files.

- Review bills. If you receive new bills or charges for services you didnt sign up for, someone may be using your personally identifiable information .

- Use identity theft protection. To automate the process of detecting identity theft, many people use identity theft protection services, ideally identity theft protection with credit reporting. The best credit protection services include not just credit and identity monitoring but also identity recovery and insurance.1

Note: The maximum reimbursement from identity theft insurance plans is $1 million, typically.

Help When You Need It

Our dedicated team of Credit and Fraud Resolution Agents give you personalized support.

If you think you have an issue with fraud or identity theft, rest assured that weâre here to help with toll-free support available 7 days a week. A Fraud Resolution Agent is assigned to work with you closely every step of the way until your issue is resolved.

How Can I Find Out If Someone Is Using My Identity What To Know About Identity Theft

The sprawling allegations of identity theft tied to the Las Vegas woman are emblematic of the scourge facing Americans and represent an extreme for their boldness, said John Buzzard, a financial fraud analyst at Javelin Strategy and Research.

Last year, he estimated identity theft accounted for more than $52 billion in estimated financial losses and impacted about 42 million U.S. adults. Long plays on a single stolen identity are rare, but the tactics used in the Las Vegas case fraudulently opening new accounts are not. That type of activity was up 109% year-over-year in 2021, according to the groups latest report.

Identity is now monetized and aggregated from an information standpoint, Buzzard said. This is their career as criminals, making millions of dollars either wrestling complete sets of identities or victimizing those in proximity.

Buzzard said each piece of the financial food chain has the responsibility to prevent and root out the fraud.

Lenders, real estate agencies and those issuing credit should be utilizing identity proofing systems that authenticate whether a passport or drivers license is real. It asks for accompanying information from applicants, like a selfie that merges with other existing consumer data to flag suspicious accounts.

Also Check: Social Security Office In Tucson Arizona

Request For Identity Verification From The Irs

When the IRS stops a suspicious tax return filing, they may send a letter called “Letter 5071C” asking that you verify your identity. It will include a couple ways to verify it: via a phone number or through the IRS’s Identity Verification Service, .

This online service is the quickest method and will ask you multiple-choice questions to verify whether or not the tax return flagged for further identity verification was filed by you or someone else. The IRS only sends such notices by mail. The IRS will not request that you verify your identity by contacting you by phone or through email. If you receive such calls or emails, they are likely a scam.

If you can’t confirm your identity using the IRS’ online Identity Verification Service, you can call the IRS at the phone number included in the letter.

When confirming your identity, you will need:

Place A Credit Freeze On Your Accounts

The first thing you need to do is freeze your credit accounts so the scammers canât open new accounts in your name. Anyone can place a credit freeze on their account, even if they havenât been the victim of identity theft.

To put a freeze on your account, contact each of the three credit bureaus â Equifax, Experian, and TransUnion.

Don’t Miss: Social Security Medicare Part B

S To Freezing Your Social Security Number

The Social Security Administration’s website, IdentityTheft.gov, provides information about social security numbers, keeping them safe, and what to do if you believe someone stole yours. Their suggestions include:

- Place a fraud alert on your banking and credit accounts as soon as you believe someone compromised any of your personally identifiable information.

- Report any misuse of your identity to the local police and the Federal Trade Commission.

- Alert stores or other businesses where someone used your identity fraudulently.

- Your local police department may advise you on more steps to take when you report identity theft. Getting a letter from the police to show any businesses that claim you’re defaulting on payments or have outstanding bills due that are the result of fraud is essential.

By creating an account on ssa.gov, you may block electronic access to anyone trying to access your number through the federal website and view your lifetime benefits to ensure that no one else has been using your number.

Another federal government website, myeverify.gov, allows individuals to freeze their social security numbers to avoid misuse in employment applications.

Heres What Our Happy Customers Are Saying

I wholeheartedly recommend

Detected identity fraud immediately

Fantastic

Weve had Identity Guard for quite some time. I feel completely comfortable and confident in the way Identity Guard conducts business. I highly recommend them.

I used to have Lifelock. They never notified me of anything. Identity Guard has notified me of every change to my account. I feel safe with them and their customer service is awesome.

Thanks to prompt notification of identity theft and with the help of Janet from Identity Guard I was able to shut down an illegal credit card issued in my name before it was used.

Posted on Trustpilot.com by Pat K.

Posted on Trustpilot.com by Justice T.

Posted on Trustpilot.com by Bruce G.

Recommended Reading: Social Security Office Dunn Ave

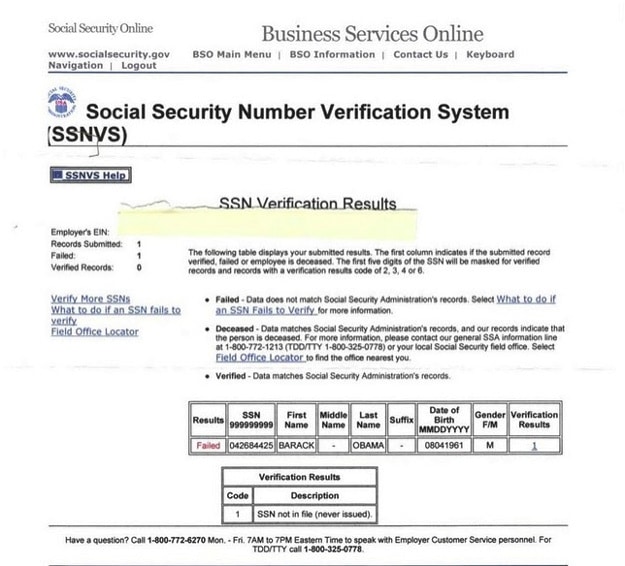

Find Out If Someone Is Fraudulently Using Your Social Security Number

The best way to find out if someone is fraudulently using your social security number is to regularly monitor your credit reports.

Consumers should obtain one free credit report from each of the three credit reporting agencies a year. We recommend consumers review their credit report every four months. For example, in January, check your report from TransUnion, in May, check your report from Equifax, and, in September, check your report from Experian. You can order your free credit reports online at: or by phone, toll free, at 1-877-322-8228.

You should also verify your Social Security Statement once a year from the Social Security Administration. This will determine if someone is fraudulently employed using your social security number. You can request your Social Security Statement online at or by phone, at 1-800-772-1213.

How Did The Attack Occur

This attack had a much better outcome than the last Unified School District breach. This attack was a system hack, while the other was ransomware. Another differing factor is that this breach only affected current and former employees instead of students being thrown into the mix. We know this may sound odd, as school employees are already overworked and underappreciated, and we dont mean to demote their importance in any way. But anyone who enjoys their work in the education system will tell you theyd rather become victims as adults than have children victimized before they can do anything about it.

Read Also: Social Security Offices In Colorado

How To Verify Social Security Number Theft

Identity theft has become one of the most frequent crimes committed in the United States , so this fraud should be reported immediately to Social Security, as it will bring you serious consequences.

So how do you verify Social Security number theft? Keep reading this article to find out if someone is fraudulently using your identity.

Enter Your Name Into The Identity Theft Data Base

Register your name into the California ID Theft Registry if you have been charged with a crime committed by another person using your stolen identity or if your identity has been mistakenly associated with a record of criminal conviction.

Once confirmed, your information would be entered into the new statewide data base and used to show others that you were actually not responsible for the crime. This information would be available via a toll-free number to the identity theft victim, criminal justice agencies and other individuals and agencies authorized by the victim to see the information.

Read Also: Social Security Office Waycross Ga

Is Someone Using Your Identity To Get Work

When a Texas man received a notice from the Internal Revenue Service claiming that his tax return reflected unreported wages from a job at Fairmont Foods, he realized right away that something was wrong â because heâd never held a job there.

Acting quickly, he reported the suspected fraud to his local police department. With a search warrant in hand, they found that someone had used his name, date of birth, and Social Security number to get the job â almost two years prior .

This form of identity theft happens more than people realize. The U.S. Government Accountability Office investigated employment identity theft in 2016 and found that over 2.9 million SSNs showed signs that theyâd been used for employment fraud .

If youâve received strange notices from the IRS or Social Security Administration about jobs you donât recognize, you need to act quickly.

In this guide, weâll explain why employment identity theft is a serious issue, what to do if youâre a victim, and how you can prevent it from happening to you.

Use A Dark Web Monitoring Service

When sensitive data like Social Security Numbers are stolen, they often end up on the dark web for sale. Dark web monitoring will allow you to find and keep track of such data by scanning these secret websites.

While your personal information showing up on the dark web is definitely an indicator that you are in danger of identity theft, it does not necessarily tell you if someone has already started using your Social Security Number.

Don’t Miss: Social Security Offices In Austin Texas

Contact Companies Where Your Social Security Number Has Been Used Fraudulently

In the case that your information was used to create fraudulent accounts, you’ll want to contact each company involved. For example, if your SSN was used to create bank accounts or credit accounts in your name, reach out to each company and explain that you’re a victim of identity theft. They can then close your accounts so the identity thief can’t use the accounts any longer.

If someone used your information to create fraudulent identification records, you’ll need to contact all agencies involved, possibly including the IRS, Social Security Administration and your secretary of state’s office, which handles cases of fraudulent identification.

Someone Claimed Unemployment In My Name What Can I Do

If you believe you were the victim of unemployment fraud, all is not lost. While theres no guarantee youll catch the perpetrator, its crucial to take action to limit the damage to your credit and to help authorities clear your name.

Here are 12 steps you can take:

1. Contact your state unemployment office

The U.S. Department of Labors Unemployment Insurance programs are managed through a network of nationwide offices.

If you think someone has claimed unemployment benefits in your name, the first thing you should do is get in touch with your local office to report the fraud.

Hereâs how you do it:

- Find the appropriate fraud hotline number or online reporting portal for your state.

- Make contact immediately â the sooner you report the fraud, the faster you can resolve the issue.

2. Do the same for multi-state claims

Criminals may have made fraudulent claims in your name across multiple states. In this case, you must contact the state unemployment office for each state where the illegal UI claims were filed.

Hereâs how you do it:

3. Alert your employer

Hereâs how you do it:

Take action:

You May Like: How To Lock Your Social Security Number

What Can A Scammer Do With My Social Security Number

Social Security numbers were originally developed to track your lifetime earnings and determine eligibility for retirement benefits. But today, your SSN is used for everything from opening new credit card accounts to buying a home and applying for a passport.

This means, if a thief gets access to your SSN, they can wreak havoc on nearly every aspect of your life.

Here are a few types of identity fraud and scams a thief can commit with your Social Security number:

- Commit synthetic identity theft, where they combine your SSN with other information to create a âfakeâ identity.

- Apply for jobs in your name .

- Open a new account at a financial institution.

- Take out payday loans or other fraudulent loans in your name.

- Drain your existing bank accounts.

- Get medical treatment under your name and use up your health benefits .

- Apply for a new passport or driverâs license using your name.

- File a fraudulent tax return with the Internal Revenue Service and steal your rebate.

- Steal benefits from government agencies. For example, unemployment benefits, pandemic relief, or Social Security benefits.

- Open accounts in your childâs name and ruin their clean credit history

Your SSN is a golden ticket for identity thieves. Of all the sensitive information tied to your identity, your SSN is the one thing you want to be especially careful about.

How Much Does Identity And Ssn Monitoring Cost

Identity theft and SSN monitoring plans range in cost depending on the provider and the services they offer. Most companies bundle SSN monitoring with other forms of identity theft protection. This could include credit monitoring, Dark Web scanning, and antivirus software.

For the simplest, most powerful SSN monitoring, Identity Guardâs Value Plan is just $7.50 per month and includes AI-powered threat detection powered by IBMâs Watson® AI.

You May Like: Social Security Administration Jackson Ms

What To Do If Your Social Security Number Is Exposed

If your Social Security number is exposed in a breach or leak, it’s important that you act quickly to prevent identity thieves from doing more damage.

Tip: As you go through this process it’s a good idea to keep documentation of any steps you take, calls you make, forms you fill out, or letters you send. If you have to dispute a fraudulent charge or activity, having these records can help smooth the way by establishing that you’re dealing with an actual identity theft.

Take Action If You Are A Victim

There are steps you can take if your Social Security number or other personal information is compromised.

If your Social Security number is compromised and you know or suspect you are a victim of tax-related identity theft, the IRS recommends these actions:

- Respond immediately to any IRS notice: Call the number provided.

- If your e-filed return is rejected because of a duplicate filing under your Social Security number, or if the IRS instructs you to do so, complete IRS Form 14039, Identity Theft AffidavitPDF. Use a fillable form at IRS.gov, print, then attach the form to your return and mail your return according to instructions.

- Visit IdentityTheft.gov for steps you should take right away to protect yourself and your financial accounts.

See Identity Theft Victim Assistance: How It Works for more information about how the IRS can help you.

If you previously contacted the IRS and did not have a resolution, contact us for specialized assistance at . We have teams standing by to help you.

Fraudulent Returns

If you believe someone has filed a fraudulent return in your name, you can get a copy of the return. See Instructions for Requesting a Copy of Fraudulent Returns.

Dependents

Data Breach

Not all data breaches or computer hacks result in tax-related identity theft. Its important to know what type of personal information was stolen.

Assigned an EIN Not Requested

Some tips:

Phishing Emails and Scams

You can report other suspicious online or emailing phishing scams to .

Recommended Reading: Social Security Office On Terry Parkway

Stay Vigilant To Help Protect Your Personal Information

If your Social Security number and personal information fall into the wrong hands, it could take you months to undo the damage. Monitoring your credit helps prevent the likelihood of this happening. The sooner you catch fraudulent activity, the easier it can be to reverse.

However, if you find that someone is using your SSN, it’s possible to remove the activity from your credit file. Filing reports with the proper authorities can help reverse the effects of someone stealing your personal information.

Diligence with your credit is a round-the-clock effort. The Tally app makes it easier for you to keep track of your credit card accounts and manage your monthly payments with a lower-interest line of credit.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.