Can I Collect Both Ssdi And Ssi

You can collect SSDI and SSI at the same time if you’re approved for SSDI but your SSDI payment is low. This might be the case if you made low wages over the years or you didn’t work much in recent years. If your SSDI payment is less than $861 , you could get a small SSI payment in addition to your SSDI payment, to raise it up to the SSI amount.

But you still have to meet the SSI requirements, so if you have more than a thousand or two in cash or assets, or income other than SSDI, you won’t qualify.

When you get SSDI and SSI at the same time, it’s called receiving “concurrent benefits.” You receive two different checks, on different payment dates for SSDI and SSI.

The Future Of Social Security

With the aging of the U.S. population, some observers have raised concerns about the viability of a system in which fewer active workers will be supporting greater numbers of retirees.

In its 2022 report, the Social Security Board of Trustees forecasts that the retirement fund reserves will become depleted in 2034, after which tax revenue will be enough to pay 77% of scheduled benefits. The trustees also projected reserves of the Hospital Insurance Trust Fund, which finances Medicare Part A, will be depleted in 2028, at which point program income will cover 90% of benefits.

If those predictions hold, Congress will need to find ways to fill the gap, which might mean higher taxes on workers, lower benefits, higher age requirements for retirees, or some combination of these elements.

How Social Security Works

Social Security is an insurance program. Workers pay into the program, typically through payroll withholding where they work. Self-employed workers pay Social Security taxes when they file their federal tax returns.

Workers can earn up to four credits each year. In 2022, for every $1,510 earned, one credit is granted until $6,040, or four credits, has been achieved. In 2023, it will be $1,640 until $6,560. That money goes into two Social Security trust fundsthe Old-Age and Survivors Insurance Trust Fund for retirees and the Disability Insurance Trust Fund for disability beneficiarieswhere it is used to pay benefits to people currently eligible for them. The money that is not spent remains in the trust funds.

A board of trustees oversees the financial operation of the two Social Security trust funds. Four of the six members are the secretaries of the departments of Treasury, Labor, and Health and Human Services, and the Commissioner of Social Security. The remaining two members are public representatives appointed by the president and confirmed by the Senate.

Medicare, the federal health insurance program for Americans 65 and older and some people with disabilities, is also supported through payroll withholding. That money goes into a third trust fund, which is managed by the Centers for Medicare & Medicaid Services .

Spouses and ex-spouses may also be eligible for benefits based on the earnings record of their partner or former partner.

Read Also: Lookup Person By Social Security Number

Social Security Ssi And Ssdi: Whats The Difference And Why Does It Matter

Apr 5, 2021 | The Practical Lawyer

Both SSI and SSDI offer cash benefits for persons with disabilities. Both programs are overseen and managed by the Social Security Administration. Medical eligibility for disability is determined in the same manner for both programs. However the eligibility requirements are quite different, attorney involvement in eligibility is quite different, and the need for a disabled recipient of these benefits to receive an inheritance protected by a special needs trust is completely different, depending on which of these two benefits is being received. Some people receive both SSI and SSDI, but this is rare. The most significant difference between Social Security Disability Income and Supplemental Security Income is the fact that SSDI is only available to workers who have accumulated a sufficient number of work credits, while SSI benefits are primarily for low-income individuals who have either never worked or who havent earned enough work credits to qualify for SSDI.

Is It Better To Retire Or Go On Disability

Winning a disability claim generally gets easier for people as they become older. … However, some older folks choose to apply for early retirement at age 62 or 63 rather than applying for disability. Even though this may seem an easier option, it can reduce the amount of benefits you are entitled to.

Also Check: Report Stolen Social Security Number

Whats The Difference Between Ssi And Regular Social Security

Learn how Social Security benefits differ from Supplemental Security Income, and how both federal benefits programs compare.

The Social Security Administration manages various safety net programs for qualified retired workers, people with disability, as well as spouses, children, and survivors of eligible workers. Two of the most prominent benefits programs are Social Security benefits and Supplemental Security Income.

Social Security benefits are payments made to eligible retired workers, people with disabilities, and dependents of eligible workers. You must have paid Social Security taxes to qualify for these benefits. On the other hand, Supplemental Security Income payments are paid to older retired workers and people with disabilities who have limited income and resources. You donât have to have worked in a covered job to be eligible for SSI benefits.

Who Qualifies For Ssi And What Benefits Do They Receive

To qualify for SSI, applicants must be aged or disabled and have little or no income and few assets .

In 2014, the basic monthly SSI benefit is $721 for an individual and $1,082 for a couple. Beneficiaries who live in another persons household and receive in-kind maintenance and support qualify for one-third less than this amount, while beneficiaries who receive long-term care in a Medicaid-funded institution qualify for $30 per month. Many states supplement the federal SSI benefit, though state budget cuts are crimping those additional payments.

Those benefits, though, are reduced when recipients have other income. In determining a persons SSI eligibility and benefit levels, SSA exempts the first $20 per month of unearned income, such as Social Security benefits, pensions, interest income, or child support as well as the first $65 per month of earnings . Above those thresholds, each dollar of unearned income reduces SSI benefits by a dollar, while each dollar of earned income reduces SSI benefits by just 50 cents a provision that is meant to encourage work. SSA also exempts certain work-related expenses when reducing SSI benefits because of earnings. While a small percentage of SSI recipients have some earnings and a somewhat greater percentage have unearned income, most recipients have no other source of income .

Recommended Reading: Social Security New Port Richey

Qualifying For Ssd Benefits

There are numerous qualifications for disability benefits. These include long-term sickness, illness, or death in the family war or national service labor or professional skills acquired through training or through working in a specific field and physical disability that is related to any of these causes. In order to qualify for any of these benefits, one must work for at least a year in a job that is considered beneficial under the guidelines of Social Security. However, there are certain jobs that are considered disability-friendly, and its important to understand that jobs are which and how to apply for them.

The first qualification is that you must have been working in the United States for a certain period of time. A few years is called the maximum period of work for Social Security benefits. If you have reached this maximum limit, you may be able to get additional benefits to add to your disability payments, but you will still need to work for a certain amount of time in order to reach the maximum benefit amount. Once you reach the maximum benefit level, you no longer have to work under Social Security guidelines. This is known as continued work credits.

What Is The Difference Between Ssi And Social Security Benefits

The United States Social Security Administration has a lot of different programs available to assist Americans in need and elderly Americans. About 178 million people pay into the Social Security system, and about 64 million people receive monthly Social Security benefits. Whether the benefits are for retirement, to help those with disabilities, or to pay survivor benefits, the SSAs goal is to improve the quality of life for many of us.

In fact, SSA plays a role in our lives directly or indirectly from the time we are born until we pass away. Most parents apply for a childs Social Security number at birth. When you get your first and subsequent jobs, the SSA verifies you with your employer based on your Social Security number, which reduces fraud and ensures the accuracy of your earnings. When you get married, you should let the SSA know so that you may receive certain retirement, survivor, and disability benefits with your spouse. And also, the SSA has assistance for those who become disabled, who need financial support in difficult times, and in retirement.

One of those main SSA programs available in the Supplemental Security Income program. Not to be confused with Social Security Disability Insurance , SSI pays monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older.

Read Also: Social Security Office Brownwood Tx

Ssd And Ssi Eligibility

One of the primary differences between SSD and SSI is eligibility. To receive SSD or SSI benefits, applicants must meet the Social Security Administrations disability criteria, which defines a disability as a physical or mental impairment that prohibits work and has lasted or is expected to last for at least 12 months or result in death.

SSD benefits are earned through payroll tax contributions. These contributions are issued to the programs trust fund and are allocated to disabled individuals based on a calculation of credits. SSD benefits may be paid to blind or disabled workers, as well as their dependents.

Unlike SSD, SSI is funded by general tax revenues, not contributions paid by employees and employers. SSI is a need-based program for low-income individuals and may be paid to disabled adults who meet income restrictions, children who are blind or disabled, or individuals age 65 and older who lack disabilities but meet financial limitations.

Should I Get Professional Help

If you need help filing an application for SSDI or SSI, or you want to appeal a denied claim, contact an experienced disability representative to discuss your options. Disability attorneys and advocates virtually always offer free consultations, and don’t charge a fee unless you win your case.

According to a survey of our readers, applicants who filed an initial application without help were denied 80% of the time. Getting help at the initial application stage gives you a good chance of getting benefits in just three or four months. That’s because a legal professional can help you complete your initial application for benefits in a way that’s accurate but persuasive. If you’d like help with your application, click for a free case evaluation with a legal expert.

Read Also: Is Social Security Going Away

How Long Does It Take To Be Approved For Ssi

Generally, it takes about 3 to 5 months to get a decision. However, the exact time depends on how long it takes to get your medical records and any other evidence needed to make a decision. * How does Social Security make the decision? We send your application to a state agency that makes disability decisions.

How Is Ssi Funded

As an entitlement program, SSI is available to anyone who meets its eligibility requirements. Unlike Social Security , SSI is funded from general revenues. At a cost of just over $50 billion in fiscal year 2012, SSI constitutes a small portion of the federal budget 1.4 percent of total spending that year. SSI expenditures were 0.33 percent of gross domestic product in 2012 and are expected to decline to 0.23 percent of GDP by 2037.

Read Also: Can I Get Va Pension And Social Security

Eligibility Requirements For Ssdi And Ssi

The SSI disability program has different eligibility requirements than Social Security Disability Insurance . To be entitled to SSI benefits, you must be a U.S. citizen who meets the requirements set by the Social Security Administration .

to qualify for SSI benefits you need to present medical evidence that your disability will last for at least one year. Your total countable income should also be below listed Supplemental Security Income levels. The SSI amount differs from state to state.

In both SSDI and SSI cases, a claimant’s medical records will be checked periodically to be sure the individual is still disabled.

The Social Security Administration will review your condition every 3 to 7 years, depending on your disabilitys nature. Once youre awarded SSI disability benefits, your financial records will be reviewed every year.

Other Facts You Should Know

When you apply for Social Security Disability benefits, you should be screened for both SSDI disability and SSI. If you are awarded SSDI benefits of an amount less than a thousand dollars per month, it would be wise to consult with a representative to check if you may qualify for SSI as well.

When you make a disability claim for SSI, you may also be required by the Social Security Administration to provide financial records which include bank statements, mortgage and lease agreements, savings and other financial data that will let them assess your financial status.

You can seek the help of a Social Security Disability advocate or disability lawyer to help make the application process for Social Security Disability benefits or appealing a decision much more manageable.

If you have a question regarding your SSI or SSDI case, you can ask in our forum here.

Also Check: Cuts To Social Security Benefits

Main Differences Between Social Security And Ssi

How Often Does Ssi Check Your Bank Accounts

As we explain in this blog post, SSI can check your bank accounts anywhere from every one year to six years, or when you experience certain life-changing experiences. The 2022 maximum amount of available financial resources for SSI eligibility remains at $2,000 for individuals and $3,000 for couples.

Recommended Reading: Calculate Spousal Social Security Benefits

Applying For Regular Social Security Vs Ssi

If you are eligible to receive SSI based on age or disability, you may also qualify to receive Social Security benefits. Therefore, when you apply for SSI benefits, you will be automatically applying for Social Security benefits. For example, if you apply for SSI based on your disability, you may also be eligible for Social Security Disability insurance.

You can apply for either or both benefits through your My Social Security account, by calling Social Security at 1-800-772-1213, sending your filed application to the Social Security address, or visiting the local Social Security office.

Tags

How Has Ssi Changed Over Time

Since 1974, the number of SSI recipients has slightly more than doubled . Over that time, SSI has changed from a program that mainly supplemented Social Security income for elderly adults to a broader anti-poverty program that aids the disabled of all ages. SSI is an increasingly important program for children and persons with disabilities.

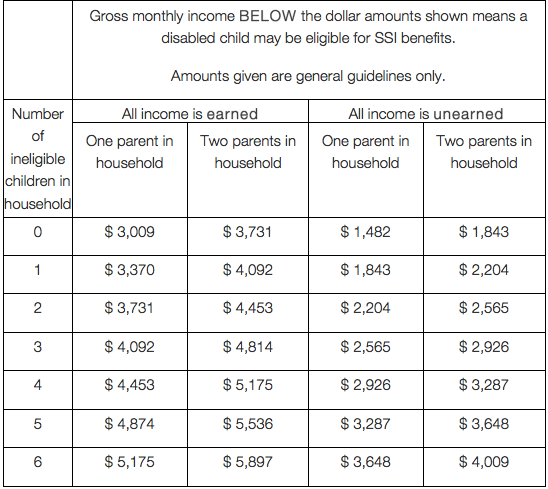

A substantial number of children 1.3 million in December 2013 receive SSI benefits. Children with disabilities may be eligible for SSI since a childs disability can impose additional costs on his or her caregiver. The number of children receiving SSI has gradually increased since 1974 and accelerated dramatically after a 1990 Supreme Court ruling liberalized the disability criteria for SSI children. Reforms enacted in 1984 that expanded benefit eligibility for the mentally disabled also influenced the surge in children receiving SSI. Congress tightened the SSI eligibility rules for children in the 1996 welfare-reform law, however.

Most children who receive SSI live with a single parent and receive special education on average, SSI payments provide nearly half of their familys total income. SSI program rules encourage parents to work one-third of child recipients in single-parent households, and two-thirds of those in two-parent families, have a working parent.

Read Also: Should I Have Taxes Withheld From My Social Security Check

Summary Social Security Vs Ssi

The difference between social security and SSI can be mainly distinguished by considering their aims. Social security is mainly concerned with retirement benefits while SSI is designed to assist persons and children in fulfilling their basic needs. SSA provides a number of welfare and development programs to US citizens where social security and SSI takes priority. The organization has documented clear guidelines for eligibility criteria in order to ensure an equitable service is provided throughout the country.

What Is The Difference Between Social Security And Ssi

In the most basic sense, Social Security benefit programs are referred to as entitlement programs. Workers of all sorts, whether a person has been self-employed or worked for an employer, pay for these benefits when they pay in with their Social Security taxes. These Social Security taxes are collected and kept in special trust funds. Then, the intention is that workers eventually qualify for Social Security benefits paid out of these trust funds based on work history. The benefit amount a person receives under the Social Security program will depend on the number of earnings paid into the trust fund over time.

In the alternative, SSI is not an entitlement program, but is instead considered to be a needs-based program for individuals with access to limited income streams and resources. Resources refer to assets owned by a person. The SSI program is supported by general tax revenues as opposed to Social Security trust funds. The amount that will be paid out by SSI is prescribed by Federal and State law. The amount will take into account where a person lives, as well as who lives with him or her and the income he or she receives.

Disability Attorney

Programs administered by the Social Security Administration are important to many but can be very complicated to understand. Disability Advocates Group is here to offer you guidance and counsel on these programs. Contact us today.

Also Check: Social Security Office Milwaukee Wi