What Is Ssdi Benefits

SSDI stands for Social Security Disability Insurance. SSDI benefits are disability payments paid to those who can no longer work because of a disability or a serious ailment. SSDI benefits are based on the amount of work credits and work history that an individual has, as well as the severity of the disability.

In order to qualify for SSDI benefits, you will need to have paid taxes though FICA, have enough work credits and have a disability that will make it impossible for you to work for at least 12 months.

If you became disabled before you reach the age of 24, you need to have at least 6 work credits to qualify for SSDI and 12 credits if your age is between 24 and 31. If you are over 31, you need to have earned 20 work credits in the past 10 years before you became disabled to be eligible for SSDI.

To file for SSDI disability benefits, you must either be a blind or disabled worker, an adult who has been disabled since childhood, or otherwise eligible to apply according to SSA’s rules. The amount of your monthly disability benefits will be based on your Social Security income record.

Council For Retirement Security

There are many types of benefits. The Social Security Administration is responsible for both Social Security and Supplemental Security Income , and while theyre similar there are a few key differences.

The SSA outlines the differences in this fact sheet to make it simple to understand. SSI is needs based and is a safety net program for people with limited resources. Social Security is an entitlement program that is based on work history and tax contribution.

SSI benefits are based on State and Federal government rules and is paid for through general revenue from taxes. Social Security is determined by wage indexes and paid by employers and payroll taxes.

SSI offers individual benefits only, while the other offers additional family benefits. Traditionally both programs are for older adults, but SSI can also offer benefits to children with disabilities and illness.

It is possible to have both types of benefits at the same time. However, applying for additional or different benefits while receiving SSI can affect the payout from that program. SSI payments dont automatically become retirement payments when you reach early retirement age.

The SSA can have the ability to force you into claiming your Social Security benefits at age 62, but by receiving both benefits at the same time, your payout wont decrease. Rather, the sum of both programs will equal you average calculated payout.

What Is Social Security

This is a program funded by basically the people, the taxes the current workforce pays to the Federal government.

A person who has worked and paid the required taxes for at least ten years is 62 years of age in the minimum while applying for the benefits.

It, not only covers the former worker but also their spouses or ex-spouses.

There is a minimum credit requirement and after that is met, the benefit is provided based on their average monthly income during their 35 years of their highest income.

In order to get disability benefits, which might last for one year or more, or result in death, the person or even their family can apply for the same.

The qualifications are based on certain earning tests and it also includes blindness.

The children or spouses of a deceased worker can also get benefits, which is the survivor benefits and it depends on the income of the deceased worker.

This however depends on circumstances and other variables, so a bit more complicated than the rest two.

Started in 1935, this is one of the major best Acts ever passed by the federal government, it has also kept up with changing times and inflation rates, and changed the rules as per the current scenario.

Also, none of the benefits or the amount of it is dependent or deterred by other factors like other income sources or the family one may live with, along with medical benefits.

You May Like: Cleveland Tn Social Security Office

Eligibility Requirements For Ssdi And Ssi

The SSI disability program has different eligibility requirements than Social Security Disability Insurance . To be entitled to SSI benefits, you must be a U.S. citizen who meets the requirements set by the Social Security Administration .

to qualify for SSI benefits you need to present medical evidence that your disability will last for at least one year. Your total countable income should also be below listed Supplemental Security Income levels. The SSI amount differs from state to state.

In both SSDI and SSI cases, a claimant’s medical records will be checked periodically to be sure the individual is still disabled.

The Social Security Administration will review your condition every 3 to 7 years, depending on your disabilitys nature. Once youre awarded SSI disability benefits, your financial records will be reviewed every year.

Social Security Cheat Sheet 202: Got Benefits Questions We’ve Got Answers

Learn more about your Social Security, Supplemental Security Income or Social Security Disability Insurance benefits, and get answers to your questions right here.

The end of 2022 brings an 8.7% cost of living adjustment to the roughly 66 million Americans who receive Social Security benefits. Social Security beneficiaries can look forward to their 2023 payment amounts increasing starting in January, while Supplemental Security Income recipients will get their first increased check in late December.

To help guide you through some of the ins and outs of Social Security — from when you should sign up to when you should look for your checks — CNET has created this cheat sheet, which is regularly updated so you can stay on top of the latest details.

Read Also: How Long Will Social Security Last

Recent Legislative And Regulatory Proposals

The Biden Administration has proposed legislative changes that would raise the maximum federal benefit under SSI to at least the poverty threshold for the United States . Under current benefit amounts, about 3.3 million SSI recipients are poor. The Administration has also proposed increasing the resource limits in SSI by changes in the price level in the United States. Under current resource limits, to qualify for SSI, individuals must have resources below $2,000 and married couples must have resources below $3,000. These limits have been fixed in dollar amounts since 1989. The Administration’s proposal would increase these to about $4,300 and $8,600 in 2021 . Amounts would be automatically increased for future price growth. The Biden Administration has further proposed to eliminate benefit reductions due to “in kind” support received by SSI recipients and to set the couple rate under SSI to twice that of the individual rate.

The Trump Administration proposed legislative changes to disregard earnings of disabled students for purposes of calculating SSI benefits, which would allow students to increase earnings without a loss in SSI benefits. The Trump Administration also proposed legislative changes to reduce total SSI benefits in cases where more than one person in the family qualified for SSI. These proposals were not acted upon by Congress.

When Will I Get My December Social Security Check

Here’s the for when you could get your Social Security check and/or SSI money:

- Payment for those who receive SSI.

- Social Security payment for those who receive both SSI and Social Security, or have received Social Security since before May 1997.

- 14: Social Security payment for those with birthdays falling between the first and 10th of any given month.

- 21: Social Security payment for those with birthdays falling between the 11th and 20th of any given month.

- 28: Social Security payment for those with birthdays falling between the 21st and 31st of any given month.

- January SSI payment. This check will have the COLA increase.

Note that was the final payment date for November.

Recommended Reading: Social Security And Medicare Tax Rates

Who Qualifies For Ssi And What Benefits Do They Receive

To qualify for SSI, applicants must be aged or disabled and have little or no income and few assets .

In 2014, the basic monthly SSI benefit is $721 for an individual and $1,082 for a couple. Beneficiaries who live in another persons household and receive in-kind maintenance and support qualify for one-third less than this amount, while beneficiaries who receive long-term care in a Medicaid-funded institution qualify for $30 per month. Many states supplement the federal SSI benefit, though state budget cuts are crimping those additional payments.

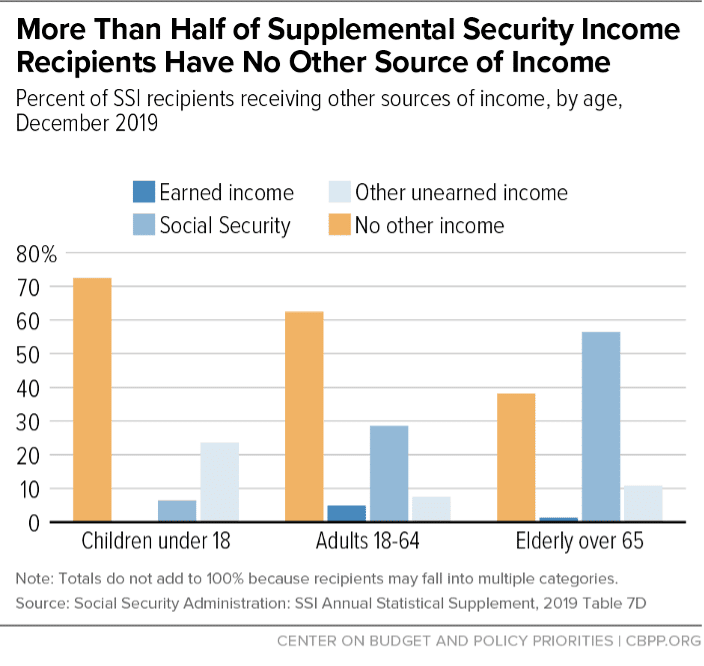

Those benefits, though, are reduced when recipients have other income. In determining a persons SSI eligibility and benefit levels, SSA exempts the first $20 per month of unearned income, such as Social Security benefits, pensions, interest income, or child support as well as the first $65 per month of earnings . Above those thresholds, each dollar of unearned income reduces SSI benefits by a dollar, while each dollar of earned income reduces SSI benefits by just 50 cents a provision that is meant to encourage work. SSA also exempts certain work-related expenses when reducing SSI benefits because of earnings. While a small percentage of SSI recipients have some earnings and a somewhat greater percentage have unearned income, most recipients have no other source of income .

Chapter : Supplemental Security Income

The Supplemental Security Income program is a means tested, federally-administered income assistance program authorized by Title XVI of the Social Security Act. Established in 1972 , with benefits first paid in 1974, SSI provides monthly cash payments in accordance with uniform, nationwide eligibility requirements to needy aged, blind, and disabled persons. In August 2018, there were 8.2 million SSI recipients receiving $4.8 billion in monthly benefit payments.

The SSI program replaced the federal-state programs of Old Age Assistance and Aid to the Blind, established by the original Social Security Act of 1935, as well as the program of Aid to the Permanently and Totally Disabled established by the Social Security Act Amendments of 1950. Under these programs, federal matching funds were offered to the states to enable them to give cash relief, as far as practicable in each state, to eligible persons whom the states deemed needy. The states set benefit levels and administered these programs. These federal-state adult assistance programs continue to operate in Guam, Puerto Rico, and the Virgin Islands. Under the Covenant to Establish a Commonwealth of the Northern Mariana Islands, enacted as Public Law 94-241 on March 24, 1976, the Northern Mariana Islands is the only jurisdiction outside the 50 states and the District of Columbia in which residents are eligible for the SSI program.

Read Also: Social Security Ticket To Work 2021

What Is The Difference Between Ssi And Ssdi

The main difference is that the evaluation of SSI is based on age / impairment and restricted income and assets, while the determination of SSDI is based on impairment and job credits. The financial policies are the main difference. Furthermore, a recipient of SSI should automatically apply for Medicaid in most cases. After 2 years of obtaining disability benefits, a person with SSDI will automatically qualify for Medicare.

Applying For Ssi And Regular Social Security Benefits

If you are eligible for SSI, then it is highly likely that you are also eligible for Social Security benefits. Indeed, when you apply for SSI, you are also applying for Social Security benefits at the same time.

Thus, it is rather easy to apply for SSI and Social Security benefits. That said, it may be a good idea to contact an experienced SSI claims lawyer in Jacksonville to ensure that your application for benefits is granted on the first try. Oftentimes, issues with an SSI application could cause unnecessary delays.

Don’t Miss: Social Security Administration Des Moines Iowa

How They’re Similar

The Social Security Administration generally uses the same medical criteria and the same process to determine if a disability entitles an adult to SSDI or SSI. Collecting both benefits is permitted.

The condition must be expected to last at least a year or result in death and must prevent you for doing most work.

Social Security requires considerable medical evidence to back up a disability claim for either benefit. Although you can apply online for SSDI, and in some cases for SSI, the process will include an in-person or phone interview with a Social Security representative.

Getting a decision generally takes three to five months, according to Social Security officials, but the time can vary depending on how long Social Security needs to get medical records and other relevant evidence. Military veterans and people with particular severe medical issues may qualify for expedited processing.

Keep in mind

A majority of applications for disability benefits are initially denied. If your application is rejected, you have the right to appeal, but getting a hearing can take a year or more. The Social Security Administration has a considerable backlog of cases.

How Has The Covid

Working people with disabilities experience disproportionate job loss, compared to workers without disabilities, during economic downturns,39 and SSI applications generally increase when the unemployment rate increases . This trend held during the Great Recession and subsequent economic recovery.40 One exception to the general trend is the period from 2003 to 2007, when SSI applications continued to rise despite falling unemployment.41 Possible explanations for this anomaly include factors such as the lagged effect of federal welfare reform leading TANF enrollees to switch to SSI and persistently high poverty rates.42 The same study also found that the likelihood of applying for SSI significantly increases during extended periods of high unemployment.43

Figure 7: Percent change in SSI Applications Filed by Adults Ages 18-64 and U.S. Unemployment Rates, 1991-2019

Recommended Reading: Social Security Office Canton Ga

Should I Get Professional Help

If you need help filing an application for SSDI or SSI, or you want to appeal a denied claim, contact an experienced disability representative to discuss your options. Disability attorneys and advocates virtually always offer free consultations, and don’t charge a fee unless you win your case.

According to a survey of our readers, applicants who filed an initial application without help were denied 80% of the time. Getting help at the initial application stage gives you a good chance of getting benefits in just three or four months. That’s because a legal professional can help you complete your initial application for benefits in a way that’s accurate but persuasive. If you’d like help with your application, click for a free case evaluation with a legal expert.

How Do I Apply For Ssdi Or Ssi

If you’re applying for Social Security disability insurance , you can file your whole claim online on Social Security’s website.

If you’re applying for SSI, you can get started on Social Security’s website, but you might not be able to file the entire application online unless you’re also applying for SSDI at the same time.

If you can’t file online, or you’re not comfortable online, call Social Security at 800-772-1213 to start your claim. For more information on applying for either SSDI or SSI, see our article on applying for Social Security disability benefits.

You May Like: Arlington Va Social Security Office

What Is Supplemental Security Income

Unlike Social security, SSI is more geared to provide for the people who are actually in need of a little extra help to get by.

This is not based on any prior income of a person, rather it depends on their present income and resources or the absence of it, they provide monthly benefits to disabled and old people.

They provide medical benefits and even food assistance is provided in certain cases. The medical benefits include the hospital bill for the stay, the prescription drugs, and other similar costs.

This is funded by the general funds of the U.S Treasury and not by the people. So these benefits might vary depending upon ones income or their caregivers or familys income.

This is exclusively for the ones who are unable to meet their basic needs of food, shelter, and healthcare.

There are four living arrangements in place for such a situation, A B C, and D. In some cases, the person might have rental liability or need assistance to get food and even medical health-care or only one of the above.

There is the separate plan C specially aimed for the children.

Other Facts You Should Know

When you apply for Social Security Disability benefits, you should be screened for both SSDI disability and SSI. If you are awarded SSDI benefits of an amount less than a thousand dollars per month, it would be wise to consult with a representative to check if you may qualify for SSI as well.

When you make a disability claim for SSI, you may also be required by the Social Security Administration to provide financial records which include bank statements, mortgage and lease agreements, savings and other financial data that will let them assess your financial status.

You can seek the help of a Social Security Disability advocate or disability lawyer to help make the application process for Social Security Disability benefits or appealing a decision much more manageable.

If you have a question regarding your SSI or SSDI case, you can ask in our forum here.

Also Check: Social Security Disability Medicare Part B

Contact Walton Law For More Information

For more information about supplemental social security and disability, contact Walton Law PLLC for a free consultation today. Our experienced team of legal professionals can help you navigate the complex process of supplemental social security and Social Security Disability payments.

We are here to help you get the benefits you deserve. With our knowledgeable guidance and expertise, we can help to ensure that you maximize your supplemental social security and Social Security Disability benefits while staying within the guidelines set forth by the Social Security Administration. Let us put our years of experience to work for your needs. Contact us now!

Contents