If Your Disability Started Within Four Weeks Of The Last Day You Worked

Who pays benefits: Your employer’s disability benefits insurance carrier.

How to Apply

- File the claim with your employer or insurance carrier, using Notice and Proof of Claim for Disability Benefits .

- Form DB-450 may be obtained using the link above, from your employer, your employers insurance carrier, your health care provider or any Board office.

Cdr And Other Disability Issues At Age 60 And Above

When someone is 60 years old is disabled, whether they are already receiving SSD benefits or they are just thinking about applying for them, the question of early retirement usually comes to mind.

Do not file for early retirement benefits at age 62 if you are disabled.

Social Security disfavors early retirement as a policy. The government designed the Social Security System to provide full retirement benefits to those who reach Full Retirement Age . You can file for early retirement at age 62, but you will lose a substantial percentage of your full-retirement-age benefit amount, and the reduced benefit is permanent.

Early retirement can cost you up to 30% of the monthly benefit you would receive if you waited until you reached your FRA. But Social Security Disability benefits are equal to what you would receive under your full-retirement-age benefits. If you are 62 or older and still younger than your FRA, you should apply for SSD benefits. There is no penalty for applying and qualifying would bring you your full retirement payments until you reach your FRA. Then, when you reach your full retirement age, your benefits simply transfer from disability benefits to retirement benefits, without any change in the amount of your monthly benefit.

Read Also: Is Being Left Handed A Disability

People Who Are Blind Or Have Low Vision

If you are blind or have low vision, Social Security offers several adjustments to disability benefits to accommodate the additional difficulties associated with loss of sight.

These accommodations include being able to work toward Social Security credits after you become blind, delayed benefits that will increase if you continue to work without receiving disability benefits and a higher monthly salary cap.

Also Check: Hours Of Operation For Social Security Office

Myth #: Your Benefits Are Based Only On Wages You’ve Earned Before Age 65

How your Social Security benefit is calculated can seem mysterious. However, it’s important to know a few essential facts to aid your claiming strategy. You can use the tools on SSA.gov to do the calculations.

- Your benefit is calculated based on your highest 35 years of earnings they don’t have to be consecutive years or before age 65.

- If you work past age 65, those earning years will be included, so long as they are high enough to be part of your highest 35 years.

- Even working part-time after turning 65 may be part of your highest 35 years of earnings.

- To be eligible for Social Security, you must have a minimum of 10 years of covered employment , which equates to 40 credits in the Social Security system.

- If you don’t have 35 years with earnings, zeros will be included in the calculation.

Read Viewpoints on Fidelity.com: Social Security tips for working retirees

Benefits For Widows Or Widowers With Disabilities

If something happens to a worker, benefits may be payable to their widow, widower, or surviving divorced spouse with a disability if the following conditions are met:

- The widow, widower, or surviving divorced spouse is between ages 50 and 60.

- The widow, widower, or surviving divorced spouse has a medical condition that meets our definition of disability for adults and the disability started before or within seven years of the worker’s death.

Widows, widowers, and surviving divorced spouses cannot apply online for survivors benefits. If they want to apply for these benefits, they should contact Social Security immediately at 1-800-772-1213 to request an appointment

To speed up the application process, complete an Adult Disability Report and have it available at the time of your appointment.

We use the same definition of disability for widows and widowers as we do for workers.

Don’t Miss: Social Security Office Wyandotte Mi

Age 55 Is The Magic Age: Social Security Disability Rules If You Are Between The Ages Of 55 And 59

For many of my clients, age 55 is often the key age that separates approval and denial of disability benefit claims.

This is because once you reach age 55 you can receive SSDI or SSI benefits if:

- Your medical impairments limit you to light or sedentary work and you do not have skills that easily transfer into new jobs or recently completed education that provides for direct entry into skilled work. Sedentary work is work that requires lifting no more than 10 pounds at once and no more than 3 hours walking or standing in an 8-hour workday.

- Your medical impairments limit you to medium work and you have limited education and no work history or a work history that includes only unskilled work.

If you are 55 or older, the only way you will be denied disability benefits if you are limited to light or sedentary work is if your past jobs gave you skills that easily fit into a less physically demanding job with little difficulty and allow you to perform the new job the same way you performed your old jobs.

Improvement Of Your Condition: Disability Reviews

The SSA will conduct periodic reviews of your medical condition, called a continuing disability review .

How often the SSA conducts a disability review depends on whether they expect your medical condition to improve. For example, if medical improvement is:

- Expected: you will get a continuing disability review within 6 to 18 months after you begin receiving benefits.

- Possible: SSA will conduct a disability review every 3 years.

- Not expected: you will still get a continuing disability review, but the first will not be any sooner than 7 years after you begin receiving benefits.

When you receive your first award notice, it will tell you when to expect your first disability review.

If your condition improves before your first continuing disability review, you can continue to receive benefits until they are terminated after your regularly scheduled review, and you wont be required to repay the benefits.

The SSA will terminate your benefits after your continuing disability review if they determine that your medical condition has improved to the point that you are no longer disabled your disability no longer prevents you from participating in any substantial gainful activity, and 1) your doctors no longer believe your condition will be fatal, or 2) your condition is no longer expected to last longer than 12 months.

Read Also: Social Security Office Coconut Creek

Different Social Security Disability Rules Apply When You Reach Ages 50 55 And 60 Learn How To Use Them To Win Your Claim And Get Approved For Ssdi Or Ssi Benefits

Your age is a big factor in determining if you win your disability claim and get approved for monthly payments, especially if you are unable to work because of an injury on the job or degenerative condition, such as arthritis.

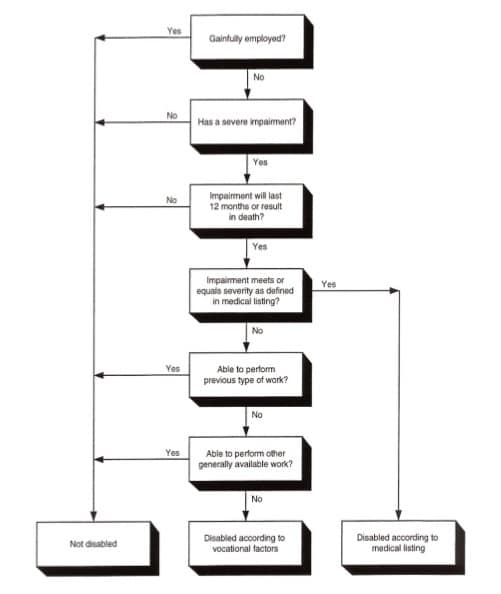

To understand why your age is so important, lets first look at the evaluation process used by the Social Security Administration when deciding claims.

Here is how it works:

If you have a medical condition that affects your ability to work, but that is not severe enough to meet or equal a condition on the Listing of Impairments, then the SSA will decide what you are capable of doing. This determination, which details both your physical and mental capabilities, is called your residual functional capacity, or RFC.

The SSA will then compare your RFC to the physical and mental requirements of all work that you did in the 15 years before you applied for Social Security Disability benefits.

If the SSA finds you can return to that prior work based on your RFC, then your case will be denied. But if it finds you cannot, then it will consider the vocational factors your age, level of education, and work experience to determine if you can do any other work. If you cannot, then the SSA will approve your disability claim.

What Are Social Security Disability Benefits

Social Security disability benefits come from payroll deductions required by the Federal Insurance Contributions Act to cover the cost of Social Security benefits, such as retirement and spousal and survivor benefits. Some of this funding goes into the Disability Insurance Trust Fund and pays for disability benefits.

According to the Social Security website, to qualify for Social Security disability benefits, you must have worked a certain length of time in jobs covered by Social Security. Generally, you need 40 credits, 20 of which were earned in the past 10 years, ending with the year you became disabled. You must also have a medical condition that meets Social Securitys definition of disability.

Younger workers might qualify with fewer credits.

SSDI should not be confused with Supplemental Security Income , which pays benefits to those who have financial needs regardless of their work history. Although these two names sound similar, the qualifications to get the payments and what you might receive are very different.

Also Check: Social Security Office In Toledo Ohio

Temporary Caregivers Insurance Faq

What is the TCI program? How long can I collect TCI?

Under the TCI program, an individual may receive up to a maximum of 5 weeks of benefits during a Benefit Year Period:

- To care for a for a seriously ill child, parent, spouse, domestic partner, parent-in-law, or grandparentor

- To Bond with a newborn child, adopted child or foster-care child

Monetary eligibility is determined the same as for TDI benefits.

Caregiver Claims: the claimant is responsible to obtain the medical documentation necessary.Bonding Claims: the claimant is responsible to provide proof of child/parenting relationship.

When and how can I apply for TCI?

You must apply for TCI benefits during the first 30 days after the first day of leave is taken for reasons of Bonding or Caregiver. Refer to Rule 37-B of the RI Department of Labor and Training Rules for the Unemployment Insurance and Temporary Disability Programs. If you are currently receiving TDI benefits, you must first be released from your doctor as fully recuperated prior to submitting your application for TCI for bonding or caregiving benefit payments.

Can I get additional weeks of TCI?

No, your claim is processed based on the number of weeks and dates requested on your initial application. If you have not reached the maximum allowance of 5 weeks you may file another claim as long as you are out of work for at least seven consecutive days after the original claim ended.

When recuperating from delivering my baby, can I apply for TCI?

The Earliest Age You Can File For Benefits Is 62

Eligible recipients get an eight-year window to file for Social Security that begins at age 62. Not surprisingly, 62 is the most popular age to claim benefits despite the fact that doing so comes with one major drawback: a reduction in your monthly payments.

As we just learned, your Social Security benefits are calculated based on your earnings record. But you’re only entitled to your full monthly benefit upon reaching what’s known as full retirement age, or FRA. FRA depends on your year of birth, as follows:

|

Year of Birth |

|---|

DATA SOURCE: SOCIAL SECURITY ADMINISTRATION.

Filing for benefits at 62, therefore, will result in the largest possible reduction you could face. Specifically, you’ll take a 6.67% hit on benefits per year for the first three years you file early, and then a 5% hit on benefits for each year thereafter. This means that if you’re looking at an FRA of 67 and you file at 62, you’ll lower your payments by 30%. Ouch.

Read Also: Social Security Office Sikeston Mo

Social Security Disability Law: A Beginner’s Guide

Have a question? Need assistance? Use our online form to ask a librarian for help.

Barbara Bavis, Bibliographic and Research Instruction Librarian, Law Library of Congress

Robert Brammer, Senior Legal Information Specialist, Law Library of Congress

Editors:Janeen Williams, Legal Reference Librarian, Law Library of Congress

Kellee Bonnell, Legal Reference Librarian, Law Library of Congress

Note: This guide is adapted from a research guide published on the Law Library’s blog, In Custodia Legis, in 2013.

July 31, 2018

May 15, 2019

Social Security Disability Payments Are Modest

At the beginning of 2019, Social Security paid an average monthly disability benefit of about $1,234 to all disabled workers. That is barely enough to keep a beneficiary above the 2018 poverty level . For many beneficiaries, their monthly disability payment represents most of their income. Even these modest payments can make a huge difference in the lives of people who can no longer work. They allow people to meet their basic needs and the needs of their families.

Recommended Reading: How To Get Disability In Florida

Don’t Miss: What Are The 3 Types Of Social Security

Talk To A Social Security Disability Lawyer For Free Today

Many people struggle to get the disability benefits they deserve. Thankfully, help is available. At John Foy & Associates, we have been assisting SSDI applicants for over 20 years.

Our lawyers know what the SSA is looking for to approve an application. We also know how to help you with any benefits-related problems. Contact us today, and well discuss the details during a FREE consultation.

To get your FREE consultation, call or contact us online today.

Call or text or complete a Free Case Evaluation form

What Do Federal Laws And Regulations Say About Age And Disability

The Social Security Administration discusses age as a vocational factor in disability claims in its regulations and internal policy documents.

Code of Federal Regulations Section 404.1563 states, in part:

We will not consider your ability to adjust to other work on the basis of your age alone. In determining the extent to which age affects a persons ability to adjust to other work, we consider advancing age to be an increasingly limiting factor in the persons ability to make such an adjustment, as we explain in paragraphs through of this section.

Commentary published with the SSAs Medical-Vocational Guidelines, also called the Grid Rules, provides additional insight:

Where age is critical to a decision, recognition is taken of increasing physiological deterioration in the senses, joints, eye-hand coordination, reflexes, thinking processes, etc., which diminish a severely impaired persons aptitude for new learning and adaptation to new jobs.

Put a different way: The Social Security Administration thinks that the younger you are, the more likely it is that you can acquire new job skills, adapt to new work, and compete with other job applicants even though you have a severe medical impairment. And the older you are, the more likely it is that you will have difficulty adjusting to new work, picking up new skills, and competing with other people when you have a severe medical impairment or combination of impairments.

Don’t Miss: Social Security Limits On Income 2022

Why Does Social Security Disability End

The most common reasons that SSDI ends include:

- You return to work.

- Your disabling condition improves.

- You serve jail or prison time.

If any of these things happen, the SSA could stop your benefits. It will depend on the details of what changes and when. When your benefits go under review also matters. The SSA will discontinue your benefits if they determine you are no longer disabled.

You could get a review every 18 months, three years, or seven years. If your doctor expects your condition to get better, the SSA will review your case more often than others on SSDI.

If you are in jail for over 30 days, the SSA will stop your SSDI benefits. However, you might be able to restart your benefits after you get out of jail.

What Can Cause Benefits To Stop

Two things can cause us to decide that you no longer have a disability and stop or suspend your benefits:

-

If, after completing a nine-month Trial Work Period , you work at a level we consider substantial.

We suspend cash benefits for months your earnings are over the substantial level during the 36-month re-entitlement period after you complete the TWP. If your earnings fall below the substantial level in that period, we can start your benefits again. In 2022, average earnings of $1,350 or more per month are usually considered substantial. The amount of earnings that we consider substantial changes each year.

- If we decide that your medical condition has improved and you no longer have a disability.

Remember, you are responsible for promptly reporting any improvement in your condition, or if you return to work. The booklet we send you when your application is approved explains what you need to report to us. For more information on what else may cause your benefits to stop, refer to How We Decide if You Still Have a Qualifying Disability.

Recommended Reading: Is Social Security Tax Free

Appealing Denied Social Security Disability Application

Its common for applicants to be denied. In fact, only about 1 in 3 applicants are initially approved for SSDI benefits. The two main reasons for denial are usually a lack of work credits, or that applicants do not meet the criteria for disability.

If you have been turned down, you do have the right to go through a Social Security Disability appeal process. Either you or your designated representative can file a Request for Reconsideration. Your initial appeal will then be turned over to Disability Determination Services, who will thoroughly review your file.

If you are denied again, you can proceed to the next level of appeal which is to appear in front of an Administrative Law Judge. An Administrative Law Judge will conduct a hearing in which all of your medical records and testimony will be heard before the judge renders a decision in the form of a written notice.

If you are still denied benefits, then you have a final appeal step you can take: filing a lawsuit in U.S. district court. You will need an attorney for this step if you havent already retained one. This can be an expensive and time consuming option, and as a result, less than 1% of disability claimants take their cases to this level.