Can Student Loan Debt Eat Up Your Social Security Benefits

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

* * *

Can You Sue Someone On Social Security Disability

The short answer is yes. I remember a law professor saying “anyone can be sued for anything.” Winning a suit and collecting on a judgment are the hard parts. … Debt collectors with judgments sometimes try to garnish bank accounts of disability recipients even though the law protects the Social Security benefits.

Do I Have To Pay Student Loans If I Am On Social Security

Student loans dont go away when you start drawing Social Security. The government doesnt automatically write off student loan debt when you retire. Youll still have to make payments towards your student loan debt until its paid in full, forgiven, or discharged at your death.

The federal government offers four income-driven repayment plans to lower your monthly payment based on your income and family size. It could even be $0 if youre retired, and your only source of income is Social Security.

Learn More: Retiring With Student Loan Debt: Forgiveness & Repayment Options

Recommended Reading: Social Security Office In Sedalia Missouri

Garnishment Of Ssdi By Creditors

Social Security Lawyers in Chicago

It can be challenging to obtain Social Security Disability Insurance benefits if you become disabled, and these benefits may not be significant enough to fully depend upon to live. Additionally, you may be concerned about whether creditors can garnish your SSDI benefits. Generally, creditors cant garnish SSDI benefits, but there are some noteworthy exceptions. It is important to discuss your particular situation and whether these exceptions apply with a Chicago Social Security attorney.

Garnishment of SSDI by Creditors

There are certain situations in which your disability benefits can be garnished. For example, if you owe federal taxes, your SSDI benefits may be garnished to recover these sums. Similarly, if you received a student loan guaranteed by the federal government and default on loan payments, your SSDI could be garnished. However, Supplemental Security Income cannot be garnished for unpaid taxes or student loans.

Child Support and Alimony

SSDI payments can also be garnished to pay child support or alimony, as well as court-ordered restitution to the victim of a crime. For example, if you are convicted of aggravated battery, you may be ordered to pay restitution to the victim. If you dont pay the required restitution, its possible that your SSDI can be garnished to pay the debt.

Limits to GarnishingConsult an Experienced SSDI Attorney in ChicagoContact Us

Automatic Student Loan Discharges For Many Disabled Borrowers Starting In 2021

On August 19, 2021, the Department of Education announced that many totally and permanently disabled student loan borrowers will get automatic discharges of their federal student loans unless they opt-out of the process.

Borrowers identified through an existing data match with the SSA will get automatic TPD discharges, beginning with the September 2021 quarterly match with SSA. This policy change removes the requirement that these borrowers fill out an application before receiving student loan relief.

Your physician, a doctor of medicine or osteopathy that’s licensed in the U.S., must certify that you’re unable to engage in any substantial gainful activity because of a medically-determinable physical or mental problem that:

- can be expected to result in death

- has lasted for a continual amount of time that’s not less than 60 months, or

- can be expected to last for a continual amount of time that’s not less than 60 months.

Loan forgiveness Is automatic for disabled veterans. On August 21, 2019, former President Trump signed an executive order directing the U.S. Department of Education to forgive eligible disabled veterans’ debts automatically unless they opt-out.

Also Check: Best Places To Retire In The World On Social Security

See If You Qualify For Other Options

Rehabilitation and consolidation are two common and relatively straightforward ways to get out of default. However, borrowers who are struggling to repay student loans during retirement may qualify for alternative forms of relief.

- You may be able to get your student loans discharged if youre totally and permanently disabled and unable to work.

- Some borrowers may be able to settle their loans by agreeing to pay a smaller lump sum.

- If your Social Security benefits shouldnt have been taken in the first place, you may be able to stop the offset of your benefit and get the amount that was already taken back.

Understanding your rights and options can be difficult, particularly with all the complexities that come with student loans. If youre looking for personalized advice, you may want to hire an attorney who specializes in student loan cases. Or, Money Management International has trained counselors who can help review your student loan situation and explain your options.

Another option? Focus on getting rid of your non-student loan debts. A debt management plan can help accelerate your credit card repayment and save you a lot of money in the process.

Can My Ssi Benefits Be Garnished

So, what about Supplemental Security Income benefits? Can SSI be garnished? Generally, your SSI benefits are completely safe from garnishment. To qualify for SSI benefits, you must show a substantial financial need. Therefore, the garnishment of these benefits could result in extreme financial hardship. Even if a creditor, like the Federal government, can garnish other types of Social Security benefits, they will be unable to garnish your SSI benefits. This law is in place to help protect the recipients of SSI benefits. Therefore, neither commercial creditors nor the Federal government or Federal agencies can garnish your Supplemental Security Income payments.

Read Also: Social Security Scam Calls 2021

Does Unpaid Federal Debt Affect State County Benefits

The answer here, as with many things student loan-related, is: It depends.

The Department of Education warns borrowers of Federal Family Education Loans that their state income tax refunds and other payments and even state-issued drivers or professional licenses could be impacted if their debt enters default.

What If You’re Retired And Can’t Afford Your Debt

In a perfect world, debt payments wouldn’t be part of your retirement years. But the reality is, it’s often unavoidable. Retired or not, you have options if you’re struggling to make debt payments, particularly when you owe the federal government.

You can typically get approved for an IRS payment plan in just a few minutes online if you owe taxes. If you have federal student loans — including Parent PLUS loans that you took on for your child’s education — an income-driven repayment plan that will cap your payment at a percentage of your income is probably an option. You may also be able to ask a court to modify payments you’ve been ordered to make.

The bottom line is, if you’re trying to protect your Social Security checks from garnishment, it pays to be proactive. Take action as soon as you know you won’t be able to make a payment.

The Motley Fool has a disclosure policy.

You May Like: Social Security Office In Selma Alabama

Can Student Loan Debt Threaten Your Social Security Payments

Yes and the government may not wait until youre nearing retirement age to recoup the debt. If you default on federal student loans, the government can take extreme measures to get your money. For example:

- The IRS can seize your federal tax refund and put it toward unpaid loans

- Depending on your circumstances and type of loan, you may also have your state tax refund held as well.

- If youre nearing retirement, the government can also garnish your Social Security benefits.

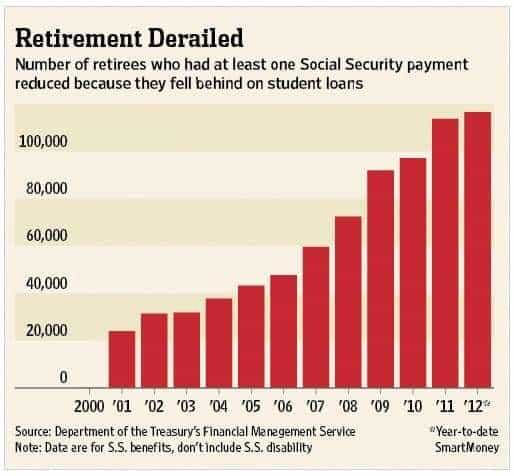

This last consequence Social Security garnishment has been affecting more and more borrowers over the years.

Many retired Americans rely entirely on Social Security benefits to fund their retirement. With garnished benefits, they may not have enough money each month to live.

The good news? There is a limit to how much can be garnished for student loans. But for retirees depending on Social Security income, garnishment could make them financially vulnerable.

Student Loans And Social Security

While up to 15% of your Social Security payments can be garnished to repay a student loan debt, your monthly benefit cannot sink below $750. Furthermore, the garnishment cannot occur until two years after you default on a loan, giving you ample time to contact the loan servicer to modify the repayment plan.

Recommended Reading: Social Security Medicare Sign Up

Can I Get My Social Security Garnished Over My Student Loans

Dear Steve,

I declared bankruptcy almost 21 years ago and was able to avoid paying student loan debt by getting forbearances.

I thought I could do that indefinitely but was told it ran out after 20 years. I have been paying it for the last year but am about to retire.

Can they garnish my retirement and social security?

Sharon

Don’t miss my free my weekday email newsletter with the latest tips and advice on how to beat debt and do better financially. Subscribe now. –

Dear Sharon,

Unfortunately if your student loans are subsidized, federal loans, or government backed student loans the answer is your Social Security can be garnished. It’s a little fact that trips up a lot of people.

The saddest cases are the grandparents that co-signed for the federal student loans and darling Jimmy can’t make his payment, grandma gets garnished.

However, there are two things you can do. The first should be to get on an income based repayment plan for your federal student loans and that will prevent you from being garnished or building up collection fees and penalties. More information about that can be found here.

A growing number of seniors have been getting their Social Security payments garnished for student loans. The problem will continue to grow.

If for some reason you do wind up getting your Social Security payments garnished you should read this article and this one to understand how you may be able to put a hold on the garnishment

Student Loan Payments Pose Unique Issues For Social Security Recipients

Student loan payments can be a heavy burden for many people, but for those who rely on Social Security disability benefits to get by, the burden is especially heavy.

With many returning to college at later ages for a change in career, and others co-signing on student loans for family members, there are more older Americans than ever who still have outstanding student loan bills to pay.

According to a recent report from the Government Accountability Office, the government garnished Social Security benefits of 114,000 people ages 50 and over during the last year to recoup student loan debt and more than half of those were on Social Security disability instead of retirement income.

Although debt collectors cannot take more than 15% of the benefits check, wage garnishment is leaving people who rely on their Social Security benefits below the poverty guideline.

Hardship Exception Can Be Hard

Many of the people who have had their Social Security benefits garnished could qualify for a hardship exception or for permanent disability discharge of their loans. But researchers at the GAO have criticized the difficult process at the Department of Education which requires borrowers to submit annual documentation verifying their income. If the borrowers do not submit their documentation, the loans can be reinstated.

Taxes and Fees

The Obama administration worked to facilitate debt discharge for those who are severely disabled and who are not expected to be able to work again.

Also Check: Social Security Office Russellville Ar

How Can You Maximize Your Benefits

Lastly, there are a few things you can do to maximize your Social Security payments. Theyre listed below for your benefit:

- Delay claiming until age 70: After you reach full retirement age, if you delay claiming your benefits, payments will rise by about 8 percent per year until you reach age 70. Once you hit 70, there is no further benefit.

- Claim spousal benefits: You can either claim benefits based on your own work record or you can claim 50 percent of your spouses benefit, whichever is higher.

- Dont earn too much in retirement: In 2020, at full retirement age, you can earn up to $48,600 before penalties are taken out. If you earn above that, Social Security will deduct one dollar for every three dollars you earn.

Apply For A Disability Waiver

Older Americans on permanent disability may be eligible for a full discharge of their student loans. Borrowers with a long-term medical condition can also qualify for full Social Security payments. Though the process can be tedious , statistics have shown that more than one-third of people in default were able to pay off or cancel their debt with this option. One caveat: The amount forgiven is considered income and you will likely owe taxes.

You May Like: Can I Contact Social Security By Phone

Social Security Garnished For Student Loans Is An Inefficient Solution

Data suggests that the garnishments are not successfully collecting an outstanding debt: more than one-third of older Americans were still in default after two years of reduced Social Security payments. One reason for this is that only a small portion of garnished payments go toward paying off the loan principal.

Instead, of the $1.1 billion garnished from benefits, nearly 71 percent were allocated to pay fees and interest, as opposed to paying down the principal. This is an inefficient solution, and some lawmakers are proposing legislation that is designed to reduce the burden on Americans owing student debt.

How To Request Social Security Garnishment Hardship

If your personal finances are tight and youre living near the poverty line, you may be able to lower or stop an offset due to financial hardship. Here are the steps to follow to request a Social Security garnishment hardship:

-

Step 1 Find your defaulted loan. Contact the Default Resolution Group to determine if your loan is with the Education Department or a guaranty agency.

-

Step 2 Complete the hardship packet. Ask the debt collector to send you a hardship packet to lower or stop the Social Security Offset. They should ask you to submit a Statement of Financial Status, proof of household income and expenses , and a copy of the notification of offset .

-

Step 3 Wait for a decision. It usually takes about 6-8 weeks to get a decision.

In my experience, its usually much easier to lower a benefit offset than it is to get back an income tax refund offset for student loan debt.

Learn More: How to Get Out of Student Loan Default

Read Also: File And Suspend Social Security

Continue Making Payments On An Income

Once your loan is out of default, an income-driven plan could make your monthly payments affordable and keep you from falling behind or winding up back in default.

The plans you can choose from depending on the type of loan you have , but they all base your monthly payment on your discretionary income. The amount can range from 10 to 20 percent of your discretionary income, and your monthly payment amount could be as low as $0.

While your monthly payments might not cover the interest that accrues, theyre still on-time payments that keep your loans in good standing. Additionally, the balance will be forgiven after 20 to 25 years of on-time payments if you stay on the income-driven plan.

Can Social Security Be Garnished For Debt

Yes, your Social Security benefits can be garnished over unpaid debt, but only in certain circumstances. Basically, the situations that would cause Social Security to withhold your benefits are similar to the ones that would cause the IRS to withhold your tax refund. In essence, if you owe the government or you’ve been ordered by a court to pay money in family law or criminal matters, Social Security could garnish your benefits.

Image source: Getty Images.

Here are some scenarios where delinquent debt could result in smaller Social Security checks:

- You’re behind on your federal student loans. Social Security can withhold up to 15% of your benefit if you’re behind on student loans. However, the first $750 a month of benefits is off limits.

- You owe back taxes. The IRS can garnish up to 15% of your benefits if you have delinquent taxes. Unlike with student loans, the first $750 isn’t protected.

- You’ve been ordered to pay child support or alimony. If you’re behind on court-ordered child support or alimony, up to 50% of your benefit can be garnished if you support a spouse or child who isn’t the subject of the court order. Otherwise, up to 60% of your benefit can be garnished. If you’re more than 12 weeks behind, an additional 5% can be seized.

- You owe court-ordered restitution to a victim as part of a criminal case. Up to 25% of your Social Security could be garnished if you’re behind on restitution payments to the victim of a crime you’ve been convicted of committing.

Also Check: Fort Wayne In Social Security Office