To Wait Or Not To Wait

Consider taking benefits earlier if . . .

- You are no longer working and can’t make ends meet without your benefits.

- You are in poor health and don’t expect the surviving member of the household to make it to average life expectancy.

- You are the lower-earning spouse, and your higher-earning spouse can wait to file for a higher benefit.

Consider waiting to take benefits if . . .

- You are still working and make enough to impact the taxability of your benefits.

- Either you or your spouse are in good health and expect to exceed average life expectancy.

- You are the higher-earning spouse and want to be sure your surviving spouse receives the highest possible benefit.

Other Factors To Consider

When planning for retirement, however, theres more to consider than just dollars and cents. You could pocket the most money in the long term by waiting to start your benefits, but only if you live past the break-even point.

Thats where other factors such as your physical condition and family situation come into play. Suppose you reach claiming age in poor health. Do you expect to live long enough to make up for the payments youd forgo by delaying? On the other hand, is your spouse going to be depending on your benefits after you die? The tradeoff for starting your payments early could be lower survivor benefits for your mate.

Other income, or assets such as a pension or IRA, might affect your claiming decision. Perhaps you like your job and want to keep working well into your 60s, or you can afford to live on your savings while you delay Social Security and boost your eventual benefit. On the flip side, if youre unable to work and need the money, collecting Social Security benefits early could help you make ends meet.

A financial adviser can help you weigh the pros and cons to determine what option works best for you.

Keep in mind

What If I Delay Taking My Benefits

If you retire sometime between your full retirement age and age 70, you typically earn a âdelayed retirementâ credit for your own benefits . For example, say you were born in 1960, and your full retirement age is 67. If you start your benefits at age 69, you would receive a credit of 8% per year multiplied by two . This means your benefit would be 16% higher than the amount you would have received at age 67.

You May Like: E Verify Social Security Number

Recommended Reading: Is Social Security Office Open To The Public

Should I Wait To Start My Social Security Benefits

Presented by Tim Weller

The first step in making your decision is to determine your full retirement age the age at which you can collect your full benefits. For workers born between 1943 and 1954, the FRA is 66 for those born later, the FRA gradually increases to age 67. Claiming benefits prior to your FRA can reduce your monthly payment by as much as 30 percentbut you will receive benefits for a longer period. If you postpone claiming benefits beyond your FRA, your social security payment will increase by a certain percentage, depending on your year of birth, until you reach age 70.

Its important to consider your options carefully. The decision to claim benefits early can result in a lower standard of living for the rest of your life. And claiming later can mean more financial security for your surviving spouse.

The benefit reduction incurred by claiming early is permanent. If you elect to start receiving benefits early, your benefits will still be increased annually by cost-of-living allowances. But despite social securitys annual inflation adjustment, your payments may never equal the benefit that you would have received by waiting until your FRA.

What timeline is best for you? You can crunch the numbers using AARPs Social Security Benefits Calculator, available at www.aarp.org/work/social-security/social-security-benefits-calculator.

Also Check: Social Security Administration Fredericksburg Va

Other Factors To Remember

When you are calculating your break-even age, look at other assets that you can collect.

For example, if you have a 401 or pension through your work, or an individual retirement account, this may impact when you choose to cash in on your Social Security.

Other assets to consider are annuities, a taxable brokerage account, savings accounts, certificates of deposit or even all of the above.

If you are unsure of how to calculate the best plan for you and your family, it could be helpful to speak with a financial advisor and explore all of your options.

Recommended Reading: Social Security Lump Sum Payment

When Should You Start Collecting Social Security Benefits

To determine when you should start taking your benefits, its important to understand how much your check is affected by when you claim your benefit. As mentioned before, you can claim your benefit as early as age 62 but reaching full retirement age can secure your full benefit.

So when exactly is the full retirement age for Social Security? That depends on when you were born.

| Year of birth | |

|---|---|

| 66 + 2 months for each year past 1954 | |

| 1960 and later | 67 |

While the full retirement age used to be 65, changes to the program have increased that age. For example, those born in 1955 now have to wait an extra two months beyond age 66 to claim their full benefit. Someone born in 1959, for example, would have to wait until age 66 and 10 months to get the full benefit. Anyone born in 1960 or later, receives their full benefit at 67.

But some retirees choose to wait even longer. You may wait until as late as age 70 to claim your benefit, but then you must take it. Youll receive a bigger check for doing so.

So, what is the upside to delaying your Social Security benefit after age 62? Your check wont get hit by a serious benefit reduction. Heres how much a $1,000 monthly check will become if you claim your benefit as soon as youre eligible at age 62.

| Year of birth |

|---|

You May Like: Negatives Of Getting Social Security Disability

Questions To Ask Yourself

From a purely mathematical point of view, most people are better off waiting to start collecting their social security benefits, but there are questions you need to ask yourself.

Do you need the cash? If you need help paying for basic living expenses, you probably should elect to begin receiving benefits as soon as possible.

How is your health? According to the most recent Social Security Administration life expectancy tables, a healthy 65-year-old females average life expectancy is 86.6. Further, one out of every four will live past age 90.

In any case, it is important to consider your familys pattern of longevity. The longer you live, the more you benefit from delaying. If your health and family history predict a long life, you may be better off delaying your benefits until FRA or later.

If you dont expect to attain a normal life expectancy and you are single, consider taking benefits early. But if you are married, be aware that doing so will reduce your spouses survivor benefit.

Will you continue to work? If your working wages are greater than $18,240 in 2020 and you selected early benefits, your social security benefits will be reduced by $1 for every $2 you earn. If you earn more than $48,600 in the year you reach your FRA, your benefits will be reduced by $1 for every $3 you earn. After that point, working has no effect on the amount of your benefit, although it may impact whether your benefits are taxed.

Recommended Reading: Social Security Blue Book For Disabilities

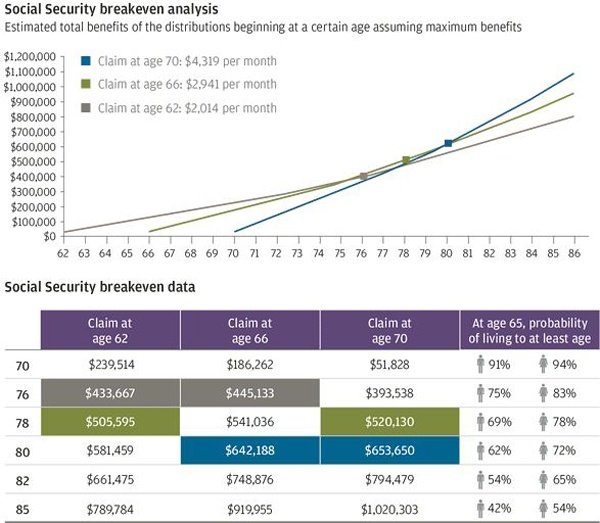

How To Calculate Your Breakeven Age

One way to understand breakeven age is by thinking of your benefit choices as two different potential streams of income. In the example given above, you would have a choice of earning $953 a month beginning at age 62 or $1,681 a month beginning at age 70.

Multiply those monthly amounts by 12 to get their yearly value, and then project the cumulative amounts earned each year into the future. The smaller stream of income would have a head start because it would begin at age 62, while the larger stream wouldnt start till age 70 but would start catching up from that point on. If you look at the cumulative total for each stream of income from then on, you can see when the breakeven point is reached.

Since different people are entitled to different social security benefits, your breakeven age will depend on the amount of your benefits. You can get an estimate of what social security benefits you are entitled to by using the Social Security Administrations Retirement Estimator.

Be advised that this tool only provides an estimate of your benefit. But this estimate provides you with a sense of what benefit amounts you may be entitled to at different ages, and you can use those amounts as the basis for your breakeven calculation.

What About Taxes On Social Security

Keep in mind that Social Security benefits may be taxable, depending on your combined income. Your combined income is equal to your adjusted gross income , plus non-taxable interest payments , plus half of your Social Security benefit.

As your combined income increases above a certain threshold , more of your benefit is subject to income tax, up to a maximum of 85%. For help, talk with a CPA or tax professional.

In any case, if youre still working, you may want to postpone Social Security either until you reach your full retirement age or until your earned income is less than the annual limit. In no situation should you postpone benefits past age 70.

Don’t Miss: Social Security Wages On W2

Social Security In The Us

Before Social Security , care for the elderly or disabled in the U.S. wasn’t a federal responsibility if they weren’t cared for by family, it fell into the hands of municipalities or states. This changed in 1935 when the Social Security Act was first established in the U.S. by President Franklin Roosevelt. The first taxes were collected starting in January 1937, which enabled monetary assistance to qualified Americans with inadequate or no income. Originally, SS was just a program that paid out retirement benefits, but a 1939 change added survivors benefits for a retiree’s spouse and children. In addition, in 1956, disability benefits were added.

Today, SS in the U.S. plays a very important role in keeping a lot of older Americans out of poverty. For most Americans in retirement, it is their major source of income, and for a significant percentage, it is their only source of income, even though SS was never intended to be a full replacement of income. On average, SS pays lower-wage earners higher relative benefits than higher-wage earners. In addition, lower-wage earners tend to pay less tax and are more likely to receive social insurance disability income and survivor benefits. SS is sometimes referred to as Old Age, Survivors, and Disability Insurance .

Social Security Facts

Finally How Does The Stock Market Figure Into The Equation

Generally speaking, the U.S. stock market has been on a record-setting run, but its ongoing performance is never a sure thing. What goes up can go down eventually, and a declining portfolio could have an impact on a retirees cash flow needs. If a retiree gets to a point where the declining value of their portfolio cannot sustain their cash flow requirements, then it would be an appropriate time to consider taking Social Security benefits earlier than previously planned.

Yes, deciding when to take Social Security is complicated, but its still a decision that is often integral to retirement planning. Its also a decision that many retirees seem to disregard. According to Employee Benefit Research Institutes 2018 Retirement Confidence Survey , only 23% of workers try to maximize their benefits by planning when to claim Social Security.

So, once youve determined your break-even age, I encourage you to take the next steps: Consider your individual circumstances, get some guidance, and make a plan. It could make a difference of tens of thousands for you over the years.

Don’t Miss: Social Security Office Russellville Ar

What Is Breakeven Age For Collecting Social Security

So there is a trade-off between when you start collecting social security and the size of your benefit but what does this trade-off look like? The following table is based on an example provided by the Social Security Administration. It assumes a person would be entitled to a $1,300 benefit upon reaching full retirement age at 66 years and 4 months.

|

If you start collecting benefits at this age. |

your monthly benefit will be |

|

$1,681 |

As you can see, each year you delay collecting raises the benefit. The amount of those increases varies, but on average the dollar amount increases by 7.4 percent each year. However, it would be inaccurate to liken delaying to earning a 7.4 percent return on your money because that doesnt take into account that the earlier you start collecting, the more years worth of benefits you get.

In fact, this is the heart of the dilemma: you will come out ahead at first by starting to collect benefits earlier, because you will receive those benefits for more years. However, if you live long enough, eventually the larger benefits you would be entitled to if you waited longer would catch up with the amounts you would have earned by collecting earlier.

Heres an example: Using the above figures, suppose you could start collecting a $953 monthly benefit at age 62. By the time you reach age 70, you will already have collected a cumulative total of $91,488 in benefits.

Whos Eligible To Receive Social Security Benefits

To qualify, you or your spouse must have worked in jobs covered by Social Security and paid the Social Security payroll tax for at least 10 years . A nonworking spouse is potentially entitled to up to half of the working spouses benefit. To collect benefits, you must generally be age 62 or older, disabled, or blind.

Read Also: Social Security Office Opelousas La

Don’t Miss: Social Security Advocates For The Disabled

Watch Out For Hidden Costs

Youll also want to consider other lifestyle factors, especially Medicare. Americans become eligible for federal health insurance coverage at age 65, well after when you can begin to file for Social Security.

If you stop working at age 62 and lose health insurance, you have to get supplemental insurance to bridge the gap until you turn 65 and Medicare kicks in, Neiser says.

If you work during retirement, you have another incentive to delay collecting Social Security. Earning too much at a job after you begin collecting your benefit can reduce your payout, but only if you have yet to hit full retirement age.

However, when you hit full retirement age, your benefit will increase to account for any benefit that was withheld earlier due to working. Heres how much you can earn and not get hit.

If youre younger than full retirement age for all of 2022, the Social Security Administration will deduct $1 of your monthly check for every $2 you earn above $19,560 per year.

If you reach full retirement age in 2022, the administration deducts $1 of your monthly check for every $3 you earn above $51,960 until the month you reach retirement age.

Youll also owe Social Security and Medicare tax on your earnings, even if youre already receiving benefits.

So those are some potential pitfalls to claiming Social Security early.

A Comparison Of Free Online Tools For Individuals Deciding When To Claim Social Security Benefits

The authors are with the Office of Retirement Policy, Office of Retirement and Disability Policy, Social Security Administration.

Acknowledgments: Brian Alleva, Tom Hungerford, Natalie Lu, Barbara Smith, and David Timmons provided helpful input and suggestions. Special thanks to Anya Olsen for her extraordinary support.

The findings and conclusions presented in this note are those of the authors and do not necessarily represent the views of the Social Security Administration.

You May Like: How To Lock Your Social Security Number

You May Like: Social Security Office Topeka Ks

Social Security For Retirement

The biggest determinant of retirement benefit amount is lifetime earnings since the benefit is based largely on the average of a person’s 35 highest-earning years. Because the SS tax is regressive, in retirement, lower-income earners will have a higher portion of their SS retirement benefits paid out in relation to their lifetime earnings than higher-income earners. Another important determinant of benefit amount is the age at which a person applies for retirement benefits.

SS is designed to replace about 40% of the average American worker’s pre-retirement income. This value is dependent on each individual’s work history higher-income earners will receive larger SS checks than lower-income earners, but the check will be a smaller percentage of their pre-retirement income. SS is not intended to be a sole source of retirement income, and as such, it is advisable to have other forms of income in retirement. This can take the form of anything from rental property income to annuities, mutual funds, or even tax-shielded retirement plans such as a 401 and/or IRAs.

Full Retirement Age

Retirement Benefits While Working

When to Apply for Social Security Retirement Benefits

- The immediate need for cash

- Life expectancy

- Relative age, income, and health of spouse

Social Security Credits

Receiving Retirement Benefits Outside of the U.S.

Defining The Social Security Break

Your Social Security break-even age represents, in theory, the ideal point in time to apply for benefits in order to maximize them. Remember, you can begin taking your benefits at age 62 at a reduced amount. But by taking your benefits at this earlier age, youll receive more Social Security checks over your lifetime assuming you reach your desired life expectancy.

On the other hand, delaying your benefits past full retirement age increases them year over year until you reach age 70. Currently, the full retirement age for most people is either 66 or 67 years old, based on Social Security Administration guidelines. If you wait until age 70 to start claiming your benefits, youd receive 132% of your regular monthly benefit amount. So the trade-off is receiving fewer checks from Social Security but the ones you do get would be larger.

Your break-even age is the point at which youd come out ahead by delaying Social Security benefits. Your actual Social Security break-even age can depend on the number of benefits youre eligible to receive, your tax situation and things like how inflation might affect the purchasing power of your benefits.

Read Also: Social Security Office In Clarksville Tennessee