When Should You Apply For Social Security Benefits

You can begin receiving Social Security at age 62. However, starting at that age means those benefits will be about 30 to 35 percent less each month than what you will receive if you delay benefits until you reach what the government considers your full retirement age.

Waiting past your full retirement age before you draw Social Security can also mean you will receive larger monthly benefits.

Full Retirement Age Based on Birth Year

| Year of Birth |

|---|

Social Security is designed to replace about 40 percent of employment income, on average.

However, that is not the same with every worker. Social Security will replace a higher percentage of the income of lower-income workers and a lower percentage of the income of higher-earning workers.

The Amish: A Sect Of American Citizens Opting Out Of Social Security And Medicare

The Amish, a religious sect, do not want to accept social security, medicare, or other government benefits. Most of them are not eligible to vote in the United States presidential election because they are Americans. To prove their identity, Amish people will need a baptism certificate, a letter from a family member, or an employer, and a directory where they can find their name and familys name. Woodworking and construction businesses, for example, have helped them raise funds. Some Amish people have a lot of money.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: How Much Social Security Is Taxable Calculator

Reporting American Social Security Income In Canada

If you are an American citizen who lives in Canada, and you receive Social Security payments, you must report them on your income tax return. Some of your payments may also qualify for an exemption.

Reporting Your Social Security Income

Report your Social Security payments on line 11500 of your Canadian income tax return. You should also include payments from your individual retirement account on this line. If you receive any Canadian pension or superannuation benefits or other foreign pensions, include them in the total on line 11500.

Converting Your Pension Income to Canadian Currency

Do not report your American Social Security or pension payments in U.S. dollars. Instead, convert them to Canadian dollars. Use the Bank of Canada exchange rate from the day you received the pension. If you received the pension on multiple days throughout the year, use the average annual rate published by the bank.

Claiming Exempt Foreign Income

Under the terms of the Canadian/U.S. tax treaty, you do not have to pay Canadian income tax on the entirety of your Social Security payments. Instead, you may claim an exemption on 15 percent of this income. Multiply the amount of Social Security benefits reported on line 11500 by 0.15, and note the result on line 25600 of your income tax return.

You may include Medicare premiums when calculating your exemption, but you cannot include other types of foreign income when calculating your exemption.

The 50 Percent Exemption

The Impact Of Roth Iras

If youre concerned about your income tax burden in retirement, consider saving in a Roth IRA. With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions. You also do not have to withdraw the funds on any specific schedule after you retire. This differs from traditional IRAs and 401 plans, which require you to begin withdrawing money once you reach 72 years old, or 70.5 if you were born before July 1, 1949.

So, when you calculate your combined income for Social Security tax purposes, your withdrawals from a Roth IRA wont count as part of that income. That could make a Roth IRA a great way to increase your retirement income without increasing your taxes in retirement.

Another thing to note is that many retirement plans allow individuals, aged 50 years or older, to make annual catch-up contributions. For 2021, you can make catch-up contributions up to $1,000. These must be made by the due date of your tax return. You have until April 15, 2022 to make the $1,000 catch-up contribution apply to your 2021 Roth IRA contribution total.

Dont Miss: Otter Tail County Tax Forfeited Land

Read Also: Social Security New Deal Program

Can I Retire With Just Social Security

Social Security has a negative rate of return as a savings programthat really sucks. Youre basically putting your money into a program that gives you less than what you put in. Ugh. FolksSocial Security is not a retirement program.

It’s also important to note that, right now, Social Security is only funded until 2034. So, its not a smart idea to bank on that as your sole source of income when you retire, or heaven forbid, become disabled and cant work.

We recommend you have more than Social Security benefits. Lookwe know that might sound impossible for some. But its not!

The fact is, Social Security was never meant to fully support you in retirementits meant to supplement your retirement income. Youve got to make a plan for your future and treat Social Security as the icing on the cake. And its never too early or too late to start saving for retirement. Its what smart people do. Our SmartVestor program can connect you with a trustworthy pro who can help you reach your investing and retirement goals.

Social Security Tax Rates

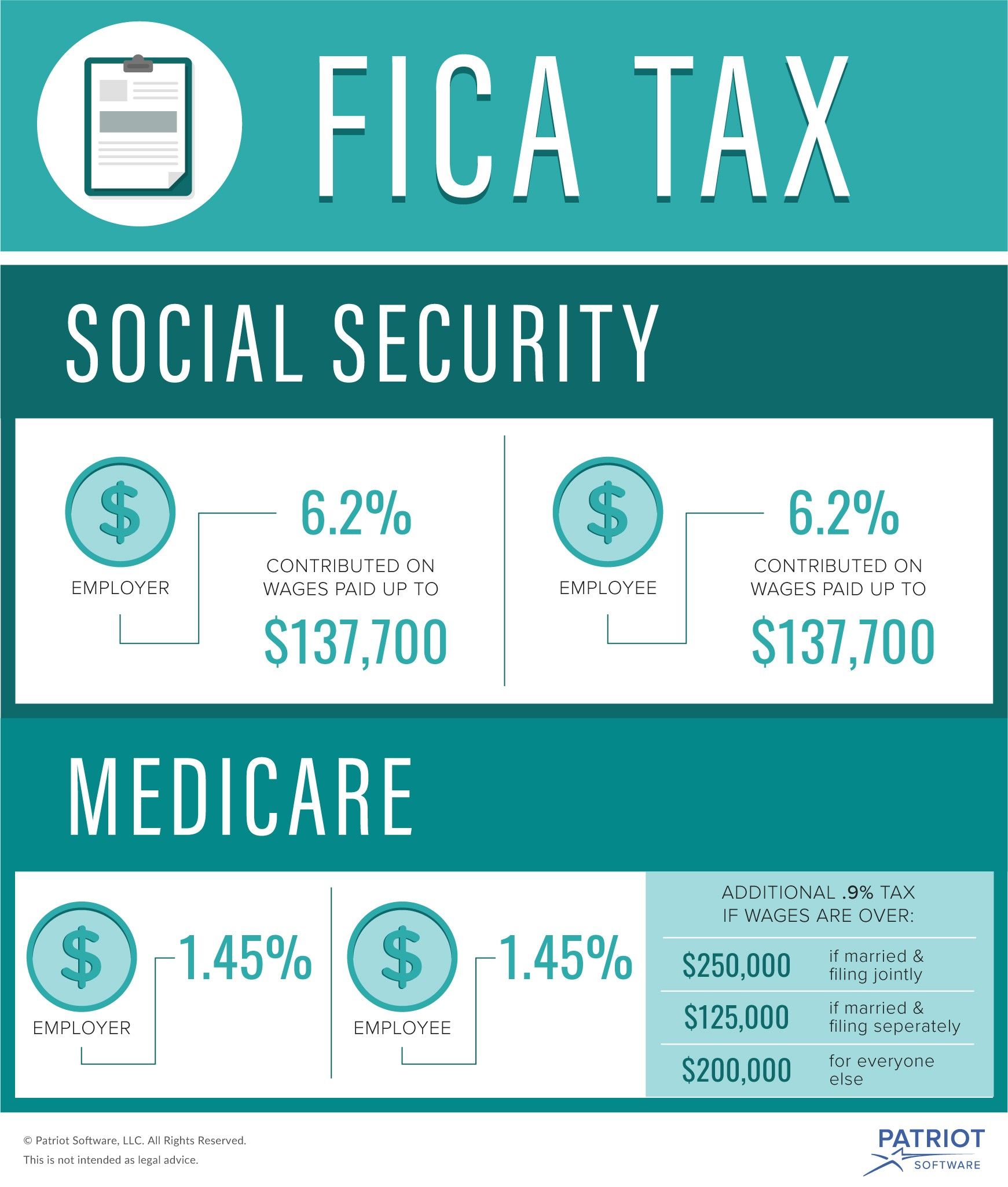

Social Security functions much like a flat tax. Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800.

Half this tax is paid by the employee through payroll withholding. The other half is paid by the employer. So employees pay 6.2% of their wage earnings up to the maximum wage base, and employers also pay 6.2% of their employee’s wage earnings up to the maximum wage base, for a total of 12.4%.

This 12.4% figure does not include the Medicare tax, which is an additional 2.9% divided between employee and employer.

Read Also: Social Security Akron Ohio Office

How Social Security Benefits Are Taxed

Social Security beneficiaries must pay federal income tax on a portion of their benefits if their income exceeds certain thresholds the portion of benefits that is taxable rises with income. Income for this purpose equals a taxpayers adjusted gross income plus tax-exempt interest, certain other tax-exempt income, and half of Social Security benefits this is referred to as modified AGI. A three-part formula applies:

- For individuals with modified AGI below $25,000 and couples with modified AGI below $32,000, no Social Security benefits are taxable.

- For individuals with modified AGI between $25,000 and $34,000 and couples with modified AGI between $32,000 and $44,000, up to 50 percent of benefits are taxable.

- For individuals with modified AGI over $34,000 and couples with modified AGI over $44,000, up to 85 percent of benefits are taxable.

For a detailed explanation of the tax calculation, see Appendix Table 1.

Also Check: How Is Property Tax Paid

Are There Ways To Avoid Social Security Tax

Not everyone has to pay the Social Security tax. If you are a nonresident alien, either as a student or an employee of a foreign government, then you wont have to worry about paying. Furthermore, if you are part of a religious group that opposes the receipt of Social Security benefits, then you wont have to pay either.

However, these are all rare circumstances. Plus, these people wont receive Social Security benefits in retirement. If you want to avoid paying the Social Security tax but still receive benefits when you retire, you should know that the amount youve paid into the system determines your benefits to some degree.

Don’t Miss: Social Security Phone Number For Medicare

Make Sure Youre Taking Your Maximum Capital Loss

If youve invested in stocks or bonds and have a loss on paper, you might want to sell and realize that loss so you can claim it as a tax deduction. The process is called tax-loss harvesting, and it can net you a sizable deduction from your income.

The tax code allows you to write off up to a net $3,000 each year in investment losses. A write-off first reduces any other capital gains that youve incurred throughout the year. For example, if you have a $3,000 gain on one asset but a $6,000 loss on another, you can claim a deduction for the full $3,000 net loss.

Any net loss beyond that $3,000 has to be carried forward to future years, at which point it can be used. And even if you cant realize the full value of that net loss, it can still make sense to realize some loss, especially if it pushes your Social Security benefit into the tax-free area.

Tax-loss harvesting works only in taxable accounts, not special tax-advantaged accounts such as an IRA.

If You Earn Enough Money For Your Benefits To Be Taxable You Could End Up Paying The Highest Income Taxes In The Country

Social Security benefits are tax free unless you earn too much income during the year. To know whether you might be subject to such taxes you have to figure your “combined income.” This is actually quite easy: Simply add one-half of the total Social Security you received during the year to all your other income, including any tax-exempt interest .

You’ll have to pay tax on part of your benefits if your combined income exceeds these thresholds:

- $32,000 if you’re married and file a joint tax return , or

- $25,000 if you’re single.

If a married couple files their taxes separately, the threshold is reduced to zerothey always have to pay taxes on their benefits. The only exception is if they did not live together at any time during the year in this event the $25,000 threshold applies.

This applies to all types of Social Security benefits: disability, retirement, dependents, and survivors benefits.

How much of your Social Security benefits will be taxed depends on just how high your combined income is.

Individual filers. If you file a federal tax return as an individual and your combined income is between $25,000 and $34,000, you have to pay income tax on up to 50% of your Social Security benefits. If your income is above $34,000, up to 85% of your Social Security benefits is subject to income tax.

Once you start receiving Social Security benefits, to keep your income below the applicable threshold, or at least as low as possible, you should:

Recommended Reading: Louisville Ky Social Security Office

Paying Social Security Taxes On Earnings After Full Retirement Age

Everyone must make applicable Social Security contributions on income, even those working past full retirement age. Working past full retirement age may also increase Social Security benefits in the future because Social Security contributions continue to be paid in.

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

Read Also: Social Security Administration Office High Point Nc

The Social Security Tax Wage Base

All wages and self-employment income up to the Social Security wage base are subject to the 12.4% Social Security tax. The wage base is adjusted periodically to keep pace with inflation. It was increased from $132,900 to $137,700 in 2020 and to $142,800 for 2021. Here’s how it broke down year by year from 2012 to 2021:

| Social Security Wage Base by Year |

|---|

| 2021 |

When Should I Take My Social Security Retirement Benefits

Waiting to collect Social Security benefits may be beneficial if youre able to do so. While the age to receive your full retirement benefit is 66-67 , you can begin collecting Social Security benefits as early as age 62. But each month you wait to start collecting increases your eligible benefits.4

Once you reach full retirement age, youre entitled to 100% of the benefits calculated from your lifetime earnings. If you wait until age 70 to begin collecting Social Security, your retirement benefit will be 32% larger.3

However, waiting may not be the right choice for everyone. Your financial advisor will help you determine an approach that reflects your options and your personal situation. For example, they may consider:

- Varying tax rates on Social Security income

- Capital gains and IRA withdrawals

- Health issues and life expectancy in your family history

- Whether your current retirement accounts and additional sources of income will cover your essential expenses before you reach full retirement age

Also Check: Age For Social Security Retirement Benefits

Don’t Miss: Social Security Disability Overpayment Statute Of Limitations

Your May Have To Pay Taxes On Social Security Benefits

Most people know that Social Security is funded by a tax on earnings, currently 6.2% for the employee . But some retirees dont realize that you may well have to pay income tax on Social Security benefits when it comes time to claim them. Benefits lost their tax-free status in 1984, and the income thresholds for triggering tax on benefits havent been increased since then.

It doesnt take a lot of income for your Social Security benefits to be taxed. Your benefits wont be taxed if your provisional income is less than $25,000 if youre single or $32,000 if youre married. If youre single and your provisional income is between $25,000 and $34,000, or married filing jointly with provisional income between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. If your provisional income is more than $34,000 on a single return or $44,000 on a joint return, up to 85% of your benefits may be taxable.

The Social Security Administration says about 40% of beneficiaries pay taxes on their benefits. Since the thresholds arent adjusted for inflation, the number of beneficiaries who pay taxes on Social Security benefits increases every year. The Social Security Trustees annual report estimates that taxes on Social Security will total $45.1 billion in 2022, up from $34.5 billion in 2021.

You may also have to pay state income taxes on your Social Security benefits. See our list of the 12 States That Tax Social Security Benefits.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: Social Security Percentage By Age

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.