Higher Social Security Disability Thresholds

The SSA pays monthly benefits to people who are unable to work for a year or more because of a disability. These benefits typically continue until recipients can work again on a regular basis. However, you might also have a qualifying disability even if youre still working, like when a medical condition prevents you from doing jobs you could previously. When this happens, youre only eligible up to a certain amount of income. Following are the threshold changes for 2023, based on average monthly earnings:

|

2022 |

|

$1,050/month |

Federal Tax On Canadian Housing Owned By Non

Recently-enacted legislation introduces an annual 1% tax, starting in 2022, on the value of non-Canadian-owned Canadian residential property considered to be vacant or underused. Certain residential property owners in Canada will be required to file an annual declaration for each Canadian residential property they own for the prior calendar year, by 30 April of the following calendar year, even if they claim an exemption from the tax. Failure to file the mandatory declaration could result in significant penalties. The tax generally applies to owners , but exemptions are available to those that lease their properties to qualified tenants for a minimum period in a calendar year.

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

You May Like: What Are The 3 Types Of Social Security

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

Line 11500 Other Pensions And Superannuation: United States Social Security

Note: Line 11500 was line 115 before tax year 2019.

Report on line 11500 of your return the full amount in Canadian dollars of your U.S. Social Security benefits and any U.S. Medicare premiums paid on your behalf. You can claim a deduction for part of this income on line 25600 of your return.

Use the Bank of Canada exchange rate in effect on the day that you received the pension. If you received the pension at different times during the year, use the average annual rate. The average monthly rate and the daily rate are available by visiting the Bank of Canada website.

Benefits paid to your children are considered their income even if you received the payments.

You may be able to claim the pension income amount. See line 31400.

You May Like: How Long Does It Take To Get Social Security Benefits

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

British Columbia Speculation And Vacancy Tax

In British Columbia, an annual SVT is imposed on residential property in certain urban centres in British Columbia . The SVT targets foreign and domestic homeowners who do not pay income tax in British Columbia, including those who leave their homes vacant. The tax rate, as a percentage of the propertys assessed value on 1 July of the previous year, is:

- 2% for foreign investors and satellite families.

- 0.5% for British Columbians and all other Canadian citizens or permanent residents who are not members of a satellite family.

Up-front exemptions are available for most principal residences and for qualifying long-term rental properties and certain special cases, including home renovation, illness, and divorce. A non-refundable tax credit may be available in varying amounts for owners subject to the SVT.

All residential property owners in the areas subject to the SVT must:

- make a declaration online by 31 March of the following year, and

- if no exemption is available, pay any tax owing by 2 July of the following year.

If a property has multiple owners, each owner must complete a declaration, even if they are married to another owner of the property. An owner with multiple properties must complete a separate declaration for each property. Failure to file a declaration for a calendar year will result in an assessment at the 2% tax rate for the taxpayer, regardless of residency status or exemption eligibility.

Read Also: National Committee To Preserve Social Security And Medicare

What Is The Extra Deduction For Over 65

If you are age 65 or older, your standard deduction increases by $1,700 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

Final Reminder: These Social Security Changes Take Effect In 2023

For most Social Security recipients, the biggest change set to take effect in 2023 is an 8.7% cost-of-living adjustment the highest in 41 years. But thats far from the only change heading into the new year.

Discover: 5 Things You Must Do When Your Savings Reach $50,000

There will also be changes in Social Security disability thresholds, Social Security earnings limits and Medicare premiums deducted from Social Security payments.

Heres a final look at Social Security Administration changes for 2023 as we head into the new year.

You May Like: Social Security Office In Portland Oregon

Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

Do I Pay Social Security Tax Or Income Tax On My Social Security Benefit Payments

If you earn between $25,000 and $34,000 per year as a single filer , you will pay income taxes on up to 50% of your Social Security benefits. If you earn more than $34,000 , youll pay taxes on up to 85% of your benefits. You will never be taxed on more than 85% of your Social Security benefits.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

You May Like: How Much Is Social Security Taxed

How Much Tax Do I Have To Pay To Qualify For Social Security Benefits

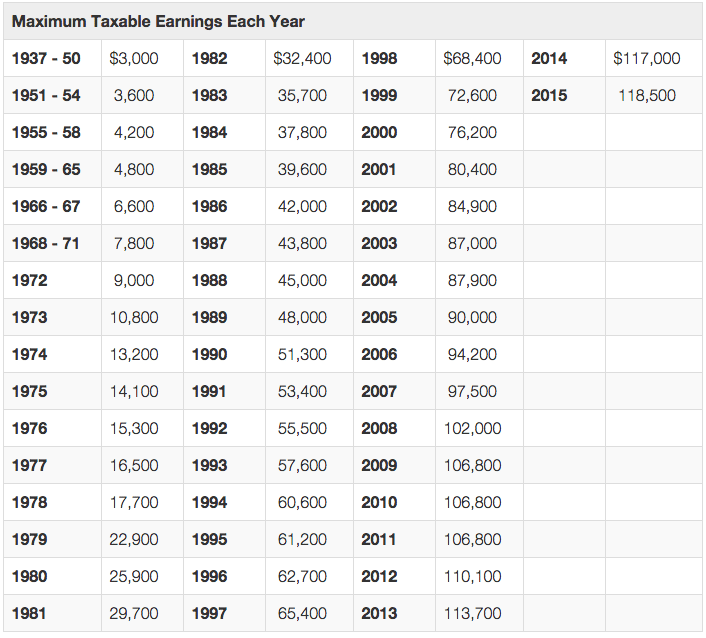

Figuring out if you qualify for traditional Social Security retirement benefits isn’t as simple as making sure you’ve paid a certain dollar amount of Social Security taxes. Instead, the system uses Social Security credits to determine eligibility. To qualify for traditional Social Security retirement benefits, you must have earned 40 Social Security credits.

Starting in 1978, you could earn up to four Social Security credits per year by paying Social Security taxes. You earn credits based on your wages and self-employment income for the year.

In 2022, you earn one credit for each $1,510 in covered earnings. To earn the full four credits possible in 2022, you must earn at least $6,040. The amount to earn one credit may change from year to year and was lower in years before 2022.

Is Social Security Taxed At Age 62

Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes. If receiving other income, you must compare your income to the IRS threshold to determine if your benefits are taxable.

Read Also: Who Benefits From Social Security

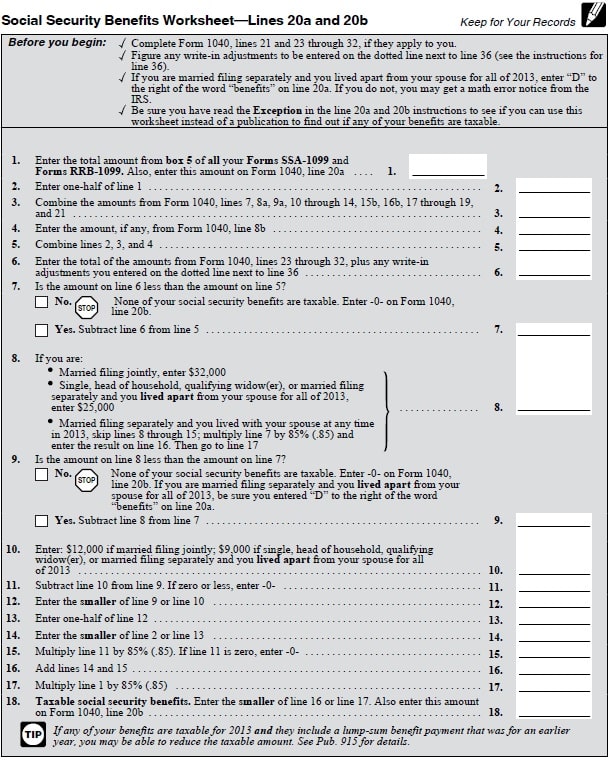

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

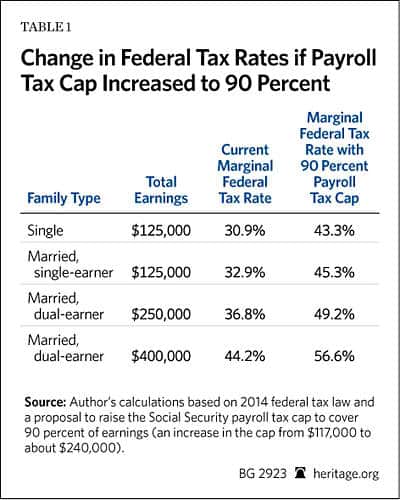

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Don’t Miss: Social Security Office Lancaster California

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Recommended Reading: Social Security Office In Eugene Oregon

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Video: What Is Social Security Tax

OVERVIEW

Note: The content of this video applies only to taxes prepared for 2010. It is included here for reference only. Social security tax is collected by the government to fund the benefits of retirees and those unable to work. Discover how much you owe in social security taxes with help from TurboTax in this video on annual tax filing.

Don’t Miss: Social Security Disability Benefits Pay Chart 2022

Employer Portion Of Social Security Tax

The portion of the Social Security tax paid by your employer isnt included in your taxable income, even though its another cost that your employer pays on your behalf for the work that youre doing, which saves you more money on your taxes. For example, say that you make $92,000. Both you and your employer will pay 6.2 percent of that amount, or $5,704, in Social Security taxes and 1.45 percent of that amount, or $1,334, in Medicare taxes. However, the $7,038 that your employer pays the government for its portion of the FICA taxes on your wages doesnt get added to your taxable income.

Waive A Pretax Deduction From Your Paycheck

Pretax deductions from your paycheck reduce your taxable income, which saves you money by reducing the amount of tax you pay. Because of the money saved, this is generally helpful for most people.

However, you can elect to waive a pretax deduction and pay after-tax. You might want to consider waiving a pretax deduction for one of two reasons:

- Social Security:Pretax deductions reduce the salary used to calculate your Social Security benefit at retirement. The impact on your Social Security, however, is typically minor. Most of the time, the money you save through pretax deductions outweighs any benefit gained by waiving the deduction.

- Unemployment compensation: Pretax deductions reduce the salary used to calculate unemployment compensation.

Health insurance premium

Your health insurance premium is automatically deducted pretax from each paycheck.

Contact the Integrated Service Center to waive pretax deductions and pay after-tax.

If youre newly eligible for health insurance, you have 31 days after becoming eligible to submit the form. After that time, you can submit the form only during open enrollment or when a qualifying life event occurs.

Read Also: Social Security Disability 5 Year Rule

Fica Taxes: The Basics

Every payday, a portion of your check is withheld by your employer. That money goes to the government in the form of payroll taxes. There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes.

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare. If you own a business, youre responsible for paying Social Security and Medicare taxes, too. Self-employed workers are referred to as SECA taxes based on regulations included in the Self-Employed Contributions Act.